One reason the restaurant industry is so maddeningly dynamic is that it’s the heartbeat of consumer behavior in America. Want to discover how guests are changing? Look at how they’re eating. Social issues stretch into menus, from packaging to the death of plastic straws. Technology’s rise dips into multiple fields. Customer data is a massive topic in all sectors, but it’s critical to the future of restaurants.

Consider the boom of third party and how this log of information created tension between aggregators and chains. What can restaurants even do with this data once they get it? How will the ability to predict consumer behavior affect how restaurants sell to customers? Think along the Google line and how they built their empire. There’s massive profit in the guest profile as defined by actions, not base data. It used to be: know a customer’s name, email, phone number, and start collecting revenue. Now, it’s about what they do—when and why, and how often. Is it more valuable to gather customer behavior than emails, phone numbers, and demographics? And if so, where do you toe the line between sending ads customers want to see and engage with versus scaring them big-brother style (why do hamburger ads show up on my feed after I talk to my friend about hamburgers …)

And then there are the value wars. With food inflation, will this stress the bottom line further? As noted by Bloomberg, Bob Derrington, an analyst at Telsey Advisory Group, predicted average food costs could rise 5.4 percent next year. Is the answer more value meals curated to local markets, kind of like McDonald’s is doing? Or stressing the $5 price point over the $1 one? Perfecting and improving the high-low or barbell strategy, a la Wendy’s and Del Taco? Gene Lee, the CEO of full-service giant Darden, spoke about this shift recently. He noted that larger chains are taking some market share due to the fact they can a., pulse big discounts more than independents and smaller chains or fast casuals, and b., have the marketing budgets to drive dollars into promotions more effectively. Check average is sitting sub 2-percent, which is an unusual turn for the industry.

“It will be interesting,” Lee said, “to see whether these large brands would continue to give up margin to advertise and promote at the intensity they’ve been promoting at. … This is putting tremendous pressure on their margins, and we’ll see how long they’re willing to eat into their margin growth to have this kind of intensity out there.”

Rising checks to balance declining traffic. What’s the future hold there? Menu engineering has never been more important. The ability to get customers to trade up is critical. Restaurants are focusing on repeat customers, already acquired, over the single-visit method so often used in the past.

“While the industry now celebrates overall 1.4 percent same-store sales growth, as reported in BDO’s The Counter report for Q3, the flow through will not offset higher operating costs unless those sales mostly consist of ‘star’ menu items,” says Adam Berebitsky, leader of BDO’s Restaurant practice.

It’s also equally important, especially in quick service, to not lose sight of the reality that low-income customers rely on fast food’s value deals to get by. There will always be a market for the guest who doesn’t want to be upsold.

“And remember in [quick service], we got about 40 percent of our customer base that makes $45,000 or less. So that’s why it is so important for all of us in the [quick-service] space to have a really solid high-low calendar to bring folks in, and allow them to mix across the calendar depending on the time of the month.” — Todd Penegor, Wendy’s CEO.

Take this November quote from Wendy’s CEO Todd Penegor:

“We’re seeing almost 10 years of economic recovery, we’re seeing lowest unemployment levels in a long time, high consumer confidence and median households finally at record levels,” Penegor said. “But as you look at that income growth, it’s skewed significantly to the higher-income households. You do have a workforce participation remaining well below pre-recession levels. And real wage growth is still not accelerating to the extent that we had all hope for.”

“And on the low end, you start looking at folks with rent and healthcare costs starting to rise that are really eating into some of the headway that they’re making. And remember in [quick service], we got about 40 percent of our customer base that makes $45,000 or less. So that’s why it is so important for all of us in the [quick-service] space to have a really solid high-low calendar to bring folks in, and allow them to mix across the calendar depending on the time of the month.”

Two other big topics for 2019 are labor, as always, and what happens with all tax-return funds. On the labor note, this shrinking pool has led quick-service brands nationwide to bolster incentives as they compete for talent. Retaining that talent is another battle. TDn2K’s People Report showed that the number of jobs in chain restaurants grew 1.7 percent after a year-over-year growth of 2.1 percent during the previous month. According to its Workforce Index, 58 percent of restaurant companies plan to add hourly workers during the fourth quarter, while 51 percent said they plan to add management staff. About 70 percent of companies reported an increase in their staffing difficulties for both restaurant hourly employees and managers.

Wells Fargo & Co., per Bloomberg, said tax cuts should start affecting customers, especially lower-income shoppers, in 2019. This is, in theory, great news for quick service. There already have been improvements seen in investments by companies, such as pouring savings into labor initiatives, like Starbucks did earlier in the year. Now, however, increased spending could help those chains that are winning with value.

As you can see, there is no shortage of issues shaping the landscape of the restaurant industry. All of these changes, and plenty more, dictated how chains operated and evolved this past year. Let’s take a look at one in particular that reshaped its business in 2018, and is poised to continue leading with innovation.

Dunkin’ runs on change

This past calendar year was one for the books at Dunkin’. It would be hard to find another chain of this size (Dunkin’ had about 12,700 units as of September 29) that had a more transformational 2018.

Breaking down the watershed run starts, fittingly, in January 2018. In Quincy, Massachusetts, about a mile away from its original store, Dunkin’ debuted a next-generational model. There are several key features, including a drive-thru lane dedicated exclusively to mobile ordering. This was designed to allow DD Perks members who order ahead via the chain’s mobile app to bypass the ordering lane and merge straight into the line for the pickup window. Dunkin’ said it was the first national restaurant brand to offer a drive-thru lane specifically for mobile ordering.

Another feature is the location’s tap system, which serves eight cold beverages, including coffee, iced tea, cold brew, and nitro infused cold brew. Continuing its push toward ease-of-ordering, the new Dunkin’ store has an area dedicated to mobile pickup so rewards members can place an order via the mobile app and pick up without waiting on the regular line. Guests can also track the status of their orders inside the restaurant with a new digital order status board. An expanded, custom grab-and go unit features bottled beverages, as well as snacks to complement the menu, including bananas, oranges, grapes, fruit snacks, Yoplait yogurt parfaits, and other packaged goods. Dunkin’ said earlier in the year it expected to have 50 next-gen units open, between new builds and remodels, by year’s end.

Since the first NextGen store opened in Quincy, the company has opened up more than 60 new and remodeled restaurants

Goodbye foam

The next big change came in February, when Dunkin’ announced it would eliminate foam cups worldwide by 2020. The removal of polystyrene foam cups began in spring 2018 and targeted 2020 to completely remove the material from Dunkin’s global supply chain. The move complemented Dunkin’ Donuts’ earlier commitments in the U.S. to have 80 percent of fiber-based consumer-facing packaging certified to the Sustainable Forestry Initiative Standard by the end of this year; eliminate artificial dyes from its menu; build new, more energy-efficient restaurants; and partner with the Rainforest Alliance to source certified coffee.

Value goes national

In April, Dunkin’ launched its first national value platform, Dunkin’ Go2s. The chain said at the time that its morning business accounted for about 60 percent of systemwide sales, and had reported positive, year-over-year and increased sequentially each quarter in 2017. In Q4, it was the best it’s been in two years, and breakfast sandwiches were being sold at the fastest clip in company history. That trend continued throughout 2018. But instead of simply sticking by its core offerings, Dunkin’ used the momentum to address the afternoon daypart and inject value into its menu. Driving lunch and afternoon business was a key topic throughout 2018 for Dunkin’. The Go2s specifically allowed guests to pick from among three of Dunkin’s most popular breakfast sandwiches. Average checks for the menu hovered around $8–$9. More than 75 percent of breakfast sandwich transactions included a beverage, the brand said.

Dunkin’s so-called Dunkin’ Deals, which started with two egg and cheese Wake-Up Wraps for $2, then went live throughout the year. Dunkin’ used these to ignite all dayparts, such as the medium hot or iced latte for $2 from 2 to 6 p.m. deal intended to target afternoon guests.

The $2 Dunkin’ Run Snacking menu hit stores in July. This lineup featured snack offerings at $2 designed to pair with Dunkin’s beverages, such as Donut Fries and Waffle Breaded Chicken Tenders.

All of this took place as Dunkin’ was simplifying its menu in an effort to improve performance. The brand cut back 10 percent of its options hoping to increase consistency across the chain. Initially, the change resulted in a short-term sales hit, but has since leveled out and bolstered Dunkin’s labor model as well as its customer satisfaction scores.

Across Dunkin’s U.S. stores, systemwide sales grew 4.6 percent and comparable store sales grew 1.3 percent during the third quarter. CEO David Hoffmann attributed this growth to the expansion of its beverage portfolio combined with its new snacking platform.

A change at the top

With July came the announcement that Dunkin’ CEO Nigel Travis, 68, was retiring from the role he helmed since January 2009. In stepped Hoffmann as part of a succession plan more than two years in the making. To that point, Hoffmann, who remained president of Dunkin’ Donuts U.S., led the implementation of a multi-year plan referred to by Dunkin as the “Blueprint for Growth,” meant to transform the company into a leading beverage-led, on-the-go brand. He has also led all aspects of Dunkin’ Donuts’ U.S. operations, supply chain, marketing, consumer packaged goods growth, digital innovation, and franchise development. Hoffmann was behind the next-generation concept design as well.

Before Dunkin’, Hoffmann spent 22 years with McDonald’s, including time as a crew member in high school. In 2008, he was named the chain’s vice president of strategy and franchising in Japan, and later held general management roles covering a wide range of international markets. Hoffmann eventually assumed the position of president, high growth markets, for the fast-good giant, which included work with China, South Korea, Russia, and several additional European markets.

In Travis’ time as CEO, Dunkin’ Brands completed a successful IPO in 2011 and returned nearly $2.7 billion to shareholders since going public. Dunkin’ entered 25 new international markets in the past decade and grew its unit count by nearly 6,000 stores globally, including more than 2,800 net new restaurants in the U.S. He also directed the launch of Dunkin’-branded consumer packaged goods, like Dunkin’ K-Cups and Ready-to-Drink Bottle Iced Coffees. Additionally, Dunkin’ introduced mobile payment apps at Dunkin’ Donuts and Baskin-Robbins during his tenure, brought the DD Perks Loyalty Program to market, and launched Dunkin’ Donuts’ On-the-Go Mobile Ordering, as well as delivery programs for both brands in markets around the globe.

On a first-name basis with America

One of the most buzzed-about changes this year took place on September 25. Dunkin’ announced it was dropping the “Donuts” from its name, which sparked a flurry of social media attention. The message was simple: Dunkin’ wanted guests to know there was something new going on. And, frankly, few people were calling Dunkin’ “Dunkin’ Donuts” anymore. This didn’t mean Dunkin’ was dropping Donuts (Dunkin’ still sells some 3 billion donuts a year. It’s a 60/40 split between beverage and food with the majority of the beverage sales being coffee). It was more a reflection of Dunkin’s moves to become a beverage-led brand. One that invested in afternoon options, cold brew, CPG products, and so on. It was also an emotional switch as much as it was a tangible one.

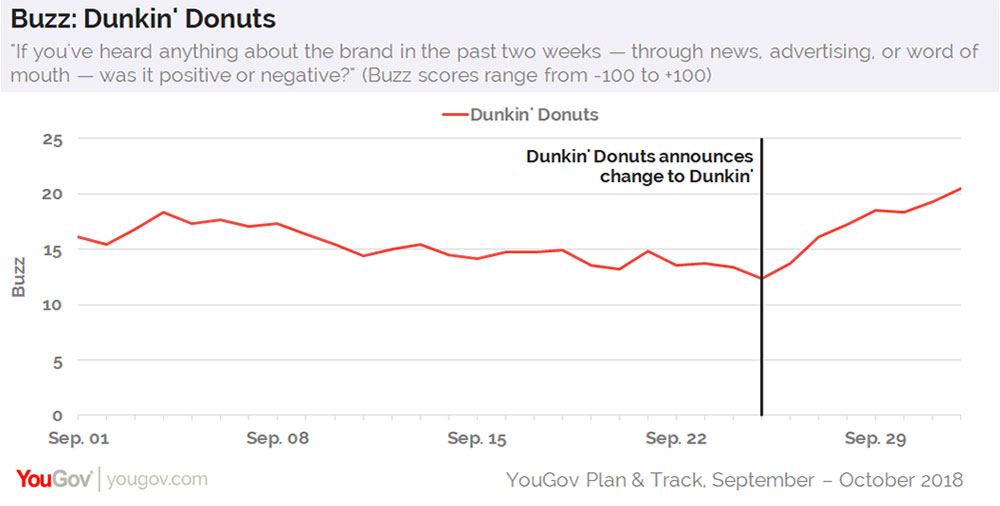

Did the flip matter? YouGov’s Plan & Track took a look at the change in the days that followed. Dunkin’s “Buzz” score climbed from 12 to 21 among the general public, indicating that an increasing number of U.S. consumers are hearing something good about the brand. In other words: more U.S. adults are talking about Dunkin’ than at any point this year. The scores range from negative 100 to 100. See the chart below to see how the Dunkin’ announcement spiked the reaction.

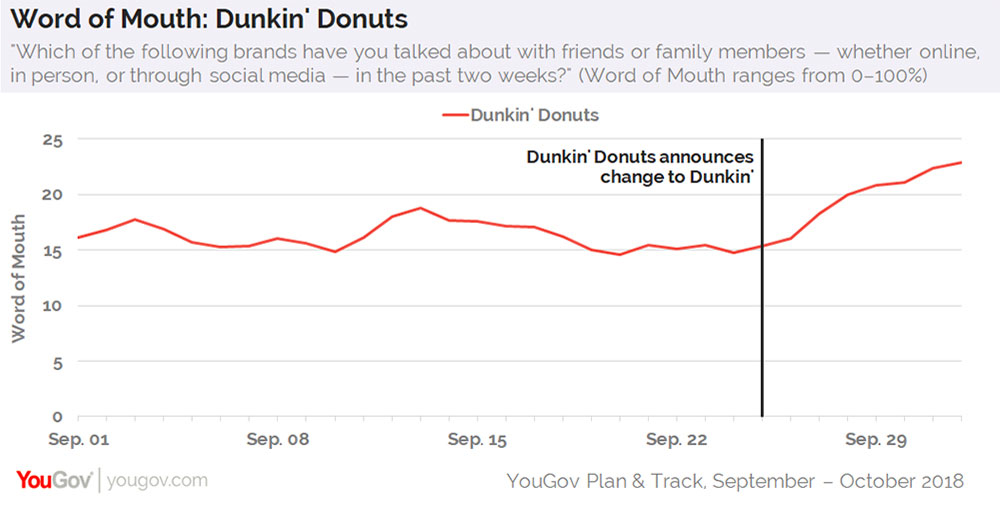

Then, on October 2, YouGov’s data showed that more people were talking about Dunkin’ than any point all year, showing that it wasn’t just a one-day phenomenon. Dunkin’ was able to slow-build this news and leverage it to multiple channels with a variety of promotions. It was also able to use the branding to tack on additional messages, like its BOGO National Coffee Day deal, the launching of an All You Can Meat Breakfast Sandwich, a Coffee Porter made with Harpoon Brewery, sustainability agreement with World Coffee Research, partnership with Dove on dry shampoo, and whatever was going on with Oreo recently on Twitter. Now, was it a coincidence that Dunkin’ changed its name and then went on a news spree for a week? Maybe so, but probably not.

Either way, on October 2, YouGov’s data showed that nearly one in four (23 percent) consumers aged 18 plus recalled discussing Dunkin’ with friends or family members in the past two weeks, up from 15 percent on September 25. Between January 1 and September 24 of this year, Dunkin’ averaged a “Word of Mouth” score of 17 percent.

Following the Dunkin’ name change, the brand’s Purchase Consideration score, which gauges how open consumers are to buying an item from the chain when next in the mood for food or drink, briefly climbed from 28 to 30 percent before settling back.

Again, though, this name change was intended, as much as anything else, to signal to customers that major changes were taking place—and more were coming. The big visual refreshes are expected to arrive in the New Year, from logos, packaging, advertising, and updated in-store branding. Dunkin’ is planning to open 1,000 net new stores in the next three years—90 percent of which will be located outside of its core markets.

What better time to start touting a brand-new look and direction?

Sipping is believing

In Dunkin’s $100 million plan to grow its U.S. business, 65 percent was dedicated to its “on-the-go beverage-led strategy.” When first revealed, Dunkin’ was a bit short on details. We found out in November what this truly meant. Dunkin’ launched in November what it called “one of the most significant product initiatives” in its 68-year history.

The brand invited media members to its Canton headquarters to showcase its new handcrafted espresso experience, which found its way to menus November 19 and ignited six straight weeks of promotions. This launch was multiple years in the making. CMO Tony Weisman told reporters that now was the optimal time to go “full steam ahead on espresso.” Last year, Weisman said, marked the first time when consumers under 35 drank more espresso beverages than hot drip coffee. Dan Wheeler, Dunkin’s vice president of strategic initiatives, added that more than 50 percent of millennials are ordering espresso beverages when they choose coffee. On top of that shift, Hoffmann said Dunkin’s customer base is skewing younger, just like espresso, and that his kids are “graduating from Coolattas to lattes.” In other words, the transitional role drip coffee once played for soda-drinking consumers as they matured—that’s what espresso represents to this new generation of beverage drinkers. It’s the gateway coffee choice for millennials and Gen Zers.

It’s hard to argue Dunkin’ was going after Starbucks here. And the brand didn’t shy from that. Weisman stood by previous comments that, “there’s now no reason to go to Starbucks.” Dunkin’s plan, essentially, was to win the category owned historically by Starbucks in very Dunkin’-like fashion. Espresso, but done at a lower price point and served up quicker than anybody else.

One challenge Starbucks has faced is competing with local cafes and other coffee shops that offer similar beverages. Dunkin’s goal, however, was to present an espresso experience nobody else could. It would use its scale, leverage, and operating procedures to procure a similar coffee experience—but cheaper and quicker than any brand in the country (it launched at $2, a deal that moved eventually just to afternoon business).

Franchisee Parag Patel, who owns 30 locations in California and Maryland and ran Dunkin’s espresso test in Baltimore over the summer, said during the event, “We’re faster than we used to be, even with the handcrafted element.”

He added that it takes “a couple of minutes,” to make the espresso drinks. Close to 90 percent of customers said they would return to buy it again as well. There was also little to zero cannibalization during the pilot. The reason being, Patel said, espresso doesn’t trade consumers from hot or iced coffee; it targets different guests, dayparts, and goes after market share that wasn’t in Dunkin’s iced and hot drip pocket already.

Dunkin’ said 50 percent of people who visit Starbucks also go somewhere else during the week, whether that’s a local shop or some other chain. So why not Dunkin’? In the past that probably had something to do with the lack of espresso options and the specialty-drink quality perception.

Dunkin’ installed new machines across its system and conducted 4–5 hour training sessions per location. Employees become espresso certified, and there’s an online class where they can demonstrate their proficiency.

Patel went as far as calling it a “360-degree culture change,” at the store level.

Espresso also opens the door to endless innovation for Dunkin’. One product being tested, affogatos at co-branded Baskin-Robbins locations, could be coming. You can bank on flavored lattes and drinks like flat whites to mirror the seasons.