There are always common threads within turnaround stories. Yet that doesn’t mean they follow a linear path. Some things work and others simply fall flat. “There is typically a sense of adjustments and course corrections that are required to ultimately and collectively have the desired impact to change the trajectory of the business,” Potbelly CEO Alan Johnson said during a May 8 conference call.

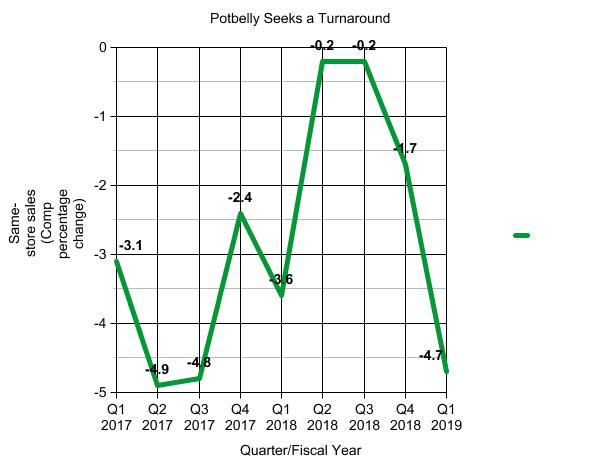

The sandwich chain is feeling the weight of that reality. Potbelly’s same-store sales decreased 4.7 percent in the first quarter of fiscal 2019. Total revenues fell 4.7 percent to $98.1 million, and the company closed eight shops.

Investors took the news hard as Potbelly shares plummeted to a record low Wednesday, dropping as much as 22 percent—the company’s biggest decline in nearly five years. It was trading for $6.56 early Thursday afternoon.

Johnson was candid throughout the call about Potbelly’s missteps. He admitted, “in times like this,” it would be easy to assume that nothing is working.

“In my opinion that would be a mistake,” he said.

What’s going wrong?

Many of Potbelly’s concerns are broad in scale. But there were some short-term obstacles that can’t be ignored. In Q1, the shutdown of the Federal government lasted 35 days and impacted more than 20 percent of the chain’s fleet. The polar vortex froze results, too.

Johnson said the median temperature across all of its markets in 2019 was 15 percent colder than the prior year. Chicago—Potbelly’s largest base—had slightly less inches of snow but more days with cover. Lastly, Washington, D.C., the second-largest market, experienced three times more snow.

READ MORE: Potbelly pumps up the franchising potential.

“As you can imagine, advertising and promotions are not effective when outside temperatures are in the single digits,” Johnson said.

Potbelly decided it would be wise then to push out its incremental marketing spend—originally slated for Q1—to Q2 and later in the year.

Additionally, the brand’s mid-February menu optimization initiative (more on this later) led to a short-term lapse in pricing. Like many chains, Potbelly typically flips its menu at the beginning of the calendar. It decided, however, to delay the process seven weeks so it could take full advantage of the changes, which went into effect February 7.

In total, Potbelly took a 130-basis point hit from the negative headwinds, it said.

Now, let’s take a wider view of the downturn.

In Q3 2018, Potbelly invested in advertising and increased promotional intensity, and its traffic beat Black Box averages by 170 basis points—a significant improvement from the negative spread throughout the first half of the year, Johnson said. So when 2019 approached, Potbelly planned to pull back on promotions and aggressively hike advertising to drive traffic. The P&L struggles if you try to do both at the same time, Johnson said. And recent history led Potbelly to pick this particular fork in the path.

In Q1, Potbelly’s traffic trends trailed that same Black Box benchmark by 110 basis points. Johnson said this, at least partly, was due to the company’s pullback on spending and promoting in Q4 2018, as well as this past period, compared to the previously noted level in Q3 of 2018. “So we may have lost some momentum,” Johnson said. The decision to delay advertising spend thanks to weather didn’t help, either.

Then, in April, Potbelly launched its first new brand campaign, “Love Lunch Again,” across three core markets. Potbelly turned the dial up on digital marketing, which Johnson said provided a cost-effective and targeted channel to “tell the Potbelly story in a way that really differentiates the brand.” It also tested some spot traditional avenues, like billboards, TV, and radio, to really measure the impact of these mediums on Potbelly’s business.

And here’s what resulted: the campaign accelerated traffic but the results were not enough relative to the size of the investments Potbelly was making, Johnson said.

“The key to success is finding the right message, media, and creative to attract customers and build our brand awareness,” Johnson said.

Potbelly realized it was missing at least one of these elements. Either the message, media or creative missed the mark.

“As a result, we are taking a step back to assess our efforts and to gain a better understanding of what brand messages resonate when combined with a call to action and promotional hook,” Johnson said. “We then plan to take our learnings and apply them with a fresh approach on how to talk to our customers to drive a more productive outcome.”

Potbelly doesn’t expect 100 percent success rate on everything it tries during the turnaround plan, he added. “But we continue to test, learn, and roll to find the right combination.”

“This business did not get into this position overnight and it will take time to turn around. In the meantime, we will continue to aggressively push those things that are working well for us and drive them to help offset some of the traffic softness,” Johnson said.

A dive into the positives

Before exploring the efforts Johnson believes are working, it’s worth recalling where some of this strategy started, and how it’s being directed. In July 2018, Brandon Rhoten, formerly of Papa John’s, joined Potbelly as SVP and CMO. The C-suite addition continued a string of changes.

Jeff Welch, the former head of Krispy Kreme’s international division, joined as SVP of franchise development. Tom Fitzgerald was named CFO after a run as president and CFO of retailer Charming Charlie. Chef Ryan LaRoche became Potbelly’s first head of culinary innovation. Matt Revord was promoted to chief people officer. Julie Younglove-Webb to chief restaurant operations officer. Maryann Byrdak to SVP of information technology. Peter Ortiz, who previously served in a similar role at FOCUS Brands, took over as VP of franchise development. Johnson himself succeeded interim leader Michael Coyne on December 4 of 2017.

The first big initiative Johnson points to is the earlier noted menu-optimization change. Potbelly’s goal was to simplify and increase the “shop-ability” of its menu, while introducing more variety and bundle options. This was a massive undertaking. The new concept menuboards hit all stores by mid-February. They included a pick-your-pair option that bundled a half sandwich with a choice of salad, soup, or mac and cheese, as well as a make-a-meal option that combines a guest’s choice of chips and a fountain drink or chips and a shake.

But the starkest change, if you look at Potbelly’s center panel of the menu, was to take it down from 55 price points to 18. Johnson previously called the change “one heck of a complicated thing.” Potbelly affectionately referred to it internally as “mission impossible.”

The chain had 481 (431 corporate) units as of March 31. When the program first unrolled, Potbelly had 680 unique menuboards in terms of size. It had to reprogram the point of sale, redo the company’s app, redo its website, change the loyalty program, and update the catering and delivery functionality for how customers pay.

Potbelly has been pleased with the results through the first six weeks of launch, Johnson said. Combined, they already represent about 24 percent of the brand’s entrée mix. “This is the highest and the best result we have ever achieved,” Johnson said.

The mix has remained consistent, he added, “which points to high customer satisfaction.”

A key metric: From the time Potbelly rolled out the new menus through the end of Q1, its average check rose 460 basis points, with the majority of the growth coming form units per transaction.

This is critical, Johnson said, because it follows the “OneMore” strategy Potbelly said could be a powerful growth vehicle—the notion of building check growth by encouraging customers to buy more versus simply raising prices.

Potbelly hadn’t tried bundles or meal deals in 41 years of operation. “Virtually every customer looks at the menu, whether in the shop or online,” Johnson said. “And our enhanced menu is optimally positioned to serve as a silent seller to drive suggestive selling in 100 percent of occasions.”

To date, the meal deal mix has tracked higher than pick-your-pair. Regarding who’s buying, Johnson said, it’s 20 percent first-time customers. It’s also skewing higher in suburban shops, which make up 62 percent of Potbelly’s system.

With the pick-your-pair, 39 percent of guests order it again on their next visit. And more than half try it again within three weeks. “So based on that, I think there’s potential for it not only to be sustainable, but a frequency driver and a check driver,” Johnson said.

He added that Potbelly is currently testing a few new items, including a premium sandwich category.

Progress in the digital space

Potbelly’s off-premises business, including catering, pickup, and delivery, grew to 21 percent of comparable sales in Q1—up from 17.5 percent in the year-ago period. Pickup is the fastest growing of the segments and Potbelly is in the process of introducing pickup racks to all of its restaurants. The process should complete in Q3.

Johnson said Potbelly is investing in technology to better integrate off-premises orders into restaurants’ normal workflow, as well as enhance the functionality for guests to track orders.

“It’s important to remember that we spent most of last year cleaning up, restructuring, and investing in resources needed to support the franchise organization.” — Potbelly CEO Alan Johnson.

Also, Potbelly’s Perks loyalty program now has 1.3 million members, up from about 800,000 last year. Those guests comprised 18 percent of Potbelly’s sales in Q1, a significant rise from 8 percent in the comparable period.

Johnson, using Starbucks and its 16.8 million-member platform as a measuring stick, said Potbelly is “punching above its weight class” with its current size.

“Longer-term, we plan to restructure our Perks program to build a strong retention and brand-building tool,” he added.

In the meantime, a Summer of Smiles overlay program is coming in early June, which will provide a virtual punch card program designed to drive frequency and retention.

The franchise growth story

The fourth area Johnson pointed to as “moving in the right direction,” was franchising. The company signed two new franchisees recently and has a contract out to a third. The collective new store development calls for about 40 new shops over the next few years, which is roughly the same number of domestic franchise units Potbelly has today (50).

Potbelly also debuted its first franchise in California this week in Irvine. “It’s important to remember that we spent most of last year cleaning up, restructuring, and investing in resources needed to support the franchise organization. And that effort is now starting to bear fruit and is one more example of something that is working and will position Potbelly as a long-term growth story,” Johnson said.

Potbelly recently approved a new-store design as well, called the “Shop of the Future” initiative. The ground-up build costs 25 percent less than the current model and focuses on customer experience. It should only help with future operators.

“Once we address the primary drivers of our traffic trends, the things that are working in our business will enhance our ability to deliver sustainable and profitable growth, which will be further enhanced by the new store design,” Johnson said.

For the year, Potbelly expects 12–18 total shop openings, including six to eight on the company side. However, it also predicts 15–22 closures, including nine to 12 corporate units. The company forecasts flat to low-single digit decreases in company-run same-store sales for the rest of 2019.