A New Year Arrives

Becky Mulligan enters 2021 hopeful and optimistic, a seemingly odd turn from the dark, coronavirus-infected clouds that hung over much of 2020.

Even though Mulligan, CEO of The Little Beet fast-casual chain, watched as a collection of her restaurants in New York City—operations accustomed to pulling in upward of $5 million in annual sales—sat dark into the fall, she now sees light shining through the overcast skies. In recent months, Mulligan celebrated the opening of a Little Beet unit in front of Grand Central Station in New York City and will soon open another store on Manhattan’s Upper East Side.

“I’m bullish about what lies ahead,” Mulligan says.

Though COVID-19 brought unprecedented challenges to the nation’s quick-service landscape, including some still-persistent turmoil, the global health crisis also created a few unique opportunities for quick-service players.

Opportunity #1:

Consumer tech adoption

For years, restaurant brands rolled out mobile apps, online ordering, and other tech-fueled solutions to stimulate traffic and revenue. After years of incremental consumer change regarding digital technology, COVID-19 “ripped off the Band-Aid,” says Anthony Pigliacampo, CEO of the 28-unit Modern Market chain.

“When we look back on this pandemic in five years, we’ll see that it accelerated the digital future of restaurants,” Pigliacampo says.

Indeed, the pandemic lit a fire to consumers’ slow-and-steady adoption of digital technology. Wary of dining out or simply prohibited from doing so, a growing segment of the American populace ordered food from mobile apps or trialed restaurant delivery for the first time in 2020.

Pokeworks, a five-year-old California-based concept with nearly 60 units peppered across the U.S., saw increased demand for mobile orders and delivery as COVID-19 invaded American life. The company responded by improving the experience on its own digital app, including boosting loyalty through points, tiers, and birthday specials.

“We want more customers coming in through our channels to give them a more streamlined experience,” says Pokeworks cofounder and chief development officer Peter Yang, adding that native app purchases also enable the brand to bolster store profitability by avoiding high third-party fees.

Modern Market, meanwhile, leaned into growing consumer tech adoption rates with the development of proprietary e-commerce tools, fashioning itself an e-commerce brand with distribution endpoints, namely its restaurants. Through a “fundamental rethink” in Modern Market’s business, Pigliacampo says, the brand continues exploring different items or categories of products it can sell on digital platforms, such as cooked proteins, soup by the gallon, or a la carte sides.

“The focus on digital has opened up product opportunities you’d probably never offer in a physical restaurant,” Pigliacampo says. “It’s a fifth-wall model and arguably the most important one moving forward.”

Opportunity #2:

Acquisitions

While acquisitions are nothing new in the restaurant space, many industry insiders predict a ripe marketplace in 2021 as enterprises in a healthy position can diversify their portfolio and apply the most successful parts of distinct brands to construct a more formidable business. In fact, those wheels are already in motion.

Last summer, The Little Beet’s parent company, Aurify Brands, seized the opportunity to acquire Le Pain Quotidien U.S. from bankruptcy, throwing a lifeline to an established brand with its share of enthusiastic fans and high-profile locations. Playing the long game with Le Pain Quotidien, Aurify will drop a proprietary app for the brand later this year, while it will also investigate ways to retool service models and ramp up to-go business to better meet customers’ needs. Aurify also recently purchased Maison Kayser’s New York City locations out of bankruptcy and has announced plans to convert about 10 of those units into Le Pain Quotidien restaurants.

“We’re excited about how we can nurture this brand and energize its results,” Mulligan says of Le Pain Quotidien, over which she is also now CEO. She adds that Aurify sees “additional compelling opportunities being available in 2021.”

Aurify won’t be alone in hunting acquisitions.

There is, for instance, Tastemaker Acquisition, a new special purpose acquisition company (SPAC) led by Bartaco cofounder Andrew Pforzheimer and Red Robin chairman David Pace, as well as FAST Acquisition Corp., a SPAC headed by Ruby Tuesday founder Sandy Beall and Doug Jacob, who helped launch the &pizza chain. FAST, which went live last summer with some $200 million to invest in restaurant brands and restaurant technology, is particularly interested in restaurant brands possessing strong recognition and affinity with consumers as well as those that have already “tightened their belt” and “started down the tech path,” Jacob says.

“We’re very bullish on the acquisition front,” Jacob adds. “We believe there’s a ton of opportunity to better optimize brands for the future, to leverage the capital markets for growth, and to provide our expertise to get brands moving forward.”

Opportunity #3:

Franchise sales

At Pokeworks, Yang says the pandemic forced the growing five-year-old chain to “do more with less.” The brand, for instance, optimized its menu, assessing sales data and ridding its stores of low-volume and low-margin items as well as those that required considerable manpower or prep work. As labor and food costs decreased, unit economics jumped.

In another profit-focused move, Pokeworks took over a second-generation restaurant in Orange County, California, and converted it into a Pokeworks for less than $100,000.

“We were able to knock this out of the park even amid COVID,” Yang says.

With Pokeworks’ improved profitability and unit economics, Yang believes the brand will prove attractive to prospective franchisees.

“When you can offer a compelling opportunity, franchisees will jump on it,” Yang says, noting that franchisees today operate about 85 percent of Pokeworks’ units.

Pennsylvania-based Saladworks has also worked to value-engineer its concept to decrease the cost of buildouts, reduce rents, and increase revenue-generating opportunities. Buoyed by its on-trend menu featuring healthy, plant-based meals and versatile store formats, Saladworks vice president of development Eric Lavinder believes the company can entice franchise deals.

“We’re optimistic we’re in the right niche to benefit,” Lavinder says.

Opportunity #4:

Commercial real estate

After years of landlords calling the shots as the economy surged and restaurants expanded, many analysts see the pendulum swinging in the tenants’ favor—and fast.

“The run up in real estate prices, especially in major urban markets, became cost prohibitive in many cases, but there’s certainly an opportunity to leverage cheaper real estate coming out of this,” Jacob says.

Saladworks’ Lavinder sees landlords and leases becoming more flexible and favorable, a marketplace check-and-balance that positions restaurants to secure better terms and improved ROI. In addition, second-generation stores offer another appealing option, allowing a new concept to recapture real estate and plant a new flag with a significantly lower investment of capital compared to a vacant commercial box.

Mulligan, too, embraces opportunity on the commercial real estate front, including access to “A++ locations.” She says developers and landlords have approached her asking what it would take to get a Little Beet restaurant into their development.

“These are places I would’ve liked to have been in, but spots that didn’t necessarily make sense financially,” she says. “When landlords have something highly visible, they don’t want it to sit empty.”

Mulligan sees greater willingness from some landlords to investigate partnership agreements, including deals tied to restaurant sales. In such agreements, the landlord enjoys upside if the restaurant performs well, while the restaurant receives more flexible and palatable terms should sales lag.

“There’s more interest in exploring different ways to work together, and that’s a real plus,” Mulligan says.

Opportunity #5:

Nontraditional store formats

Fueled by factors such as convenience, safety, digital adoption, and unit economics, quick-service brands are embracing a range of nontraditional store formats.

Both Pokeworks and Saladworks, for instance, teamed up with REEF Kitchens, a leading ghost kitchen operator, to boost on-demand delivery. REEF Technology, which has more than 5,000 parking facilities across North America, created its Kitchens division to put restaurant vessels (similar to food trucks) inside their parking facilities. Yang says working with partners like REEF and Epic Kitchens, the chain’s ghost kitchen of choice in Chicago, enables Pokeworks to break the frequent bottleneck associated with brick-and-mortar site selection.

“With ghost kitchens, we’re able to get into a market and see how it plays, which should help us scale quicker,” Yang says.

In October, meanwhile, Saladworks opened a slimmed-down unit inside of a Giant Co. grocery store in Camp Hill, Pennsylvania. A total of six such Saladworks locations are open, with 10 more under development with three national grocery store chains.

“The timing for us is great because the salad bars have to go away and are probably obsolete for a while,” Lavinder says. “Here, our guests can grab a made-to-order salad just as they would in our traditional restaurant.”

Saladworks also recently introduced Sally the Robot, a fresh food robot that can create customizable salads inside a 3-feet-by-3-feet space akin to a soda machine. The first Sally, which was created in partnership with Chowbotics, opened at a Philadelphia hospital in November. Staff from a nearby Saladworks store prepare the foods before stocking Sally for the day.

“It’s essentially our store operating 24/7 inside of a robot,” Lavinder says.

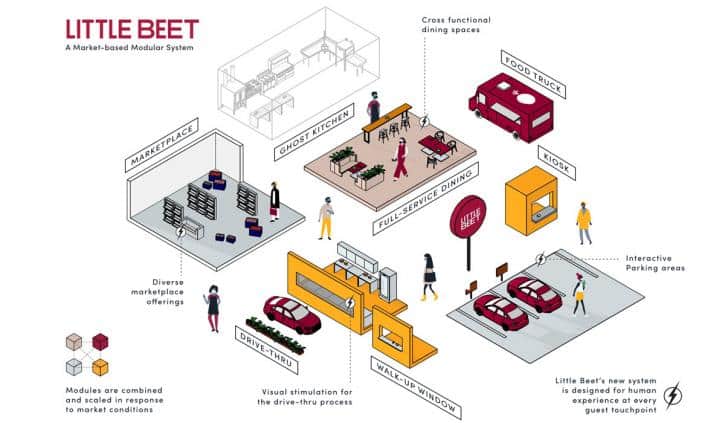

Brands also see the opportunity to alter their tried-and-true traditional store formats. Fast casuals like The Little Beet are adding drive thrus—the first of which will open later this year—while Pokeworks is preparing a new store in Knoxville, Tennessee, for the chain’s first order-ahead cruise-thru window.

“We see the future of ordering from apps is here, and this is the classic drive-thru lane built purely for mobile pickup,” Yang says.

Opportunity #6:

Expansion into new markets

Beyond new store formats, many restaurant companies are also exploring new markets, especially urban mainstays looking to invade the suburbs.

Recognizing that The Little Beet had “a lot of its eggs in the Manhattan basket,” Mulligan has led the chain’s move into some strategically selected suburban markets. In the coming months, a Little Beet unit will open in Westport, Connecticut.

“That’s a very suburban location for us, but the agility to pivot to these types of locations is necessary to deal with shifts in consumer behavior,” Mulligan says, adding that such units can service smaller satellite locations built with pickup and delivery in mind. “We can rethink how our system of stores operate together.”

Once dining room restrictions wane and individuals gain more comfort being out and about—an admittedly TBD reality—Pigliacampo sees an opportunity for fast casuals like Modern Market to become a “third place in suburbia,” particularly for the work-from-home crowd seeking more flexibility to their day. He believes fast casuals can leverage their more sophisticated, comfortable interiors to attract regular guests.

“Restaurants are a great respite, so how do we reposition furniture or create dividers that create a safe yet inviting environment for our guests?” he asks. “It’s that kind of innovation and opportunity this pandemic is creating, because people aren’t going to stop turning to restaurants.”