Over the past 18 months, Potbelly has tested, and tested some more. And while the sandwich chain “significantly changed our corporate culture, leadership, and the way we do business,” chief executive Alan Johnson said, it’s still searching for a formula that fits.

“It’s clear to us that we need to gain further insights into consumer needs and trends in order to further sharpen our brand position and competitiveness,” he said after Potbelly’s third-quarter review.

To turn the final corner, the brand tapped what Johnson labeled, “a top-tier consulting firm,” in June. As that process unfurls, though, Potbelly plans to batten down the development hatches. The company said it will effectively halt all company-owned development until traffic improves. Guest counts dropped 8.3 percent in Q3 against a flat year-ago result.

Johnson said Potbelly might open an airport store or other high-profit venue if the opportunity arises but, mostly, the company is done expanding corporately as it works to improve store-level performance.

Potbelly shut down three restaurants in Q3 (two company run), opened a unit, and closed an international one. For the year, Potbelly expects to shutter 15–22 restaurants, including 9–12 corporate units, and open 8–13 total (two to three company), which is lower the management’s previous guidance of 10–15 (four to five corporate).

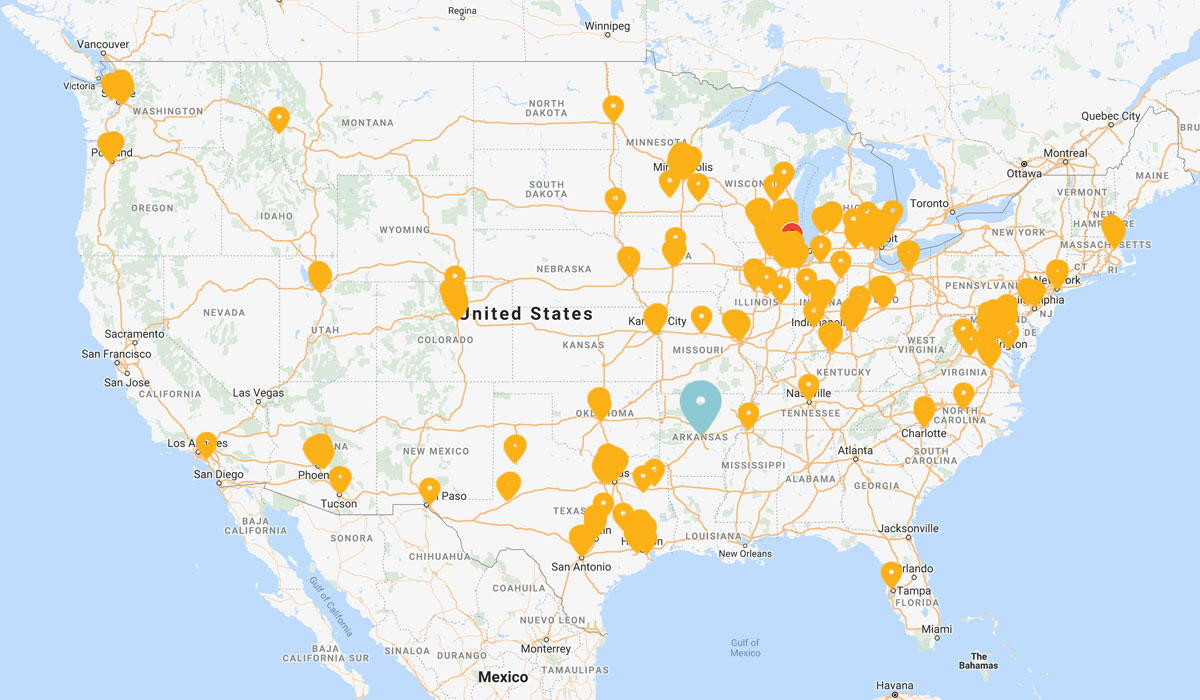

Additionally, Potbelly revealed it was now open to refranchising “in the majority of our markets,” Johnson said.

The brand finished Q3 with 427 company-run and 45 franchised shops. The figures slipped from 435 and 53, respectively, last year.

Potbelly’s sales have tumbled along with its unit count. Same-store sales decreased 3 percent on the company side in Q3. Average check grew 5.8 percent to somewhat offset the negative traffic.

As noted, Potbelly’s soft guest counts measured against a flat traffic quarter in 2018, which, at the time, marked its best performance since Q4 2015. In that period, Potbelly invested in advertising and increased promotional intensity, and its transactions beat Black Box averages by 170 basis points—a significant improvement from the negative spread throughout the first half of the year.

It even led Potbelly to kick off 2019 by scaling back promotions and aggressively hiking advertising to drive transactions. Yet the P&L struggled with both in play.

As other issues surfaced, too, Potbelly realized it would be better served to pare down spend in favor of fixing some core components of its business. This way, marketing efforts could reach their full impact as the company struck the right mix of sandwich messaging, media, and creative amid a hotly contested corner of quick service.

Notably, Potbelly plans to roll out a simpler Perks program in 2020 that will help it build brand awareness and retention from a much more cost-effective perch. The brand had about 1.5 million users last quarter.

As a result of this marketing shift, gross margin comps were negative 2.9 percent in Q3—230-basis points better than the first half of 2019

Potbelly has run up red same-store sales closing in on three years now.

- Q1 2017: –3.1 percent

- Q2 2017: –4.9 percent

- Q3 2017: –4.8 percent

- Q4 2017: –2.4 percent

- Q1 2018: –3.6 percent

- Q2 2018: –0.2 percent

- Q3 2018: –0.2 percent

- Q4 2018: –1.7 percent

- Q1 2019: –4.7 percent

- Q2 2019: –4 percent

- Q3 2019: –3 percent

The company’s total revenue decreased 2.6 percent in Q3 to $104.2 million from $107 million and adjusted EBITDA fell to $7.8 million from $8.8 million.

With refranchising active, Potbelly is rethinking its growth chart. The company has two main targets currently—traffic trends and franchise development. Potbelly signed more deals in the last six months than the previous eight years, with 42 or so locations inked across four agreements. And all are in new-market territories.

Potbelly is looking at non-core areas for refranchising, which merits a long list. But Johnson cautioned it’s something the company is eager to explore, not chase. “Let me be clear, we’re not going to give away the business just so we can say we’ve done a refranchising deal, and no deal is better than a bad deal,” he said.

Opportunities ahead, and a prototype to back

Potbelly opened a “Shop of the Future” model earlier this month in Chicago’s Logan Square neighborhood. The hero feature is a new streamlined ordering process that includes a cohesive menuboard that presents all of Potbelly’s menu items in one area. There are also glass counters to allow guests to follow along and see their food being made. Additionally, consumers complete their order and payment first.

Ascetically, the restaurant separates the ordering process from the dining room to improve in-store experience.

Johnson said the layout reduces the capital investment by about 25 percent for operators (a big lure for potential franchisees), and reduces the payback period for a new restaurant by about a year.

Overall, the design reflects what’s changing within Potbelly’s day-to-day stores. Off-premises and digital channels boosted 18 percent in Q3, driven by the company’s DoorDash national delivery rollout in early July. The company recently added Grubhub.

The digital elements represented 21.6 percent of Potbelly’s sales last quarter, which is an all-time high. Potbelly has put together 15 consecutive periods of positive comps growth on the digital side between catering, delivery, and pickup. “So, it’s not a flash in the pan,” he said.

It wasn’t that long ago, either, Potbelly mixed just 17 percent, Johnson added. The company now has a dedicated catering website and offers delivery in every shop, every day, every single hour that they’re opened, he said.

Also, Potbelly installed pickup shelves systemwide.

The other main switch for Potbelly was a menu optimization effort that led to a 580-basis point improvement in check versus Q3 2018, driven by a combination of price and mix.

Essentially, Potbelly brought new concept menuboards to stores over the winter that included a pick-your-pair option (bundled a half sandwich with a choice of salad, soup, or mac and cheese), as well as a make-a-meal section (combines a guest’s choice of chops and a fountain drink or chips and a shake). Potbelly’s center panel went from 55 price points to 18, an undertaking Johnson previously called “one heck of a complicated thing.” At first launch, Potbelly had 680 unique menuboards in terms of size. It needed to reprogram the point of sale, redo its app, website, change the loyalty program, and update the catering and delivery functionality for how customers pay.

Yet even with all those guest-centric updates in place, Potbelly is still not as differentiated as it needs to be, Johnson said. That’s where the consultant comes into the picture.

“We felt we needed an outside-in perspective to develop the perspective-based consumer insights that create a winning strategy,” he said. “In working with this firm over the past 16 weeks, we have been fundamentally addressing the strategic question of where are we going to play and how are we going to win.”

The consulting work is impacting Potbelly’s P&L by about $3 million this year. Johnson offered a glimpse at some early findings, but wouldn’t divulge further details just yet.

He said Potbelly expects to launch a “couple of large-scale tests” in the first half of 2020 and roll out the successful elements in the second part of the year. The strategy “will leverage the core strength of what the Potbelly brand represents,” Johnson said. Not a radical departure, but one to emphasize core equities the brand currently isn’t getting credit for.

It also includes significant competitive benchmarking, he said. “Suffice to say that we identified some opportunities to improve the in-shop customer experience. We have rallied our operators to address these gaps by focusing on the fundamentals to improve the customer experience,” Johnson said.

He said Potbelly had to make a quantum shift with its culture. Before, it was very insulated—an inside-looking company with no outside perspective. It was making decisions without consumer insights and fact-based competitive benchmarking.

“So, this now allows us to be a heck of a lot more focused on our brand position, our menu offering. And the experience that we offer is now aligned to the needs of the consumer,” Johnson said.