For years, there was a sense of inevitably about third-party delivery, and then there was Domino’s. The brand’s scale and fleet of drivers allowed it to sidestep the category and its often-messy implications. But in the summer of 2023, Domino’s changed course by inking a deal with Uber Eats and Postmates, starting with a four-market pilot slated to stretch nationally by year’s end.

CEO Russell Weiner said Domino’s viewed the opportunity like it would entering a new marketplace. The brand sells more food on its digital platform than any pizza company in America. Yet now, aggregators were at scale, making “the next logical marketplace for us to enter … order aggregation.”

Domino’s research in the U.S. and learnings from 13 international markets where it did work with aggregators, suggested the upside was akin to what you generally hear—that doing so would introduce the brand and franchisees to a fresh segment of customers that could, in theory, provide meaningful, incremental delivery orders well worth the margin trade-off. Or put differently, the incremental business gained from third-party platforms was better than never getting in front of these platform-loyal users in the first place. And in doing so, Domino’s could then work to retain their business, either through the same avenue or flipping them direct, where rewards and better prices await.

To Weiner’s earlier point, third-party delivery simply became a universe Domino’s couldn’t ignore.

READ MORE:

Domino’s Unveils Four-Part Plan to Capture $7B in Sales and Nearly 50,000 Stores

The Inevitable Reality of Domino’s Bet on Third-Party Delivery

On the same token, Domino’s faced challenges in its delivery business, which saw comps in the channel decline 2.1 percent in the quarter that led up to the announcement (Q1). That negative 2.1 percent rolled over a 10.7 percent decline in 2022. Domino’s blamed the drop on guests opting for dine-in occasions and tight spending. The chain also, like much of the category, had a tough time hiring delivery drivers in a jam-packed world of gig jobs and rideshare opportunities. Domino’s worked to solve that through flexible shifts, including the ability to sign up for hours with shorter lead times, and even the rollout of an army of electrical vehicles for people who might not have cars.

Papa Johns CEO Rob Lynch mentioned in May 50–60 percent of the company’s third-party marketplace business was incremental, and he lauded aggregators’ ability to supplement the chain’s labor pool during peak stretches. Pizza Hut president David Graves noted in May as well that, in early 2022, the brand witnessed roughly five transactions per store per week through third-party. By the end of the year, it was up to nearly 50.

However, what made Domino’s decision unique was, as part of the agreement, Uber Eats signed on to be the exclusive platform in the U.S. until at least 2024. Customers are still able to use the Domino’s Tracker through the Uber Eats app, orders are delivered by uniformed Domino’s drivers, and Uber One and Postmates Unlimited members receive deliveries with no charge.

That means Domino’s didn’t look at third-party delivery as much as a fulfillment objective to ease labor as an inevitable moment in digital maturation. Domino’s said the opportunity could represent a $1 billion business. Where did it get that figure from? According to The Wall Street Journal, 14 percent of pizza sales flowed through delivery apps in the past year or so. Weiner said aggregator sales had grown to nearly $5 billion in the 12 months leading to May 2023, and Domino’s planned to get “our fair share of this market.”

The pizza chain and Uber Eats overlap in nearly 30 global markets, meaning the agreement would cover about 70 percent of the brand’s worldwide footprint.

Uber, per the WSJ, also agreed to hand over customer data to Domino’s.

Domino’s plans to spend marketing dollars with Uber Eats, but not on driving customers toward the channel. Rather, the goal is to capture the right kind of guests over all of them. And those value diners, the brand hopes, heads direct to Dominos.com. “But this will be a premium price channel for us, and specifically the higher-income customers that they’ve got are the ones that we’re going to be targeting here,” Weiner said in July. “And so, I think if anything, this gives us more levers to unlock value for customers, but also value from our franchisees as far as a higher-income, higher-price marketplace.”

In the company’s most-recent quarterly call (Q3), Weiner labeled the decision a “value-creating initiative.”

It’s one he expects to drive incremental delivery volume from new customers, increase the brand’s share of the pizza delivery market, and generate stronger economics for the company and franchisees. “This will begin in a measurable way in the first quarter of 2024,” he said. “We want to exceed the expectations that the incremental customers will get through Domino’s Rewards [also a ‘value-creating initiative’] and Uber Eats.”

Weiner added Domino’s strategy to do that—since it controls the labor on both fronts—would be to achieve best-in-class delivery service. In Q3, the chain returned to pre-pandemic Q3 2019 delivery times. That was one of the lead goals during the “Summer of Service” training program where U.S. franchisees visited headquarters in Ann Arbor, Michigan, to learn best practices, such as making pizzas before customers complete their online order or dispatching orders to drivers before they arrive to ensure they don’t have to leave their car. “This focus is important for us to provide an excellent delivery experience for new customers flowing in from Domino’s Rewards and the Uber Eats channel,” Weiner said after Q3. “We want these experiences to lead to loyal lasting customers who will provide considerable lifetime value for our brand and our company.”

“We already deliver more pizzas than anyone in the country, and so as we take on these incremental orders, we just need to make sure that technology works,” he added. “That’s what we’re doing now and then certainly making sure the staffing is right, and we’re working with Uber and our franchisees to do that.”

The basic premise, when you consider Domino’s assets, is customers who seek the best price or loyalty program, flow white label. There are going to be some (a sign again of the aforementioned scale) who are Uber customers, or both. And in turn, Domino’s ensured it is pricing in a way where there isn’t consumer incrementality and the company is positive on the margin side. So while the whole Domino’s menu is on Uber, there’s a premium with price. “The second thing that we do really well, and you see this in our digital media, the Uber marketplace is a digital platform for us,” Weiner said. “And so, we’ve got our National Advertising Fund budget and all the expertise we have from being on Facebook and all the other social media platforms. We’re going to bring that into Uber, and we’re going to drive folks within that platform with our marketing money.”

If guests are in that platform, the brand plans to push them to Domino’s. “And we have a lot of expertise on how to do that,” he continued. “And once you’re there relative to other menu prices that you’re going to see from the competition, we’ll be in a really good place. So I think we’ll be a value player there, and we’ll have high awareness once you’re within that platform. And so absolutely, I think we can get to our fair share on that platform, as well as eventually the entire marketplace for aggregators.”

An outside look

Research and analytics firm M Science looked into the partnership between Domino’s and Uber Eats. Since its November launch, early indicators suggest share of sales remains modest, the company found, but Domino’s is, in fact, attracting new customers.

Before getting into this, it is worth noting the brand reported Q3 same-store sales declines of 0.6 percent, a figure weighed by order count decreases, but partially offset by a higher average ticket (Domino’s Q3 U.S. average price increase was 3.2 percent). The brand’s carryout business was up 1.9 percent rolling over a 19.6 percent spike in Q3 2022. Delivery slid negative 2.3 percent, lapping negative 7.5 percent.

Weiner, though, told investors Domino’s expects delivery orders to improve in Q4 (this will be revealed on February 26) as the company’s updated loyalty program and Emergency Pizza Promotion roll out of the picture. And that, as noted, should be followed by “considerable improvement” thanks to transaction growth from Uber Eats. CFO Sandeep Reddy added Domino’s profit was up from $150 million to $155 million quarter-over-quarter and, “frankly, with the Uber opportunity coming next year, we expect to see even more growth in 2024 in terms of profitability of the stores.”

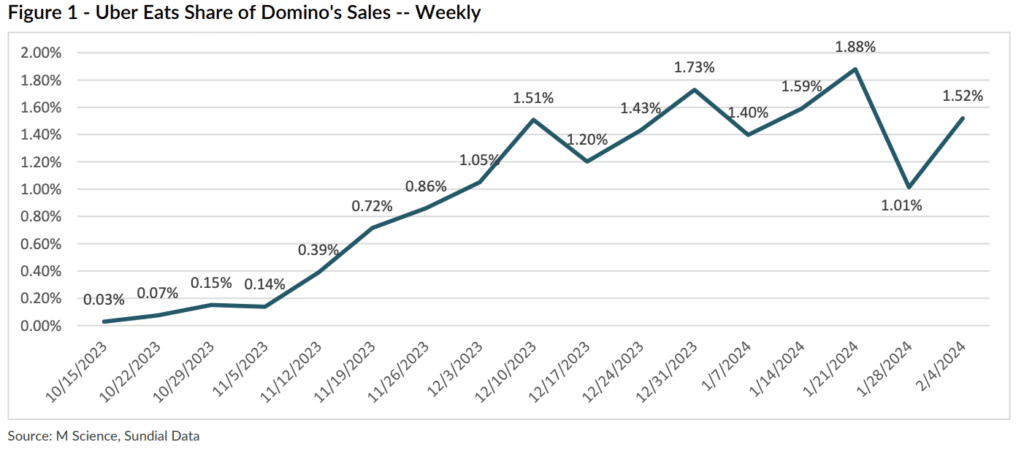

Where it concerns orders, M Science said, after an initial ramp in December 2023 as Uber Eats availability spread across Domino’s system, share of sales have proven relatively flat thus far in 2024 at less than 2 percent of the sales in its data.

At annual U.S. system sales of about $9 billion in 2023, M Science added, the company estimates this share implies an annualized run rate of sales via the Uber channel of directionally $100 million, once accounting for cash sales (M Science’s data doesn’t capture cash transactions). So about a 10th of the way there.

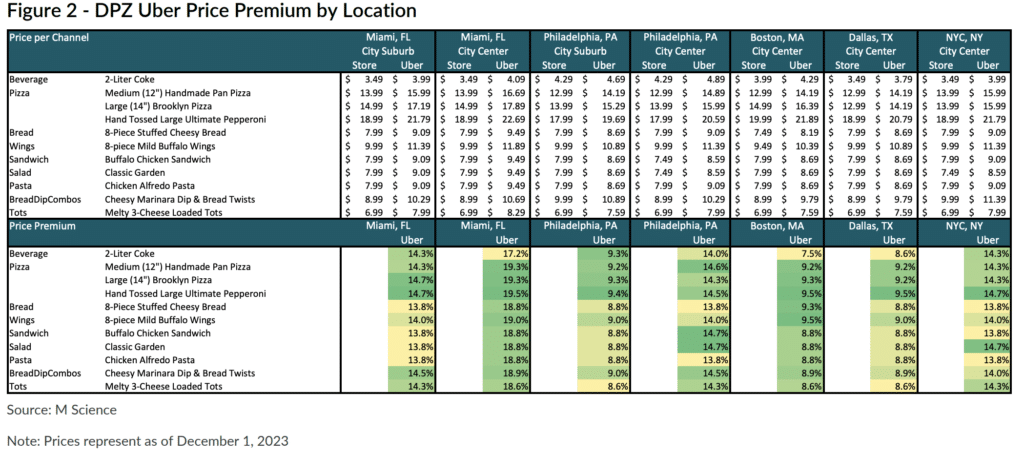

M Science compared first-party Domino’s prices to the brand’s costs on Uber Eats across key geographies. It revealed a general price premium for Uber Eats of 9–14 percent.

M Science selected a sample of items and identified pricing via Domino’s-branded channels and Uber Eats. Premiums by location were generally consistent across products.

In Miami and Philadelphia, M Science found a 5 percent greater price premium when ordering Domino’s through Uber versus direct delivery in urban locales compared to suburban ones.

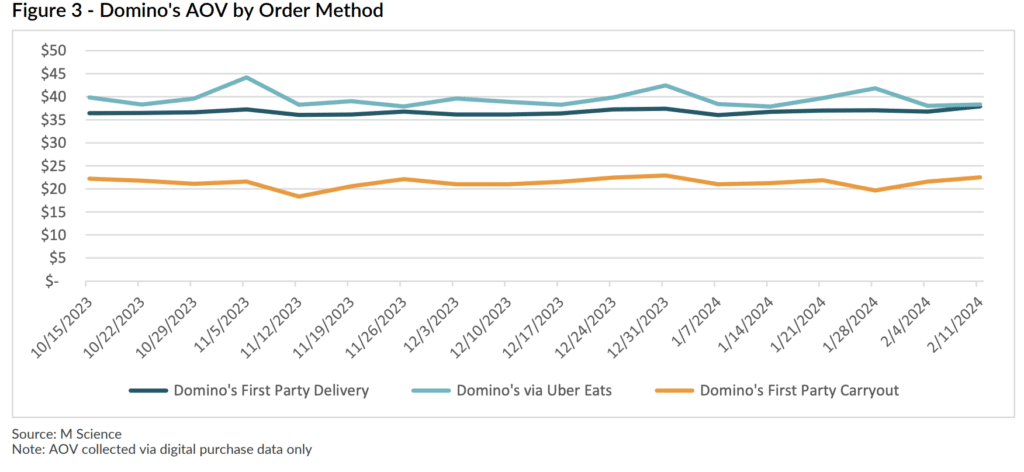

That helps illustrate why Domino’s average check on Uber Eats in M Science’s digital purchase data was roughly $38, or $9 above the first-party order average check of $29.

“We think the premium pricing on the Uber Eats platform might be dampening demand, though note we do think Uber Eats-directed orders largely represent a different ordering occasion than orders directed to Domino’s directly. Admittedly, most brands have premium pricing on third-party delivery platforms [though the difference here is that the same premium delivery service is available for less directly through the company],” M Science said.

Check for Domino’s orders on Uber were, on average, 8 percent higher than white label since November, despite promotions.

M Science said the higher check was driven partly by loftier Uber Eats prices, naturally, but also by a lack of promotions available via first-party ordering. “While customers do not have access to first-party promotions when ordering from Uber Eats, we do note DPZ has consistently pushed discounts on the Uber Eats app since the partnership’s nationwide rollout, helping to partly offset these costs,” the company noted.

For reference, Domino’s delivery orders via Uber Eats averaged an 86 percent higher average check than the first-party carryout channel since November.

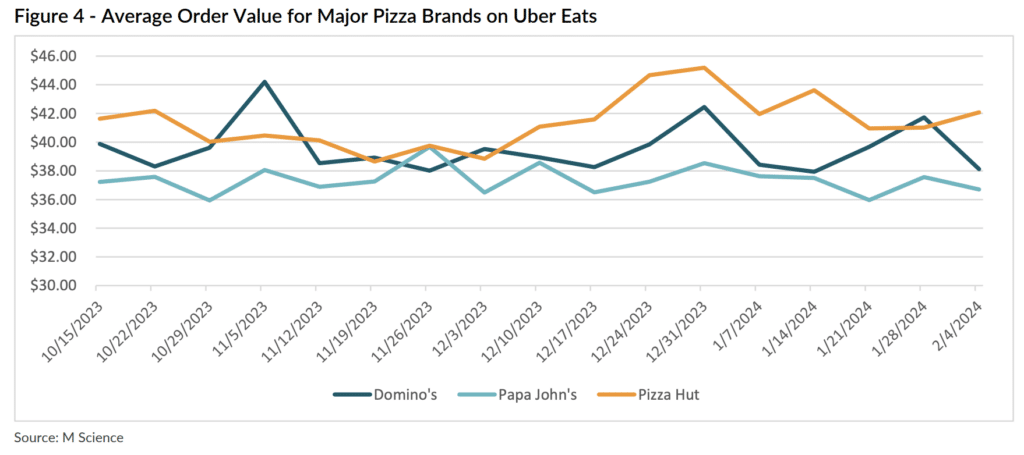

Yet measured against peers and not itself, average check for Domino’s on third party was materially similar to Papa Johns and Pizza Hut, M Science data showed (which goes back to what Weiner said about the type of customer it was reaching out to through aggregators—one who expects to pay more). Since early November, average check for Domino’s on Uber tracked roughly 6 percent higher than Papa Johns orders but 4 percent below Pizza Hut.

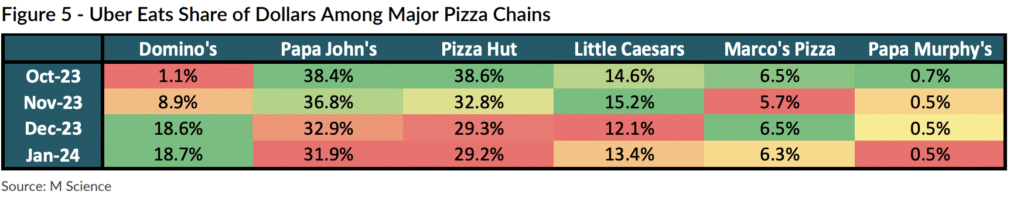

Since rollout, Domino’s successfully grabbed share from major competitors on Uber Eats, yet still lags more established cohorts.

At 19 percent share in December and January, M Science said, Domino’s eclipsed Little Caesars as the third-most popular pizza chain in the group. That said, it was behind Papa Johns (32 percent) and Pizza Hut (29 percent). It’s still early.

Scale wise, Domino’s reported 6,762 U.S. units as of its Q3, Pizza Hut 6,593 U.S. units as of Q4, and Papa Johns reported 3,397 North America restaurants as of Q3.

More than half of Domino’s Uber Eats first-time customers had not ordered from a major delivery chain via digital channels in the prior three months, M Science said. That suggests the partnership had its intended effect of reaching a fresh base of customers.

About 58 percent of diners in M Science’s digital purchase data that ordered Domino’s via Uber Eats did not order from a national pizza chain in the 90 days prior, “suggesting Domino’s is somewhat tapping into a new customer base through its partnership with Uber Eats.”

Among those who ordered Domino’s on Uber Eats and also ordered from a national pizza chain in the preceding three months, give or take 15 percent had ordered Domino’s via first-party channels during that span. Nearly 20 percent had not ordered from Domino’s direct but had ordered from another major pizza delivery provider on the Uber Eats app. The last 7 percent had not ordered from Domino’s through first-party channels or a competitor on Uber Eats, but had ordered from a competitor through a different order method.

Prior-order channels for customers who ordered Domino’s on Uber Eats (based on prior three months of order history)

- Domino’s first-party orderer: 15 percent

- Uber Eats orderer from major competitor: 20 percent

- Non-Uber Eats orderer from competitor: 7 percent

- None of the above: 58 percent

Additionally, M Science data showed Domino’s retained a significant percentage of the new pizza customers it gained via the Uber Eats channel (this, in the plainest terms, is why the brand elected to last-mile staff its orders and keep the data, despite the benefits of having labor help, and why it stressed training so deeply over the summer). For guests who did not digitally order from a national pizza chain in the three months prior to ordering Domino’s via Uber Eats, 72 percent returned to order again on their next order from a national pizza chain. Of these, 18 percent ordered via Domino’s direct channels.

Subsequent order for customers who did not order from a national pizza chain for three months prior to ordering Domino’s via Uber Eats

Next order method

First party

- Domino’s: 18 percent

- Competitor: 5 percent

Uber Eats

- Domino’s: 54 percent

- Competitor: 19 percent

Domino’s has also done a solid job retaining customers it attracted from competitors, M Science said. Among users who ordered from a top pizza competitor on Uber Eats in the three months prior to dialing up Domino’s on Uber Eats, about 45 percent returned to Domino’s on their next pizza order. This included 7 percent who subsequently ordered directly through Domino’s white-label offerings. Of course, M Science said, this means 55 percent of those guests either returned to the previous concept from which they ordered or went to another pizza purveyor on the Uber Eats platform.

Meanwhile, customers who previously ordered from competitors outside Uber Eats stayed with Domino’s at a solid rate—35 percent ordered from Domino’s again in their next pizza purchase. Within that, 13 percent ordered straight from Domino’s and 22 percent via Uber Eats again. “We view both of these outcomes as generally solid given these customers did already have a relationship with the prior merchants. Admittedly, some portion of these customers may also be bargain hunters who are willing to order from whichever merchant is offering the best promotion,” M Science said.

Subsequent order for prior customers of competitors on Uber Eats after ordering from Domino’s on Uber Eats

First party

- Domino’s: 7 percent

- Competitor: 7 percent

Uber Eats

- Domino’s: 38 percent

- Competitor: 45 percent

Subsequent order for prior customers of competitors via non-Uber Eats channels after ordering from Domino’s on Uber Eats

First party

- Domino’s: 13 percent

- Competitor: 34 percent

Uber Eats

- Domino’s: 22 percent

- Competitor: 13 percent

Lastly, Domino’s largely retained its own customers who tried ordering from the brand on Uber Eats after previously using the direct options.

Interestingly, though, M Science pointed out, some customers who previously purchased from Domino’s direct channels stuck to using Uber Eats after giving it a try. For those who ordered from Domino’s white-label systems prior to ordering via Uber Eats, 27 percent ordered again from Uber Eats for their next transaction. M Science said this could be due, in part, to Domino’s promotions on the app. “Nevertheless, this is not an ideal scenario for Domino’s as direct channels are likely to be higher margin transactions despite the higher pricing on the Uber Eats app, it said.

Subsequent order for customers that ordered Domino’s on Uber Eats and previously ordered from Domino’s first-party app

First party

- Domino’s: 40 percent

- Competitor: 8 percent

Uber Eats

- Domino’s: 27 percent

- Competitor: 21 percent

“Overall, it seems that Domino’s has successfully managed to bring in incremental customers to its brand, and even its first-party channels, through its partnership with Uber Eats,” M Science said.