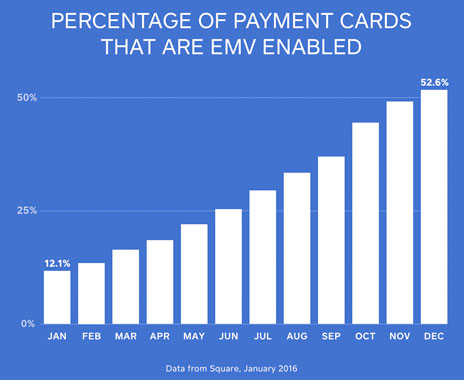

The nationwide switch to EMV chip cards is progressing at a steady clip with the Payments Security Task Force projecting that 98 percent of cards will be chip enabled by the end of 2017. Furthering the point, recent data from Square, a California-based mobile payment and business solution provider, shows that roughly 53 percent of cards processed on Square Stands payment system in December 2015 were chip cards, up from 12 percent the year before.

While it may seem like a painful process to get a new point of sale (POS) that can accept chip cards, for quick-serve owners, it’s something to prioritize. For one, most people will soon have new cards. And second, as of last October, the EMV liability shift went into effect. [Read more about the liability shift.] Now businesses that don’t accept chip cards could be on the hook for certain types of fraudulent transactions, whereas previously the banks ate this cost. So to protect your business against unwanted charges, you’ll want to update your system.

Why is the industry switching over to chip cards? For starters, magstripe-only cards are woefully outdated. They’ve been around for decades and run on extremely antiquated technology (it’s actually the same technology as cassette tapes), which makes them particularly susceptible to counterfeiting. Since the data on the magstripe is static, it’s relatively easy for even unsophisticated fraudsters to clone bank information onto a new card.

In part because the United States has been a magstripe-card market to date, fraud here has been particularly rampant. Here’s a shocking stat: Half of the world’s credit card fraud happens in the U.S., even though only a quarter of all credit card transactions happen here. In an effort to curb fraud, the U.S. is phasing out magstripe and phasing in EMV as the credit card–processing standard.

Why are EMV chip cards safer? They contain a microchip in the upper-right corner with enhanced security features that protect against fraud. The data on the microchip is encrypted and constantly changing, making it extremely difficult for fraudsters to extract anything meaningful. The switch to EMV chip cards is part of our charge towards “authenticated” payments, meaning transactions that have multiple layers of identification baked into them to protect bank information.

Countries that have already adopted EMV chip cards (the U.S. is actually very late to the EMV party) have seen a dramatic decrease in certain types of fraud. In Canada, for example, research firm Aite Group reports that losses from counterfeit, lost, and stolen cards dropped from 245 million Canadian dollars in 2008 to 111 million in 2013.

But despite the fact that EMV chip cards are far more secure than magstripe cards, many businesses have been sluggish to adopt the technology. A recent report by Software Advice, a reviews hub for POS systems, found that 78 percent of retailers still aren’t EMV compliant. Experts believe this is due to the perceived friction and cost of getting a chip card–enabled POS up and running, which isn’t unsubstantiated. Many EMV chip card readers can cost hundreds of dollars (Square’s chip card reader retails for $49). But the fact that EMV chip cards are not the best paying experience may also be holding things up.

If you’re already taking chip cards at your business, you’ve probably noticed that the transaction time is very slow—noticeably longer than magstripe cards. Granted, this is all while the chip technology is working to spot anything suspicious, so even though there’s a drop in efficiency at the register, it means you’re more protected. Still, the sluggishness is pretty glaring, especially when you have a line out the door.

Industry leaders predict that this lag will help accelerate the adoption of mobile payments like Apple Pay, Android Pay, and Samsung Pay. Mobile NFC (near field communication) payments are leagues faster than chip cards; they’re processed pretty much instantaneously. And with several layers of dynamic encryption, they’re arguably even more secure than chip cards. In addition to employing a technology called tokenization, which scrambles the bank details each time a customer pays, mobile payments like Apple Pay are locked down with fingerprint ID. So even if you were to lose your phone, you’re safe.

Increasingly, people will expect to be able to pay via more secure methods. So to make sure you can accept every sale—and protect yourself from the liability shift—it’s a good idea to outfit your business with a new POS, ASAP.