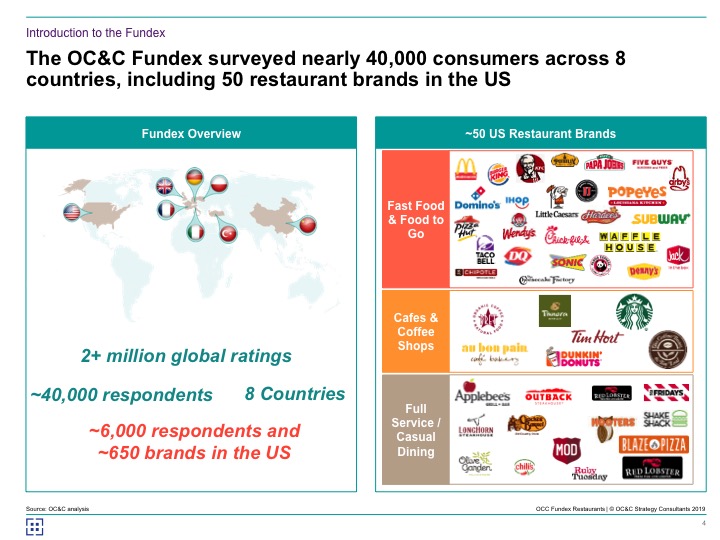

When it comes to ranking restaurant performance, there are typically two paths: hard data and survey data. We can sort by sales. Size. Different financial metrics (AUV, total systemwide sales, revenue, same-store sales, foot traffic, and so on). We could also ask consumers what they think and filter the results. There are also times where these things tie together. OC&C Strategy Consulting recently conducted a survey that questioned more than 40,000 consumers, which is a pretty massive pool. The key measure is what the company calls the “fundex.” It reveals, simply, which brands are connecting with their audiences on the most basic level—answering yes to “did you have fun” when eating in the restaurant. Fifty brands were examined. Beyond counting down the winners, the results provided interesting insight into what it takes to impress guests in an industry that’s spreading customer frequency faster and across more channels than ever more.

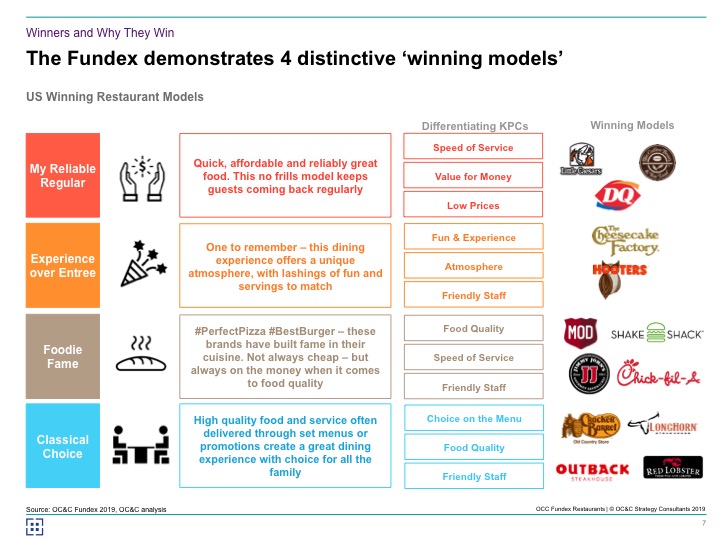

“Our research demonstrates the importance of brand distinctiveness in the crowded restaurant market,” said John Franklin, an associate partner at OC&C who led the study, to QSR in an email. “The highest rated brands—for example MOD Pizza, Chick-fil-A or Cheesecake Factory—have established ‘fame’ in a category with sights, sounds, and smells that can only mean one thing to their target consumers. Further, these brands deliver consistently on the basics of a great customer experience—high quality food, friendly service, and clean, inviting environment.”

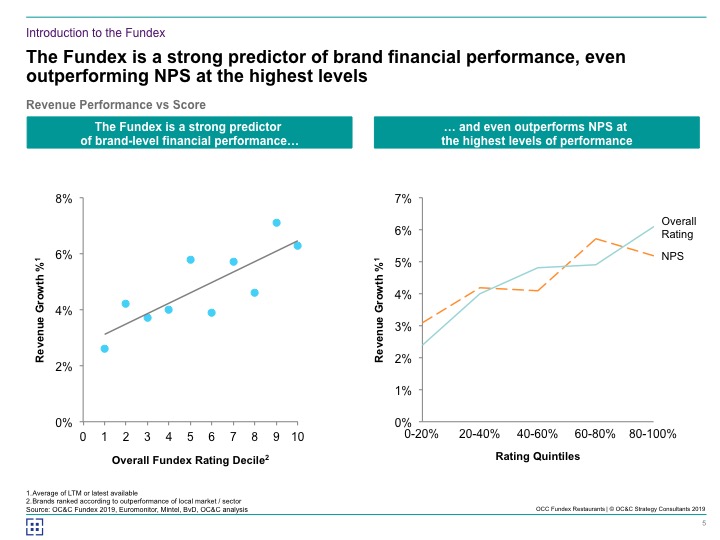

Below is a look at how OC&C’s “fundex” aligns with financial performance, proving that survey data and results can draw similar lines.

Now, on to the winners.

Overall Top 10

1. Chick-fil-A

2. Cracker Barrel

3. The Cheesecake Factory

4. MOD Pizza

5. LongHorn Steakhouse

6. Coffee Bean & Tea Leaf

7. Outback Steakhouse

8. Red Lobster

9. Shake Shack

10. Dairy Queen

Other rankings

- Most fun: Hooters

- Best value: Little Caesars

- Best service: Jimmy John’s

- Best food and drink: Chick-fil-A

- Best menu choice: Cracker Barrel

- Best atmosphere: Cracker Barrel

As with any ranking, the results themselves need to be judged against what the parameters were, who the competition was, and what kind of survey sample we’re talking about. Sometimes it’s more illuminating to just break down why certain chains shined, and what learnings can be gleaned from the results.

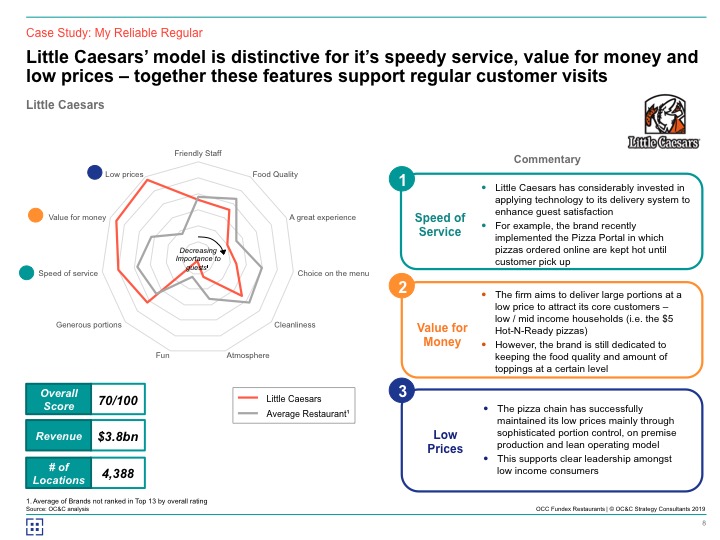

Little Caesars

The pizza chain fell into OC&C’s “My Reliable Regular” category. A combination of speedy service, value for money (abundance), and low price points inspire regular customer visits.

Overall, the 4,300-unit chain scored a 70 out of 100.

Little Caesars’ investments in tech and delivery are leading to better overall customer satisfaction. One example is the Pizza Portal, one of QSR’s 2018 Applied Tech Awards winners. The device is the first self-service, mobile pickup unit in quick service. Customers scan a QR code from their phone or enter a three-digit code, and the Pizza Portal’s automated doors dispense the order. Heat-holding technology ensures that each individual compartment keeps pies hot. Little Caesars said earlier it hoped to roll the product out by the end of the year. It was developed with Apex Supply Chain Technologies, a leading provider of automated dispensing system, exclusively for Little Caesars. If that isn’t the definition of convenience, nothing is.

On the value front, Little Caesars’ $5 Hot-N-ready options is one of the more iconic offerings in the carry-out game, and one they’ve played off with other deals, like the $6 ExtraMostBestest pizza that features “the most pepperoni and cheese of any large round standard menu 1-topping pepperoni pizza sold by the other three major national pizza chains.” Value in two places: size and price, as the study noted. And with no shortage of customer recognition around those brand values.

Little Caesars’ sophisticated portion control, on-premise production, and lean-operating model has allowed it to maintain low prices over the years.

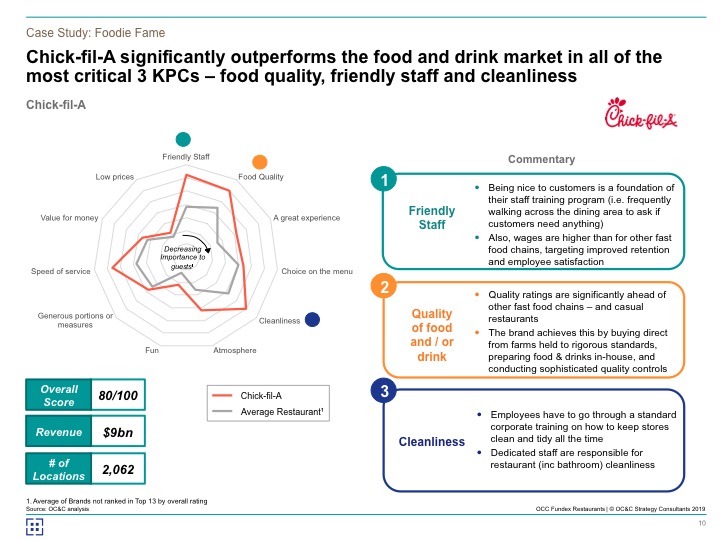

Chick-fil-A on cruise control across the board

Another list, another Chick-fil-A victory. The brand significantly outperformed the field in food quality, friendly staff, and cleanliness.

It is nothing short of remarkable—and can’t be undermined—how Chick-fil-A has built “being nice” into its training program. Sure, countless brands send employees around the dining room asking about refills, conducting table checks. But nobody holds a candle to Chick-fil-A from a consistency standpoint. The brand’s higher wages help with improved retention and employee satisfaction. Yet, more than anything, it’s just embedded into the deepest levels of Chick-fil-A’s culture. And it’s iron clad. It’s one of those operating traits that has matured to the point where it feeds itself and the entire organization, and will as long as Chick-fil-A keeps leading from the top down, and supports a single-operator model that doesn’t offer any slack where it matters most.

The other traits follow suit. Chick-fil-A’s in-house preparation of food and drinks, sophisticated quality control, direct buying practices. Employees go through corporate training on how to keep stores clean and tidy, and there are dedicated staff responsible for restaurant cleanliness. All the impressive notes you can check off as you walk through any Chick-fil-A in America—they didn’t happen by accident.

OC&C gave the $9 billion brand an 80 out of 100.

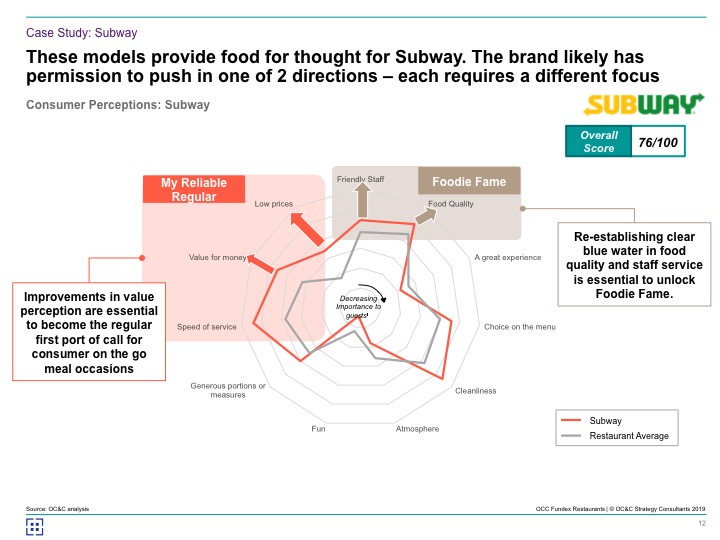

Let’s talk about Subway

The chart below suggests an inflection point for Subway. Which direction should the world’s largest restaurant brand go in? Can it achieve both?

Tips to live by

Naturally, restaurant brands are trying to achieve different things in regards to customer experience. Not every brand is going to push all of its resources into superior food quality. Speed might not matter as much to certain guests at certain restaurants. Value is relative to the experience and the offering. It’s all about identifying a core guest, writing a narrative around those goals, and then reinforcing and promoting those pillars with every avenue available. Don’t tell customers what they want. Figure it out and then give it to them, as seamlessly as possible.

Here are five key learnings from the study:

Avoid the fun killers

Quality food and friendly staff are essential. Not one brand in the top 10 scored below average on those measures.

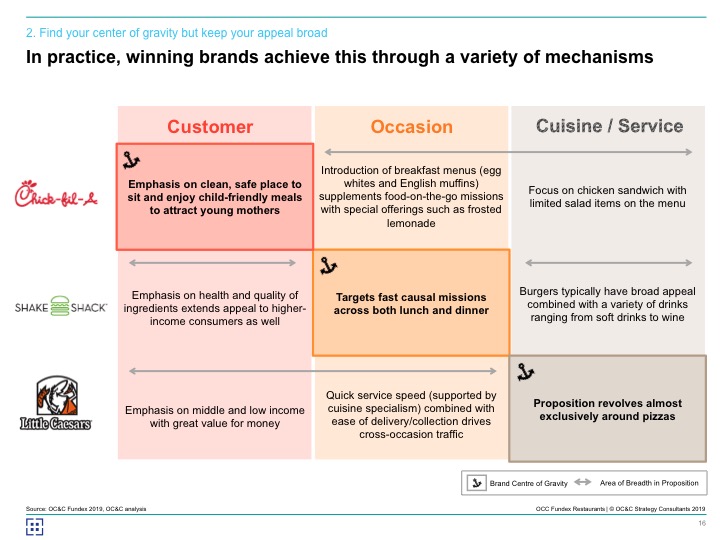

Find your center of gravity but keep your appeal broad

It’s impossible to be all things to everybody, the study said. Quick service, in general, has had less of a problem with this notion than casual dining in recent years. But those chains are starting to come around, too. Chili’s, in one example, sliced its menu 40 percent in 2017 so it could focus on core items, speed up service, and improve back-of-the-house execution. What followed? The best traffic performance in more than a decade.

Develop a distinctive and authentic proposition

Gone are the days when a one-stop shop would cut it. Diners look for authenticity now. From sights and sounds to smells even, customers want to know exactly where they are when they’re eating.

Keep your visitors coming back for more

As any restaurant chain can attest, repeat visitors are essential. There are only so many LTOs or discounts you can devise to inspire new business. Leading brands strategically tailor their propositions to encourage habitual usage.

We might be there already, but if we’re not, the app and loyalty war is about to ignite. People typically don’t use more than a few apps, even though they’ve downloaded 700. But those they do lean on, they frequent more than they take steps in a day. For restaurants, inspiring true loyalty through mobile mediums is the golden egg.

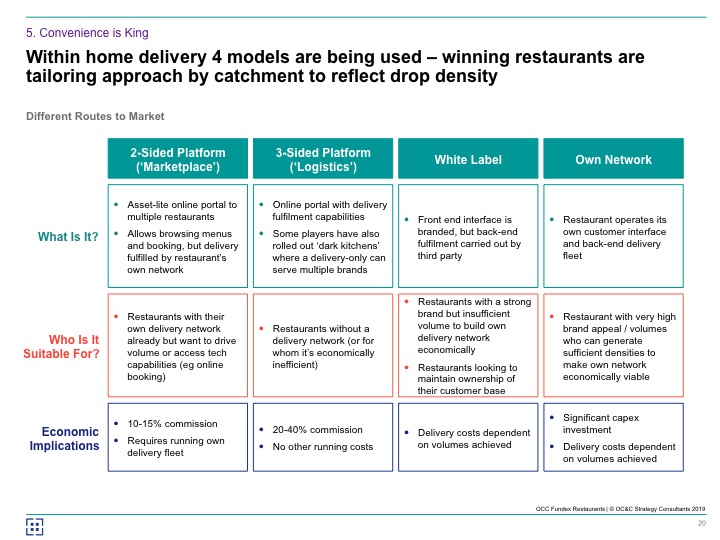

Convenience is king

Winning restaurants develop solutions to serve their menus through home delivery, in-store pick-up, and automated kiosks, as well as offering all-day menus when it makes sense. Take Shake Shack as a case study. Not too long ago the burger brand was pretty straightforward from an accessibility standpoint. Walk in, order, grab your buzzer, and sit down. Now, there are five ways to order. Guests can still walk in, of course, but now they can also use a self-serve kiosk in some locations; access the brand’s newly refreshed mobile app; tap its recently launched web-ordering platform; or dial up one of Shake Shack’s delivery pilots via third party. Can restaurants meet guests at these off-premises opportunities while still guarding four-wall experience? That’s the challenge ahead.

What do you stand for?

OC&C notes that winning brands successfully navigate the tension between standing for something while being broadly accessible. That’s no easy task. And again, it’s not for everyone. Some smaller fast casuals might want a very specific customer to walk through the door. In general, however, it’s important to find a center of gravity and appeal to multiple demographics.

Customer

Specialize in serving the needs of a specific demographic or attitudinal customer set (say, value hunters or millennials). Top chains target the customer segments with growing spend potential, and that fit their brand goals.

Occasion

It’s worthwhile to own a specific type of trip across all customer groups (birthdays, date night, and so forth). Being excessively occasion-led could lead to a slowdown during non-target dayparts, though. Whether or not that’s a problem depends on the brand, and how much volume is coming during the sweet spot. Dunkin’, for instance, has pushed afternoon business in recent months, using deals like cheaper espresso and a $2 snacking menu. But this initiative unfolded as the chain appreciated robust breakfast sandwich transactions—75 percent of which were coming with a beverage. That daypart churned along, giving Dunkin’ whitespace to innovate in the p.m. In other terms, it didn’t sacrifice one for the sake of the other. McDonald’s has experienced a slowdown in regards to breakfast sales lately. The issue being a daypart one (less transactions in the morning as opposed to less breakfast item purchased). To fix the issue, McDonald’s focused on menu engineering, like the Donut Sticks, and shifted toward local value instead of national in an effort to compete with nearby restaurants. How much of this is tied to pushing breakfast to an all-day platform? While McDonald’s is enjoying higher checks, how can it improve guest frequency moving forward?

Cuisine/service

Offering a genuinely differentiated experience through a unique selection of dishes or service style can set a restaurant apart. Unique service styles are often associated with serving particular occasions as well. And that doesn’t always boil down to food. This is one reason fine dining has been a solid performer in recent years. Today’s diner buys experience as much as food sometimes, especially given the improved consumer confidence and people’s tendency to spend on eating out. That doesn’t mean you need to toss in a prix fixe menu and hire a sommelier. Even the friendly nature of dining at Chick-fil-A is a very specific experience. You can expect it every time you pull out your wallet. And that’s the selling point. Consumers are usually seeking out something specific when they pick a restaurant. The question is: Is it clear what your brand offers? And are you delivering it?

Below is an example of some success stories.

Off-premises is still growing

There’s no shortage of data to prove this point but here’s another look.

And take a look at this slide from OC&C below that talks about the different routes to market.

To close out, OC&C offered up some questions for self-reflection.

They fit into the earlier categories.

Avoid the fun killers

- What approaches are you using to ensure food quality standards and overall customer service at the store level?

- How are you supporting innovation and spreading best practices across the business?

Find your center of gravity but keep your appeal broad

- Are you clear about who your target and adjacent customer groups/occasions are?

- What share of these groups are you winning?

- Where do opportunities exist to win share of stomach?

Develop a distinctive and authentic proposition

- What would your customers say defines your brand?

- Is this clearly differentiated versus competitors?

Keep your visitors coming back for more

- How is NPS trending?

- What proportion of customers are regulars?

Convenience is king

- Where is delivery/collection more important for consumers?

- How does the proposition meet consumer needs?

- How can the supply chain be optimized to meet varying levels of walk-ins versus delivery customers?