While I typically tie my monthly column into QSR’s concurrent cover story, I’m making an exception this July. Please don’t interpret this diversion as a dismissal of the importance of sustainability. Rather, it is a reflection of the shifting economic tide we are wading through, and its contemporary impact on our lives and businesses.

For many reading this column, today’s economic conditions are unlike anything you’ve experienced before. And that is for good reason. As I write, inflation is at a 40-year high. The number reported for May was 8.6 percent. The last time we saw a rate that high was December of 1981, when year-over-year inflation was 8.9 percent. It is noteworthy that inflation was falling at that point; the high point of that turbulent cycle occurred in March of 1980, when year-over-year inflation reached a staggering 14.8 percent. If you are searching for a rate of inflation higher than that, you need to retreat all the way back to the 17.6 percent of June 1947 (a decline from the 19.7 percent recorded in March of that same year). To find anything worse than that, we need to go back over 100 years to June of 1920 when inflation peaked at 23.7 percent.

Given the above stats, we find ourselves in the midst of the fourth highest rate of inflation in the modern history of the U.S. That’s the bad news. The good news is that, at least up to this point, it is not the worst. I’m compelled to examine the details of these past periods of inflation in search of insights that might help us navigate through the current challenges. However, each of these inflationary periods have distinct historical foundations, and the relevance of each to today’s events are less than concrete.

The post-war inflationary periods of the 1920s and 1940s are definitely a different breed than what we face today. Double-digit inflation related to the Great War actually began during the war, hitting 10.8 percent in October of 1916. Inflation remained above 10 percent until October of 1920 … a full four-year stretch of double-digit inflation. The compounding effect was staggering. The post WWII double-digit spike began in August 1946 and lasted through November 1947. The war-time influence on these events, combined with the fact that the restaurant industry was so different in those eras, makes comparison to these periods of lesser value than what we might glean from other patches of inflation.

When reflecting back on the historical record, the closest example to today is arguably found in 1973. In May of that year, inflation hit 5.5 percent. Seven months later, it was 8.7 percent. Similarly (but hopefully not ominously), we hit 5.4 percent in June of 2021, and it took 11 months to climb to the current 8.6 percent. The ramp up period is similar, but hopefully, the road ahead deviates from what we experienced through the balance of 1973 and well into 1975. During that cycle, inflation peaked at 12.3 percent in December 1974, and did not drop below 10 percent until May of 1975.

Is there similarity between these two periods? You bet. The price of oil skyrocketed back then. The underlying causes for the oil/gas crisis of 1973–74 are eerily reminiscent of today. I’ll refrain from going into a lesson on the geo-politics of the time, but (according to a report from the Federal Reserve) the net effect took a barrel of oil from $2.90 in October of 1973 to $11.65 by January 1974: a nearly 4X increase. Sound familiar? The role of energy in the current economic saga is likely the cornerstone for inflation and will drive much of what is to come.

The restaurant industry currently faces a number of challenges, several of which are either direct results of the pandemic, or highly influenced by it. But I dare say that the current rate of inflation and its dual impact on the consumer wallet and the restaurant operator’s input costs is for many operators at the top of the list of challenges. Staffing challenges are perhaps the lone contender for the top spot.

But wait. It gets better. Hand in hand with inflation is the likelihood of a recession. Dealing with a recession is a more relatable experience, given how many of us had to navigate through the recession of 2008–09. I imagine that many leaders in our industry are dusting off their Great Recession handbooks. I know I am.

It was July 2008 when I wrote a trade opinion piece that emphasized “staying the course.” As I read it back to myself today, I swear that, once a recession is formally announced (that is, if we aren’t in one already, as some pundits claim) I could simply change the date to July of 2022 and have it republished.

The primary focus of that long-ago article was that if an operator had the ability to stay the course with their primary brand strengths, they were in an enviable position. Fourteen years later, several quotes from the article continue to resonate:

When applying short-term tactics to sales and traffic declines, “the medicine may be what actually kills the patient.”

“Solutions being applied across the industry range from short-term promotions to long-term repositioning of brands. The challenge resides in knowing just how long the current economic climate will last.”

“If consumer confidence remains this low for another year or more, and there is no abatement in gas prices, a successful limited-time promotion may be nothing more than a Band-Aid.”

When inflation of the sort we have today is coupled with recession, staying the course can be a more daunting task. During the Great Recession, inflation never rose above 5.6 percent (July 2008) and we actually had deflation to a point as low as negative 2.1 percent (July 2009). The pressure we see today relative to the cost of doing business is unlike anything we saw in 2008–09.

Some of the learnings from that time will help us today. Others, not so much. The brands that navigate most successfully through today’s economic challenges may well be the ones that figure out what pages of the playbook to keep, and which ones to discard. One page that some may double-down on might be found within that 2008 opinion piece:

“As we deal with some of the harsh realities of today’s economy, we must constantly remind ourselves that the vast majority of customers still cross the threshold expecting that they will get their money’s worth. That means we must provide them with the product quality and portions they have come to expect, at a fair price, served in a clean, inviting environment by people who deeply appreciate their business and demonstrate it through their actions.”

Some things never change.

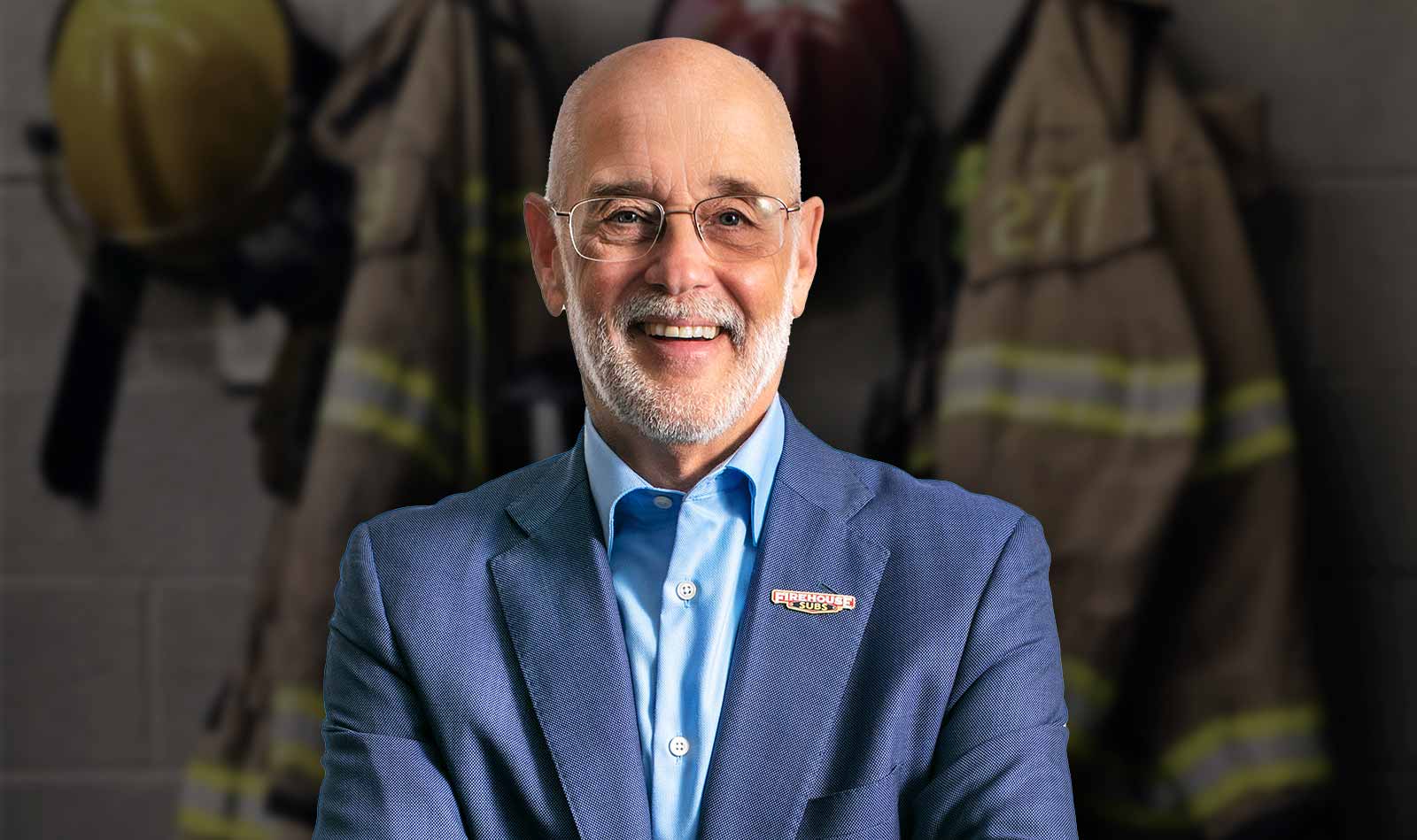

Don Fox is Chief Executive Officer of Firehouse Subs, in which he leads the strategic growth of Firehouse Subs, one of the world’s leading restaurant brands. Under his leadership, the brand has grown to more than 1,200 restaurants in 45 states, Puerto Rico, Canada, and non-traditional locations. Don sits on various boards of influence in the business and non-profit communities, and is a respected speaker, commentator and published author. He was recognized by Nation’s Restaurant News as 2011’s Operator of the Year. In 2013, he received the prestigious Silver Plate Award from the International Food Manufacturers Association (IFMA).