Burger King spent months fine-tuning a value platform to correct what’s become a noticeable drag versus quick-service competitors. The chain was “a bit choppy” with value in recent years, Restaurant Brands International CEO Jose Cil said Thursday. It’s tried bundling and promotional activations, like paper coupons. “Which haven’t been resonating as well,” he said during a conference call. “And so, we haven’t had a value proposition—an everyday value proposition—that’s been credible and reliable, and something that our customers can count on for quite some time.”

Cil has been open about the challenge in the past, saying Burger King needed to sharpen its focus on the “value for money equation,” and that it saw success with LTOs such as the $1 chicken nuggets and five for $4 and two for $5 deals. These opened the door for Burger King to rethink its promotional approach, both to value and to new products.

But it’s really December’s launch Cil hopes will cover ground. Burger King officially debuted its $1 Your Way Menu on December 28. It features a Bacon Cheeseburger, Chicken Jr., Value fries, and Value soft drink. The high-level goal—everyday value with a long-term mindset.

Cil called the launch a “very important step,” but not the brand’s value savior. Rather it’s a component of a broader strategy to tighten innovation around Burger King’s core, and to continue promoting everyday branding customers can expect. In other terms, embed value into Burger King’s menu for good.

Widely, Burger King plans to launch a new chicken sandwich this year and bolster breakfast once mobility increases on the (hopeful) backside of COVID-19. Today, breakfast mixes around 13–14 percent of the chain’s sales. “And we think it could be a much bigger part of our business long-term, and we’re making the similar investments in terms of quality and making sure we have a broader offering, both on product and beverage and making the commitments for investing behind that with media as well as with digital,” Cil said.

Another example of the core positioning is Burger King’s recent Whopper improvements (removing colors, flavors or preservatives from artificial sources), and the investment behind that in communication.

Additionally, Burger King just this week announced a loyalty test with the potential to engage—and reengage—guests through its app and drive thru with “a benefit every single time” approach.

“There’s a tremendous opportunity on all those areas,” Cil said. “And none of these are promotions that we think we should be dropping in at some point in time. These are important platforms that will be long-standing platforms for the business to drive top line and franchise profitability for years to come.“

Burger King’s overall digital opportunity is wide-ranging and heavy on drive-thru potential. Before diving in, however, how deep is the competitive delta for Burger King?

The brand’s Q4 same-store sales declined 7.9 percent globally against a 2.8 percent rise in the year-ago period (they fell 2.9 percent in the U.S.). Net restaurant growth fell 1.1 percent, with Burger King exiting the period at 18,625 restaurants. This date last year (December 31, 2019), the chain had 18,838 locations.

In the U.S., where RBI cautioned higher closures in 2020, net restaurant growth decreased 3.6 percent. Burger King finished Q4 with 7,081 domestic units compared to 7,346 last year.

Overall, with Tim Hortons and Popeyes added in, RBI shuttered just under 1,200 restaurants in 2020 and opened about 1,100. The closure figured represented about 4 percent of the company’s global locations, but only roughly 2 percent of systemwide sales.

“Not only is this healthy and positive for our brand image, but it positively impacts franchisee profitability and frees up resources for our franchisees to redeploy into building newer, better and more profitable restaurants,” Cil said.

The average-unit volume for Burger King stores that closed was in the neighborhood of $800,000. Generally, U.S. venues come in at $1.35–$1.4 million.

Cil candidly said RBI was disappointed by Burger King’s negative growth in Q4. McDonald’s is the only other main-line competitor to post results so far this earnings season, and the chain’s domestic comps rose 5.5 percent.

Across 2020, Burger King’s systemwide sales fell 11 percent to $20 billion, driven by a decrease in global same-store sales of 8 percent.

Cil said Burger King continues to see varied performance across dayparts as COVID disrupts routines, with particular softness in breakfast and late night, partially countered by lunch and snack growth.

Burger King has actively worked to reroute trends. With the Whopper quality change, 85 percent of the permanent menu is now free from artificial flavors or preservatives, with a path to getting to 100 percent in the next few months, Cil said.

Yet the value question looms. Cil said the $1 Your Way construct, while still early days, helped jolt Burger King’s comps into positive territory in January. The results are encouraging but a bit difficult to read against a pandemic backdrop. “To be sure, this is not a victory lap since some of that performance improvement was bolstered in part by the government stimulus,” Cil said. “That said, a straightforward, easy-to-understand, everyday value proposition featuring craveable products only Burger King can offer is something [quick-service restaurant] fans are demanding, and we’re happy to oblige and confident we’re on the right path.”

In early January, Burger King unveiled a new visual design it plans to roll throughout all touchpoints of the guest experience. Complete with new logo, merchandise, uniforms, and restaurant signage, it marked the company’s first complete rebrand in more than two decades.

While this unfurls, RBI continues to make a major drive-thru push. In an effort to deliver an improved and personalized experience, RBI is upgrading drive thrus by installing outdoor digital menuboards across the system.

To date, more than 1,700 Tim Hortons and 1,900 Burger Kings (all U.S. in Burger King’s case) have been completed. The “considerable majority” of remaining installations are expected by year’s end, COO Josh Kobza said. Most of Popeyes’ system will follow in 2021.

So about a third of the more than 10,000 targeted drive thrus (by mid-2022) in the U.S. and Canada are finished.

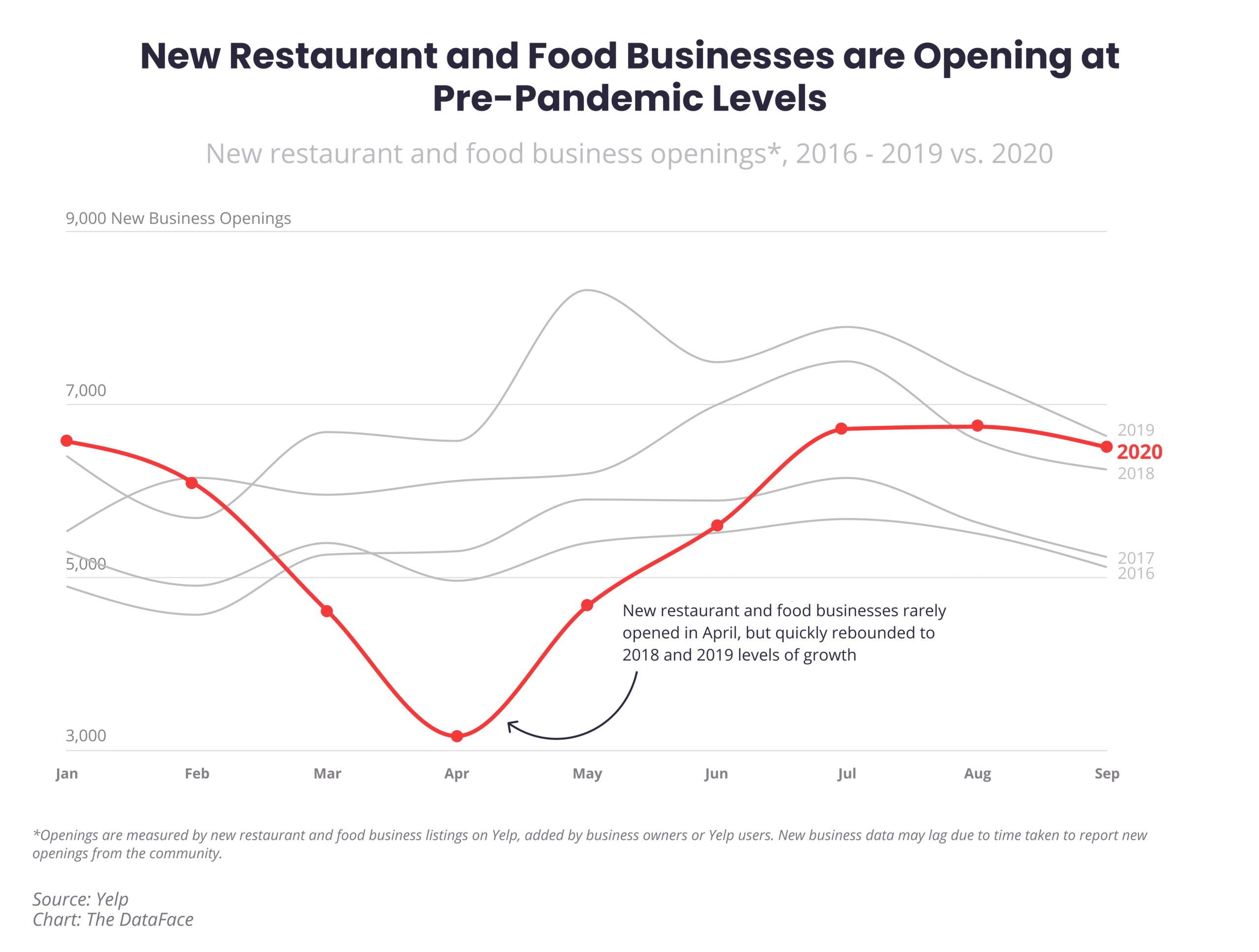

[image source_ID=”128458″]

Kobza said early results show better speed of service, as guests can more easily read menus and it’s simpler to confirm orders. It’s boosted accuracy, too. Also, an uptick in guest satisfaction and uplift in check at locations where RBI introduced predictive selling technology.

“As we look into 2021 and beyond, we’ll be focused on integrating the mobile experience with the drive-thru and our menuboards across our brands,” Kobza said.

These menuboards offer the ability to integrate loyalty programs, allowing for customized menu items to be displayed based on a guests’ favorite purchases and redemption history. They can accommodate loyalty integration via scanning, Bluetooth, or near-field communication.

“Intelligent selling technology,” Kobza added, which was developed in-house, is being rolled out across a rapidly expanding number of drive thrus and other digital consumer experiences. It allows for special promotions to be curated based on previous orders, regional weather patterns, the time of day, and many other factors.

“We’re still developing those and evolving those technologies, but we’re already seeing the ability to drive some pretty observable sales upside from the technologies,” he said.

RBI’s digital menuboards also boast flexibility to add immediate, remote contactless payment to enable guests to order and pay simultaneously, and speed up drive-thru lanes. The company partnered with payment solutions provider Verifone to develop a new global remote contactless payment device for drive-thru lanes.

New installations are weather-proofed, too, and IP56 certified, which means they are fully waterproof and can sustain continuous water pressure, even from waterjets. Existing drive thrus will be retrofitted to this standard. The 46-inch screens themselves are powered by STRATACACHE Media Engines clustered together, redundantly, for high availability. STRATACACHE provides 24/7 network monitoring to RBI’s restaurants from National Operation Centers in Ohio and Montreal where it can manage any digital screen and update or modify RBI’s menuboard content across remaining digital screens in the event of a hard screen failure.

It’s no secret why this is critical to RBI. Drive-thru sales at all of company’s brands climbed double-digits year-over-year in Q4—a common COVID result this past year. Digital sales reached $6 billion globally for RBI as home-market sales more than doubled.

In Q4, digital sales represented 8 percent of Burger King’s total U.S. take and more than 16 percent of Popeyes’. It was 23 percent of Tim Hortons in Canada.

Delivery sales were up more than two and three times, respectively, at Burger King and Popeyes in 2020, year-over-year. Tim Hortons’ delivery sales are now 14 times higher.

About 10,000 restaurants in RBI’s footprint offer delivery via multiple aggregators and through its own apps. Kobza said the company plans to bring greater focus to white-label delivery in 2021, which allows customers to order food directly through its own website or brand app, with fulfillment from third parties.

Popeyes continues to impress

RBI’s chicken chain witnessed same-store sales declines of 5.8 percent in Q4. However, perspective paints a very different picture. The brand, buoyed by its chicken sandwich launch, posted growth of 34.4 percent in Q4 2019. Meaning, Popeyes got 94 percent of the way back, despite being mired in a global pandemic.

It’s even clearer broken apart. Just in the U.S., Popeyes’ comps dropped 6.4 percent in the period. Last year, they rose 37.9 percent. Internationally, Q4 showed a 1.1 percent decline versus 10.3 percent growth in 2019. The chicken sandwich arrived permanently in November 2019.

Perhaps the most vivid way to illustrate this is at the store level. Popeyes presently generates an average of more than $1.8 million in sales per restaurant. Before the chicken sandwich? It was $1.4 million. One record-setting product pushed an additional $400,000 per restaurant across Popeyes’ system. And again, this is during COVID.

“This strong growth in top line has led to record levels of four-wall profitability for Popeyes franchisees in the U.S., making Popeyes one of the most exciting and profitable [quick-service restaurant] concepts in the U.S.,” Cil said. “As we’ve mentioned in the past, a large part of this growth is attributable to the Chicken Sandwich, but we continue to see significant growth across every category of our menu. The compelling unit economics and the consumer demand for more access to the brand have created a tremendous amount of appetite for new development.”

It’s leading to growth as well. Popeyes, all pandemic challenges included, appreciated 132 net restaurant growth domestically in 2020. The chain ended the quarter with 3,451 restaurants globally, a lift from 3,316 last year. In the U.S., Popeyes grew from 2,476 restaurants to 2,608.

Tim Hortons’ Canada same-store sales declined 11.9 percent in Q4 and 11 percent systemwide. The chain had 4,949 restaurants (3,936 in Canada). There were 4,932 in the Q4 2019 (4,014 in Canada).

Net income attributable to common shareholders fell to $91 million, or 30 cents per share, compared with $165 million, or 54 cents per share, in Q4 2019.

RBI earned 53 cents per share and total Q4 revenue came in at $1.36 billion, compared with $1.48 billion in the year-ago period.