The value wars have returned.

For an industry built around cheap eats and value meals, competition around low prices had become relatively quiet in the years immediately following the Great Recession, with major quick serves shifting their strategies to talk more about quality.

But what’s old has a way of becoming new again, and chains across the U.S. are returning to their value-driven ways. Just look at the last six months or so: McDonald’s unveiled its McPick 2 for $2 menu. Wendy’s debuted its 4 for $4 Meal, while Carl’s Jr. and Hardee’s launched their own $4 meal and Burger King one-upped them with a 5 for $4 promotion. Subway, meanwhile, listed all footlongs at $6, and even Pizza Hut got in the value game with its $5 Flavor Menu.

The fact is, for as much as consumers demand quality from their favorite restaurants, many brands still find that the low price point is what brings customers in the door.

Take Checkers/Rally’s as an example. The typical customer who visits the restaurant chains frequents a quick-serve establishment roughly 20 times a month.

“They’re visiting a [quick serve] almost every single day. So to stand out and compete and win, you have to offer great value,” says chief development officer and SVP Jennifer Durham. “And value is relative, because it’s about what you get for the money. It’s not just the lowest price.”

The 820-unit Checkers/Rally’s has centered much of its research and development efforts on creating high-flavor, low-cost menu items, as Durham says value is foundational to the drive-thru chain. That’s evidenced in the brand’s “Value at Every Price” menu. Rolled out in late 2015, it offers items at $1 and $2 price points, as well as “2 for $3,” “2 for $4,” and “2 for $5” options.

“There are times when our guests literally only have $1. They haven’t eaten anything, and they need something,” Durham says. “They’re taking change from their center console and scraping together what they can.”

She says customers are drawn to rock-bottom prices, but they want something tasty—not just cheap. She pointed to the concept’s $1.99 Montreal Steak Burger, a burger with shaved steak, Swiss cheese, crispy onions, and McCormick’s Grill Mates Montreal Steak Seasoning. Getting a quality burger like that at a lower price, she says, makes customers feel good about their transaction and draws them in to the sale.

Durham says rising food and labor costs industry-wide seem to be putting the traditional dollar menu on its last leg. “I think $2 may be the next $1,” she says. “As prices rise, I think $2 has become that sexy price point.”

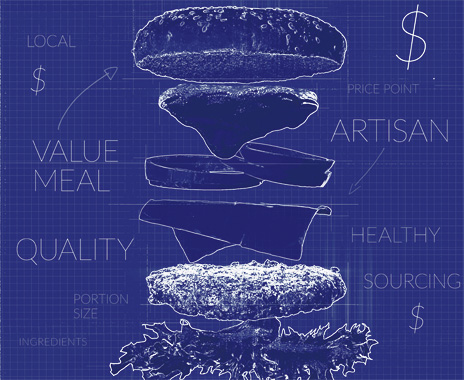

As restaurants face growing pressure from both labor and food costs, operators are increasingly competing with value messaging that goes beyond the dollar amount, changing the traditional definition of value. Some brands are reshaping the definition to be more inclusive of product quality, portions, and customization. The changing nature of value is no doubt a side effect of the dominance of fast-casual players, which highlight ingredient sourcing and quality but rarely include low prices as a central part of the value proposition.

“The contrast with fast casual is noticeable. There are no value menus, and more important, no value meals in fast casual—no discounts or bundling,” says Leslie Kerr, president and founder of Intellaprice, a pricing advisory firm for the restaurant industry. “And what’s more, there are no apologies. For them, ‘value’ means good food. There’s no willingness to discount items 5 and 10 percent because a guest is buying a meal. If a guest is going to buy a sandwich and a soda, so be it. That is not the basis on which they compete, and that’s been a deliberate strategy. To me that’s their message: that we want to compete on the quality of these ingredients.”

For years, traditional fast-food chains trained customers to focus on their dollar menus, Kerr says. Now, with inflationary price pressures, many are trying to downplay the importance of the $1 price point while also better competing with fast-casual offerings designed around quality.

“The dollar menu may not have met its demise, but it’s definitely on its decline,” she says. “The shift is understandable, and [quick serves] are seeking to innovate so they can dissociate from the $1 price point.”

Kerr points to some higher-priced menu items at McDonald’s as an example of new ways that quick serves are rethinking value. Her company’s research found that the brand’s Artisan Grilled Chicken Sandwich went for as much as $8.49 in a value meal in Boston. She says McDonald’s strategically used the word artisan to take the customer’s focus away from the price and put it more on the product quality.

That’s not to say that quick serves have abandoned traditional value menus. In the fall, McDonald’s rolled out its McPick 2 menu, which allows customers to choose two items for $2. Earlier this year, Pizza Hut rolled out the $5 Flavor Menu, a selection of pizzas, pastas, sides, and desserts for $5 each when customers purchase two or more. And Wendy’s launched the 4 for $4 promotion late last year, creating a new price point between the single-item value menu and full combo meal deals. For $4, diners receive a Jr. Bacon Cheeseburger, four chicken nuggets, a small fry, and a small drink.

Frank Vamos, director of brand communications for Wendy’s, says single value menu items are still important, but bundled deals are growing in popularity. And so far, the company has been encouraged by the “4 for $4” promotion’s ability to drive traffic.

“It’s a program that seems to have staying power,” he says in an email, “and the consumer reactions that we’ve seen to it have been very strong, both online via social media and with purchase intent.”

Vamos says Wendy’s customers will always love a deal, though they don’t necessarily have to choose between low prices and high-quality food. “Our customers have shown us that they depend on value deals. We’re listening to our customers because value is an important part of their meal occasions,” he says.

Rick Johnson, owner and CEO of Lenny’s Sub Shop, says his 110-unit chain has more wiggle room on prices because customers largely come to the Memphis-based concept for its convenience and quality.

“Our guests are not price-first shoppers. If they were price-first shoppers, they wouldn’t eat with us now. I don’t want to say they aren’t interested in value; they really are,” he says. “It isn’t that we aren’t focused on delivering a great value. It’s just that price isn’t the main component of that value. It is a piece, but we know it’s not the main reason people shop with us. But we don’t want it to be an impediment—we can’t charge anything we like.”

[pagebreak]

Executives have tweaked Lenny’s menu and improved ingredient quality since Johnson bought the chain about three years ago, he says. The brand rolled out a new 5-inch sub meant to appeal as a lighter and more value-minded option. And the company has put more emphasis on its 15-inch Monster sub.

“There are people who find value in that size. It’s a quantity value,” Johnson says. “Lots of people say, ‘Hey that’s a great offer. For $10.99, my wife and I will split that thing for dinner or for lunch.’”

Johnson says he’s more interested in the company’s total experience than the bottom line when comparing Lenny’s to the competition. And with three sandwich sizes ranging from $4.45 to $11.49, Johnson says, the sandwich chain is well positioned to appeal to a variety of consumers who hold varying views on what exactly value is.

“That’s a pretty big range. Somebody has an option to pick a menu item, a size, and a price that fits them,” he says. “They find ways to get the value they need out of our offer.”

Kurt Schnaubelt, managing director at global consulting firm AlixPartners and co-head of the company’s restaurant and foodservice practice, says value is still a primary consideration among many customers. But in its surveys, AlixPartners has found that consumers don’t necessarily think about value in terms of low prices.

“Value matters to the consumer. It always has and it probably always will,” he says. “And when you say value, the No. 1 thing the customer mentions is quality.” Next to overall quality, consumers point to the quality of ingredients and portions as being key to value. Schnaubelt says quick-service operators should focus on execution and food quality first, and only squeeze their margins in other areas when necessary.

While fast-food concepts advertise heavily on price, fast-casual concepts are largely able to sidestep the price conversation, allowing their product quality to stand on its own. And lower prices in that segment might actually deflate consumers’ perception of value.

“Point one is that fast-casual players have got to be exceedingly careful to not underprice their value proposition,” Schnaubelt says. “Essentially, the fast-casual players have come out and said we’re a better quality product than you can get at some of the fast-food players. … If they drop that price down, it starts to dilute that value proposition.”

Some traditional fast-food chains may be able to replicate some of fast casual’s success by offering more premium products, Schnaubelt says, but it will have to be at more premium prices. He says that a traditional quick-serve brand could face the risk of being undercut on price by another fast-food brand.

“You have some very, very large and powerful companies in [quick service],” he says. “And if they choose to take a strategic approach on their menu to offer a huge value and higher-priced items that get them into that $8 per-person average, if that’s successful, they’re going to pose a very significant threat to fast casual. We haven’t seen that yet. We’ve seen some dabbling from the quick-service guys.”

Lately, a sort of in-between zone has sprung up between quick service and fast casual when it comes to value. Some operators have pledged to offer fast-casual quality at a more traditional quick-service setting and price point. For example, Loco’l, spearheaded by celebrity chefs Daniel Patterson and Roy Choi, opened this year in Los Angeles, serving high-quality meals with $5-and-less prices. Patterson and Choi hope to replicate the model across the country.

Meanwhile, the three-unit Bryn & Dane’s in Philadelphia offers healthy food at prices closer to a fast-casual concept, but with the convenience and speed of its drive thru, is more reminiscent of a traditional fast-food joint.

The concept, which plans to double its footprint in 2016, is centered on offering full meals—a wrap or salad, plus a side and drink—for about $11, says founder Bryn Davis. By leveraging quality with its offering of local and healthy food, Davis says, Bryn & Dane’s is able to pull off higher-than-average prices and still communicate value.

“There’s no math problem. I don’t want to be more expensive than our competitors, but naturally we are. We can get away with a $10.99 meal, but our competitors are nowhere near that,” Davis says. “I would feel uncomfortable selling anything for under $1, because I know it would be so low in quality.”

While Bryn & Dane’s can’t match McDonald’s or Burger King on price, Davis says it can compete with convenience. He says the brand competes with fast casuals for dollars and competes with fast food on convenience.

“It’s a huge convenience factor. That’s the most important thing we think about: how can we make it as easy as possible to be healthy,” he says. “It’s very convenient if you have those ideals. We’ve changed a lot of things about ourselves. I’ve always wanted to be healthy fast food, but have items that are more traditionally aligned with traditional fast food.”

Davis says customers are willing to pay more when pricing is transparent. And they like having control over how much they pay. So customers of Bryn & Davis can choose to pay slightly more for certain proteins like a vegan meat replacement or a black bean burger.

“As long as we communicate that we put the leg work in, people are OK spending slightly more money,” he says. “And if they don’t want to, especially with our proteins and such, they can choose not to put it on there. If they don’t want to spend that extra money, they don’t have to.”