It continues to be hot times for restaurants across the U.S. According to the National Restaurant Association’s (NRA) 2015 Industry Forecast, the restaurant industry is booming; industry sales are expected to hit a record high. Restaurant operators are expressing ongoing optimism for their domestic and overseas prospects, and, to stay ahead of the competition, these businesses need to keep an eye out for opportunities to invest in their continued growth. Here are the five key drivers set to impact growth in the restaurant industry this year:

IPOs and private equity involvement

The year 2014 rounded out with a wave of IPO announcements. With an increase in industry IPOs and restaurants continuing to consolidate for long-term success, restaurant operators are leveraging investment banking strategies for business expansion opportunities, both domestically and internationally. We can expect continued activity throughout the year, according to several 2015 industry forecasts, and for companies wishing to stay ahead of the competition, these operators should be focused on putting a strategic growth plan in place and thoughtful remodeling to remain competitive in the marketplace.

Investment in the restaurant space from private equity firms continues to explode, with investors seeking returns from brands with significant upside from growth opportunities, both organic and via acquisition.

Global food cravings

U.S. franchisors have an increasing desire to expand their brand in global markets to help initiate more growth opportunities, and foreign markets are not fighting it. In fact, IBISWorld’s Global Fast Food Restaurants global market research report points to rising international expansion of U.S.-based fast-food chains as the primary driver of industry growth. The question is: Are all restaurants taking advantage of this opportunity?

While the big-league quick-service brands, such as McDonald’s and KFC, have experienced success overseas, many similar industry players have yet to see as much success, with international markets accounting for less than 20 percent of revenue, according to L.E.K. Consulting Executive Insights. These businesses need the time and focus necessary to attract the right local partners in foreign markets, keeping in mind the various regulations, taxes, and compliances, as well as having the right local resources in place to monitor the growth of each new location.

Capital expenditures

The restaurant sector is on an upswing, with restaurants experiencing strong same-store sales and increased traffic with a positive outlook. That’s leading restaurant operators to prepare for an increase in capital expenditures. According to data from the NRA’s Restaurant Performance Index, 53 percent of operators plan to spend money on equipment, expansion, or remodeling in the next six months.

In fact, the Index was at 102.2 in March, the 25th consecutive month it stayed above 100, demonstrating a continued positive outlook for the sector. Looking ahead, companies will continue to seek opportunities to expand in order to accommodate an increased demand and serve additional markets.

E-restaurants

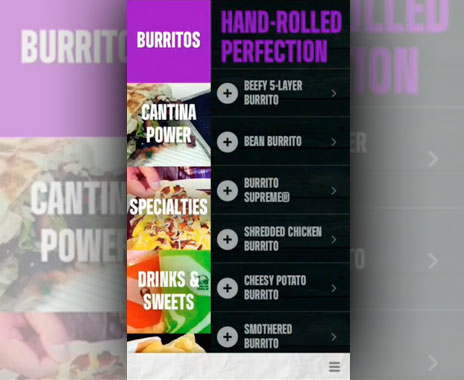

In the midst of the evolving digital revolution, the restaurant sector can’t escape customers’ desires for a more seamless experience. The NRA’s Industry Forecast found that about a quarter of consumers see technology as being an important feature in their choice of restaurant. Taco Bell, for instance, has invested heavily in its new mobile ordering app, which yields a 20 percent higher bill from customers than traditional in-person orders.

Restaurants investing in technology options, such as apps for faster delivery service or the use of digital tabletop menus to place quicker orders, will attract more business while streamlining their businesses due to more seamless processes.

Some “choppy” conditions

In addition to increased growth opportunities, restaurant operators will experience increased costs as food prices and labor competition are expected to rise this year. The average price of various foods have increased nearly 25 percent in the past five years and are expected to continuously affect restaurants’ bottom lines. According to our 2015 CFO Outlook, 52 percent of companies will be hiring additional full-time workers. Companies are offering benefits including healthcare insurance, retirement funding, bonuses, wellness programs, education funding, and flexible hours to attract and retain employees.

Despite these expense increases, restaurant operators are in a great position to invest in future growth in 2015. Whether it’s in the form of new equipment or bringing their food and service overseas, this year is proving to have a strong appetite for growth in the restaurant sector, and by keeping the above indicators in mind, companies will stay ahead of the competition.