It is a simple question: Has COVID-19 impacted the world of restaurant franchising? The simple answer is a resounding yes. However, the nature, degree, and longevity of the impact is far from certain, given that we remain in the clutches of the pandemic.

When we examine the industry data for the top 1,500 brands at the end of 2020, we find a decline in franchised units versus the prior year. There were 183,020 franchise locations compared to 187,604 at the close of 2019; a drop of 2.4 percent. By comparison, company-owned units declined 1.2 percent, dropping from 62,930 to 62,194.

On the surface, it appears that franchise locations were less resilient than company units, having declined at twice the rate. However, before leaping to that conclusion, one should factor Subway into the equation. Subway suffered a net loss of 1,796 units, or 39 percent of the franchise unit erosion experienced by the top 1500. If we take Subway out of the mix, franchisee units declined by only 1.7 percent.

The loss in units is a relative matter. Are these numbers, regardless of company or franchised units, better or worse than the industry at large? I have yet to see a consensus for the decline in units across the entire industry. But I think most observers would agree that within the top 1,500 brands, franchise and company units alike fared much better than the overall industry.

READ MORE:

The 17 Best Restaurant Franchising Deals for 2021

The Next Frontier of Restaurant Franchising

How did quick-service and fast casual (FC) brands perform? Combined, these segments accounted for 94 percent of all restaurant franchises in the top 1500 at the close of 2020. Quick service and FC dominate franchising. The combined segments consisted of 42,399 company units and 171,879 franchise units. Company-owned quick-service and FC units were very resilient, declining by only 25 units (this in the face of some brands selling their company units, which would further erode the count). The franchise side (heavily impacted by Subway) dropped by 3,934 units (2.2 percent).

How did the balance of the industry fare? Company units declined from 20,556 to 19,795 (3.7 percent), while franchised locations dropped 5.5 percent (11,791 down to 11,141). The challenges faced by the other industry segments were much heftier than those faced by quick service and FC, and one needs to look no further for evidence than the differential in year-over-year unit counts.

The major point to be gleaned from the data is not as much about franchising as it is the advantage of scale. If scale equals resiliency, then franchising becomes an appealing option for investors. Those seeking the shortest route toward harnessing the benefits of scale will be drawn to franchising. Of course, this is nothing new! The pandemic only heightens the importance of resiliency.

Due to the contraction of units within the overall restaurant industry, there is as-yet unrealized development opportunity. Logistical issues, coupled with a wait-and-see attitude by some investors, continues to suppress restaurant development. Sooner or later, these issues will subside, and we will see a steady increase in net unit count for the industry. Due in large part to the resiliency demonstrated by brands, franchising will likely comprise a greater share of new restaurant development (though that growth is not likely to come in leaps and bounds).

Restoration of unit growth will not be universal. There will be winners and losers. To be sure, a franchisor’s success in dealing with COVID-19 may make their brand a more appealing option than it was prior to the pandemic. What will drive a prospective franchisee’s decision in the post-COVID world?

Investors will likely apply a pandemic litmus test alongside the traditional considerations. For brands that managed to succeed during the pandemic, you can bet that their brand story will be expanded to include those tales. What pre-pandemic strengths worked in their favor? Did the franchisor demonstrate that they could quickly adapt to the pandemic marketplace in order to overcome declines in sales and traffic? What did the franchisor do for their franchise community during the darkest days? Franchisors that successfully navigated the past 18 months have likely made fundamental changes to their brand narrative. Those that have not enjoyed success will have tough questions to answer.

DOWNLOAD OUR BEST FRANCHISE DEALS REPORT

The foundation for an investment decision, however, will continue to be unit economics. It remains to be seen whether the pandemic’s impact on a typical restaurant P&L is short or long term (e.g., the impact from costs associated with third party delivery services). For the most part, the fundamentals remain the fundamentals. Franchisors that put forward a compelling Item 19 in their Franchise Disclosure Document that reflects superior performance during the pandemic will likely have a leg-up in the franchising market place.

One cannot overlook the fact that a franchise candidate’s decision is seldom driven exclusively by the numbers. A compelling brand story goes a long way. On the flip side, franchisors that have not fared well have a lot of work ahead of them if they are going to succeed at selling franchises in the post-pandemic world. However, I would submit that many of these brands had weak fundamentals before the pandemic. For some, their performance during the past 18 months made a bad situation worse. And even if they were able to improve their fundamentals during the pandemic, the margin of difference probably widened between them and the better performers in their investment range.

Franchising has its pluses and minuses, to be sure. There are bad actors when it comes to franchisors and franchisees; they both do their share to give franchising a bad name in some circles. But during the pandemic, the good far outweighed the bad, and the inherent strength of a quality franchise allowed franchisees to achieve results that, in many cases, exceeded expectations. Franchise systems were able to compete and handle adversity in ways that their independent restaurant rivals were hard pressed to match. The inherent resiliency of franchising was on display like never before.

When the pandemic finally becomes something that we refer to in the past tense, and a tally is made of the restaurants that comprise the industry, I am confident that a gain in share will be achieved by the franchise concepts that are comprised of committed franchises and franchisors; teams that add value in their respective roles and have the fundamentals down pat!

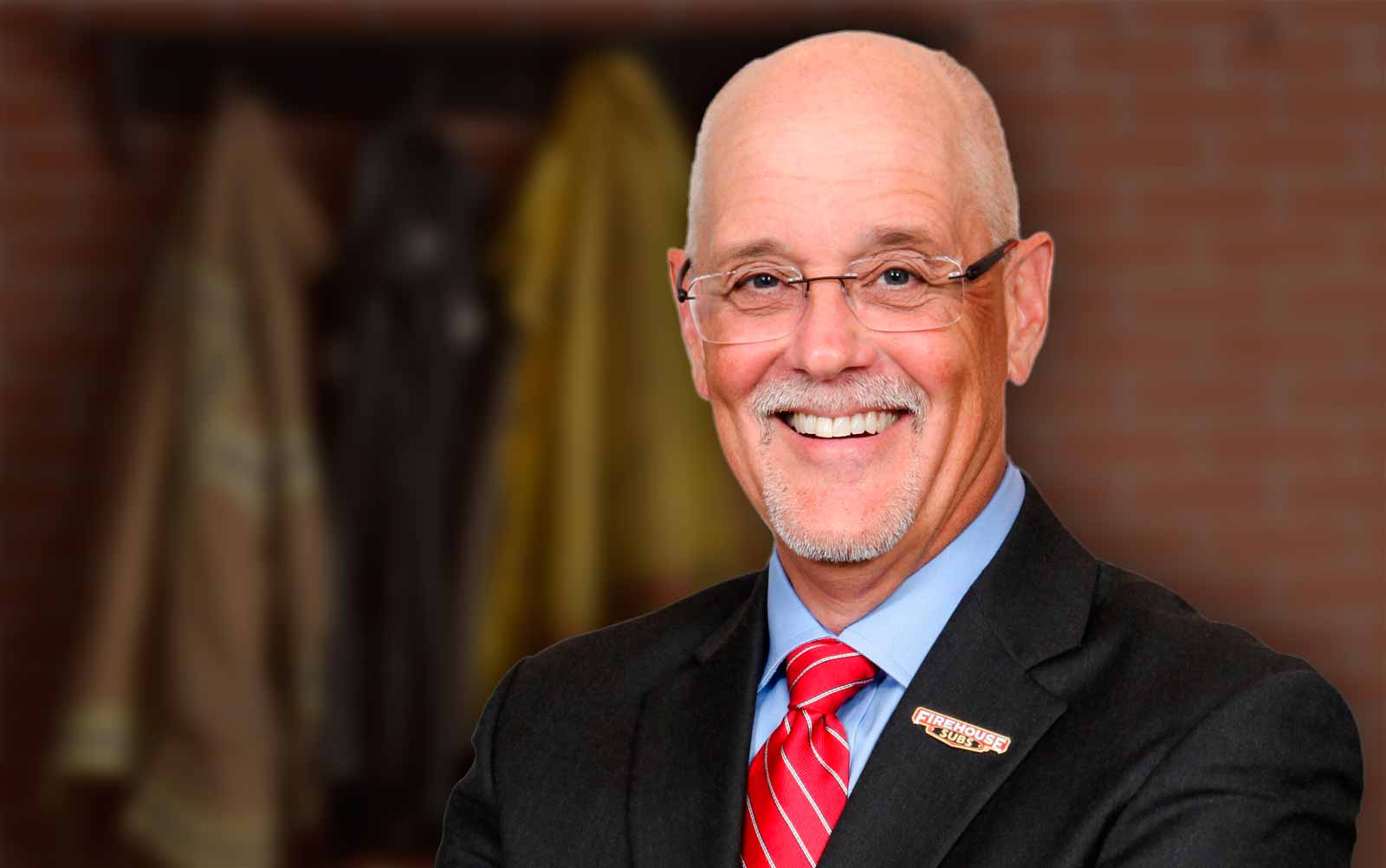

Don Fox is Chief Executive Officer of Firehouse of America, LLC, in which he leads the strategic growth of Firehouse Subs, one of America’s leading fast casual restaurant brands. Under his leadership, the brand has grown to more than 1,190 restaurants in 46 states, Puerto Rico, Canada, and non-traditional locations. Don sits on various boards of influence in the business and non-profit communities, and is a respected speaker, commentator and published author. In 2013, he received the prestigious Silver Plate Award from the International Food Manufacturers Association (IFMA).