Chain: National Restaurant Association

NRA Reveals Progress in Restaurant Tech

The National Restaurant Association released new research focusing on technology in the restaurant industry. In “Mapping the Restaurant Technology Landscape,” the Association set out to explore current technology adoption in restaurants, plans for future adoption, and restaurant operators' thoughts and opinions on restaurant technology overall. "Restaurant operators and consumers generally agree on the benefits of […]

NRA Testifies on Bureaucracy’s Burden on Business

On July 12, Jamie Richardson, White Castle System’s vice president of government, shareholder, and community relations and chairman of the Ohio Restaurant Association, testified before the Congressional Joint Economic Committee on the negative impact excessive government regulations have on Main Street businesses. Richardson testified on behalf of the National Restaurant Association, which represents over 500,000 […]

NRA, FPI, Keep America Beautiful Create Littering Guide

In an effort to help foodservice operators address litter and littering behavior in and around restaurants and other foodservice establishments, the Foodservice Packaging Institute (FPI), Keep America Beautiful, and the National Restaurant Association (NRA) have partnered to produce “Being a Good Neighbor: A Guide to Reducing and Managing Litter.” The 10-page guide has a handy […]

NRA Invites Kitchen Innovation Submissions

The National Restaurant Association (NRA) is now accepting applications for the 2016 Kitchen Innovations Awards. Now in its 12th year, the KI Awards program recognizes and celebrates meaningful advancements in foodservice equipment and technology. Recipients of the 2016 KI Awards will be featured in the popular Kitchen Innovations Pavilion at NRA Show 2016, to be […]

Americans Embrace Global Cuisines, NRA Finds

The National Restaurant Association (NRA) issued new research that finds a wider variety of ethnic cuisines are increasingly becoming part of everyday American diets. The NRA’s Global Palates: Ethnic Cuisines and Flavors in America study found that Italian, Mexican, and Chinese cuisines reign supreme in terms of familiarity, trial, and frequency of eating, while consumers […]

NRA Issues Mobile Payment Guide

Today the National Restaurant Association (NRA) issued a guide on the future of mobile payment technology and its growing role in the restaurant industry. The paper, “Mobile Invasion: Mobile Payments in Restaurants,” features tools and research that will help restaurateurs better understand the benefits of mobile in growing their business. “Mobile technology is a new […]

Restaurants Lead in Post-Recession Growth

The National Restaurant Association's (NRA) chief economist Bruce Grindy breaks down the latest employment trends. “The restaurant industry continued to add jobs at a steady pace in May, according to preliminary figures from the Bureau of Labor Statistics (BLS). Eating and drinking places added a net 17,000 jobs in May on a seasonally adjusted basis, […]

NRA Forms Small Merchant Taskforce For Cybersecurity

Speaking to merchants at the National Restaurant Association (NRA) Show, the PCI Security Standards Council (PCI SSC) announced the formation of a dedicated global taskforce to help improve payment data security for small businesses. Co-chaired by Barclaycard and the NRA, the Small Merchant Taskforce will collaborate on guidance and resources that simplify data security and PCI Data Security Standard (PCI DSS) compliance […]

For the First Time, Restaurants Beat out Grocery Stores

Monthly sales at restaurants exceeded grocery stores sales for the first time on record, according to the National Restaurant Association (NRA). In his latest Economist’s Notebook commentary, the NRA’s chief economist Bruce Grindy broke down industry sales trends. For the first time on record in December, monthly sales at restaurants exceeded grocery stores sales, according […]

Arianna Huffington to Keynote NRA Show

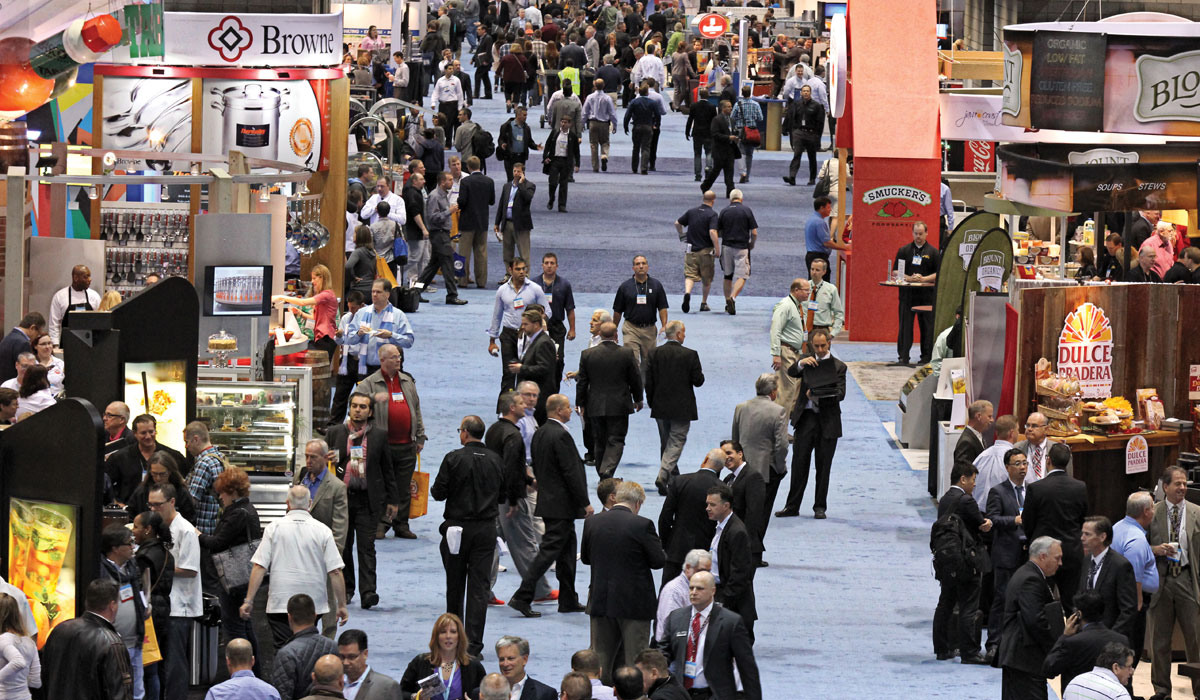

The National Restaurant Association (NRA) announced that Dawn Sweeney, president and CEO of the association, and Arianna Huffington of the Huffington Post Media Group will present the keynote address at the 2015 National Restaurant Association Restaurant, Hotel-Motel Show and BAR (Beverage Alcohol for Restaurants) at the NRA Show Sunday, May 17 at 2 p.m. at […]

Habit Burger CEO to Keynote Restaurant Finance Summit

The National Restaurant Association announced Russ Bendel, CEO of the Habit Burger Grill, will serve as the keynote speaker at the second annual Restaurant Finance Summit. The event takes place during the 2015 National Restaurant Association Restaurant, Hotel-Motel Show at Chicago’s McCormick Place on Monday, May 18. The daylong conference connects top foodservice financial executives […]

High School Students Attend National ProStart Invitational

High school students who have won their state ProStart competitions are headed to Anaheim, California, for the 14th annual National ProStart Invitational, April 18–20 at the Disneyland Hotel. ProStart is one of the largest industry-supported career technical education programs in the nation, offering students the knowledge and skills necessary to consider and forge rich and […]

NRA Performance Index Signifies Expansion

Despite dampened sales and customer traffic levels as a result of extreme weather in parts of the country, the National Restaurant Association’s Restaurant Performance Index (RPI) held relatively steady in February. The RPI—a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry—stood at 102.6 in February, down slightly from a level of […]

NRA Recognizes Women’s History Month

In celebration of Women’s History Month, the National Restaurant Association (NRA) is recognizing the contributions of many dynamic women, who through their vision, hard work, and dedication, have achieved success in restaurants and made the industry a leader in the national economy. “Restaurant jobs provide opportunities for women of all backgrounds and experience levels, helping […]

Restaurant Industry Added 58,700 Jobs in February

The National Restaurant Association's chief economist Bruce Grindy breaks down the latest employment trends: “Despite the challenging winter weather conditions in parts of the country, restaurants continued to add jobs at a robust pace in February, according to preliminary figures from the Bureau of Labor Statistics (BLS). Eating and drinking places added a net 58,700 […]

NRA Reports Continued Industry Optimism

Buoyed by higher same-store sales and traffic and a positive outlook among operators, the National Restaurant Association’s Restaurant Performance Index (RPI) remained elevated in January. The RPI—a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry—stood at 102.7 in January, which represented the fourth consecutive month above the level of […]

NRA Supports Clarified Definition of Seasonal Worker

The National Restaurant Association executive vice president of policy and government affairs, Scott DeFife, issued the following statement of support for the STARS Act of 2015, legislation that will align the definitions of seasonal employment in the Affordable Care Act and streamline the applicable large employer determination process. “The National Restaurant Association commends the introduction […]

NRA President’s Contract Renewed Five Years

The National Restaurant Association issued the following statement regarding its decision to renew the contract for association president and CEO Dawn Sweeney: "We are pleased to report that at last week's joint NRA board of directors/National Restaurant Association Educational Foundation trustees meeting, we announced that Association and Educational Foundation president and CEO Dawn Sweeney's contract […]

NRA Report Indicates a Positive Conclusion to 2014

Driven by positive sales and traffic and an uptick in capital expenditures, the National Restaurant Association’s Restaurant Performance Index (RPI) finished 2014 with a solid gain. The RPI—a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry— stood at 102.9 in December, up 0.8 percent from its November level of 102.1. In […]

NRA and SBA Partner to Promote Small Business

The U.S. Small Business Administration administrator, Maria Contreras-Sweet, announced that the federal agency is partnering with the National Restaurant Association to promote dining out during Small Business Saturday on November 29. The partnership will amplify restaurants during the national push to support our nation’s small businesses on the busiest shopping weekend of the year. “Local restaurants pack a big […]

NRA Launches Sustainability Newsletter

The National Restaurant Association has issued “Bright Ideas,” its first-ever sustainability newsletter, which offers tips and tools to restaurant and foodservice operators on eco-friendly practices. The newsletter, produced by Conserve, the NRA’s sustainability initiative, features a variety of videos, best practices, case studies, and personal accounts of chain and independent operators who have achieved success by practicing sustainability at […]

NRA Names New VP of State Restaurant Relations

The National Restaurant Association has named Brendan Flanagan Vice President of State Restaurant Association Relations. In his new role, Flanagan will lead and manage enterprise-wide relations with the State Restaurant Associations (SRAs). He previously oversaw the Association’s state and local legislative affairs. “Brendan’s extensive experience with NRA‘s state and local initiatives makes him the […]

New York Upholds Decision to Overturn Beverage Ban

New York’s highest court has upheld a lower court’s decision to overturn the 2012 ban on the sale of sugar-sweetened drinks larger than 16 ounces. The National Restaurant Association joined the American Beverage Association and others in filing a lawsuit challenging the ban, saying the Board of Health acted unlawfully outside of its scope of […]