Follow this zen logic, Grasshopper: Pizza Hut’s growth will come not from pizza, but from wings and pasta. But the challenge of the moment, execs cryptically point out, is reviving pizza sales. If that doesn’t lead to head scratching, consider that officials want to improve the perceived value of pies as a means of boosting wing and pasta sales. So they added a permanent discount, the $10 Any Pizza deal. Huh?

There’s less confusion at No. 2 Domino’s where the company did the unthinkable: It updated its signature recipe. The bold move paid off, and then some. Q1 same-store sales in 2010 were up a staggering 14.3 percent over 2009.

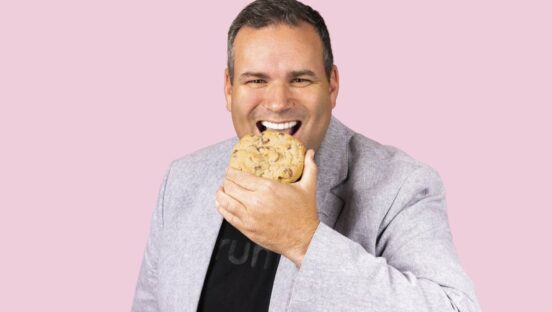

Domino’s isn’t the only pizza chain that focused on marketing in 2009, however, the Papa John’s squad was buzzing like a college dorm on the night before finals, brainstorming promotion after promotion. And these weren’t your usual two-fers. A whole ad campaign was built on John Schnatter’s old wheels. But the hoopla didn’t spare the brand from the pizza market’s price slashing. Among its head-turners was an offer of two pies for $17—undercutting Pizza Hut’s $10-a-pie deal.

| Segment Rank |

2010 QSR 50 Rank |

Chain | U.S. Systemwide Sales ’09 (millions) |

U.S. Average Annual Sales Per Unit ’09 (Thousands) |

Franchised/ Licensed Units ’09 |

Company- Owned Units ’09 |

Total Units ’09 |

| Pizza/Pasta | |||||||

| 1 | 8 | Pizza Hut2 | $5,000.0 | $786.0 | 6,917 | 649 | 7,566 |

| 2 | 14 | Domino’s* | $3,030.8 | $598.0 | 4,456 | 481 | 4,937 |

| 3 | 17 | Papa John’s | $2,057.0 | $755.0 | 2,193 | 588 | 2,781 |

| 4 | 25 | Little Caesars* | $1,130.0 | $450.0 | 2,000 | 600 | 2,600 |

| 5 | 33 | Papa Murphy’s | $630.0 | $560.2 | 1,136 | 35 | 1,171 |

| 6 | 38 | CiCi’s Pizza | $563.6 | $909.0 | 609 | 16 | 625 |

| 7 | 41 | Sbarro* | $517.1 | $645.0 | 300 | 485 | 785 |

| 8 | 62 | Fazoli’s4 | $242.3 | $900.0 | 115 | 127 | 242 |

| 9 | 70 | Marco’s Pizza3 | $102.7 | $571.4 | 199 | 0 | 199 |