There’s no question that the 2016 presidential race will go down as one of the most unusual runs for the White House in modern history.

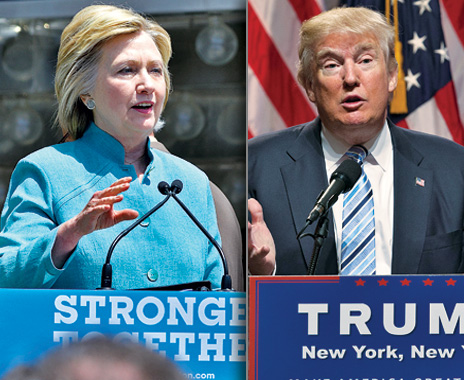

The primary season tore apart traditional political playbooks and laid bare sharp divisions within both major parties. And since June, the general election race that’s pitted former Secretary of State Hillary Clinton against billionaire Donald Trump has been divisive and, at times, chaotic.

But now, as voters across the country prepare to choose between Clinton and Trump, the U.S. restaurant industry is finding itself in more familiar territory: lobbying for relief from federal regulations and framing the election around issues, not personalities.

While Trump has been scant on policy details, restaurant industry insiders tell QSR they’re hopeful his business background will make him more sympathetic to rolling back the tide of new regulations introduced during President Barack Obama’s two terms.

“I think the general feeling about Mr. Trump is cautious optimism,” says Cicely Simpson, the National Restaurant Association’s (NRA) executive vice president of policy and government affairs. “I think people are still learning about him and his policies. He says he is a deal-maker, but we’re still waiting to see what his policies are.”

Meanwhile, if Clinton is the candidate who is sworn in come January, some predict it will be an improvement over the last eight years, which were defined by political gridlock and unilateral executive action from the Obama administration. Simpson says the business community has been frustrated by the White House’s heightened regulations that directly affect business owners.

But Clinton has a record of legislative compromise. In the U.S. Senate, she found Republicans to cosponsor bills with her on dozens of occasions. “She is also a deal-maker, and we know that she is willing to make deals and be that kind of honest broker of honest conversations,” Simpson says. “I’m not going to say she agrees with us on every issue, but the opportunity to plead our case will in fact be there.”

Here, we take a look at five issues restaurant operators should consider as they head to the polls this November.

Labor regulations

Labor costs are always important to restaurateurs. But many are fretting a deluge of new pressures, both from the federal government and local regulators.

In May, the U.S. Department of Labor vastly expanded the number of workers eligible for overtime—a move poised to have widespread implications for restaurants upon implementation in December. The rules mean workers who earn $47,476 or less per year will be eligible for overtime, nearly double the previous threshold of $24,000. It could affect thousands of restaurants’ management employees who previously were salaried.

Trump has not substantially weighed in on that issue, though other Republicans widely criticized the rules and pledged congressional action. U.S. House Speaker Paul Ryan called the move an “absolute disaster.” Clinton applauded the Obama administration’s new rules, indicating employers shouldn’t expect a change if she wins her bid for the Oval Office.

Meanwhile, operators are still hoping for some regulatory relief from the Affordable Care Act, or “Obamacare.” Trump has vowed to completely repeal the healthcare policy, and Clinton has promised to improve it through new policy tweaks.

Restaurant companies also see another regulatory threat by way of the National Labor Relations Board’s hard line on joint employers. In ruling that companies are liable for labor violations from their contractors in 2015, the agency reversed conventional wisdom on the legal separation between franchisors and franchisees. In May, New York attorney general Eric Schneiderman used similar logic in filing a lawsuit alleging Domino’s was equally responsible for supposed wage theft perpetrated by its franchisees in the Empire State. Some have predicted the changing attitude could prompt quick-service chains to either wield increased control over franchisees or walk away from franchise agreements altogether.

“That is existential to the future viability of the franchise business model,” says Matthew Haller, senior vice president of communications and public affairs at the International Franchise Association.

Haller says restaurant companies and franchisees alike are “counting the days” to the end of the Obama administration. After a deluge of new rules and regulations, they are ready for a fresh start in Washington, he says. Still, Haller stresses that restaurant operators are savvy entrepreneurs who will find a way to adapt to the changing political landscape.

“Whether it’s Hillary Clinton or Donald Trump or somebody else, they’re going to figure out a way to navigate,” Haller says. “But these regulations do have consequences. Particularly in the labor space, the consequences are going to fall on the consumer, the employee, or the U.S. economy.”

Minimum wage

Clinton has made raising wages a cornerstone of her campaign. She’s pushing a $12 national minimum wage, and the Democratic National Committee’s official platform approved calls for a $15 national minimum in July.

For his part, Trump has been tougher to pin down. In a November 2015 primary debate, the business mogul said American wages are “too high.” By May, that stance seemed to have evolved. Trump said on television, “I haven’t decided in terms of numbers. But I think people have to get more.” He said he would like to see the states set their own minimum wages, not Congress.

While the federal government may jump into the minimum-wage debate after the election, restaurants are facing wage pressures closer to home. Already, 29 states have minimum wages higher than the federal $7.25. Another 29 cities or counties have pushed the legal wage floor up higher than their state minimums.

That dynamic means the stakes of the presidential race vary across the country. For instance, in California, restaurateurs are already facing a statewide minimum wage of $10. San Francisco’s $13-an-hour minimum wage will reach $15 by 2018. Los Angeles will reach $15 by 2020. Other statewide regulations require mandatory sick leave for all workers and make employers liable in civil court for wage or workers compensation violations—even when temporary workers are hired through a contractor.

“For California clients, the [presidential] election isn’t as much of a sea change,” says Alden Parker, a regional managing partner for the Fisher Phillips law firm and a member of the California Restaurant Association’s legal center. “For those operators who have locations outside California, there’s a lot going on that is troubling and impacting a lot of those businesses.”

Supreme Court

One thing restaurant operators may not be focused on in this election but perhaps should is the balance of the U.S. Supreme Court. With already one vacancy, the next commander in chief will influence the nation’s law decisions for decades to come.

Parker says that restaurants and all other employers should care what direction the court swings. He believes a slew of weighty employment issues, particularly the enforceability of arbitration agreements and standards for joint employers, will likely find their way to the nation’s highest court in the coming months.

Normally, restaurant companies care just as much about congressional races as the presidency, Parker says. But this year, he says, it’s the presidential election that could have the biggest impact on American businesses.

“It’s not every presidential election where there are teed-up issues that are going to affect employers in the next four, eight, 10 years before the Supreme Court,” he says. “There’s always a threat of it, but there’s not a balance that is on the precipice of tipping in one direction or another, viewed as pro-business or not pro-business. And we have that here. So I think there’s a particular importance for restaurateurs here.”

Tax reform

Both Clinton and Trump have promised some sort of tax reform, an issue that restaurants, like all businesses, are closely watching.

“We know that certainly the current administration and Congress cannot come to an agreement,” says the NRA’s Simpson. “So the next president, whether that’s Mrs. Clinton or Mr. Trump, is going to have to tackle tax reform.”

Trump has pledged across-the-board tax cuts if he is elected. His plan calls for removing the federal income tax burden from some 75 million low-income Americans, according to his campaign website. No business would pay more than 15 percent in income taxes. Aside from creating the lowest tax rate since before World War II, Trump’s site says, his plan will greatly simplify the complicated U.S. tax code, claiming it will move from seven to four personal income brackets.

The billionaire plans to pay for the cuts by reducing or eliminating most deductions and loopholes for the rich, adding a one-time 10 percent tax for repatriation of corporate cash held overseas, and taxing future overseas profits for American businesses.

Clinton’s tax plans heavily target the wealthiest Americans, though she has no plans of re-engineering the entire tax structure. She would close corporate tax loopholes and add new taxes on millionaires and billionaires, according to her campaign website.

At the same time, she would simplify and cut taxes for small businesses in an effort to spur growth. She also plans to offer tax relief to individuals with excessive out-of-pocket healthcare costs and for those caring for ill or elderly family members.

The Trump factor

While restaurant industry insiders certainly have their sights set on key issues, there’s no question that Trump’s personality, background, and comments during the election season are shaping the race even among this constituency.

After all, Trump is defined by seemingly contradictory traits: On one hand, he boasts a storied track record in business, ostensibly a draw for business-minded conservatives. But at the same time, he’s known for being unpredictable, brash, and quick to reverse his positions on the issues—the bane of those businesspeople who thrive on certainty.

In a survey of all Fortune 500 CEOs, Fortune magazine found that 58 percent preferred Clinton over Trump—an unusual position for the usually conservative-leaning demographic. The magazine said corporate leaders have been rattled by Trump’s hard line on immigration and international trade.

Scott Gittrich, founder and president of Toppers Pizza, can relate. He has grown tired of state and local regulations hampering the growth of his franchisees, and he believes the Obama administration’s use of executive orders to pass stricter labor regulations has set a dangerous precedent for the White House.

But don’t expect him to check Trump’s name on the ballot in November. Though Gittrich holds conservative ideals, he plans to “throw away” his vote and cast a ballot for a third-party candidate. That’s because he can’t stomach Trump’s call on banning Muslims from immigrating to the U.S. In addition, he’s nervous about how Trump’s unpredictable personality would fare in a time of crisis.

“Trump has fatal flaws,” Gittrich says. “If all hell broke loose on a global scene, I think I want Hillary there. I don’t want Trump’s finger on the button in a war room blustering.”

But Trump is a businessman. And Gittrich believes his fiscal policies would prove more advantageous to the 75-unit pizza chain.

“I do think he would probably be better for business people. If I was just voting my business, my pocketbook, I would vote for Trump,” he says. “But I’m willing to give up more of my pocketbook and vote my conscience.”

CKE Restaurants CEO Andy Puzder wasn’t on the Trump train early on, but he says he has “converted.” Aside from his plans to reduce business regulations, Puzder says, Trump’s own experience will make him sympathetic toward business interests.

“Donald Trump has been more successful for a longer period of time than the vast majority of businesspeople in this country,” he says. “He’s got vast experience. And the bottom line is you can’t fake that.”

On the campaign trail, Clinton and her running mate, Virginia Sen. Tim Kaine, both talk up the small family businesses that marked their respective childhoods; Clinton’s father ran a printing shop in Chicago, while Kaine’s father owned an ironworking shop in Kansas City.

But with no personal business background, Clinton cannot relate to the concerns of entrepreneurs and corporate America, Puzder says. “I think [Trump] has a far better frame of reference,” he says. “I think Hillary Clinton has no frame of reference.”

Clinton has embraced Obama-era regulations and said she plans to build upon the 44th president’s legacy. Puzder also notes that her primary challenger, Vermont Sen. Bernie Sanders, pushed Clinton to move to the left on several issues during the Democratic primary campaign.