Recent data suggests the pace of restaurant pricing has begun to calm. Limited-service menus rose 0.5 percent in December, while full service ticked up 0.1 percent. The numbers were 6.6 and 8.2 percent higher, year-over-year, but a visible crawl compared to 2021’s month-to-month surges. More than anything, though, prices appear to have approached a ceiling in terms of consumer kickback.

In Q4 2022, according to Revenue Management Solutions, traffic across the quick-service industry declined 4.2 percent versus the prior-year period. Net sales were 6.1 percent higher, yet on the shoulders of average price rising 16.2 percent. Average check was also up 10.7 percent. Quantity per transaction decreased 4.8 percent.

In sum, continued price hikes led to more guests trading down and reducing the number of items they purchased. And, more generally, they came to restaurants less often as trips cost more.

To a degree, this was beneficial to quick service. In a survey of 800 U.S. consumers, RMS asked which segment consumers were using “more or much more.” More than 40 percent tapped quick service compared to coffee shops, breakfast spots, and full service. Additionally, when measuring cohorts, the majority of respondents reported at least one weekly drive-thru visit, with Gen Z claiming the heaviest usage (85 percent said they visit at least once a week) and Boomers the least (69 percent).

Higher-income consumers proved more likely to visit a drive-thru (85 percent) than average and lower-income counterparts. The “high rollers” were also likelier to dine in (92 percent) and order takeout (83 percent) and delivery (73 percent) at least once a week.

Some other observations:

Eighty-one percent of households with children noted at least one weekly delivery order, compared to just 48 percent with no children. Urban dwellers were likelier to order delivery versus suburban and rural dwellers.

Gen Z and millennials reported heavier restaurant users across all channels. RMS observed the most significant age difference in the delivery channel. Just 30 percent of Boomers claimed a weekly delivery order, compared to 74 percent of Gen Z, 78 percent of millennials, and 64 percent of Gen X.

By the figures, drive-thru year-over-year traffic was down 12.2 percent in Q4. Like recent quarters, this wasn’t an alarming spin as much as a stabilization. The category held across 2022. Simply, it’s higher than it was in 2019, but not where it was during 2021 and 2020 when other channels evaporated.

Dine-in traffic, for instance, rose 31.1 percent, year-over-year, in the period. But it has trended downward through recent months. Takeout traffic was up 22.1 percent and delivery traffic 15.9 percent above 2021.

Into the Chipotle case

Chipotle’s journey with price stretches back. In April and November of 2017, the brand took a 5–7 percent hike in select markets—a turn that made national news. The lift extended to the remaining 45 percent of Chipotle’s system soon after the 2018 New Year. At the time, the decision was meaningful for a couple of reasons. Firstly, it marked Chipotle’s first price change since mid-2014—before its E. coli crisis cratered sales. But the second fits snugger into today’s view: Chipotle, historically, was exceptionally delicate with value.

Even after the price climb, according to BTIG data, Chipotle’s national Mexican competitors were priced a sizable 6.6 percent higher on popular entrée items. QDOBA was 10.1 percent; Moe’s about 3.1 percent. So you could still argue the chain was underpriced versus the field, paving the way for potential margin expansion, assuming traffic proved resistant to higher prices.

In the years to come, as results would pan out, Chipotle was able to weather this increase without much of a traffic dent, if any.

Naturally, all prior parameters and cadence was derailed by 2021’s 40-year inflation highs. The cost of labor and supply drove restaurant pricing more than opportunity did. It was one of those dynamics where guests were (generally) accepting because their whole lives got more expensive. Even if they cut visits somewhat, they weren’t pulling the occasion out of their habits altogether. One culprit—the fact food away from home was 8.3 higher in December and food at home 11.8 percent. Again, everything cost more.

However, are customers reaching their price limit at Chipotle? The brand’s menu pricing increased from 8.5 percent in Q4 2021 to 13 percent in Q3 2022. In early October, Chipotle took a price lift in about 700 locations to address pockets of “outsized wage inflation” (the brand upped wages $1–$3 more than the country average to compete for talent). Menu prices in those stores hiked between 2–3 percent. All told, the pricing line moved from 13 percent to closer to 14.5 percent, approaching 15 percent, before dropping down to 11 percent in Q1 of 2023.

In July, Chipotle’s pricing ran 20 percent higher than year-end 2020—about 4–5 times above normal.

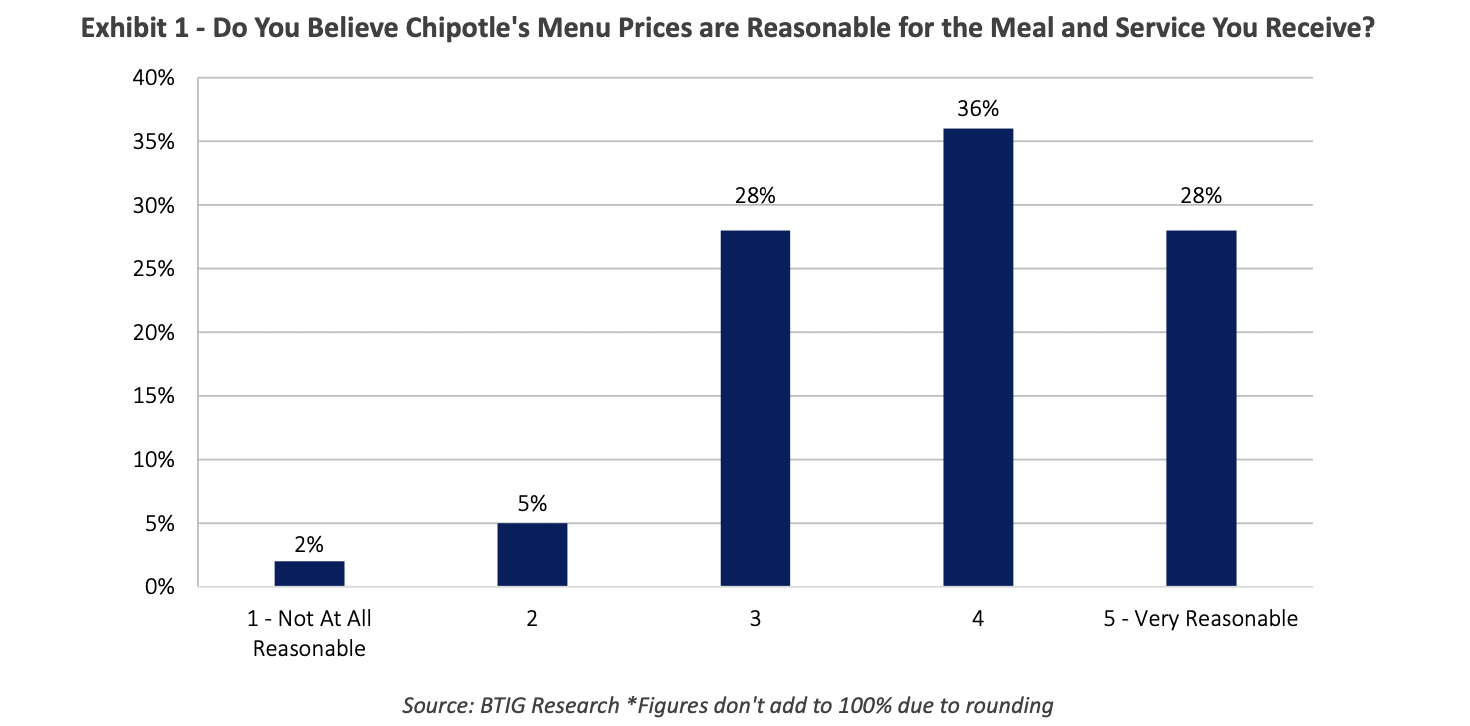

BTIG surveyed more than 1,000 Chipotle customers to gauge if they feel the fast casual has raised prices too much since this period ignited. Seven percent said Chipotle’s prices have become unreasonable, with 2 percent giving Chipotle the lowest value score, and 5 percent the second-lowest score. Digging deeper, about a third of guests who handed Chipotle the lowest value score earned $25,000 per year or less. BTIG also discovered roughly half of the customers who gave Chipotle the second-lowest value score earned $60,00 per year or less. “In our view, these customers are feeling the pinch of inflation in their daily lives, regardless of Chipotle’s specific price hikes, and were likely to reduce frequency anyway,” BTIG analyst Peter Saleh said.

Furthermore, those guests who rated Chipotle low on value (a 1 or 2) tended to be less frequent users anyway, with the majority visiting Chipotle every couple of months or a few times per year.

Of the respondents who rated Chipotle “very reasonable” on value, about half reported income of $75,000 or more per year (the brand’s core customers, typically speaking) and tended to be more frequent diners overall. In fact, BTIG found that roughly 45 percent of consumers earning $75,000 or more visited Chipotle a few times per month or more. AKA, heavy users.

What does this boil down to? Saleh believes Chipotle’s recent price hikes likely out-priced some lower-income, less frequent guests, but had little impact on the chain’s typical, most loyal consumer.

This line aligns with what the brand shared on recent quarterly recaps. Also, the notion Chipotle feels, price hikes layered in, its value still surfaces. In Q3, announced in October, Chipotle’s same-store sales rose 7.6 percent, year-over-year, as total revenue bumped 13.7 percent to $2.2 billion. To illustrate the dynamic: Chipotle’s 7.6 percent result comprised of 13 percent of price, negative mix of 4.4 percent, and a 1 percent decline in traffic.

Niccol said trends by income level widened as pricing persisted, with the lower-income consumer visiting less often (to Saleh’s observation). Yet given the landscape, namely grocery prices, Chipotle also reported trade-down of higher-income guests into its business.

And it comes back to perspective. Chipotle’s average chicken bowl, or burrito, which makes up roughly half of its U.S. orders, remained below $9 in restaurants. “Whether you look at it on a relative basis to what competitive pricing looks like or you look at it to alternatives, like with the grocery store; whether you look at it how new units are opening and how we’re performing on that front … we continue to demonstrate in all areas that the Chipotle brand is strong, and we continue to have a really strong value proposition,” Niccol said.

This wasn’t merely lip service. Chipotle, even after 10.5 percent greater pricing in Q1, was 10.7 and 9.2 percent cheaper than QDOBA and Moe’s, respectively, per BTIG pricing surveys. Chipotle was also 5 percent less than Baja Fresh.

Since 2018, per Saleh, QDOBA and Moe’s raised prices on chicken entrées by 21.5 and 28.1 percent. Chipotle, roughly 19 percent. Niccol agreed with the overall view: “When you look at the fast-casual competitors, we’re anywhere from 10 to 20, 30 percent less than what you see on their menu,” he said in October. “So you’ve seen, unfortunately, in all this inflationary environment, everybody is taking price. Our costs, I think, are up over 20 percent over the last two years. Not surprising, other people are experiencing something similar, and they’ve taken pricing accordingly.”

And he echoed the behavior point, too. “We’re not seeing people all of a sudden not buying guacamole or changing what they typically add to their order or switching between proteins,” Niccol said. Essentially, lower-income users might be showing up less often, but core Chipotle users are ordering just as they always have.

Despite softening guest counts—an industry wide reality, as RMS showed—Chipotle posted two- and three-year stacked traffic figures of 7.5 and 9 percent, in Q3, respectively. So the fast casual gained share amid a higher-priced market. “This is a tremendous value when you consider the quality of our food, including our food with integrity standards, the fresh preparation utilizing classic cooking techniques, the customization, generous portions and of course, the convenience and speed,” Niccol said.

The generalized answer to the question, has Chipotle raised menu prices too much, Saleh said, is, in his view, “yes.” Some consumers, he noted, are likely to reduce or eliminate their visits given the above-average price hikes. However, the trade-off of modestly lower transactions but significantly higher margins is something investors should readily accept.

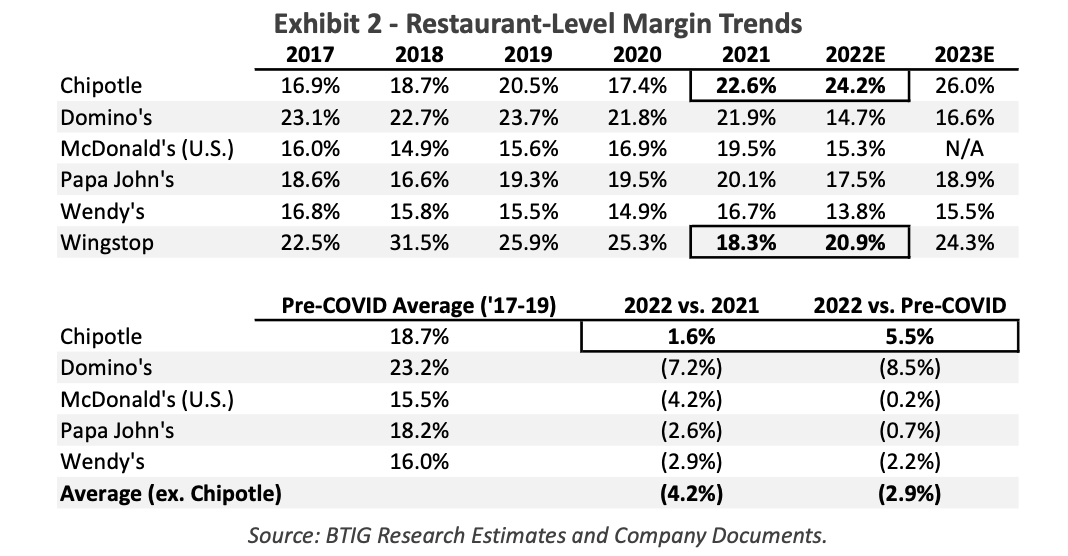

So the true answer has its nuances. But Chipotle has reason to be optimistic beyond the price line. Despite double-digit commodity and labor inflation over the past year, Saleh expects Chipotle’s Q4 2022 restaurant-level margin to increase about 500 basis points from last year. The improvement will

largely owe to low-teens price increases taken in the past year. He estimates menu pricing to remain in the mid-single-digit range for the full year, with higher levels in the first versus second half, assuming no incremental pricing actions. “While we don’t expect labor costs to moderate in 2023, we believe commodities could be flat to down this year, producing another year of margin expansion from the mid-single-digit pricing and moderating commodity costs.”

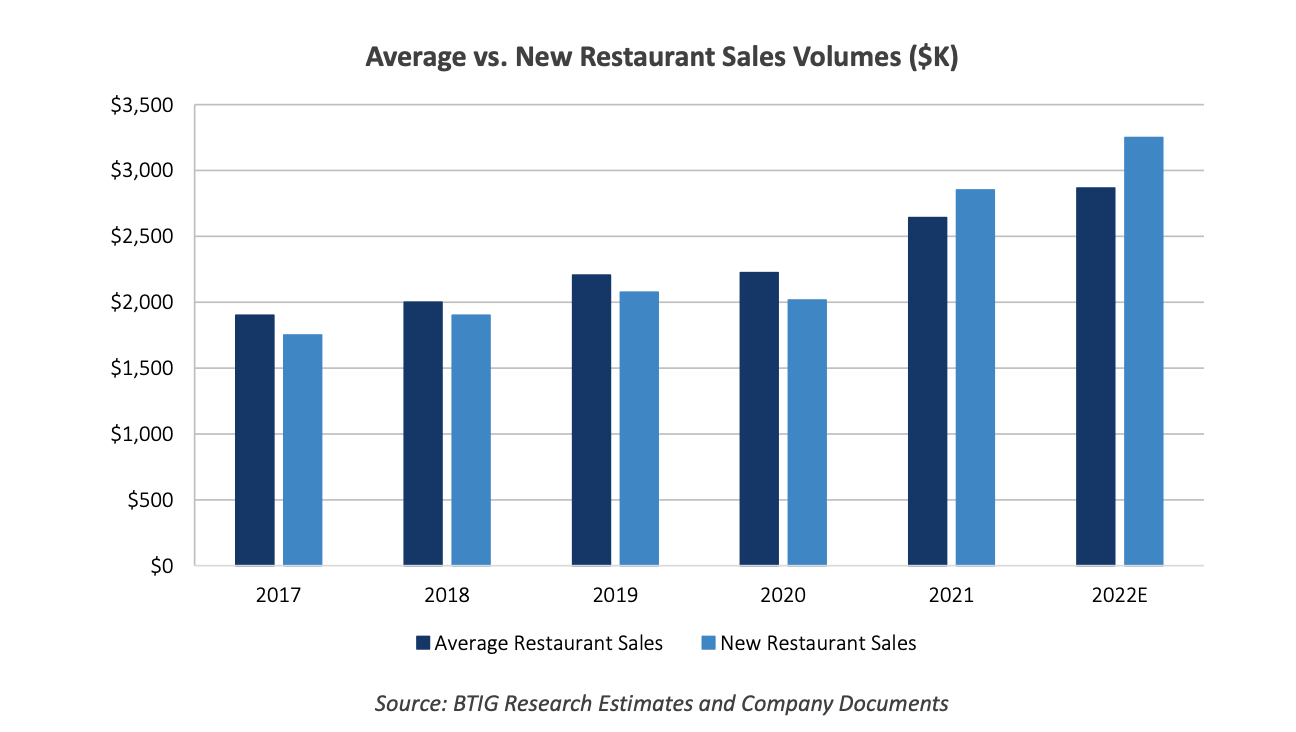

There’s another lever at hand as well. Saleh predicted Chipotle’s new units are generating higher sales volume than the system average due to the high mix of Chipotlane units (about 80 percent of recent growth). He charts these units, equipped with an order-ahead pickup lane, are appreciating low- to mid-$3 million in annual sales volume, “several hundred thousand ahead of traditional units,” propelling new builds into the low $3 million range compared to the system average of about $2.8 million last year. This is only going to gain. Chipotlanes represented just 40 percent of growth in 2019 and 63 percent in 2020. That 80 percent figure isn’t subsiding.

Chipotle opened 43 new restaurants in Q3, including 38 with a “Chipotlane.” It’s on track to open 235–250 units this fiscal calendar, including 10–15 relocations to add a Chipotlane. That would add somewhere between 188 and 215 Chipotlanes, give or take. The brand opened its 500th in November.

Chipotle’s restaurant-level margin has expanded, too, which bucks another industry line (READ MORE ABOUT THAT HERE). The decline averaged 420 basis points for the relevant companies in BTIG’s coverage universe. Only Chipotle and Wingstop posted restaurant-level margin expansion (the latter due to wing prices).

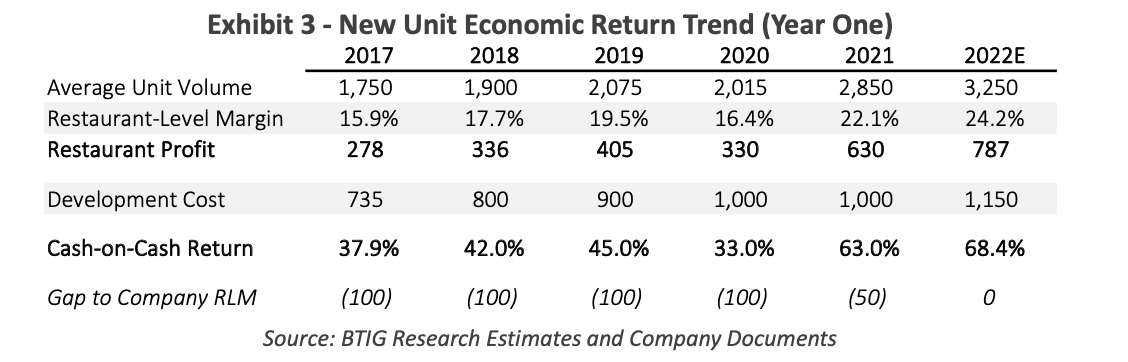

The combination of above-average sales volumes and restaurant margin expansion “translates to improving cash-on-cash returns for new units in recent years, despite the escalation in development costs,” Saleh said.

“This is in sharp contrast to most other restaurant concepts, as margin contraction and higher build costs have reduced new units returns and dampened enthusiasm for unit growth,” he added.

With restaurant margins at or above the company average in their first year, Saleh estimated cash-on-cash returns for new units have increased in recent years to close to 70 percent.

And lastly, has Chipotle created a category of one in a crowded arena? The brand paced $8.7 billion in sales last year, nearly double from five years ago. Its two closest competitors remain below $1 billion.