A good deal of ground-level sentiment hints at a resilient restaurant consumer. But patterns are changing. Foodservices and drinking places earned $84.98 billion in May, per federal data. It represented only a 0.7 percent increase from April and perhaps the surest sign yet guests are starting to adjust spending amid an inflationary climate.

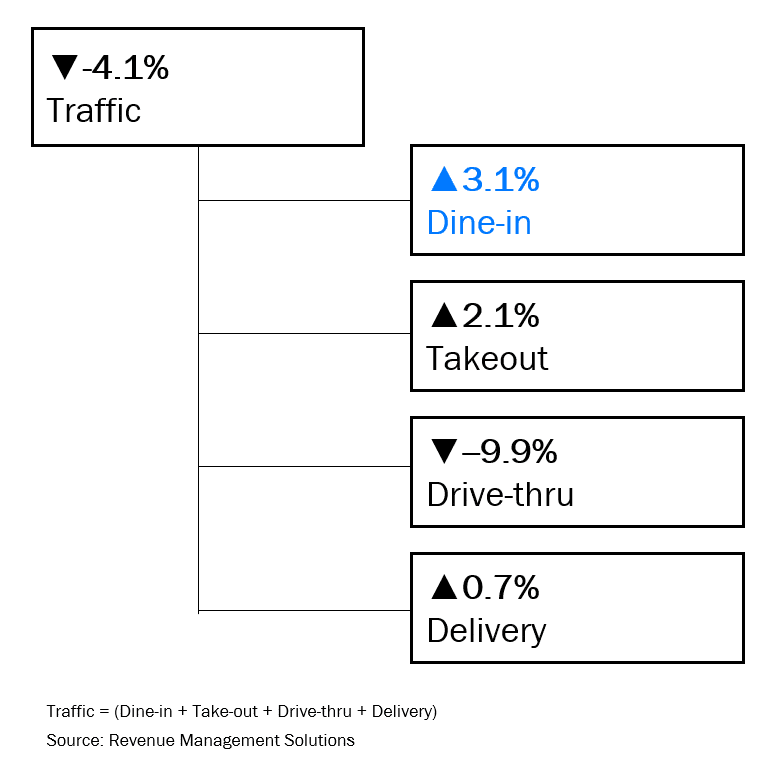

Over 2022, the bulk of the industry’s recovery has stemmed from price versus traffic. The latter decreased 4.1 percent, year-over-year, across quick service in May, according to Revenue Management Solutions.

Net sales moved into the green at 3.4 percent after a 2.9 percent dip in April. However, again, this was a kick back from spending as overall prices hiked 11.8 percent in the May and average check rose 7.8 percent, year-over-year. Basket size, meanwhile, was down 3.6 percent and, compared to the previous month, quantity per transaction decreased by 1.6 percent.

Shrinking basket size and slowing traffic are consistent with reported consumer behavior, RMS said. In its Q1 consumer report, 37 percent of respondents reported spending less of their disposable income on restaurants than last year. In addition, when asked how they were spending less, one in three reported trade-down behaviors, with 34 percent ordering less expensive items and 30 percent opting for less expensive restaurants.

Lunch and dinner traffic slid versus May 2021. Lunch was down 2 percent and dinner 1.8 percent. Both saw a roughly 1 percent increase over last month.

Dine-in now represents 10.4 percent of average daily quick-service traffic—up from 6.9 percent last year. Drive-thru, simply comping against a significant 2021 peak in favor of dine-in, is 9.9 percent down, year-over-year.

Broader industry trends have been relatively steady. Sales were $84.42 billion in April and $82.39 billion in March. In May 2021, restaurants hauled in $72.34 billion.

The question, though, is where this heads as inflationary pressures continue to hold.

The food-away-from-home index rose 7.4 percent year-over-year in May, the biggest 12-month increase since the period ending November 1981, according to the Bureau of Labor Statistics. Quick-service menu prices rose 7.3 percent while full-service prices increased 9 percent. Also, the average cost of gas reached $5 for the first time in recorded history, AAA said.

Guest are still tapping restaurants for “bridge meals” and because eating out and eating in aren’t as disproportionally priced as some might think. The food-at-home index rose 11.9 percent over the last 12 months, the largest 12-month increase since the period ending April 1979. All six major grocery store food group indexes increased over the span, with five of the six climbing more than 10 percent. The index for meats, poultry, fish, and eggs lifted the most, rising 14.2 percent, with the index for eggs increasing 32.2 percent. The remaining groups saw upticks ranging from 8.2 percent (fruits and vegetables) to 12.6 percent (other food at home).

May also represented the third consecutive month the cost of full-service restaurant items increased at a higher rate year-over-year than limited service. Prior, it hadn’t happened since March 2020.

Mobile location analytics platform Placer.ai found examples of trading down in its latest data pull, too. During the week of December 13, 2021, for instance, visits to full-service restaurants were up 53 percent, year-over-year, and 43.4 percent at quick-service locations. But as of the week of June 6, visits to full-service restaurants were down 4 percent but still up 7.3 percent in counter service.

Since the week of March 14, year-over-year quick-service visits have outperformed equivalent foot traffic to full-service restaurants.

Visits for the week of June 6 climbed 17.8 percent for McDonald’s and 17.2 percent for Chipotle versus the same periods last year, even though both have bumped prices significantly in recent months. McDonald’s was up some 8 percent over 2021 in Q1. Chipotle roughly 10 percent in January.

QSR caught up with Dante DiCicco, a former builder of Snapchat and third-generation restaurateur, to chat about the current arena and how operators are going to navigate what could be a coming recession. DiCicco today runs Zitti, a startup aimed at fixing supply chain problems for independent restaurants, like the ones where he grew up working for his parents/grandparents.

Let’s start with the big point. Is a recession coming?

Unfortunately, yes, we do believe a recession is coming. With the Federal Reserve’s 75-basis-point rate hike earlier this month, the probability of recession has doubled, and stocks are under increasing pressure. According to a recent report by Morgan Stanley, the likelihood of a recession on most econometric models has risen from 30 percent to about 60 percent. Stocks also face further downside risk, and consumer inflation is the highest the US has seen in 42 years.

Food and commodities prices are already being some of the hardest sectors hit. More than ever, it is vital for restaurants to have real-time information on rising food costs and the implications of those rising costs on your bottom line.

How do you think these conditions are going to affect restaurant spending? It seems like the consumer has been relatively resilient thus far. But is it only a matter of time before people start trading down?

Rising food prices will eventually affect consumer restaurant spending. It’s a simple supply and demand equation. However, you are correct that the consumer certainly has been relatively resilient thus far. Any restaurant still around today has also proven its resilience, as it has made it through the last few years of the pandemic. And with unemployment levels still near record lows, consumers still have disposable income.

The last few years showed us how important restaurants are to America’s day-to-day life. According to the National Restaurant Association’s 2022 State of the Industry Report, 63 percent of adults say restaurants are essential to their lifestyle. That statistic includes 75 percent of millennials and 70 percent of Gen Z.

It remains to be seen how the unique combination of low unemployment, consumer spending, and pent-up demand to eat out—which was driven by the pandemic—will impact consumer spending at restaurants.

However, we are cautiously optimistic that any decreases will not be significant and that by using new resources, the restaurants that have made it this far will be able to weather any future storm.

Do you think they’ll trade down more versus eating out less? Or will it be both?

I am not sure it will be either. We believe that the consumer will stick with their existing favorite restaurants, just potentially eating there a little less often given rising food prices.

Trading down takes consumers out of their existing behaviors, which is unlikely unless consumer spending decreases massively, which we do not believe will be the case.

Eating out can often be less expensive than ordering in, as you avoid the exorbitant fees that food delivery apps charge. After the last two years, who doesn’t prefer eating out with real people in real places?

How can restaurants prepare for that change? Do they need to rethink menu prices? Start considering value again?

Restaurants can prepare for potential changes in consumer spending by rethinking how they run their back-of-house, which is often the difference between strong profitability and cash flow, or not. This preparation will involve embracing new technologies.

By providing time- and money-saving services like streamlining payments with food suppliers, leveraging data and insights, and forecasting future price volatility, technology can play an invaluable role in helping restaurants gain a better handle on their balance sheets during these uncertain times.

What could be coming, supply-wise, in the months ahead, such as a wheat shortage?

Unfortunately, a bad mixture of geopolitics, climate change, and supply chain disruption is leading to shortages and sky-high prices on food products across the board. Wheat is an especially dramatic example. About a month ago, a food insecurity expert testified before the United Nations that due in large part to the invasion of Ukraine, where about one-third of the global wheat supply is grown, the world had almost ten weeks of wheat supplies left.

Hopefully, this disruption will be resolved before it starts. But we suggest that restaurant operators prepare in three key ways:

Assess your product mix. Take a hard look at your product mix and assess what percentage is wheat-based products. If that percentage is high, start planning alternatives now.

Diversify your suppliers. Expanding your network of suppliers now will give you better odds of getting the products you need, whether it’s wheat or something else, at a better price.

Cut other expenditures. Look for other places to cut costs. We know–the cost of food is already sky-high. But analyzing your ordering habits and eliminating excess, switching to a back-office payments system that cuts down on busy work, and even streamlining your menu are ways to save money to help offset this cost.

How can independents navigate some of these challenges without the resources and leverage their larger chain peers enjoy?

Historically, independent restaurants have been disadvantaged compared to large chain restaurants in three key ways: antiquated payment processes, lack of access to data and analytics, and unfavorable payment terms. By adopting back-of-house financial services software, independent restaurants can start to achieve parity.

Antiquated payment processes such as faxed invoices and payment via paper checks disproportionately harm independent restaurants because of how much manual labor these processes require. Big chain restaurants have entire departments and CFOs to manage this busy work, whereas independent restaurants usually have one overworked manager running all front- and back-of-house operations. By digitizing these processes in the cloud, independent restaurant managers can get valuable time back and avoid costly human errors.

Thanks to supply chain disruptions and inflation, data and analytics are more valuable for restaurants than ever. Big chains have invested heavily in this technology over the past decade, but independent restaurants have not been able to afford to do so. With back-of-house software, independent restaurants are gaining free, invaluable insights into historical spending patterns and market value costs that will allow them to stay competitive in an ever-shifting landscape.

Unfavorable payment terms have been a thorn in the side of independent restaurants since my family opened their first Italian eatery in the 1950s. Back-of-house software that offers flexible and extended payment terms gives independent restaurants the cushion that larger chains get, allowing them to manage cash flow better.

While there’s no getting around the current challenging economic conditions entirely, back-of-house software can offer independent restaurants the resources and leverage of large chains.

What about staffing? Do you think the industry ever gets back to pre-2020 levels?

Recruiting and retaining employees remains a top challenge for restaurant operators in 2022. During the early phases of the pandemic, when many restaurants were operating on extremely limited hours, a huge number of restaurant staffers moved into other industries–and they’re staying.

We don’t think the industry will get back to pre-2020 levels, but we also don’t think that’s bad. Good back-of-house software can take over quantitative administrative jobs that people used to do, such as recording expenses and paying invoices, eliminating costly human errors, and making existing workers more efficient. These changes will free workers to focus on important tasks like food preparation, customer service, and planning and executing strategic growth.

In the year to come, how are successful brands going to win, despite all these challenges?

In the year to come, successful brands are going to win by:

Maintaining a rigorous focus on the customer. At the end of the day, if you continue to execute on delivering a great food product and a best-in-class customer experience, people will keep coming back.

Streamlining the back-of-house. Irrespective of how well sales are doing, many restaurants fail because they lose focus on their back-of-house. By streamlining back-of-house operations, restaurants can manage spending while spending more time with customers.

Using data and analytics. With high inflation and the supply chain in constant flux, tracking real-time ingredient costs and adapting accordingly is imperative