Wendy’s stuck to its playbook in the third quarter, but a menu mix misstep ended one of the industry’s more impressive sales streaks.

Wendy’s North America same-store sales fell 0.2 percent in the period to snap a 22-quarter run of positive gains. Traffic was down slightly. Revenues totaled $400.6 million, up from $308 million last year. Global same-store sales rose 1.7 percent. Net income totaled $391.2 million and adjusted earnings per share came in at 17 cents. Wendy’s also lowered its outlook to expect North America comps of 1 percent from 2–2.5 percent.

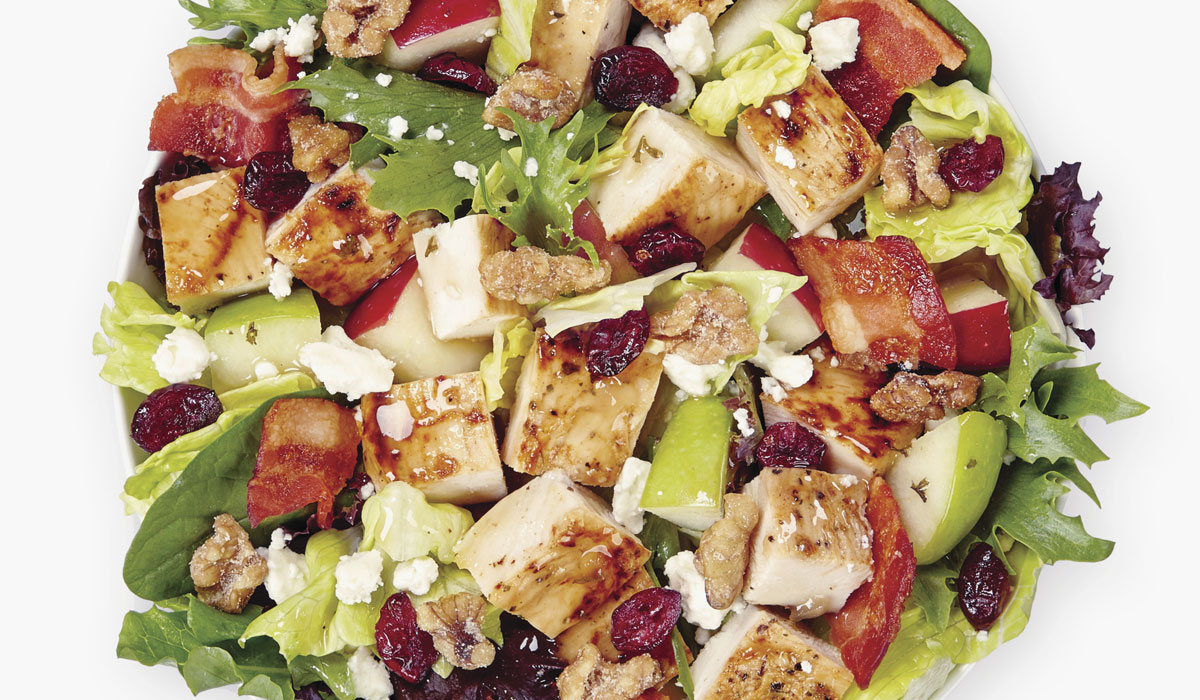

As usual, Wendy’s pushed a balanced marketing approach in the quarter, kicking off with a high message on chicken tenders, and then on the low end with a $1 Buffalo Ranch Crispy Chicken Sandwich. It followed this with more 4 for $4 spend, and a focus on fresh, never frozen beef. The quarter rounded out with a 50-cent Frosty deal and Wendy’s new Harvest Chicken Salad.

Sounds standard for the burger chain. So what tailed?

“Our high-low offerings in the third quarter did not create sales growth as planned in the context of a heightened competitive environment,” Penegor said.

What happened, essentially, was Wendy’s high and low message drove traffic, as it often does. But the opportunity lies not in driving guests into its restaurants, but in how to mix them into Wendy’s core and premium items. “As we look at our calendar into the fourth quarter and set up our plans into early next year, we need to have that right balance between driving them in, and trading them up to continue to drive more mix realization and we’re going to have the plans in place to accomplish that,” Penegor said.

As Penegor has mentioned on past calls, he believes quick service is the place to be, with more than 80 percent of all restaurant visits. The burger segment comprises roughly 30 percent of all fast-food businesses.

Wendy’s is driving traffic and taking share, as is its top competitors. That’s not really the top challenge for the biggest players with scale. “… the opportunities—how do we trade them up? How do we continue to move folks from the 4 for $4 offering into a higher-price pointed offering, like a $5 bundled meal? How do we continue to have exciting offerings on our core and premium menu? Once we get them to the restaurant with the appropriate upselling and the appropriate messaging trade them into those more premium offerings.”

The issue right now is Wendy’s is losing share on the dollar front, meaning the chain didn’t do as good a job trading customers on once they decided to traffic the restaurant. They came in for the deals and left after individual purchases. “And we’ve really got to look at, do we have that right balance on the value promotional items to make sure that they’re good add-ons as we bring folks into the restaurants,” Penegor said. “So you did see a lot of pressure on mix relative to the competitive set in the quarter.”

“Last year we had a trade-up program down to a $5 [Junior Bacon Cheeseburger] that obviously drove mix,” added CFO Gunther Plosch. “As we designed the program for this quarter, obviously, we had three dreams; operationally, financially, and consumer wise all these promotions tested well. Just in the environment we are in, it didn’t get us to the check accretion that we have seen in past.”

Right now, Wendy’s has a high message on the Bacon S’Awesome Cheeseburger and low on $1 Any Size Fry. “And when you think about driving folks in, trading them up, and then making sure that we’re driving add-on purchases to drive favorable mix. You would say that is a subtle adjustment to where we were relative to where we performed with our promotional calendar in the third quarter,” Penegor said.

The goal is to create a calendar with not just traffic drivers, but mix drivers. Get guests into the restaurant and trading up, and then make sure they’re coming back.

And this is a challenge unique to the sector compared to others based on the economic climate. “We’re seeing almost 10 years of economic recovery, we’re seeing lowest unemployment levels in a long time, high consumer confidence and median households finally at record levels,” Penegor said. “But as you look at that income growth, it’s skewed significantly to the higher-income households. You do have a workforce participation remaining well below pre-recession levels. And real wage growth is still not accelerating to the extent that we had all hope for.”

“And on the low end, you start looking at folks with rent and healthcare costs starting to rise that are really eating into some of the headway that they’re making. And remember in [quick service], we got about 40 percent of our customer base that makes $45,000 or less. So that’s why it is so important for all of us in the [quick-service] space to have a really solid high-low calendar to bring folks in, and allow them to mix across the calendar depending on the time of the month.”

Repeat customers—a futuristic take

On the note of getting customers to come back, Penegor explained the outlook like this: “We talk a lot about the investments that we’re making in technology. And when you think about what it’s going to take to really win in the long-run, technology is going to have to be one of those things that connect to the next generation of consumer as a big enabler.”

In addition to offering brands the ability to connect with consumers in fresh ways, technology is the key to unlocking consistency across a multi-unit system of this size, Penegor said. Wendy’s is pouring investments into the runway.

In an effort to drive more active users into its app in Q3, Wendy’s focused on an acquisition strategy to entice customers to download and use the Wendy’s app with a free Dave’s Single offer.

“This deal resulted in us doubling the number of active users compared to the second quarter, which was a huge success. Our mobile offers, which are available for use in all of our U.S. restaurants, will continue to drive mobile app usage and will set us up for a successful roll-out of mobile ordering, which has now begun across North America,” Penegor said.

As mobile ordering rolls, Wendy’s keeps making improvements to its app. “This coupled with increased downloads from our mobile offers strategy is providing more access to the brand and more importantly, one that is seamless and easy to navigate,” Penegor said.

Wendy’s delivery program with DoorDash accelerated quickly. Wendy’s is now live at 50 percent of its North America system and forecasts 60 percent penetration by year’s end. Check sizes are 1.5 to 2 times larger and Wendy’s sees “repeat business and we believe this a clearly incrementality on the business especially in the evening daypart.” For perspective, only 25 percent of the system offered delivery at the end of Q1.

“We continue to see nice builds on delivery, every time we create a little more awareness, whether that’s DoorDash support, or the brand talking about DoorDash delivery,” Plosch added. “So we don’t feel like it’s a fickle customer. We feel like we can get people into the routine and we’re seeing customers come in on delivery across all dayparts, but a little more skewed to dinner in late night.”

Franchising and the growth path

Wendy’s opened 37 global restaurants in Q3 for a net increase of 13 units. Year-to-date, Wendy’s has grown its footprint by 35 restaurants. Also, 48 percent of the global system was image activated by quarter’s end compared to 43 percent this time a year ago. That should hit 50 percent by the end of 2018.

To stimulate franchisee demand for restaurants, Wendy’s recently launched what Penegor called a groundbreaking incentive that provides franchisees 11.5 percent of royalty and advertisement abatements over two years if the operator signs the development agreement to build incremental new restaurants. As part of the incentive, franchisees are also eligible to use Wendy’s “refresh light” model for any future reimaging projects. This was previously only available for restaurants with average-unit-volumes of $1.3 million or less. The incentive program removes the cap.

“While it is still early, we have been seeing low to mid-single digit lifts on refreshed lights and we have exceeded our internal expectations. These are great examples of how we find solutions to create better financial returns for our franchisees, as we continue to invest in growth,” Penegor said.