A “dangerous trend” has cropped up for restaurants at this latest COVID-19 turn, the National Restaurant Association stressed to members of Congress Tuesday. Based on recent survey data from the Association, 19 percent of adults said they’ve stopped going out to restaurants and 9 percent cancelled existing plans amid the rise of the Delta variant. OpenTable found similar trend lines—with dining down 16 percent in San Francisco compared to July, and business dipping as far as 66 percent below 2019 levels.

On August 20, a citywide mandate requiring proof of vaccination to dine or drink inside went into effect across The Golden City. A top restaurant, China Live, told the San Francisco Chronicle reservation cancellations leapt by 15 percent.

Also, according to the Chronicle, about 40 percent of reservations in San Francisco over the past six weeks were made for outdoor tables, nearly double the rate in other cities globally.

“We concluded that a majority of consumers have changed their dining behavior in a manner that is beginning to put acute pressure back on the restaurant industry,” Sean Kennedy EVP of Public Affairs at the Association wrote in a letter to Congressional leaders.

Compounding this concern is a balancing act playing out industry-wide; the dynamic of demand outpacing supply, with food and labor costs increasing at their fastest pace in several years.

The “dangerous trend” the Association referenced, however, is what happens if pent-up demand suddenly wanes thanks to Delta. There are still indoor capacity limits in 11 states and “crushing long-term debt loads for countless restaurant owners,” Kennedy said.

READ MORE: Restaurants Brace for Delta Surge, and Survival Tactics Yet Again

The Association surveyed 1,000 U.S. adults from August 13–15. Six in 10 said they’ve changed their restaurant usage due to the highly contagious variant, which, as of last week, accounted for more than 98.8 percent of American cases, per the Centers for Disease Control and Prevention. So far, August has been the third-worst month for COVID numbers in 2021, just behind January and February.

In addition to pulling back on dine-out plans, 37 percent of respondents said they ordered takeout or delivery instead of sitting down in a restaurant, while 19 percent added they chose to dine outside.

Forty-one percent said they didn’t change behavior at all, with Baby Boomers and people who identify as Republicans saying they were most likely to not take any of the above actions due to a rise in COVID cases.

The positive spin? Restaurants have been here before. And flipping the switch to outdoor dining and off-premises channels shouldn’t shock the system like it did last March. But, in the Association’s belief, “for an industry that requires a ‘full house’ every evening to make a profit,” any setback is going to strike a major dent in the sector’s recovery efforts. And it’s pushing for further Restaurant Revitalization Aid in response.

“While the first half of 2021 showed positive gains for the industry, there is still a long road ahead, especially for full-service restaurants facing the greatest threat from new government restrictions in response to the Delta variant,” the Association said.

One in three respondents said they would be less likely to go out to a restaurant if masks were required to dine inside. On the flip side, 25 percent said it would actually make them more likely to go out, showing yet again the stark line that divides consumer perception during the pandemic.

Forty-three percent said masks had no impact on their decision.

Gen Z adults and Democrats were the most likely to say a mask requirement made them more apt to venture out. Republicans, Gen Xers, and rural residents mainly comprised the opposite stance.

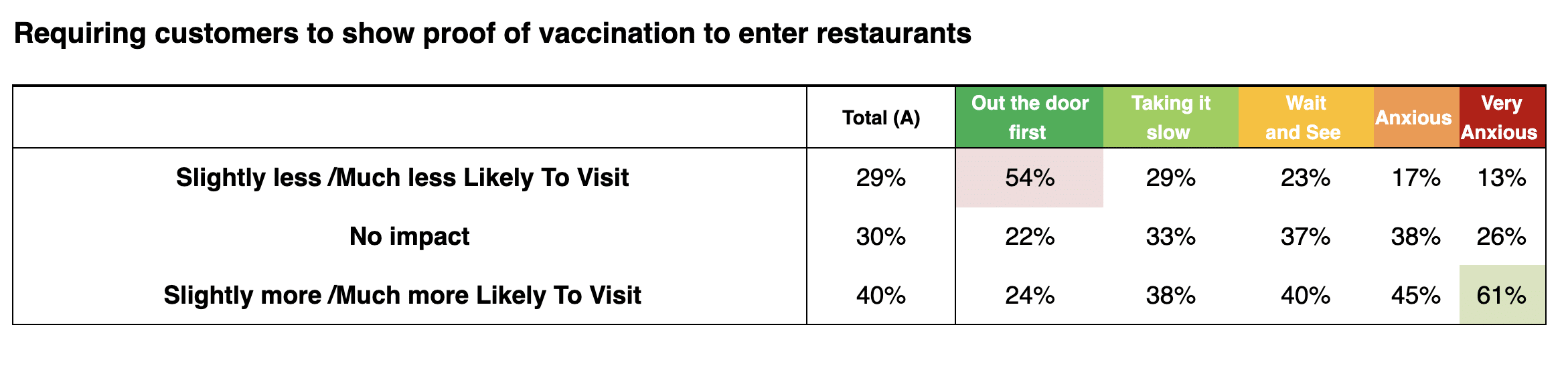

On the topic of vaccines, one in three said they’d be less likely to go to a restaurant if proof of vaccine was required to dine inside. Thirty-three percent said the requirement would inspire confidence, while 35 percent didn’t care one way or the other.

And like masks, the topic was visibly split. Democrats, Gen Z adults, and individuals in higher income households were the most likely to say a proof-of-vaccine requirement would make them more eager to dine out. Republicans, independents, Gen Xers, and rural residents represented the other spectrum of the debate.

Three major markets—New York City, San Francisco, and New Orleans—have mandated vaccination for indoor dining customers and employees in light of Delta concerns. San Francisco requires both vaccine doses, and New Orleans offers the option of a recent negative COVID test.

Below is a look at how some consumers might respond to vaccination proof requests, from Lisa W. Miller & Associates.

“These changes indicate declining consumer confidence that will make it more difficult for most restaurant owners to maintain their delicate financial stability,” Kennedy said.

“The rise of coronavirus variants like delta threaten to push these restaurants closer to permanently closing their doors,” he added. “… The small gains that our industry has made toward financial security are in danger of being wiped out, dashing the hopes of communities, entrepreneurs, and consumers nationwide.”

While August’s full sales data won’t be clear for another couple of weeks, Black Box Intelligence has seen weekly results in line with the Association’s concern.

Despite 22 weeks of stronger sales growth compared to the same stretch in 2019, performance has begun to soften. In the period ending August 15, the industry posted its weakest figures in the last nine weeks, Black Box said. Traffic growth also slid. Forty-two states averaged lower sales growth during the first weeks of August compared to the length of July.

Data from Lisa Miller, a consumer insights and innovation strategist, found, out of a group of 1,000 American consumers polled, 51 percent were “very/extremely concerned” about the Delta variant in July. And 59 percent said the impact of the Delta variant would somewhat or significantly reduce their activities.

By August 16 (compared to July 26), consumer positive sentiment had dropped 58 percent among the “first-out-the-door” group of already wary guests. Seventy-one percent said they were somewhat/significantly reducing activities due to COVID, and 31 percent even said we should consider shutting back down to curb spread. This time last year, the number was 33 percent.

Also, there’s the question of how this all affects an already stretched labor pool, which is directly playing into the dine-out equation for guests. In July, Miller’s data revealed 43 percent of consumers were frustrated with not enough staff during a recent restaurant visit.

And this as restaurant menu prices hiked 0.8 percent on a month-to-month basis in July, according to the Bureau of Labor Statistics—the largest monthly increase since February 1981. Full-service restaurant prices upped 4.3 percent, while limited-service saw price hikes of 6.6 percent. Restaurant prices rose in June as well, up 0.7 percent month-to-month and 4.2 percent on an annual basis.

Red Robin, in one case study of late, had to reduce hours of operation at some stores in Q2, hampering its sales recovery. The chain has added 1,900 employees since late May but remains 2,000 short of its goal to best 2019 staffing levels. This equates to about five employees per restaurant, or roughly an employee short per location across the system. Red Robin also forked up $1.6 million in incremental labor costs in Q2 due to increased onboarding, as well as retention and sign-on bonuses to lure candidates.

Clearly, it’s one visible lever for why prices are climbing industry-wide. At the end of Q2, hourly wage increases were in the mid-single digits at Red Robin, partially offset by a favorable lift in front-of-house hours. Full pricing in 2021 for the chain is expected to be between 3.5 percent and 4 percent.

An example of the commodity inflation—Texas Roadhouse said in July it expects food cost inflation of 7 percent in the near future, up from a previous guidance of 4 percent laid out in April. As other chains lamented in recent months, Texas Roadhouse has had to buy more product on the open market and outside the cost parameters of its original contracts to counter issues.

This has pushed the cost of basket items, like beef, upward. At this time last year, chicken cost about $1.13 per pound. Since April, prices have climbed above $1.80 per pound, according to The Associated Press.

And will all of these issues, namely around vaccines, make it even more difficult to hire employees?

According to a study of more than 1,600 employers from Littler Mendelson, the world’s largest employment law firm, fewer employers in retail and hospitality (9 percent) are requiring vaccines or planning to, compared to 21 percent of all respondents. When asked about their concerns with mandating vaccines, employers in these industries expressed greater concern across several areas:

- 80 percent (retail/hospitality) picked resistance from employees who are not in a protected category but refuse to be vaccinated (compared to 75 percent of all respondents)

- 73 percent cited the impact on company culture and employee morale (compared to 68 percent of all respondents)

- 69 percent noted loss of staff and difficulty operating (compared to 60 percent of all respondents)

Broadly, there’s a question of whether or not restaurants ever get back to previous staffing levels, and if adjustments such as automation, QR codes, smaller dining rooms, cross-training, or additional shifts in the labor model are here to stay.

There are roughly 70 percent more job vacancies currently than pre-pandemic across all industries, and 10 percent fewer people looking for work—the greatest gap in recorded history.

Job openings jumped to a series high of 10.1 million by July, per the BLS, with the accommodations and food services sector accounting for a large portion of the increases.

According to Black Box and Snagajob, current staffing challenges have full-service restaurants operating with 6.2 fewer employees in the back of the house and 2.8 fewer in the front of the house than they did in 2019.

There are myriad culprits, from unemployment benefits to childcare to safety concerns, gig opportunities, and now, vaccine dilemmas. But in Black Box and Snagajob’s study, 71 percent of operators credited higher pay through unemployment or higher pay in another industry as the main driver behind today’s labor shortage.

There are roughly 70 percent more job vacancies currently than pre-pandemic across all industries, and 10 percent fewer people looking for work—the greatest gap in recorded history.

READ MORE: The Restaurant Guide to Surviving the 2021 Staffing Shortage

What this has resulted in are higher turnover rates and voluntary quits at an all-time high.

In 2019, hourly turnover in limited service was 135 percent, on average, Black Box data showed. This June, it soared to 144 percent.

Those figures were 102 and 106 percent, respectively, for full-service.

Restaurants are raising wages to battle conditions. In Q1, counter-service brands lifted hourly wages by 10 percent, year-over-year, or the highest jump seen in years, Black Box said.

And yet it’s still difficult to compete with the other industries looking to staff back up at higher entry points: 51 percent of workers cited higher pay or the need for consistent schedules and income as their top reasons for switching industries.

When asked why people are choosing to work in restaurants, 51 percent tapped “flexible hours.” Another 43 percent pointed to a “fast-paced environment.” Thirty percent liked the “social aspect of the job,” while 29 percent were attracted to earning potential (tips), and 21 percent the ability to “work with friends.”

Of those looking to work in restaurants, 17 percent were first-time job seekers and 39 percent employed but looking for a new gig. Notably, 36 percent turned to online job searches to find employment.

The five most important things restaurant workers said they look for in a new job:

- 1. Starting hourly wage

- 2. Promotion opportunities

- 3. Flexible schedules

- 4. Health benefits and paid time-off policies

- 5. Company culture/work environment

These were the incentives restaurant workers desired most:

- 1. Cash bonus if hired

- 2. Cash bonus for interviewing

- 3. Retention bonus

- 4. Free meal at the interview

Eighty-seven percent of respondents also said they’d rather have a set liveable wage than tips.

Another point worth considering is childcare, which McDonald’s cited as one of the top reasons employees weren’t hesitant to sign on. The chain already offered paid parental leave, but recently added emergency child care.

According to Snagajob data, 35 percent of current hourly workers and job seekers are parents, and 18 percent of unemployed hourly workers had to leave their job to take care of family or children. In 2020 alone, women globally lost more than 64 million jobs, which equals 5 percent of the total jobs held by women. A majority left to stay home and provide child care.

So how can you keep employees? One place to start is with why they are leaving. Black Box found, of surveyed employed hourly workers, 15 percent have changed industries in the last year and another 33 percent want to.

- 1. Higher pay in other industries: 28 percent

- 2. Needed consistent schedule/income: 23 percent

- 3. Lack of professional development and promotion opportunities: 17 percent

- 4. Work hours: 16 percent

- 5. Work environment/company culture: 15 percent

“Recently, restaurants have been hit with higher than usual turnover and this is a moment for restaurant owners and managers to take a look at how they do things and what their staff is up against,” Black Box said.