Peter Ortiz wants to look back and say, “I was here at 39 [restaurants].” It’s the dream of any franchise development guru, but one typically reserved for emerging brands in the infancy of their expansion dreams. Potbelly, though, has 478 locations. Yet of those stores, only 41 are currently franchised (39 when Ortiz arrived around Labor Day). The Chicago-based, 42-year-old brand began franchising roughly a decade ago. It’s never quite pieced together the tools to scale that side of its business, says Ortiz, who was announced as VP of franchise development in January.

But that’s about to change.

And one thing Potbelly has in place that many young franchises don’t, and should serve as a fire starter: brand awareness that doesn’t need a bulletin board to get the message out.

“People get excited because they’re not bringing that new brand in and praying that it’s going to be successful,” Ortiz says. “I think that’s huge.”

Because Potbelly is a public chain and offers growth guidance quarter-by-quarter, Ortiz doesn’t want to toss out any concrete projections. But he says a conservative, internal long-term projection for the brand is 2,000–2,500 stores. While corporate growth will continue, franchising is the real vehicle to get there, Ortiz says. That’s where he comes in.

If you look at Ortiz’s background, he’s no stranger to the model and what it can mean for a restaurant concept’s growth. He served in a similar role at franchise-heavy FOCUS Brands, where he was responsible for recruiting, awarding, and onboarding new operators at Moe’s Southwest Grill, Schlotzsky’s, and Carvel Ice Cream. He executed the sale of nearly 2,000 franchisees throughout the U.S. and internationally.

By the time January arrived, Ortiz had already led “six or seven” discovery days at Potbelly. He was eager to get moving. Ortiz uses the adage, “building the plane in flight,” when talking about what his early goals were, and how he planned to ignite this unrealized aspect of Potbelly’s growth.

It means taking what you have from day one and selling immediately instead of saying, “let’s start dealing when everything is perfect.” Meanwhile, work behind the scenes to ensure the franchise is set up for long-term and sustainable growth. For Ortiz, this involved devising a marketing plan that incorporated social, digital, and print. Refining Potbelly’s message for conferences and trade shows. Hosting those aforementioned discovery days. But, again, still selling while this all unfolded.

One thing that hasn’t taken all that much work, though, is getting people to love the brand as much as he does. Ortiz’s daughter worked at Potbelly 15 years ago in Columbus, Ohio. He developed such an affinity for it he would fly into Chicago’s Midway International Airport just to make sure he could eat there.

When CEO Alan Johnson succeeded interim leader Michael Coyne on December 4, Ortiz shot him a message on Linkedln and wished him luck. Johnson responded in less than 30 minutes and the two stayed in touch. Eventually, industry vet Jeff Welch, Potbelly’s SVP of franchise development who also joined the company in 2018, called Ortiz and the negotiations began. The former head of Krispy Kreme’s international division, Ortiz says the experience “was like the president was calling me.”

It also appealed to Ortiz to join a rapidly evolving executive team. Johnson brought in Brandon Rhoten from Papa John’s to serve as CEO; named Tom Fitzgerald CFO after a run as president and CFO of retailer Charming Charlie; picked Chef Ryan LaRoche as its first head of culinary innovation; promoted Matt Revord to chief people officer; Julie Younglove-Webb to chief restaurant operations officer; and Maryann Byrdak to SVP of information technology.

“There are many places where I’ve been to where I’ve been Ringo,” Ortiz quips.

Work to be done

Potbelly enjoys a cult-like fanbase in many of its legacy markets. There’s even an underground menu. However, even with serious brand equity to spare, the sandwich chain’s top- and bottom-line health has been a bit more stressed recently. During a strategic review last year, the company considered—then ditched—a possible sale.

Its total revenue dropped 1.3 percent to $422.6 million from $428.1 million in fiscal 2018 versus the prior year. The company opened 17 restaurants, including 10 corporate units and seven franchised, but closed 23 (10 company run and 13 franchised).

In the fourth quarter, company-run same-store sales decreased 1.7 percent as nine restaurants shuttered (seven franchises) and seven opened (four company-run).

Perhaps the blockbuster event of 2018 was a fall test of concept menuboards at 58 locations. The chain also piloted, for the first time in its history, the inclusion of combos and bundle offers on its menuboards. It offered a pick-your-pair option that bundled a half sandwich with a choice of salad, soup, or mac and cheese, as well as a make-a-meal option that combines a guest’s choice of chips and a fountain drink or chips and a shake. By February 12, the new enhanced menuboards were systemwide.

The biggest change, if you look at Potbelly’s center panel of the menu, was to take it down from 55 price points to 18. This was “one heck of a complicated thing,” Johnson said on a March 1 conference call. It was affectionately being called “mission impossible,” internally.

Here’s why it was so intensive: With 486 locations (at the time) Potbelly actually had 680 unique menuboards in terms of size. It had to reprogram the point of sale, redo the company’s app, redo its website, change the loyalty program, and update the catering and delivery functionality for how customers pay. “Other than that, we didn’t have to change too much,” Johnson joked.

It’s only been a few weeks, but Johnson said the results are mirroring initial tests. Average transactions are up. It aligns with Potbelly’s “OneMore” goal, which encourages employees to prioritize suggestive selling to get existing customers to buy one more item, spend one more dollar, and visit one more time.

The addition of LaRoche, a Michelin-starred chef who served as executive sous chef to legendary culinary figure Joël Robuchon and most recently was vice president of culinary operations at Mariano’s, helped turn up the dial on product innovation in 2018. The company’s LTO program featured seven premium sandwiches, two cookies, and a shake last year. Additionally, Potbelly added a soup and made all soups available every day of the week.

“We are 100 percent behind making this brand the strongest sandwich concept in the segment. And I foresee us being quite successful in the near future. This is not something that’s going to happen years from now, this is something I see having an immediate impact.” — Peter Ortiz, VP of franchise development at Potbelly.

On the digital front, the company grew its off-premises business from 15.3 percent last year to over 17.5 percent of comparable sales in 2018. Potbelly also now offers delivery and catering in all of its restaurants. Potbelly has its own drivers but rolled out a platform with DoorDash last month to cover the entire footprint. What Potbelly does is use its own drivers to deliver the bulk of orders during peak lunch hours and then supplement with DoorDash to flex the demand during peak hours and to provide delivery during an expanded all-day window. “Think of it as a variable labor model, where you only pay for it when you need it,” Johnson said.

Potential worth buying into

Potbelly expects its same-store sales to grow in the range of 0.5–1.5 percent in 2019, which would mark the first run of positive gains since 2016.

From a growth perspective, the performance obviously would help Ortiz attract buyers. But he has no shortage of selling points regardless.

Ortiz says he was asked by one group to chat ahead of a recent expo. The reason being, they wanted to be the first ones in. “People were anxious about it,” Ortiz says.

Operators are drawn to Potbelly’s current structure for a few reasons, he adds. They appreciate the corporate-heavy design because Potbelly can test initiatives not in a few stores, but in hundreds, if it wants to. And then there’s wide-open franchise runway that’s letting owners take an entire pie instead of a piece. “There’s nobody putting their toe in their pond,” Ortiz says. “They don’t have to worry about getting markets sold out from behind them.”

Potbelly doesn’t want to be one of those companies that has an average of two restaurants per operator. They’d rather build that scale 10–15 locations at a time. “We want groups that are going to be passionate about the brand,” Ortiz says. “So passionate that they’re going to come in and they’re going to do 10 stores.” So 1,000 restaurants made up of 30 operators, in other words. Not 300.

The only time Potbelly will sell less than 10 locations, he says, is if the market can’t support more.

The perfect buyer is a multi-unit party that owns one to three different segments non-competitive with Potbelly. What Ortiz likes about that target is they typically have the infrastructure to transfer GMs with restaurant experience and get trained and running quickly. Ortiz admits this isn’t unique to Potbelly. “We’re all looking for the same type of multi-unit group,” he says. “The only thing is we’re far more unique than what’s offered out there right now.”

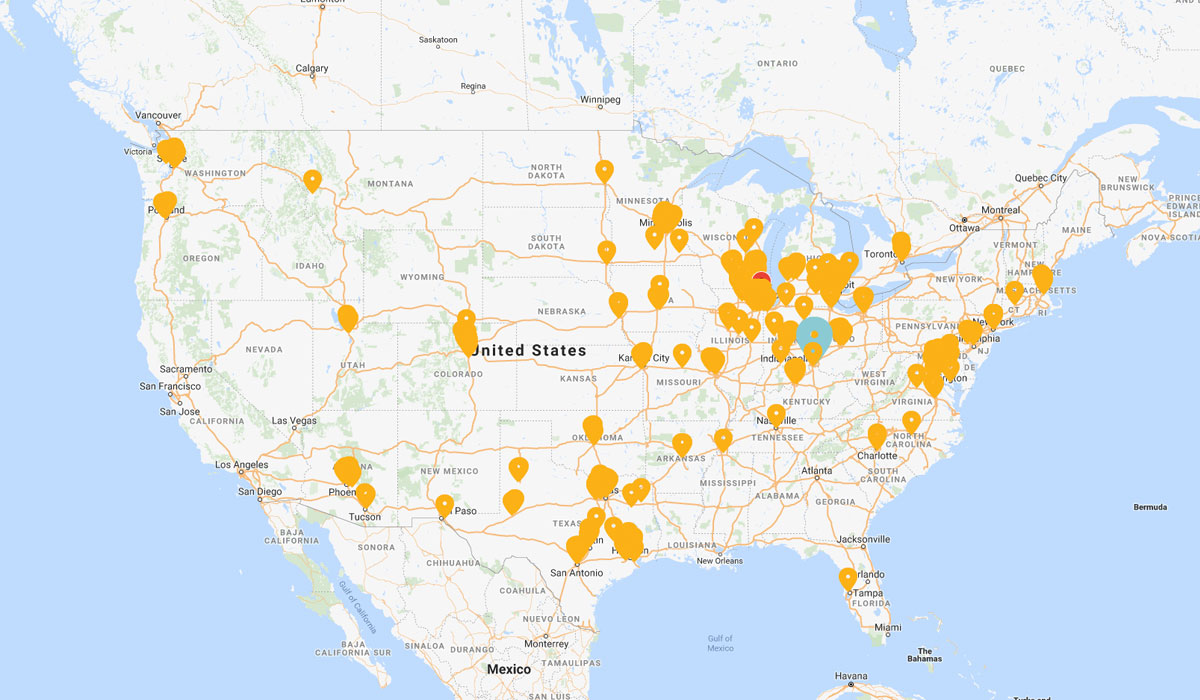

There are two other key notes: One, as the map below shows, outside of Chicago, D.C., New York, and Texas, Potbelly is staring down a pretty open franchise market. And it’s food is not regional or specific. It works everywhere, Ortiz says, as the airport locations prove. “This brand has been just about in every market you can think of. And has been successful there,” he says. “So we don’t have truly a sweet spot.”

Second, on that final point, non-traditional represents a significant path for Potbelly, Ortiz adds. “I can’t sleep at night, sitting up, thinking of different ways to do it and getting to people quick enough,” he says.

This is a process that’s going to ramp up. In 2019, the chain plans to open 12–20 restaurants, including 6–10 company-run units, and close 12–20 (also 6–10 corporate). From a development standpoint, Potbelly expects to break even this coming year.

Perspective franchisees see the chance to get on board before the boom, Ortiz says.

“Everyone is trying to be first with us because we’re not there yet,” he says.

“We are 100 percent behind making this brand the strongest sandwich concept in the segment,” Ortiz adds. “And I foresee us being quite successful in the near future. This is not something that’s going to happen years from now, this is something I see having an immediate impact.”