Hot on the heels of the QSR 50, McAlister’s Deli is a growing soup, salad, and sandwich chain with a 22-state footprint that ranked at the top of QSR’s Contenders list (brands 51–65). Positioning itself to most likely make the jump to the big list next year, McAlister’s implemented a number of changes over the last 12 months that turned around negative comps and pushed the company toward more aggressive franchising.

In one of his last interviews as McAlister’s CEO, Phil Friedman said it’s still early for that segment’s behemoth, Panera Bread, to be worried about competition, buthe feels good about the fact that multiple McAlister’s markets that once struggled are finally beginning to bounce back.

Some of the biggest changes are McAlister’s in fiscal 2009 were the addition of paninis and the effort to enhance the experience. The brand went from disposable to realplateware “so that the presentation was a little more authentic,” Friedman said.The company also launchedtossed salads, a menu technique that was used only for the Caesar salad originally.

Tapping into the personalization wave, McAlister’s launched its “Choose Any 2” menu program last year, a systemwide move that jolted sales. The Mississippi-based chain has now paired that program with an iPhone app, allowing customers to create a personalized entrée from more than 930 possible combinations and be directed to the closest McAlister’s location. A new prototype restaurant is making its debut, just as the brand prepares to bring its famous Sweet Tea into new markets.

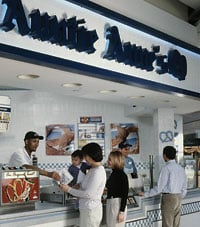

New menu additions, led by Lemonade Mixers and the Pepperoni Pretzel, sparked a record-setting year for Auntie Anne’s, which enthusiastically capitalized on the snacking trend. As it celebrated the opening of its 1,000th store, the Pennsylvania-based brand also expanded its international presence, adding locations in Mexico, Ireland, and Egypt. Japan’s next, as is an increased focus on college and airport locations and the continued use of social networking and text messaging to connect with customers.

With price and portion size top of mind, Moe’s introduced Junior Burritos in August, which immediately jumpstarted languishing sales and created much-needed positive momentum. With a growing focus on nontraditional locations like its spot in the Las Vegas airport, cobranded units such as those with Carvel and Cinnabon, and an emerging international presence highlighted by a 40-unit franchise agreement in Turkey, Moe’s expects to open 100 new restaurants by the end of 2011.

It’s been a tough go for Fuddruckers, the one-time hamburger darling. Amid double-digit drops in same-store sales, parent company Magic Brands declared Chapter 11 bankruptcy and later sold 62 Fuddruckers locations in April before shuttering 25 corporate-owned stores. Some bright prospects remain, however. Nearly 200 locations, including 135 franchised units, remain open to promote the brand’s newest menu offering: Fudds Exotics, a line of all-natural, free-range, grass- and grain-fed game burgers as well as a wild-caught salmon filet.

While new product introductions, namely the Apple Cinnamon Oatmeal line, allowed Au Bon Pain to steady itself in a challenging 2009 environment, the years ahead claimed the Boston-based brand’s overriding attention. Convinced that more promising economic times loom, Au Bon Pain researched its target demographic and its dining desires, and feedback spurred the still-in-development new concept prototype that will overhaul not only the physical space, but the restaurant’s service and menu as well.

International growth and restaurant openings in the Midwest and Northeast fueled Wingstop to a 20 percent jump in systemwide sales in 2009, which inspired the Texas company to intensify its development efforts under the direction of Roark Capital Group, which acquired Wingstop in April. Sixty stores are expected to open in 2010 alone, a complement to Wingstop’s first-ever interior redesign and its pursuit of a 28th consecutive quarter of positive comparable store sales.

[pagebreak]

When James White assumed the Jamba Inc. presidency in December 2008, he championed a complete metamorphosis, including efforts to rebrand Jamba Juice from a smoothie chain into a healthy, active lifestyle brand. Though 2009 witnessed a strong dip in systemwide sales, energy remained positive. Jamba cut its expenses; opened 25 franchised locations; introduced licensed products, such as at-home smoothie kits; and expanded its menu to include oatmeal, grab-n-go wraps, salads, and sandwiches.

Into its 20th year, Baja Fresh recently targeted growth in two areas: its Baja Fresh Express units in nontraditional environments, such as colleges and airports, and its Baja Fresh “Guest Choice” prototype conversion, which enhances the brand’s service and food preparation. Leadership views the Express locations as the company’s best opportunity to build both brand awareness and restaurant count, evident in the fact that 17 of Baja’s 60 openings in 2010 carry the Express banner.

Amid recessionary pressures, parent company Garden Fresh saw an opportunity to adjust the brands’ strategy in a new economy. Smaller prototypes opened to create “right-sized units,” which allows Garden Fresh to capitalize on real estate opportunities and create optimal market breadth and penetration, while new relationships with Costco and grocery stores supplied multiple sales channels and catering opportunities. Garden Fresh now looks to open up to 12 new locations each year and target the breakfast crowd.

With stagnant sales, Taco John’s looked to improve its restaurants’ operating profit, hosting profit-enhancement programs for operators that increased both cash flow and restaurant operating profit margins by 160 basis points. The coming months will see the debut of a franchisee incentive program aimed at stimulating new growth as well as a smattering of new menu items and the continued roll out of Taco John’s new “My Town, My Taco John’s” advertising campaign.

With a 40 percent sales jump in its remodeled stores, a number of freshly inked multiunit franchise deals, and a growing clientele of females and young adults, Schlotzsky’s new prototype restaurant, complete with vibrant colors, playful slogans, and a new service model, has revitalized a once-sagging brand. Toss in a cobranded partnership with Cinnabon and today’s Schlotzsky’s boasts a restored energy, a more relevant dining experience, and hopes for up to 700 locations by 2015.

After three years of declining guest counts, Fazoli’s witnessed 11 straight months of positive attendance in 2009, generating renewed interest from current and prospective franchisees and reenergizing what some viewed as a tired system. With 21 new menu items in tow alongside a new prototype store, Fazoli’s is testing enhanced service, including the addition of servers as well as traditional dinnerware, to further showcase the brand’s position as fresh, affordable Italian food.

While Firehouse Subs has grown from one single location in 1994 to 370 outlets today, such explosive growth has been responsible and strategic.

Debt-free since 2001, Firehouse Subs’ financial arm loans money to franchisees, a practice that strengthens the overall business. Such reciprocity came back to Firehouse leadership last September when franchisees committed to doubling their marketing investment as corporate unveiled a new advertising campaign—”Our Way Beats Their Way.” Everybody won when sales jumped 8 percent.

For Taco Bueno, fast casual pays. In its remodeled locations outfitted with full-size booths, stone counters, and a salsa bar, volume jumped from $1.2 to $1.9 million as dine-in sales escalated, and the average check increased 10 percent—all without any price changes. Recent renovations into a fast-casual concept at existing outlets in Texas and Oklahoma produced record-setting sales and spurred the brand to introduce premium menu offerings, including a line of gourmet quesadillas.

A&W, one of America’s most iconic names, endured a powerful uppercut from the recession as systemwide sales dropped $100 million in 2009. Ironically, it is the economic recession that has given birth to the brand’s latest evolution: nostalgia. In 2009, the Yum! Brands–owned chain began introducing its “Three D” concept, highlighted by the hearty resurrection of drive-in service. The future wasn’t totally forgotten, however, since A&W is experimenting with breakfast offerings.