When the economy is tough, restaurants tend to get tough in their advertising. As customers tighten their wallets, chains will often claim superiority over competitors in the hopes of boosting business. Comparative advertising, as it’s called, veils an often messy marketing strategy.

Take Domino’s recent campaign-touting victory in a nationwide blind taste test that pitted the Ann Arbor, Michigan–based chain against Pizza Hut and Papa John’s. In the study, conducted by Lieberman Research Worldwide, a majority of participants preferred Domino’s pepperoni, sausage, and extra cheese pizzas to its main competitors’ offerings.

Domino’s insisted the results accurately reflected consumer taste preferences, but both Pizza Hut and Papa John’s immediately called them into question.

The corporate dust-up mirrors a similar situation early last year when Subway and Domino’s duked it out over their oven-baked sandwiches, a battle that featured a commercial of Domino’s CEO David Brandon putting a cease-and-desist letter from Subway in the oven (where else?).

But Domino’s isn’t the only chain claiming—and defending—its king-of-the-hill status in hard times. After seeing advertising disputes jump 40 percent in 2008, the National Advertising Division (NAD), which reviews ads for truthfulness and accuracy, saw another “sharp increase” last year, says Bruce Hopewell, the director of the NAD’s review board.

“When times get tough, advertisers are more aggressive about both defending their market share and trying to get other market share,” Hopewell says. “They make very strong claims, and everything gets ratcheted up and we see more cases come in.”

Garnering the most interest at annual NAD conferences, comparative advertising is the “No. 1 ad strategy” in marketing, Hopewell says.

While it can be effective, going after the competition has its risks.

“One of the dangers,” says Jeff Davis, president of foodservice consumer research firm Sandelman & Associates, “is that you are to some extent promoting the other player. You are mentioning the other player and giving them some respect by mentioning them.”

To Davis’s point, Papa John’s spokesman says he considers Domino’s recent campaign “in some ways flattering.”

“When a larger competitor targets you in their advertising, it usually means that you’re hurting them in the marketplace,” spokesman Chris Sternberg says.

But Domino’s spokesman Chris Brandon says that, in this case, size doesn’t matter.

“We’re not measuring bigger versus smaller here—we’re measuring taste,” he says. “And we won.”

Of course, Papa John’s has touted its share of taste-test victories, and the company’s motto—“Better Ingredients. Better Pizza”—is, itself, an exercise in brash, if rather vague, comparative advertising. But that doesn’t stop Sternberg from questioning the strategy’s effectiveness.

“At this point, we’re not sure the consumer really cares a lot about companies arguing over advertising slogans or taste tests,” he says.

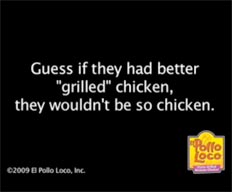

Still, comparative advertising does have its unabashed proponents. Mark Hardison, spokesman for El Pollo Loco, says his concept scored significant gains last year when it attacked KFC for using beef byproducts to marinate its grilled chicken. The eight-week “beefy chicken” campaign, Hardison says, contributed to El Pollo Loco’s brand awareness growing “at a greater rate than ever in the past.”

As for the danger of provoking a giant like KFC, Hardison says the gamble paid off.

“For us to have been silent would not only have cost us some business, it would have cost us a huge opportunity … to leverage KFC’s tremendous spending and PR efforts,” he says.

But even true believers like Hardison suggest using comparative advertising sparingly.

“It should be used in regulated doses,” he says. “Its effectiveness will definitely wane if overused.”

Despite its cons, the marketing strategy will likely remain a regular practice among chains for the near future. “As long as we have tight economy and companies are doing everything for every inch of market share, we’ll see this very high level of cases being brought to our group,” Hopewell says.