It’s Chipotle’s first national commercial, a 2-minute spot that aired during the 2012 Grammy Awards. The short animated film unfolds with scenes of a family farm: cute little pigs and cows, a young farming couple with a baby, hand-built pig pens, a red barn. An idyllic Americana, all made out of clay.

But as a Willie Nelson cover of Coldplay’s song “The Scientist” plays, the quaint scene evolves. The family farm expands until it’s a factory, pigs and cows carried along conveyor belts through factory doors and back out as nondescript cubes of product. An industrialized setting—semi trucks, metallic crates, concrete—takes over, and the skies darken. An older version of the farmer looks around him, disappointed in the factory farm his enterprise has become, and proceeds to tear it all down, converting the factory back to a cage-free, farm-to-table bliss.

Titled “Back to the Start”—after one of the song’s signature lyrics—the commercial made exactly the impact one might expect from Chipotle at the time.

It was creative but effective, making clear that Chipotle was different than other brands, not afraid to invest in a high-quality short film for its first national TV advertisement. Not afraid to take high-profile shots at the “corporate” supply system it professed to rebel against.

Seven years later, Brian Niccol still sings the video’s praises. Sitting in a Newport Beach, California, Chipotle on an overcast February morning, the company’s new CEO reflects on the previous marketing strategy—which would go on to include other animated videos, such as “The Scarecrow” and “A Love Story”—as being groundbreaking, transformative.

“I think that ‘Back to the Start’ video that they did a couple years ago is probably one of the best pieces of film in the restaurant industry, maybe even retail for that matter,” Niccol says. “But we want to take components from that and put it into the advertising we’re doing.”

(Listen to the Niccol’s first-hand thoughts in the latest episode of our new podcast, “Fast Forward,” available to stream below.)

Subscribe to “Fast Forward”: iTunes | Spotify | Google Play | Stitcher

It’s a challenge that perfectly encapsulates Chipotle 2.0, which has been in full swing since Niccol’s arrival in March 2018: How can new leaders pull from an iconic brand’s core values and strong foundation while also adapting it for the future—and regaining customer trust in the process?

More than three years after the seams came undone at Chipotle, and just over a year into Niccol’s tenure, the answer is starting to come into focus.

Regime change

By now, more consumers are familiar with Chipotle’s fall from grace than they are the clever animated videos. Hundreds of guests fell ill from E. coli and norovirus in a series of outbreaks that started in the fall of 2015 and occurred as late as the summer of 2017. Same-store sales plunged by more than 20 percent in 2016. The company and founder Steve Ells apologized, hired food-safety experts, shut down restaurants to retrain employees, and tweaked kitchen processes, but one thing seemed clear to the industry and consumers alike: Chipotle, a brand that regularly did double-digit quarterly comps, was at a loss for how to claw its way back to respectability.

Or, as Niccol puts it, Chipotle wasn’t being aggressive enough in changing the conversation around the brand. “I just really believe the brand had gotten into this position of being very defensive, as opposed to talking about what made the brand great,” he says. “This idea of ‘Food with Integrity,’ giving people access to a higher level of food—that just didn’t exist before Chipotle created the category of fast casual.”

As soon as Ells announced in the fall of 2017 that he would step down from the CEO position, Niccol’s was a name on many speculators’ lips as being a potential replacement. He’s seen as something of a rock-star executive; young and charismatic, the 45-year-old has a long track record of success in digital innovation and brand management, extending back to his early career when he worked at consumer-product giant Procter & Gamble.

More importantly, Niccol spent three years as the CEO at Taco Bell, the culmination of a 13-year stint at Yum! Brands that also included the CMO roles of both Pizza Hut and Taco Bell. His years at Taco Bell—2011–2018—were some of the company’s strongest, a period that included as many buzz-worthy menu innovations (such as Doritos Locos Tacos) as it did thoughtful marketing programs and experiential touchstones (like the upscale Cantina prototype).

“I wanted us to be feeling good about what’s next, as opposed to dwelling on what’s happened in the past—both successes in the past and challenges in the past. It should be focused on what’s coming around the corner.” — Chipotle CEO Brian Niccol.

“One of the things that I’m very grateful for, and the opportunity I had at Taco Bell, was reshaping it around the idea of being a youthful brand, a culturally relevant brand, and then using innovation to do that—both taking advantage of the new mediums that were evolving and then just communicating in an authentic way,” Niccol says.

The transition from Taco Bell to Chipotle seemed a natural one for many, considering each occupies the popular Mexican category. But Peter Saleh, managing director and restaurants analyst at global financial services firm BTIG, reminds that Taco Bell and Chipotle have significant differences that might have made the transition more difficult for Niccol. For one, he says, Taco Bell has a “completely different asset base,” with restaurants primarily designed around a drive thru. There’s also the fact that Taco Bell is predominantly franchised, while Chipotle is 100 percent company-owned.

“They have probably more differences than they have similarities, but I think he’s been successful in that he comes in with a fresh set of eyes and he has been more aggressive in terms of change. Previous management had just been doing what they’ve done in the past—which worked for them for many, many years, but they didn’t have that willingness to change and see things differently,” Saleh says. “So far, the change has resulted in success.”

That success has been multifaceted, having touched on everything from marketing and menu to leadership and technology. But in Niccol’s words, it needed to start with a cultural reset.

Recruiting all-stars

Ells, the Culinary Institute of America–trained chef who founded Chipotle in Denver in 1993, is credited with not only bringing a chef’s touch to the quick-service world, but also with carving out the upscale niche we now know as fast casual. His “Food with Integrity” mantra provided a foundation for Chipotle to build upon for nearly a quarter of a century, revolutionizing how Americans view quality fast food along the way.

But Howard Penney, restaurant sector head for investment research firm Hedgeye, believes the company got bigger than Ells was capable of managing and lacked an organizational structure necessary for brands at a national scale—something that became abundantly clear after the food-safety issues. “Entrepreneurs,” he adds of Ells, “don’t do well in a crisis.”

READ MORE: Chipotle’s new CDO on the opportunity ahead.

In Niccol, Chipotle has found a qualified leader with the ability to get the brand back on track while also instilling trust throughout the company, Penney says. “You have to have people want to work for your CEO, and I think Chipotle had lost that. So the first thing [Niccol] brought back to the company was respect,” he says. “That’s really critical for any restaurant company. As soon as you lose respect for the CEO, your employees don’t want to work as hard, they’re looking for jobs, all those things.”

Having people want to work for Chipotle was something Niccol believed was crucial to its turnaround—and why he decided to relocate the company. Shortly after he took the CEO position, Niccol announced that Chipotle would be moving its headquarters from Denver to Newport Beach, California, as a way to attract new talent (it didn’t hurt, Niccol says, that some 20 percent of the company’s locations were in the Golden State).

With a few exceptions—notably CFO Jack Hartung and chief restaurant officer Scott Boatright, among a few others—much of Chipotle’s headquarters team turned over (Ells, meanwhile, remains executive chairman of the board). CMO Chris Brandt, Niccol’s former CMO at Taco Bell, replaced Mark Crumpacker, the long-time marketing chief and force behind the animated videos.

Niccol explains the move with a sports analogy: Chipotle had good shortstops, but he wanted to find the great ones, and the move to SoCal better helped the company recruit all-stars. Beyond recruiting new talent, he also wanted to give Chipotle a completely fresh start as it set out to reclaim its leadership status. “I wanted us to be feeling good about what’s next, as opposed to dwelling on what’s happened in the past—both successes in the past and challenges in the past,” he says. “It should be focused on what’s coming around the corner.”

The corporate reset on Chipotle announced to the world that Niccol wasn’t afraid to make sweeping changes for the benefit of the brand. And it was a message that things weren’t business as usual at Chipotle—a stark reality for a company that famously resisted change throughout its history, likely to a fault.

“Sometimes change is hard,” Niccol says. “And look, they were tremendously successful for 20-plus years, and they hit a rough patch. And it was just difficult, I think, for the organization to pivot and deal with the change.”

The “real” difference

The shift from Ells to Niccol was a shift from a culinary master to a marketing and branding mastermind. Which isn’t to say the menu piece of the business is going to be kicked to the curb; Niccol recognizes that what has set Chipotle apart from the competition for 26 years is its upscale menu, made with ingredients prepared fresh every day.

“To Steve’s credit, I think he always knew he had a special brand. Granted, it was centered on culinary and his passion of culinary,” he says. “Luckily, there’s never been any compromise on the culinary aspect of the company as they’ve grown. I am highly convicted to not allowing any compromise on the culinary aspect of this company.”

Menu additions used to be so rare at Chipotle that a new menu item was water-cooler conversation fodder. The Sofritas roll-out in 2013 and chorizo launch in 2016 (and relaunch in 2018) were each such a big deal that they made national headlines. The queso debut in 2017 inspired passionate back-and-forth among loyal customers, as many took issue with its grainy texture (an issue that has since been remedied).

While guests shouldn’t expect Chipotle’s menu to morph into Taco Bell’s—no value menus, no novelty items—Niccol & Co. are at least taking a page out of that company’s playbook by leveraging menu innovation to draw consumer interest. Earlier this year, Chipotle announced the launch of a Lifestyle Bowls platform tailored to fit guests’ healthy-eating aspirations. The Whole30, Paleo, and Keto Salad Bowls, along with the Double Protein Bowl, each highlighted ingredient combinations that accommodated restrictions for those popular diets. And in March, the company expanded that platform with vegetarian and vegan Lifestyle Bowls.

The company is also testing new food platforms like an avocado tostada, a quesadilla, and nachos, and beverages like hibiscus and strawberry lemonades, a frozen Paloma margarita, and a Mexican chocolate milkshake. The beauty of many of these new products is that they don’t add much more operational complexity; most of these items are made with ingredients already in the Chipotle kitchen.

Niccol says the menu strategy moving forward will be designed around consumer demand. “What are the menu innovations that meet our customer requests? And what are the menu innovations where we think we can continue to lead food culture?” he says. “Regardless of all of it, though, it cannot screw up our great throughput and the ability to give the customer the customization that they want.”

BTIG’s Saleh says restaurant companies typically have two significant levers to pull to build their business—menu and marketing—and the previous Chipotle regime was reluctant to pull either. Not only has the new leadership team already made an impact with menu innovation, he says, but they’ve also succeeded in converting Chipotle’s marketing strategy from one that is more focused on local, grassroots campaigns to one that is visible to all American consumers, primarily through television advertising.

“As you become a national brand and as you have the budget that they have in terms of sales dollars, you’ve got to spend in ways that you get the most bang for your buck, and TV is that way,” Saleh says.

The first big marketing push under CMO Brandt was the “For Real” campaign, a launch across traditional media channels that emphasized its 51 ingredients and featured the clever line, “The only ingredient that’s hard to pronounce at Chipotle is ‘chipotle.’” And in February, the company unveiled “Behind the Foil,” a series directed by famed documentarian Errol Morris that depicts real-life employees preparing fresh ingredients in Chipotle kitchens across America.

Niccol says “Behind the Foil” is “more human” than a standard ad, demonstrating to consumers how freshly prepared Chipotle’s food really is. “I think it shows you, This is a real kitchen with real culinary skills that you have access to for really reasonable value,” he says. “And that’s what we’re going to continue to talk about.”

A digital transformation

When Chipotle announced in 2017 that it would pursue a new CEO, one could practically see the saliva pooling at the corners of the lips of prospective candidates. Sure, the company was in a tight spot following the food-safety scare. But it also had an unfair competitive advantage in its menu, and incredible brand affinity among consumers—not to mention plenty of runway ahead of it.

READ MORE: Chipotle booms digital sales 100 percent.

In Niccol, Chipotle found the perfect person to capitalize on those advantages while also leveraging his operational and management expertise in chasing new opportunities. In his words, the opportunity was primarily rooted in removing friction points between the Chipotle guest and his or her order.

“When I first got here, the digital transformation was more focused on the back of the restaurant, like, how do we operate with digital orders?” he says. “They hadn’t turned the corner yet on … how we turn that digital operation into the easiest digital experience for the consumer.”

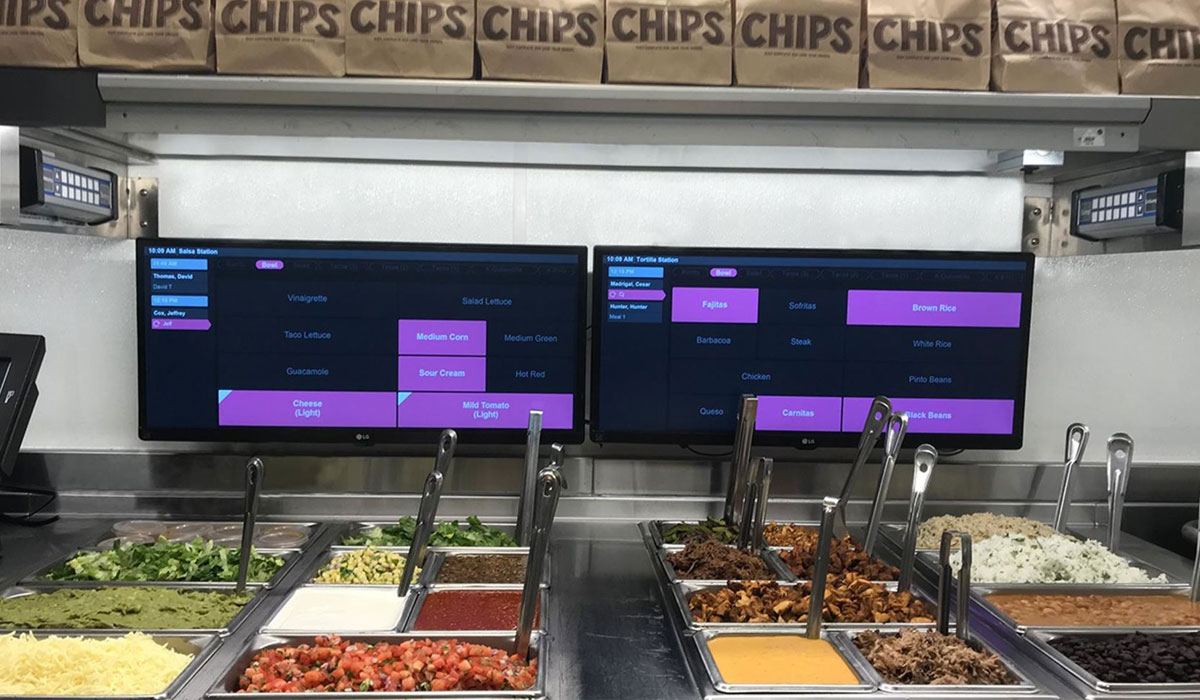

Niccol points to the digital-order pick-up experience as an example of that friction. Prior to his arrival, customers who placed an order digitally didn’t have clear direction of how to pick it up at the stores. Last summer, the company unveiled its new digital-order pickup shelves, a fairly simple change that lets digital-order guests skip the line and grab their food.

“We’re going to have it in all our restaurants by the middle of 2019, and it wasn’t even on the radar back in March,” he says of the shelves. “I think that’s an example of my background of understanding what the consumer experience is, married with, I would say, some operational excellence and attention to culinary details that I really hadn’t seen in any restaurant company, especially at this scale.”

The off-premises category has further helped Chipotle remove friction between the customer and their food. Niccol says Chipotle’s DoorDash partnership has been incredibly fruitful, with delivery speeds averaging around 30 minutes or less. This allows the company to tap into whole new demographics, he says—like, say, a family with a busy evening activity schedule that needs quality food fast.

Perhaps the starkest difference between Chipotle’s old and new guards is the recent acceptance of a drive-thru operation. Whereas the company under Ells was known to reject the notion of drive thru as being too emblematic of fast food, today’s leaders recognize the potential of channeling a portion of the business to an outdoor pick-up window. The so-called “Chipotlanes,” now featured in 11 locations across the country (with a few dozen more coming this year), are for mobile orders only and will be an option for new builds in the future.

“The thing that has been the unlock for the Chipotlane is the fact that we have this digital app,” Niccol says. “Back in 2010–2011, we didn’t have that, and it would have been really difficult to experience Chipotle the way people experienced Chipotle, which is a high level of customization, without this technology. The digital transformation allows Chipotle to still give all this customization at tremendous speed and tremendous value.”

Chipotle’s efforts to strip away the friction through digital operations have already proved massively popular. Just look at the quarterly sales results in 2018, which progressed with 2.2, 3.3, 4.4, and 6.1 percent same-store sales bumps, respectively. Further, in the latest quarterly earnings report, the company announced that about 12.9 percent of orders were placed digitally in Q4, and 10.9 percent for the year. What’s more, the $158.6 million in digital sales in 2018’s fourth quarter were a 66 percent year-over-year jump, while app downloads in all of 2018 increased 77 percent over 2017.

Saleh and Penney are both bullish on Chipotle because of that “unlock” Niccol mentions—not only with drive thru, but also with operations and throughput in general. By shifting a significant portion of its sales to digital, Saleh says, the company can ease pressure on the primary make line, which will help throughput, allow employees to spend more time on product, and drive up margins.

Penney believes Chipotle’s digital transformation will prove to be the industry’s most successful because of the pieces the company already had in place for such a strategy—notably the second make line. If the restaurants were doing $2.5 million in average unit volume before, he adds, a second make line that supports a growing digital-sales business could help the restaurants clear $3 million AUV and beyond.

“Steve Ells put in this second make line to create all this capacity for the restaurant in order to execute on a digital strategy. They just couldn’t execute on a digital strategy because they didn’t have the people in place to do that,” Penney says.

The magic piece

How do you catch a falling company? How do you convince customers to trust you again? For starters, you fix the underlying issue, and in Chipotle’s case, that was the food-safety problem it couldn’t quite shake over the course of two years.

“I know everybody thinks there’s some magic to this,” Niccol says. “But one magic piece here is, have an extended period of time with no food-safety issues. And we are maniacal about our food safety.”

That maniacal nature includes microbial handwashing soap and cleaning materials for employees that kill norovirus, and air filters that kill bacteria including norovirus and cough/cold viruses. In addition, anyone who enters a Chipotle kitchen has to complete a wellness check, answering a few simple questions related to personal health, such as whether or not the person has vomited in the last three days.

With food safety shored up, Niccol and his team have more time to worry about the Chipotle of the future and how they can keep evolving the brand to fit guest expectations. Niccol ticks off several areas he hopes to improve upon in the coming years: catering and other off-premises group occasions; packaging, which will help support off-premises growth; and its loyalty program, which rolled out nationwide in the spring and offers free food after a certain amount of points are accrued.

Then there’s data, the power of which Niccol says the company has only scratched the surface. “Today we have transaction-level information. In the future, we’re going to be able to know that transaction is your transaction,” he says. “And from that, what we hopefully do is take much better insights to make this place more relevant for you.”

With those pieces of the puzzle in place, only time will tell what Chipotle can accomplish on its repaved road to fast-casual superiority. Niccol says the economics support expanding Chipotle to as many 5,000–7,000 locations, but that he wants to ensure “the existing business is running tip-top.” And a big part of that is reminding customers what they loved about the company in the first place.

“I love the fact that in the fast-casual category, not only are we a leader in food culture and food with integrity, but we’re also the leader in the value proposition, so that more and more people can experience what I believe is a real difference: Fresh ingredients being prepared every day with real culinary skills,” Niccol says.

Sound familiar? Perhaps nothing at Chipotle has really changed at all.