Facebook may be the online hub that dominates headlines and most of consumers’ personal time, but there’s no denying that Google remains the king of the Internet and the No. 1 website in the world.

So when Google speaks, people should listen—and speak Google did, to QSR about the restaurant insights and tips that every restaurateur should know in today’s increasingly tech-driven world.

How does Google have anything to do with the quick-serve industry? Simple: The company has a range of tools, from AdWords to Places to Analytics, that lend a hand in the day-to-day operations of businesses, including yours.

That’s why Google’s own Karen Sauder, industry director for restaurants, and Kelly Davis Seeman, head of restaurants, shared with QSR the tech company’s five best practices for restaurateurs.

Google founded its success on its weighed search engine and, to this day, remains the premier search destination on the Web—so much so that Google is not just a noun, but also a verb and a regular member of the world’s lexicon.

The two Google executives say that when it comes to consumers’ searching habits, restaurant operators must do themselves a favor by putting their business in the direct line of a customer’s vision

Sauder says online searches for restaurants are up 122 percent in the last five years, and that there are now twice as many searches for restaurant menus than there are for pop behemoth Lady Gaga. Further, 82 percent of diners look online for quick-serve information, while 76 percent of diners say they use online searches as part of their quick-service decision-making process, she says.

Sauder says online searches for restaurants are up 122 percent in the last five years, and that there are now twice as many searches for restaurant menus than there are for pop behemoth Lady Gaga. Further, 82 percent of diners look online for quick-serve information, while 76 percent of diners say they use online searches as part of their quick-service decision-making process, she says.

“People want to know a restaurant’s availability, their hours, whether they deliver, if you can order online,” Sauder says. “The most important thing you have to do is be there when customers are looking for you.”

“Being there,” the Google experts say, is multifaceted. A website and social media presence is one thing, but Google encourages operators to be more proactive when trying to be front and center of a potential customer’s online search.

“Restaurants are going after a share of the stomach,” Seeman says. “People have to eat every single day, and what we find is that most meals are more planned out than you realize. What we recommend is to make sure that … potential customers are searching on brand terms. Make sure that you’re showing up either on natural search results”—achievable through search-engine optimization—“or, if you have the budget allocations, also in search ads.”

Google AdWords, for example, lets operators target customers through carefully selected keywords. All the operator has to do is create an ad for his business, choose some keywords, set a budget, and choose what geographic territory he wants his ad to run in. The ad then pops up when someone Googles that keyword in that territory, and the operator only needs to pay each time the ad gets clicked. Google even helps the operator craft keywords to maximize an operator’s return on investment.

Google Places, meanwhile, lets operators become the face of their own brand online. The tool offers operators a free profile hosted by Google, through which they can post store information, photos, videos, promotions, and be reviewed by customers. To get started, operators just need to claim their business online with Google.

But Sauder and Seeman say operators should go beyond just helping their brand or store be found online. Menu items, they say, should also be easily searchable, and the same for promotional campaigns.

“We recommend that if there’s a promotional window when there’s something new that you’re launching, make sure people hear about it,” Seeman says. “[Customers are] going to search for it when they see the TV ad, it’s going to be in the news. Make sure you help them connect the dots so they can research it online and find it quickly.”

[pagebreak]

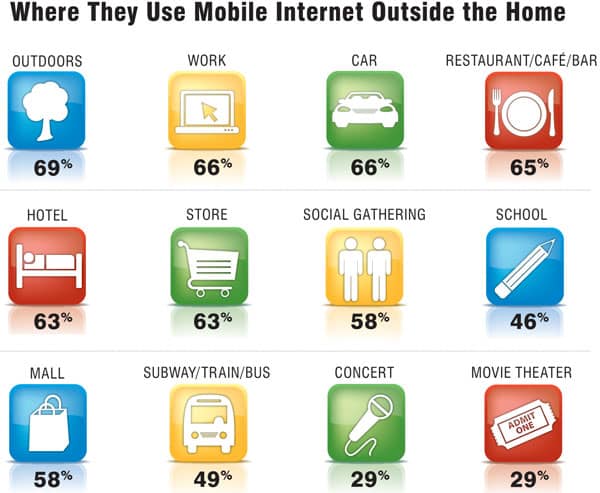

Quick serves are living in a mobile world, and to ignore the rise of the smartphone would be a grave error. Today, there are about 240 million mobile subscribers in the U.S., which is a 76 percent penetration, Sauder says.

“The rise of mobile-device usage is exponential across any category, but in the restaurant business, it’s over 40 percent of all searches that are done around restaurants and [quick service],” she says. “So obviously, your customers are very active, on-the-go consumers, and you want to make sure that you have an optimized mobile site so they can get that accurate information.”

Optimizing a website for mobile can require an overhaul of a quick serve’s traditional website, but Sauder says the time and effort are worth it for when customers search for that store on a phone or tablet.

“[If a company] doesn’t have a mobile-optimized site, when I click on it, and I can’t even read the hours or the location or the special of the day, I’m not even going to go,” she says.

“[If a company] doesn’t have a mobile-optimized site, when I click on it, and I can’t even read the hours or the location or the special of the day, I’m not even going to go,” she says.

“In fact, it will have a negative impact on your brand.”

Sauder says quick serves’ focus on mobile devices will become even more crucial as near-field communication gains in popularity. Near-field communication lets smartphones transfer information, like a credit card payment, to another device simply by holding it close to that device.

“While [near-field communication] is not ubiquitous yet, I think it will become ubiquitous, and I think it’s important for [operators] to understand those changes that are happening,” she says.

“They should be talking to their POS providers; all of that is going to be a boom for restaurants, because it can make the transaction process faster, it can make ordering more accurate, and there are so many advantages over the long term for the restaurant industry.”

In fact, Google itself jumped on new technology in May when it announced Google Wallet, a mobile-payment app that combines payment, promotional, and loyalty functionalities all on one mobile experience.

The rise of smartphones has paved the way for consumers to be easily connected with brands both across the world and across the street.

It’s the across-the-street piece that Sauder and Seeman say is becoming more critical for restaurants.

“We really think from a reputation standpoint, and from a consumer usage standpoint, that searchability of the local space is really important, [and] how it relates to your marketplace,” Sauder says.

“We really think from a reputation standpoint, and from a consumer usage standpoint, that searchability of the local space is really important, [and] how it relates to your marketplace,” Sauder says.

“Usually the competitive set for a restaurant is in a certain mile radius. … That’s why we say understanding your local marketplace and how to be competitive is the key to winning digital.”

In fact, Seeman says, one in three searches on a mobile device are of local intent, and 75 percent of diners have used a mobile restaurant locator like Google Maps. This makes tools like AdWords and Places all the more critical, as operators can target nearby customers more carefully and be sure their information is found when potential customers in the area do a search, she says.

Moving into the future, Sauder says, geo-location—essentially, customers using their mobile devices as a GPS and opting in to be “on the grid”—will make it even more necessary for operators to focus on the locality of their business.

“We see the geo-location piece playing a big role,” she says.

“One of the new products that we will have is that you can bid by distance based on your mobile device. So if I’m searching on my mobile device for hamburgers, I could, if I’m the hamburger place, bid to get higher in the rankings, or more prominent in the advertising, on that search.”

[pagebreak]

While getting involved with social media is not a new tip for restaurant operators, Sauder and Seeman stress that it’s crucial in today’s marketplace—and something that needs to continuously evolve over time.

Sauder says the most effective social campaign is one that doesn’t just announce deals and new products, but tells a brand’s story and engages with fans.

“Is there something special about your location? Do you have specials? Do you have music on Fridays?” she says. “You want to make sure you’re involved in that dialogue.”

While the world of social media might seem daunting to some operators, Sauder says, they should start with what they know and work their way up to become familiar with social media.

Some sites, like YouTube, are becoming so popular with consumers, especially on their mobile devices, that operators must get involved now, she says.

“People become afraid—‘Will my channel be perfect? Will it have all the right videos?’” she says.

“People become afraid—‘Will my channel be perfect? Will it have all the right videos?’” she says.

“Our advice is to get in there early and to keep making it better. Whatever you’re working on, constantly enhance what you’re doing and try to be out there in as many different places as possible.”

Seeman says putting videos up on YouTube can also be intimidating for operators; sometimes, she says, filming so much detail about your operation and showcasing it for the world to see can seem scary. But the potential penetration, she says, makes it well worth it.

“We see that more than 400 tweets per minute contain a YouTube link, and over 150 years’ worth of YouTube video is watched on Facebook every day,” she says.

Restaurant operators are usually on their feet for the majority of the day and don’t have much time to sit at their computers crunching numbers that don’t pertain to their profit-and-loss statements. But the Google executives say trend-spotting is a data process well worth investing time in.

Tools like Google Analytics let operators measure activity on their entire online presence to gauge how customers are interacting with their brand.

“There are tools like Google Analytics that are free that can help you understand how consumers are searching around your restaurant, searching around food trends,” Sauder says.

“You can find out if people are searching and then not coming into your store. You can see how ordering online is affecting your business. There are all these great ways to understand your business because of the way online works.”

Seeman says Google’s Insights for Search tool, a product that is now in beta testing but available to the public, allows operators to see how certain keywords have trended over time. They can even find out how topics trend in certain geographic locations.

Seeman says Google’s Insights for Search tool, a product that is now in beta testing but available to the public, allows operators to see how certain keywords have trended over time. They can even find out how topics trend in certain geographic locations.

“Basically, it gives you access to our search data—not the real numbers, but at least trends and a sense of what’s popular,” she says.

“If you’re thinking about launching a new dish or there’s a new area that you’re moving into, you can type in different terms, and then see how search popularity is trending for those terms, and whether it’s on the increase or on the decline.”

For instance, if one were to gauge the popularity of the term cheeseburger from April through June in the city of Chicago, they’d see that its search popularity was a rollercoaster for that period, but was consistently high between April 15 and 28 and peaked on June 4.

“It’s a lot cheaper than focus groups, because it doesn’t cost you anything,” Seeman says. “So you can get information from the world’s largest focus group.”