When former Arby’s executive Scott Boatwright joined Chipotle as chief restaurant officer in May 2017, he was greeted by operational opportunity. The fast casual’s structure was top heavy. Field and district managers oversaw 12–15 restaurants apiece, which fostered a reactionary culture instead of a proactive one. Leaders extinguished more fires than they brainstormed ideas. There were other surprising gaps—everything from buddy-system training programs to a lack of technology and accessibility.

As has been widely publicized, Chipotle’s comeback story is now well past the introductory pages. The chain’s first-quarter same-store sales growth of 9.9 percent, year-over-year, represented Chipotle’s fifth consecutive period of accelerating comps. Perhaps most impressive, the figure included 5.8 percent transaction growth as restaurant-level margins hit 21 percent, 150 basis points higher than last year.

If we’re just talking stock price, the company’s shares moved around $726 on Tuesday. In October 2017, Chipotle dipped below $300 for the first time since March 2013.

CEO Brian Niccol has made no shortage of changes during this climb. Read more about them here. Running better restaurants and infusing tech into the model was chief among them. Chipotle didn’t just bounce off the bottom with digital—it springboarded. Last quarter, the company’s digital sales boomed 100.7 percent versus the comparable period, up to 15.7 percent of total sales for the quarter.

All of these updates are gaining momentum, Boatwright says, and there’s no reason to expect a slowdown. But in a recent conversation with QSR, it wasn’t the topic he choose to start with. That would be what Boatwright calls the restaurant world’s “talent crisis.”

If you look at the industry agnostically, without equating brand value into the debate, how do you win in today’s oversaturated and ultra-competitive climate?

“There are a couple of ways,” Boatwright says. “One of which is to ensure you have the best talent because the labor pool, for the first time in my lifetime or my career, just surpassed a mark—and I think it was a key milestone for our country—where there are now more jobs available than people to fill those roles.”

It might be a celebratory moment for America, but it signals something very different for restaurants. This is an industry, in particular, negatively affected by a bursting labor pool. Today, people in general don’t aspire to rush out of college and work in foodservice, Boatwright says.

[float_image image=”https://www.qsrmagazine.com/wp-content/uploads/2019/07/Scott.jpg” width=”50″ link=”” caption=”Scott Boatwright was the senior vice president of operations at Arby’s before joining Chipotle.” alt=”” align=”left” /]

“People are not informed on how emotionally and financially rewarding the restaurant industry can be,” he says.

According to the National Restaurant Association, nine out of 10 restaurant managers and eight out of 10 restaurant owners started their careers in entry-level positions. How many industries boast similar statistics?

The dynamic Boatwright is referencing reflects changing labor goals among younger people. Teenagers aren’t flocking to work like they once were. College is now considered more of a necessary and natural step than a privileged one. This creates a force of employees with degrees seeking employment beyond entry level from the moment they walk off the stage. And they probably didn’t major in restaurants, although they likely have translatable skills without even realizing it.

The number of restaurant employees between the ages of 16 and 19 years old has ticked up to pre-2007 levels, right before the financial crisis, per CNBC. However, the labor force participation rate of teens has stagnated since 2016. Restaurants have pulled from other industries, like retail, which has been plagued by closures over the past decade. The Department of Labor’s Bureau of Labor Statistics found that 1.7 million teens worked in restaurants in 2018—the same number as 2007. You have to also remember that in the past decade, per the Bureau of Labor Statistics, the number of restaurants jumped close to 16 percent.

From 2010–2017, restaurants accounted for one out of every seven new jobs, according to The Wall Street Journal.

What this all means is there are a lot of restaurants, a ton of job growth, and yet the same amount of teenage employees in restaurants as 2007.

Another way to look at it: 41.3 percent of teens held a job in 2007. Last year, it was 35.1 percent. The force hasn’t rebounded since the recession and more young people are working on college resumes than trying to line their pockets with spending money.

The Bureau of Labor Statistics also estimates that the number of teenagers in the labor force will drop by 600,000 during a decade-long span ending in 2026.

According to the National Restaurant Association, teens used to outnumber adults aged 55 years or older in the industry 3 to 1. It’s now 2 to 1. And that older demographic rose by an eye-opening 70 percent between 2007–2018. Why the massive bump? People are living longer and need to work more to sustain their lifestyles as health-care costs and other financial needs surface. Adults 65 years or older are predicted to be the fastest-growing component of the American workforce over the next decade, according to the The Bureau of Labor Statistics.

This past March, the National Restaurant Association pegged the number of hospitality vacancies at 1 million. With the national unemployment rate sub-4 percent (it was 3.6 percent) in May, it’s easy to see why Boatwright says restaurants face a talent crisis.

One nice thing for Chipotle, though, he adds, is that this isn’t a brand agnostic situation. “We’ve been really positioning ourselves, and we’ve been fortunate,” he says. “We have a great brand people have an affinity for.”

Basically, the name on the front of the building does some heavy lifting. It’s been on Chipotle, though, to match equity with the right employee-value proposition.

The No. 1 factor is training and developing talent. Chipotle’s greatest strength has also been one of its riskier propositions over the years. The company doesn’t have freezers, microwaves, or can openers. The ingredient-forward platform fuels the chain’s affinity but it’s resulted in some serious issues, too. The norovirus incident in Sterling, Virginia, for instance, which shut down a store for two days, came from an employee coming to work sick and not following Chipotle’s protocols. After an Ohio outbreak sickened more than 600 people last July, the company retrained all of its employees and installed an augmented daily routine. It then deployed Zenput, the platform used by Domino’s and KFC, to provide a mobile checklist solution.

“We’re effectively teaching teenagers classic culinary techniques, which is not easy,” Boatwright says. “And it’s not easy to do in one restaurant, much less at scale.”

Chipotle turned to tech here as well so it could deliver content in a more meaningful way to its 75,000 employees. “We wanted to provide a balance with how they’re consuming information today, via electronically or through social media channels,” Boatwright says.

An early add for Boatwright was to bring mobile-based back-of-house user interfaces into Chipotle’s training, field leader management, and operational systems. That meant putting iPads into restaurants and moving training out of the kitchen.

The shift reduced turnover, Boatwright says, and allowed Chipotle to make real-time updates instead of relying on employees to pass down knowledge to each other.

Chipotle tries to strike a balance with online training and videos and what Boatwright refers to as “shoulder-to-shoulder training” in store.

In terms of other retention-inspiring moves, Marissa Andrada, named Chipotle’s chief human resources officer last April, has worked to get the chain’s bonus program all the way down to its team member level.

In February 2018, Chipotle announced enhancements to employee benefits across the system. This included special cash and stock bonuses and improved parental leave. Like many restaurants, it stemmed from tax reform savings. Chipotle took more than a third of its haul and put it into accelerated training, including a formalized classroom program, maternity/paternity coverage, and life insurance and short-term disability insurance coverage for hourly restaurant managers.

“I think it’s something that we need to sing from the rooftops. You meet people all over this industry who started out as a dishwasher or a line cook or just a crew member and have gone on to achieve great things, emotionally and financially.” — Scott Boatwright.

Traditionally, Chipotle has provided twice-annual metric increases, paid vacation and sick time, and stock rewards at the manager level.

One thing in particular, Boatwright says, that’s aided the process is the company’s partnership with Guild Education. The tuition assistance program, Cultivate Me, provides qualifying Chipotle employees access to financial support up to $5,250 each calendar year. Workers can also earn as many as 37 college credits for their on-the-job training at Chipotle.

“We’re also bringing forward our new GED program and our English as a second language program we’re offering to all team members and family members, which I think is also a competitive advantage,” he says.

Everything leads to one goal: “We want them knocking on our door first,” Boatwright says of employees.

Another labor mend is transparency. Chipotle, Boatwright adds, tries to map out its career path, from crew member to vice president, so employees, especially those just getting started, can see the opportunity ahead. This is something Boatwright believes the restaurant industry as a whole can do a better job of.

“I think it’s something that we need to sing from the rooftops,” he says. “You meet people all over this industry who started out as a dishwasher or a line cook or just a crew member and have gone on to achieve great things, emotionally and financially.”

Making the make-line work

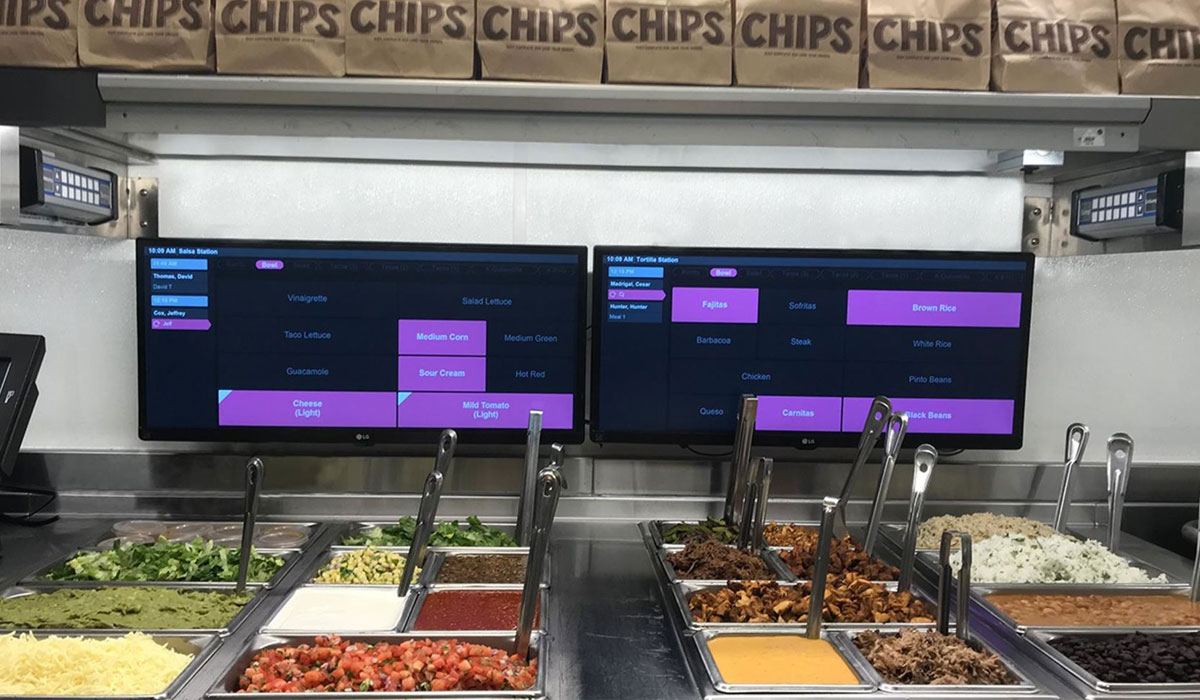

Chipotle’s digital make-lines, en route to all stores by year’s end, mark “the biggest change in the space since I joined the brand,” Boatwright says.

The tech-enabled equipment helps Chipotle serve the influx of digital orders. It also improved efficiency and accuracy. “Pretty significant capital expense,” Boatwright says, “but we are skating where the puck is going.”

Boatwright ran through how they work. The old process was an analog one where Chipotle would use CHITs (tabs) that spit out of the printer. So every order would come in when it was placed, not necessarily in the order of when it was to be delivered. And the restaurant operator would organize the CHIT by time slots.

They were cumbersome, Boatwright says. Paper stacked up. Restaurants wouldn’t know which ones were going to which guests. “It caused all sorts of guest experience problems as well as accuracy problems,” he says.

The new system loads orders in order of delivery time. All others slide behind the current order. Then, when the order is fired, employees start a burrito (or bowl, salad, etc). The screen shows exactly what goes into the meal. The second part of the line provides toppings and then a digital sticker is printed out for every guest, with their name and ingredients. Workers bring the order to Chipotle’s digital pick-up shelves, which also rolled out over the past year.

That latter update has been a major fix, Boatwright says. Just in terms of delivery, third-party drivers can walk in and grab the food and leave. It’s helped ease a top hurdle in the space—driver abandonment. “For us, we have become a destination of choice for drivers because they know they can get in and out of our restaurants very quickly without friction,” Boatwright says. “And they know exactly what time that order is going to be ready for pickup.”

Boatwright says Chipotle is “looking at everything,” in regards to what’s coming next. There are currently 12 restaurants with mobile-order ahead “Chipotlanes.” They’ve been a huge success, he says, in overall sales performance as well as consumer adoption. “It’s going up exponentially,” he says.

“We’re going to continue to think about the digital ecosystem,” he says. “How do we continue to innovate, continue to remove friction, and continue to growth that side of the business? I really can’t say what numbers we will see, but I will tell you, in regards to last year’s growth, there’s no reason to think we can’t see similar growth in the months and years to come.”