KFC is riding eight consecutive years of positive same-store sales growth—a comeback that’s progressed beyond the turnaround stage into something more lasting. Now, it’s time to complement one streak with another, chief development officer Brian Cahoe says. KFC opened 55 new U.S. locations in 2021, for a net of four stores. Despite pandemic setbacks, delays, and closures, it represented the first time the chain has been net new unit positive in 17 years.

And Cahoe says KFC will go back-to-back in 2022.

“What you’re seeing in the U.S. is a continuation, and even a building, of momentum of all of the strategies we’ve been bringing to life and the foundation that we’ve put in place,” he says.

In domestic markets, KFC’s same-store sales climbed 12 percent in Q4 and 13 percent for all of 2021, both on a two-year basis.

Beyond coupling sales with unit expansion, KFC’s multi-year effort to reinforce its brand identity is coming into sharper focus as well. This past year, the chain hit a prior goal when it converted 70 percent of its system to the “American Showman” design, recognizable by bright red-and-white stripes (like a chicken bucket), bucket chandeliers, and graphics that serve as an allusion to the Colonel’s hard-working background. A modern take on KFC’s roots.

Cahoe says the brand remodeled “hundreds of assets” over each of the last few years, pandemic conditions or not.

However, during the chain’s sales climb, there’s been underlying innovation at work. KFC’s digital integration, via delivery, pickup, ecommerce, and app, was a development gaining relevance ahead of COVID. But it’s rushed to the surface, just as it has across Yum!’s portfolio and much of the sector. Yum! posted $22 billion in digital sales last year—a company record. KFC’s U.S. digital sales soared 70 percent, year-over-year, driven by its delivery service channel and e-commerce platform that launched nationwide early last year. In Q4, KFC also introduced “Quick Pickup,” where guests walk-in and grab mobile orders out of cubbies. Cahoe says the update, in essence, is rolled out nationally at this point.

All of it, though, is fueling where KFC goes next: the rapid introduction of the company’s “Next Generation” asset base, and all the connectivity that comes with it.

KFC opened its first Next-Gen restaurant in Berea, Kentucky. First introduced in November 2020 and debuted in Q4 2021, it boasts a digital-forward and contactless experience, including the company’s first double drive-thru lane. Additional Next-Gen stores opened in Westfield, Massachusetts, and Detroit.

Sitting today, about 25 percent of KFC’s pipeline are Next-Gen builds, Cahoe says. The only reason the mix isn’t higher is because 2022 represents a transitory phase of sorts, due to construction and general growth timelines. “We went from concept design to last year getting those first locations permitted and built out and now open,” Cahoe says. “And we’ll go through that round of learnings and feedback with franchise operators.”

In other terms, learnings and field experience are influencing KFC’s next act. But it’s coming fast.

Pradnya Bendre, director of KFC U.S. architecture and design development, says flexibility was a key component to concepting the brand’s Next-Gen models. And so were some of the tenets driving the chain’s eight-year comeback. “We wanted to elevate KFC’s distinctive identity and really take it to the next level,” she says. “Especially from the point of new customers emerging in a post-COVID world.”

Reflecting trends seen across quick service, Next-Gen packs digital integration into a smaller footprint, anywhere from 1,300 square feet to 2,200. The lower end is an off-premises-centric model without a dine-in element. There’s a lobby for customers, or couriers, to walk in and grab their food.

The signage is deliberate, too. Dedicated parking spots for online orders. Visible wayfinders to lead customers to an entrance for online orders. And the Quick Pickup shelves are a part of all Next-Gen builds to remove friction inside.

The dual-lane drive-thru is something that can flex as well. Bendre says there are options, based on trade area and markets, and, essentially, how much digital business is part of that location’s mix, to use them as multiple order points or to dedicate one as an “express lane” for order-ahead guests. Adding dual lanes is an option KFC wanted to make available for franchisees, she adds, due to how challenging it is (or virtually impossible) to retrofit to current locations.

Meanwhile, there’s work being done in the back of the house to create more efficient flow, Bendre says. “How our back-line responds to the online channel, or how the cook-line responds to the drive-thru channel—it was very important for us that we put focus on those aspects,” she says.

[image source_ID=””]

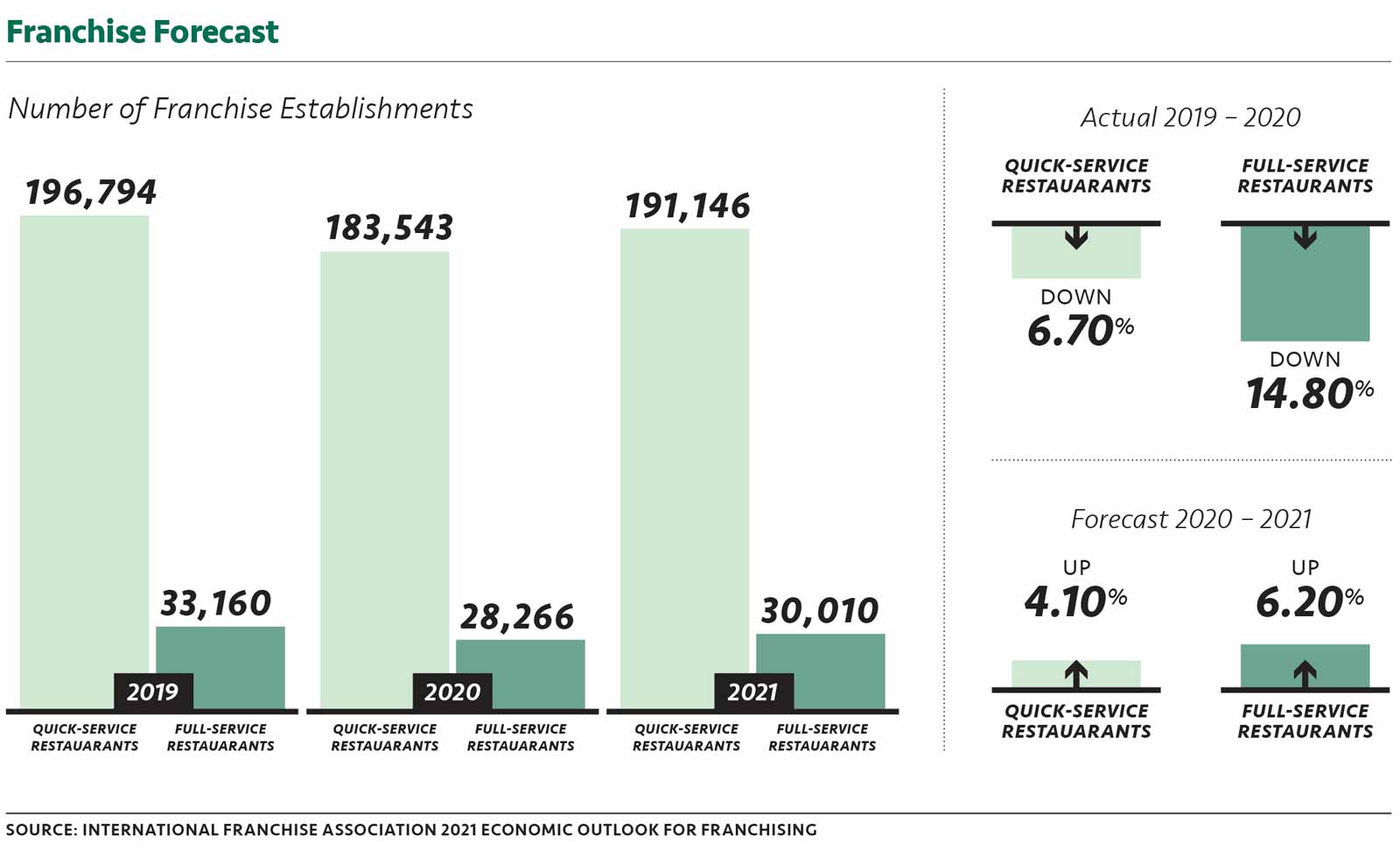

Cahoe says the COVID real estate market has been a jumble, varying wildly from market to format. In the early days, forecasts of mass closures suggested sites would be up for grabs in the fallout. That hasn’t quite come to fruition, Cahoe says, at least not for KFC, because the quick-service sector isn’t where the retraction pulsed. Especially at drive-thrus. That and off-premises “has been a strength that has been part of our momentum,” he says, “but it’s also been a part of the momentum for competitors.”

In turn, there’s a mixture of availability and cost of real estate as it relates to existing drive-thrus or pads that can be permitted or zoned for drive-thru. “That, arguably, has got more competitive since the pandemic started,” Cahoe says.

And not only are brands like KFC jostling for drive-thru, or pickup lane, space with other established players, but fresh entrants are flocking in, like Shake Shack, sweetgreen, CAVA, Chipotle, Noodles & Company, etc.

All that said, however, KFC ended 2021 with 26,934 restaurants—22,981 internationally and 3,953 in the U.S.

Back in 2000, there were 5,364 KFCs stateside. The figure started to fall from 2010–2011, when KFC’s system retracted by 388 locations. It would drop by at least 100 units for the next six years, going from 4,780 to 4,109. And then, the comeback mentioned earlier picked up. Closures slowed to 58, 35, and nine, before 122 in COVID’s first year. As noted, the number flipped into the green for 2021.

Yum! CFO Chris Turner called this past year an “inflection point in development” for KFC, and one Cahoe believes will only shoot upward.

Additionally, 3,953 locations presents “tremendous runway for growth,” Cahoe says. “Really, in every market throughout the U.S.”

For a national brand with massive awareness and equity, sub-4,000 gives it plenty of space to infill, enter new markets, and everything along the way. There are 11 quick-service brands with more locations than KFC today. Subway, at the end of 2020, had more than five times the number of domestic units (22,190).

“In some cases, competitors that are larger than us today might have that cannibalization or infill challenge. We don’t,” Cahoe says. “So we can be opportunistic and competitive and go after those sites and continue to grow.”

A key part of KFC’s go-forward strategy will unfurl across urban inline expansion. KFC’s Next-Gen design and features are flooding this arena as well, where the chain has aggressive plans for New York and St. Louis, and other city centers.

Cahoe says this is one U.S. area where KFC is underpenetrated versus its national footprint. The company opened its first Next-Gen urban inline in 2021, and more are coming down the pipe.

Bendre says KFC’s Next-Gen hallmarks, like Quick Pickup and digital call-outs, are taken to “the next level” with urban designs given the consumer that generally comprises those markets. “Their expectations are a little different,” she says. “Their lifestyles are different.”

Interiors are designed to reflect communities and stores feature 10–20 seats, including more countertop seating as opposed to the typical four-top tables seen in suburban KFCs. There’s also designated signage to direct customers and delivery drivers to in-store mobile pickup areas.

The Next-Gen urban inlines, which range from 1,400 to 1,800 square feet, are modern in look and spend even more time on the kitchen layout to ensure tight spaces don’t stall throughput. Six are planned for this year.

The foundational unlock, Cahoe says, is access through digital channels. It alleviates the must-have of a drive-thru to deliver on convenience.

[image source_ID=”130447″]

[image source_ID=”130447″]

In time, all new builds and formats, in the suburbs or cities, will be Next-Gen assets. Bendre says franchisees are clamoring to open them, and the brand is seeing “more traction than we expected.”

Cahoe believes that can be traced back in time as well. Off-premises, as recent a movement as it feels, is something that’s actually been in KFC’s DNA for decades. Picnics. Buckets of chicken on the Sunday dinner table. The brand didn’t have to cross many awareness gaps when it came to serving at-home occasions spurred forward by COVID. Digital simply made it all work faster, and in multiple formats.

“As much as you can talk about that being nostalgic, the reality is that it’s very fitting to where the consumer has already moved,” Cahoe says. “And where we think the consumer continues to stick as we go forward.”

Current conditions are also helping to democratize KFC further. Delivery, in particular, is bringing KFC to a broader audience and allowing it to reach different demographics.

“I like to think these are exciting times,” Bendre says. “We don’t see them as challenging times.”