In October, Starbucks framed its decision to close 800 locations as a repositioning more than a retraction. But to what aim exactly wasn’t clear. Would the result be a healthier, trimmer, and more future-ready base? Or a springboard to something larger?

Among many initiatives and views into 2021 and beyond, Starbucks addressed this question Wednesday at its virtual biennial investor day.

And the answer sent Starbucks shares to all-time highs on the stock market. CFO Patrick Grismer said Starbucks has a “long runway of growth” once it crosses into 2021 with recovery tailwinds behind it. He said Starbucks will reach a unit level “that is currently unmatched by any other single food and beverage retail concept.” Today, Starbucks boasts some 33,000 company operated and licensed stores across more than 80 markets. By 2030, it expects to reach roughly 55,000 restaurants, Grismer said, as it “continues to develop experiences that address evolving customer routines and deliver the ‘third-place’ experience.”

Subway presently operates somewhere in the range of 40,000 global locations, but witnessed figures slide in recent years. According to Statista, there were 41,600 worldwide Subways in 2019, down from 42,431 the previous year. McDonald’s had 38,695, up from 37,855 in 2018.

Domestically, Subway closed 2019 with 23,802 venues, a 996-store drop, year-over-year. Subway had 27,103 U.S. units at the end of 2015—more than Burger King, Wendy’s, Taco Bell, and Pizza Hut combined; 12,844 more than McDonald’s; 14,582 ahead of Starbucks. Since, however, Subway’s total U.S. figure declined by 359, 866, 1,110, and the aforementioned 996, in respective years.

While Starbucks’ 800 closures (500 in the U.S.) is expected to net only 50 units in 2021, the brand was expanding ahead of COVID-19. Its 216 domestic net growth from 2018 to 2019 was second only to Domino’s (253) across all U.S. restaurant chains.

Grismer said Starbucks on the other side of coronavirus “would be fueled by unparalleled brand appeal globally and strong unit-level economics.”

Notably, though, the 800-unit cut will serve as a trigger for diversified development in ways Starbucks has not appreciated before. What it mainly accomplishes is a reset of Starbucks’ real estate to build and then expand fresh models adapted for a changing consumer. These new stores, Starbucks said during the virtual conference, would consist of drive thru, “Starbucks Pickup,” and curbside formats. In China, the company plans to debut 600 venues next year alone, with 10 percent of those being “Starbucks NOW” stores (similar to the pickup U.S. model). By the time fiscal 2022 closes, Starbucks predicts its China footprint will stretch 6,000 restaurants across 230 cities.

The Pickup U.S. format, as well as desire to rush forward with drive thru and curbside, really surfaced in June when Starbucks guided an 18-month plan to accelerate a new-store portfolio, anchored by convenience-led models. Starbucks said COVID-19 shifted retail to meet the “evolving customer needs of convenience, connection, and personalization.” And the brand saw an opportunity to power this pivot through its Starbucks App, which measures to 19.3 million 90-day active members (another 13.5 million in China) and drives nearly 50 percent of the chain’s revenue.

[image source_ID=”127697″]

Pickup stores, in particular, will target dense markets facing some of the harshest COVID-19 restrictions, like New York City, Chicago, Seattle, and San Francisco. But even when the virus clears, Starbucks believes convenience and the preference for digital-enabled transactions will stick. Before COVID-19, roughly 80 percent of Starbucks’ U.S. transactions were on-the-go.

In addition to designing stores that follow that shift, Starbucks’ transformation includes renovating layouts to add separate counters for mobile orders at high-volume stores, which enable customers and delivery couriers to grab-and-go orders without the bottleneck.

Pickup venues, which Starbucks said will number in the “hundreds” within five years, plan to drop into trade areas as additional accessibility points, not so much replacement hubs. The company pictures traditional cafes, complete with the “third-place” promise, supported by a Pickup store within walking distance that can reduce crowds and provide a more convenient format for those guests who don’t want to grab a seat.

While this unfolds, and curbside tracks toward 2,000 locations by the end of next year, the brand will lean into drive-thru development in suburban and semi-rural locations. The goal being to extend the reach of the Starbucks brand with high volume, high-margin stores, providing customers the convenience they’re seeking, CEO Kevin Johnson said.

And, at the end of the day, a versatile roadmap to 55,000 locations. Starbucks said its global store portfolio is expected to grow by about 6 percent on a net basis annually starting in fiscal 2022. The U.S. plans to deliver net new store growth of 3 percent.

The plan for America includes some permanent COVID-19 shifts. About 45 percent of stores will offer drive thru moving forward from a current level of 35 percent, the company said. Some could feature double lanes or walk-the-line order takers with tablets, as outlined previously. In Q4, about 75 percent of Starbucks’ U.S. sales volume flowed through drive thru as well as mobile orders. That figure was 97 percent in April’s final week and 60 percent or so pre-crisis.

Getting to Starbucks’ final 55,000-store target would represent growth of more than 66 percent in the next decade, which would have sounded a tall order in April when Starbucks reported some of the deepest COVID-19 drops of any quick-service leader. At that point, pandemic conditions had cost the company $915 million. COVID-19 resulted in roughly $3.1 billion lost—relative to pre-pandemic expectations—by July. Starbucks’ Q2 same-store sales declined 3 percent in the U.S.—the first negative number since 2009—as 50 percent of corporate units and 46 percent licensed temporarily closed. Comps plunged 40 percent globally in Q3 and traffic sliced in half. Revenue declined 38.4 percent to $4.2 billion.

But then cafes started to get back on line, with additional points of purchase, like curbside, and trends improved.

Starbucks boosted U.S. same-store sales from negative 40 percent in Q3 to negative 11 percent in August. They declined just 9 percent in Q4, a vast jump from the COVID-19 depth figure of negative 65 percent.

Grismer Wednesday reaffirmed Starbucks’ fiscal 2021 non-GAAP earnings per share range of $2.70–$2.90 on a 53-week basis. He called that a “very dramatic” year-over-year rebound. He added Starbucks expected a year of outsized EPS growth with non-GAAP EPS gains of at least 20 percent. In 2023, it’s predicted to climb in the 10–12 percent range.

On the top line, Grismer said Starbucks’ global comps sales should track 4–5 percent growth in 2023 and 2024, which is up 1 percent from prior-growth projections. In the U.S., same-store sales are expected in the 4–5 percent range, while China is looking at 2–4 percent.

In terms of stock market recovery, Starbucks traded at a low of $50.02 in mid-March. On Wednesday, it was up around $104.

The COVID-19 disruption accelerated shifts in consumer behavior, the brand said. Johnson noted the positive byproduct for Starbucks was it led to quick adaption for short- and long-term implications—a process that fundamentally opened Starbucks up to new ways for customers to engage.

He shared five guiding points that emerged:

- The fundamental need to be seen and experience a feeling of connection to others.

- Seeking out experiences that effortlessly fit their lifestyle.

- Appreciation of consistent experiences.

- Desire for high-quality and sustainable products and experiences that support the well-being of people and the planet.

- Increasing loyalty to brands with strong values.

“Looking ahead, coffee remains a very large and attractive market that is growing globally. We are focused on growing category share and believe Starbucks is better positioned than ever for continued success,” he said, citing a Euromonitor projection that pictured the $360 billion coffee market (2019) growing to $450 billion by 2023.

In this, Starbucks said plant-based, non-dairy milk will play a role. It introduced soy milk in 1997, added coconut milk in 2015, and almond milk in 2016. Next, is the spring 2021 planned rollout of oat milk nationally, which tested regionally in recent months. The company said it would feature oat milk in a new spring release of “Shaken Iced Espresso.” The drink will include espresso, brown sugar, and oat milk.

COO Roz Brewer said during the event millennials and Gen Z pushed the trend toward cold coffee, responsible for more than $1 billion in sales for Starbucks over the past three years. In the last four years, Starbucks’ cold-beverage platform grew by nearly 45 percent.

Starbucks opened some other windows into the future, too. One was the company’s “Deep Brew” proprietary AI platform. The company said it would soon start deploying the technology at drive thrus. Like McDonald’s Dynamic Yield system, it can offer product suggestions and upsell based on specific conditions, like weather, inventory, trends, and so on. “In the future, customers will receive even more suggestions, like how to make their drinks perfect for them and recommendations that help us manage inventory and improve speed of service leaving more time for our baristas to do what they do best, connect with customers,” Brewer said.

“Leveraging AI to deepen digital relationships and architect experiences will allow Starbucks to both surprise and delight customers in new and different ways,” the company added.

Starbucks also announced deeper investments in eco-friendly options, regenerative agricultural practices, and environmentally friendly menus.

Including:

An intent to support for Net Zero Initiative, a partnership with the U.S. dairy industry to achieve net-zero greenhouse gas emissions improvements in water quality on farms.

Rollout of oatmilk nationwide in the U.S., joining plant-based options including soymilk, almondmilk and coconutmilk.

A $50 million Investment in The Global Farmer Fund, providing access to capital so coffee farmers can use these funds to strengthen their farms and farming practices to be even more productive and sustainable.

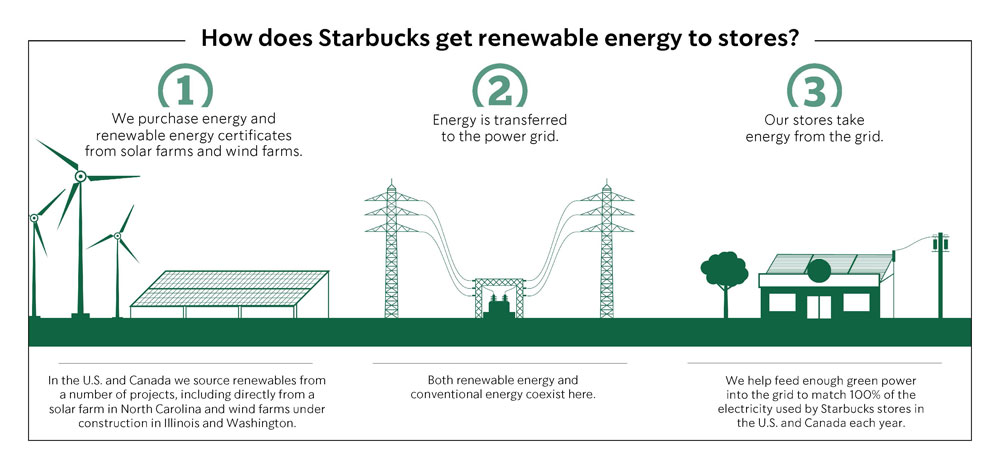

A Diversified Renewable Energy Portfolio, aiming to offset 50 percent of company-operated roasting and beverage production sites and electricity consumption in the U.S. by 2022 through Starbucks first supply chain Virtual Power Purchase Agreement with a solar farm in Virginia.

“We are well positioned to invest in the right areas to strengthen our competitive advantage and drive consistent, sustainable growth for decades to come,” Johnson said.