Indiana was on the verge of entering Stage 5 of its reopening. The phase, set to go into effect this past weekend, allowed restaurants to operate at full capacity. Even bar sections in restaurants could do so, although customers must be seated.

While this was welcome news, 100 percent capacity is still a relative notion. Social distancing was mandatory, as were face coverings. So “no restrictions” actually came with restrictions. Texas Roadhouse explained in August that 100 percent is more like 80–85 percent given what it takes to keep guests and tables 6 feet apart. Yet 80–85 percent, especially with outdoor dining thrown in, represents massive progress, without question.

Is this a sign of things to come? In some markets, yes (Florida took the step last week). In others, like New York City and San Francisco, indoor dining has yet to return (the Big Apple plans to open at 25 percent capacity September 30).

READ MORE: Why a full recovery could take years, not months

Across both extremes, however, operators find themselves trying to decipher the new normal’s lasting or fleeting impact—which parts will stick and which will vanish.

One way to approach the query is to look at trends that have emerged from COVID-19’s shadow. With help from insights platform Sense360, here are some of the more prevalent shifts to date.

1. COVID-19 changed lifestyles. Away from work commutes, increased value focus.

Once people started sheltering at home and working remote, or filing for unemployment, some of the steadiest traffic drivers fell off. This was mainly a two-pronged disruption: Breakfast and late-night. Brands like Starbucks and Dunkin’ reported shifts to mid-morning and afternoon business. Daily routines are becoming almost “break routines” for consumers as they try to balance new schedules.

You can see below how things have adjusted. Breakfast is gaining a bit as lunch faces fresh barriers from familiar foes—customers replacing meals at home.

Chances are this sticks? It’s likely the breakfast daypart will recover as people head back to work. Will there be more remote workers than pre-virus? Absolutely. But will there also be less than there were in April? That’s a sure-fire bet, too. Restaurants will also continue to open up distribution points so they can cover gaps. Delivery, for instance. You see Starbucks and Dunkin’ broadening networks of late to capitalize on new occasions, and the rise in group ordering. Just as people at home ordered for multiple people instead of taking solo trips, the same could be true of offices tapping bulk purchases for staff. Or perhaps guests will start to normalize the practice of having coffee delivered to their homes. There’s a lot of awareness hurdles yet to clear for morning-focused chains, but there are fresh opportunities surfacing as well.

On a side note, late-night is something that will probably require large gathering type venues to reopen before it kicks into gear. Things like concerts and, of course, bars. Colleges as well. That might be a 2021 curve.

Here’s a look at top factors influencing recent food decisions. From that, lines can be drawn to what needs to change for some semblance of normal to return.

“What, if any, are the top factors that have influenced your recent food decisions the most?”

- I am being more conscious about eating healthy foods: 25 percent

- Nothing in influencing my food decisions: 25 percent

- I’m not receiving my usual income: 18 percent (circle this one)

- I’m seeing options that don’t require me to leave my house: 16 percent

- I’m seeking food that hasn’t been touched/prepared by other people: 14 percent

- I’m trying not to deplete my food supply at home: 12 percent

- I’m not commuting to work daily: 11 percent (circle this, too)

- My kids aren’t at school daily: 10 percent

What are customers giving restaurants credit for?

Per the Sense360 chart below, these have been truly strange times. Menu variety not top of mind? The bar that jumps out is the value one.

Chances are this sticks? It seems a safe assumption value is going to take on a significant role in the coming months. For one, nobody is quite sure where discretionary income is going to be. Will America be in a recession? Even if it’s not, restaurants are going to have to win back customers and they’re going to have to compete with grocers and other at-home options that historically carry better value perception. It’s one reason you see a lot of restaurants offering discounted bundle meals.

Additionally, keep an eye on what happens with loyalty, rewards, and app battles as restaurants break out the incentives to build lists and fight for the most valuable currency there is—data. This was unfolding pre-COVID and it’s only become more relevant as restaurants try to reach customers through mobile ordering and other contactless lures that have gained prominence, and to encourage spending journeys through direct channels instead of less-profitable third-party platforms. That app signup is going to be worth its weight in gold. Customers have proven more brand loyal in a COVID arena where they value safety, familiarity, and ease of ordering.

2. COVID drives a massive growth of off-premises purchasing

Here’s an interesting data point from Sense360: While about half of people used delivery during the pandemic, just as many have done it by calling on the phone as through third-party aggregators.

“Have you purchased food from a restaurant since the start of coronavirus?”

- Drive thru: 52 percent

- Curbside: 46 percent

- Carry-out: 42 percent

- Dined inside: 27 percent

- Delivery from calling: 26 percent

- Delivery from website: 25 percent

- Third-party delivery: 23 percent

- Delivery from restaurant’s app: 22 percent

- Have not eaten from restaurant: 8 percent

In sum, as of early July, 54 percent of people had used one or more restaurant delivery options since COVID began.

And despite the colossal growth in third-party delivery, more than half of those ordering delivery said they preferred to order directly from the restaurant.

“Which of the following do you prefer to use?”

- Directly from the restaurant: 63 percent

- Third-party delivery: 18 percent

- No preference 20 percent

Chances are this sticks? Restaurants have learned a lot from COVID restrictions and cost-cutting measures. One of them is the desire to invest in white-label or direct delivery. The pandemic compressed the innovation cycle and forced brands to get on board with delivery. In many cases, this meant engaging one or multiple third-party vendors or breaking exclusive contracts to expand reach (like Shake Shack did). There’s little doubt third-party delivery will remain a growing (and consolidating) player for an extended period of time, and many restaurants will continue to find ways to make it work, including jostling for better deals and data sharing, but the push toward direct delivery isn’t going away. Restaurants want to control the experience, and keep the fees down. Plus, it’s a more cost-effective option for customers and one reason curbside has been so popular.

The heightened adoption rates during COVID (forced by necessity) informed customers to some costs they might have ignored before. Or just traded off for convenience without understanding how many options they had. That’s likely changed now. There are far more off-premises choices in the game, and that includes restaurants that deliver through their own app or site. Whether they engaged outside help for last-mile service or not, restaurants have come a long way, quickly in terms of advancing delivery capabilities. And first-party preference is heart to the progress.

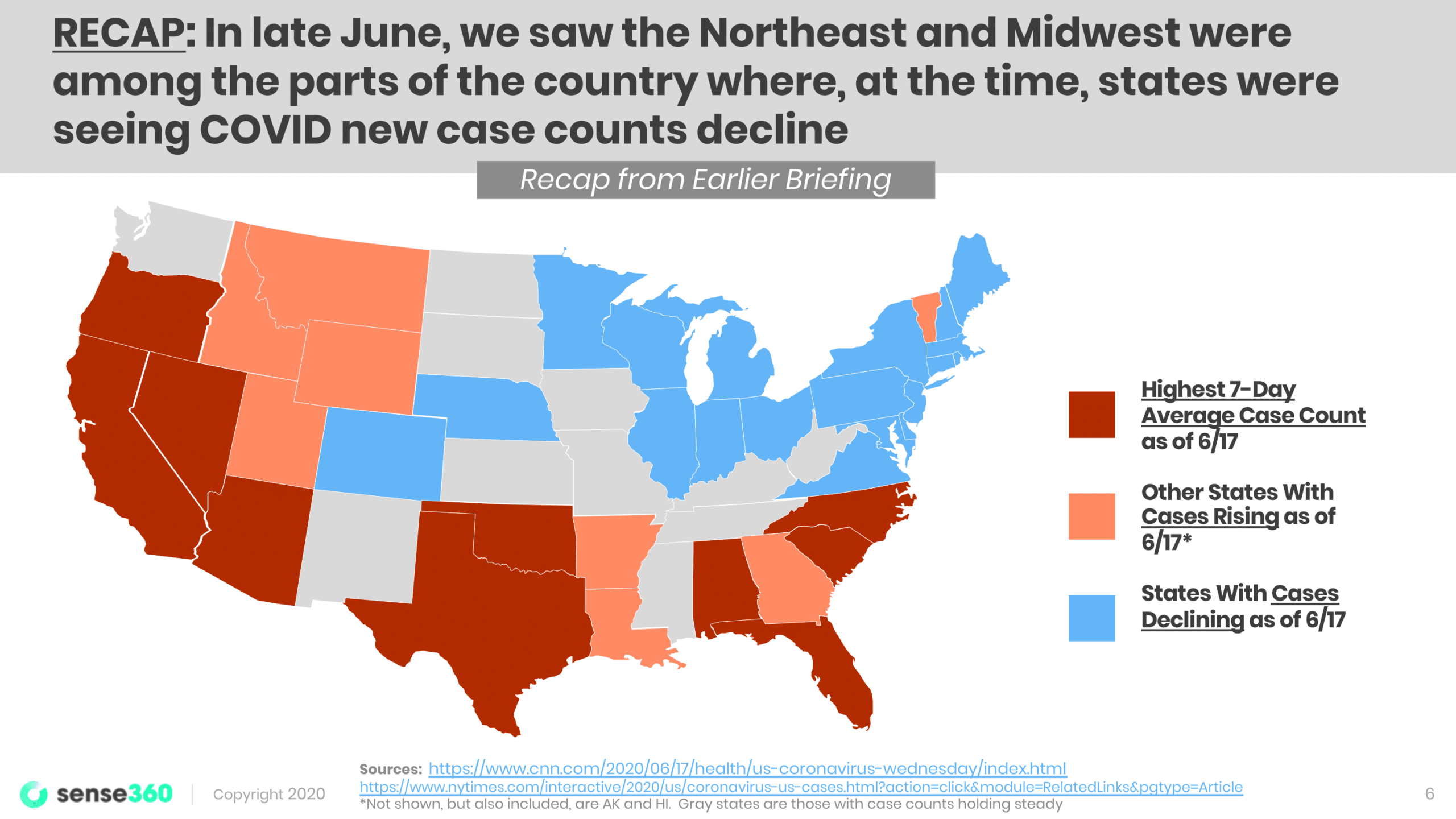

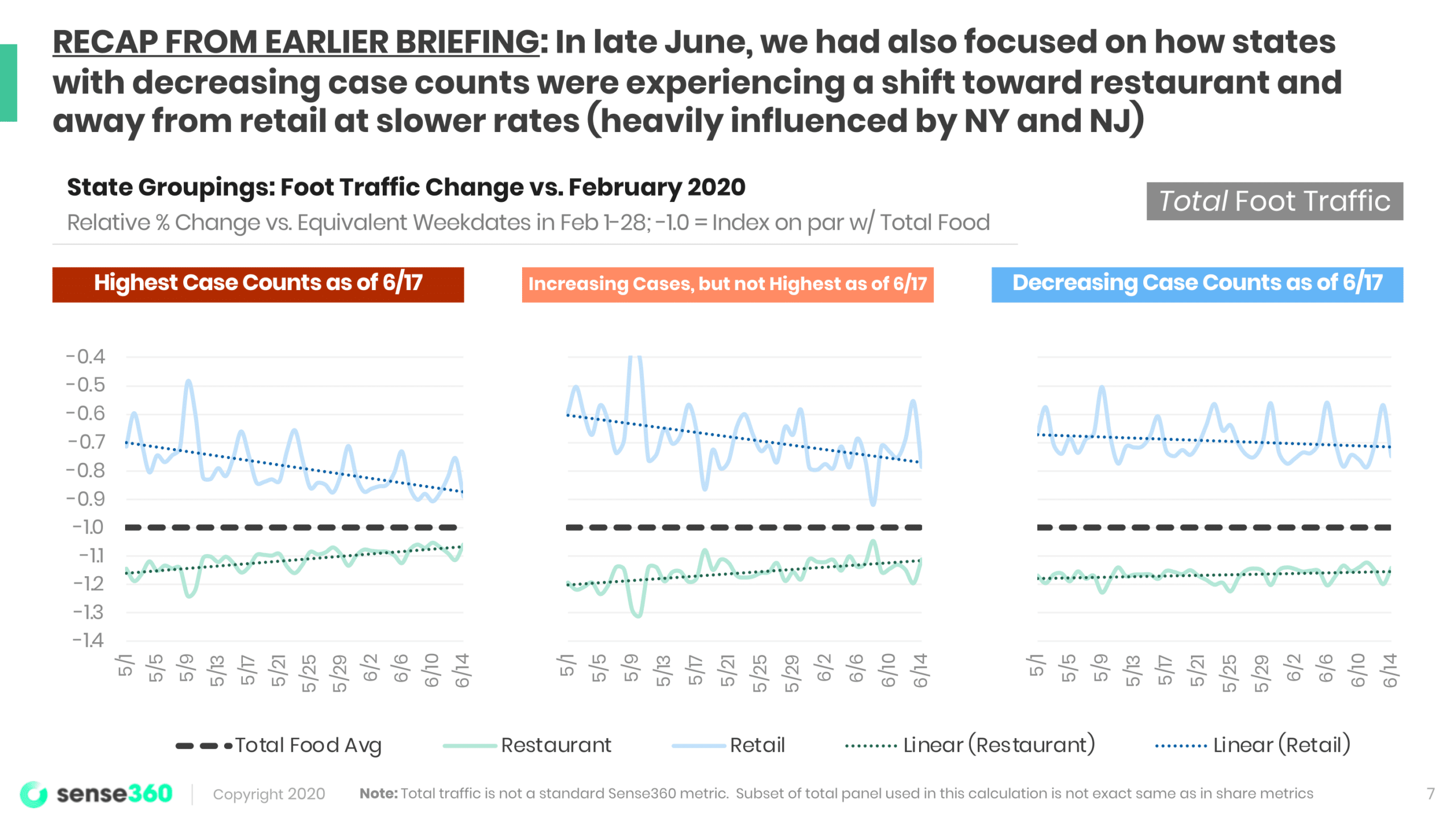

3. How restaurants and retailers have performed during COVID comes down to location.

Restaurants are racing to the suburbs. Starbucks has spoken at length about this. Urban city centers, as NYC’s indoor dining shows, are going to lag recovery. But importantly, moving to the suburbs allows brands to build drive-thru locations en masse. A lot of chains unveiled “restaurant of the future” models in recent weeks. What do they have in common: Smaller dining rooms, dedicated curbside spots outside, and pickup windows concepted with mobile ordering in mind. Taco Bell and Starbucks are working on the Chick-fil-A and In-N-Out model, too, where employees roam the line to get orders in quicker. This tells us one simple fact—restaurants are trying to bolster drive-thru experience and tools as we prepare for a convenience war unlike any other.

[image source_ID=”128247″]

Chances are this sticks? Quick-service giants are going to flood the real estate market left behind by closures. That’s bankable. Who and when, and to what extent, remains to be seen. Darden recently mentioned there is real estate to be had, but it’s not necessarily cheaper yet. Chipotle, in another example, said it expects to return to the mid-200s pace of development within a couple of years—something it hasn’t done since before the 2015 food-safety crisis. And it’s suggested 70 percent-plus of that boom will include “Chipotlanes.” Restaurants are going to roll prototypes built for contactless guests. This might differ brand to brand but they’re almost surely going to be smaller, more tech friendly, and ready to scale. It’s just likely to take a year or two.

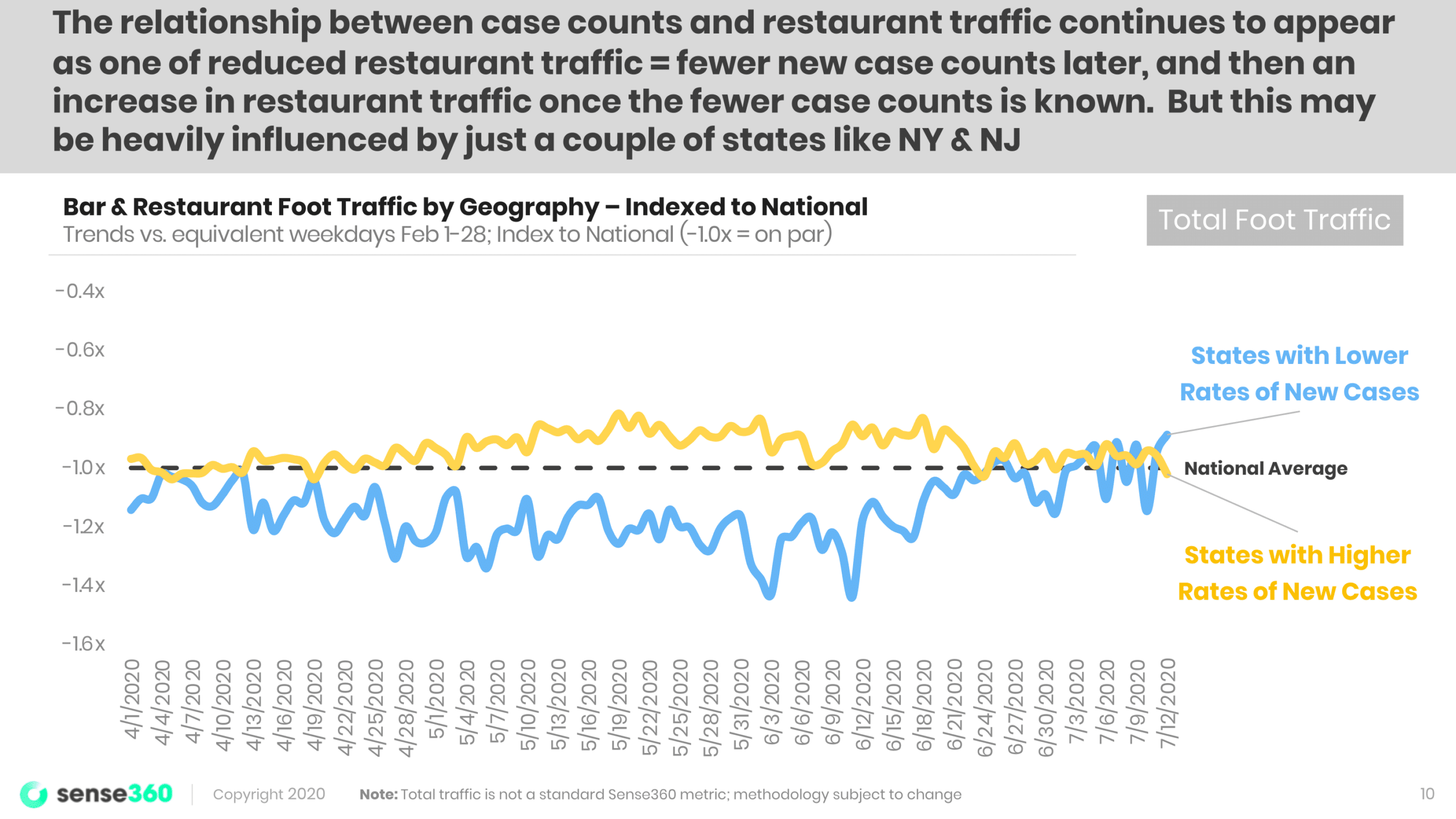

4. Consumers follow media and government influence, even if skeptical.

Mixed messaging has remained one of the biggest roadblocks, and it started on day one for restaurants. Officials opened the gate by telling people to stay out of restaurants, and they listened. It bears asking if the reverse will eventually be true. Once the green light is put on display, will a rush of customers show up? A different reaction than, say, the great recession when it was a steady trickle upward. There was some evidence of that back in June during early case spikes. Surges didn’t really seem to deter customers until states started to respond. Whether that’s a good or bad thing overall is up for debate, but it could hint at a quicker recovery than some are anticipating, at least from a guest demand perspective.

A recent comment from Darden CEO Gene Lee: “So far … we have seen no change in demand based on COVID levels in a market unless capacity restrictions change. So, [for] example, we’re in South Florida when we had the spike after the Fourth of July and the restaurant restrictions were very limited, we definitely saw demand dropped. But that was not because of the consumer, it was more because of the restrictions the local municipalities put on us.”

The closure picture and ensuing impact is a different story.

However, can we really predict what the message will look like in November? Not a chance. This perception battle is elusive, to put it lightly.

A good illustration: Sense360 asked consumers if they knew whether or not certain activities were even allowed. For indoor dining, 40 percent said they had no idea; 37 percent said the same of outdoor dining.

Restaurants are going to have to keep their foot on the pedal when it comes to educating guests. Outdoor signage has never been more important.

Chances are this sticks? This one is a mystery. Who really knows what officials will say or how case counts will develop at this point. Lower numbers of cases will result in higher confidence—that much is clear. But outside of that, with a contentious election coming, there’s going to be a lot of noise and not a lot of straight lines.

5. Preparing for the light at the end of the COVID tunnel (or not)

We’re all a prisoner of the moment, even when we can’t afford to be. Six months ago, only 10 percent of people thought COVID restrictions would last more than six months. Who could have known? Today, the number is nearly 50 percent.

For restaurants, thinking about the holiday calendar is still important, just as preparing for a year-long COVID run was back in March. Starbucks controlled this recently by pushing its Pumpkin Spice Latte release to the earliest date ever. Results followed. This could very well become a common practice as restaurants try to remind customers of “the good old days.”

Chances are this sticks: Highly probable. Nobody knows what day it is anymore, right? Well, why not tell them. Consumers miss their routines, especially the pleasant ones (like drinking PSL beverages to welcome fall). Owning the calendar can help break through some of the quarantine fog.