A recent mobile ordering study conducted by Intouch Insight found that 71 percent of consumers have made a mobile order—a number that would’ve been unthinkable pre-pandemic. It also appears to be a number that’s only growing.

“Mobile ordering is now table stakes,” says Laura Livers, head of strategic growth at Intouch Insight. “It’s allowed customers different and new purchase paths, and you see this fast movement toward the practice that’s being driven by customer convenience.”

This slideshow will take a closer look at some mobile ordering trends that quick-service operators should be paying attention to—including a segment that is increasingly encroaching upon the quick-service restaurant’s market share for prepared-food sales.

Convenience

The Intouch Insight study included 500 mystery shops across 20 different brands across the quick-service, full-service, and c-store segments to collect field data. It also leveraged Flash Points surveys to get consumer feedback, drawing perspectives from over 1,500 participants to gain insights into mobile ordering habits and behaviors.

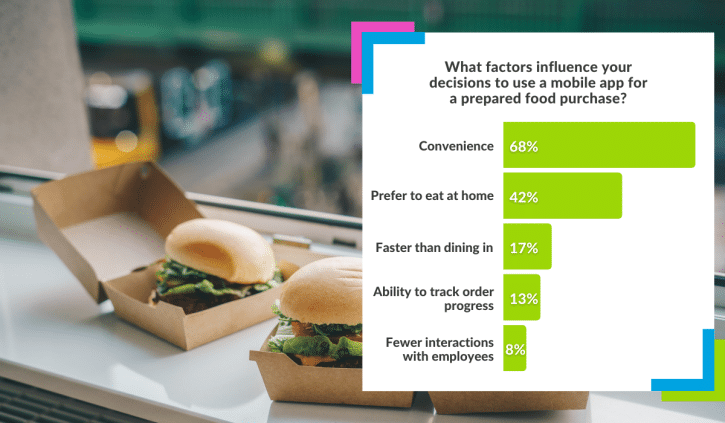

The study zeroed in on why consumers choose mobile ordering over traditional channels and found that 68 percent of consumers did so due to convenience. Forty-two percent of respondents said they prefer to eat at home, while 17 percent said it was quicker than dining in.

“We found that convenience is the number one factor that drives consumers to use a mobile app to order food,” Livers says. “Brands who want to delight customers with mobile ordering and draw traffic from third-party aggregators must concentrate their efforts on enhancing key elements of the user experience, making it as easy as possible for consumers to order online directly from their own channels.”

C-Store Competition

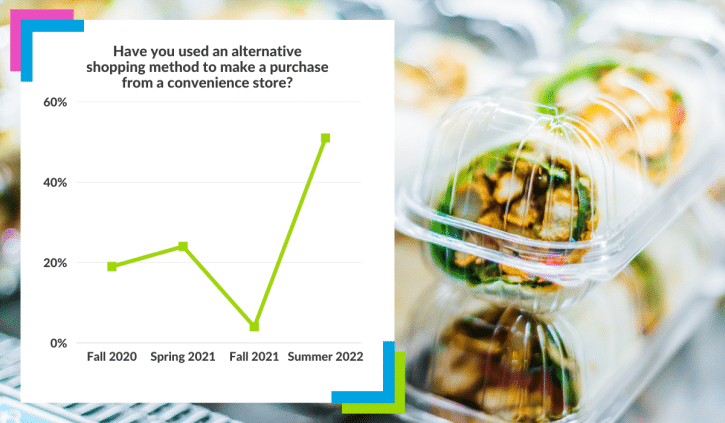

As recently as last fall, when compared with restaurants, c-stores had relatively low mobile-ordering adoption rates. That has changed in a dramatic way—a new Intouch Insight report found usage of last-mile services like mobile ordering spiked 47 percent in the c-store sector during summer 2022.

“As brands have increasingly jumped onto the mobile ordering bandwagon to drive convenience, we’ve seen a significant increase in blurring between channels like c-stores, quick-service restaurants, and fast casual restaurants,” Livers says. “With these apps offering all prepared food options side-by-side, it’s never been easier for consumers to get what they want yet harder for brands to differentiate themselves.”

The Prepared Food Battleground

The influx of mobile ordering in the c-store space seems to indicate a new battleground in the prepared food space for restaurants. This is further cemented by the fact that, according to Intouch Insight, prepared food (78 percent) and groceries (77 percent) were the top two most purchased items by those using alternative shopping methods.

“Quick-service restaurants are now competing for ‘share of the stomach’ not just with other restaurants, as they’re accustomed to,” says Sarah Beckett, director of marketing at Intouch Insight. “But now technology has made it easier for c-stores to go head-to-head with restaurants, giving mobile applications the potential to be the hottest battleground around prepared food heading into 2023.”

Why—or Why Not—Buy From a C-Store

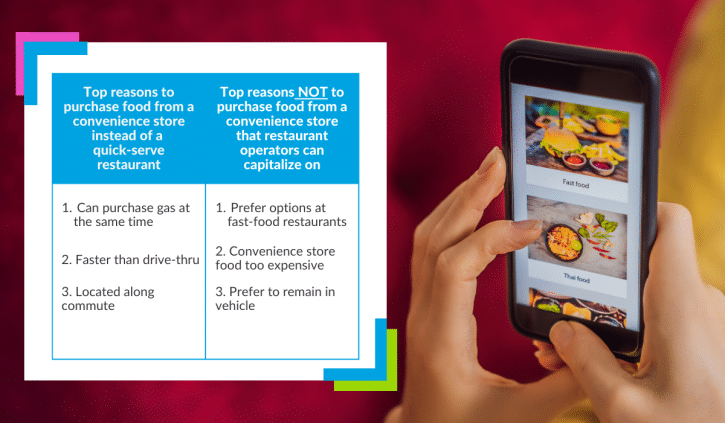

When it comes to c-stores competing for the dollars that may have previously been spent at quick-service restaurants, consumer preferences shed light on some areas where restaurants have advantages. For example, consumers preferred quick-service food options over c-store options. Consumers also said they found less value at c-stores. Finally, a third advantage for quick-service restaurants was that few c-stores have drive-thru windows, and thus consumers are forced to get out of their vehicles.

On the other hand, c-stores trump quick-service restaurants in the eyes of consumers when it comes to speed of service, location, and, fittingly—convenience.

The Playbook: Fast, Friendly, Accurate Service

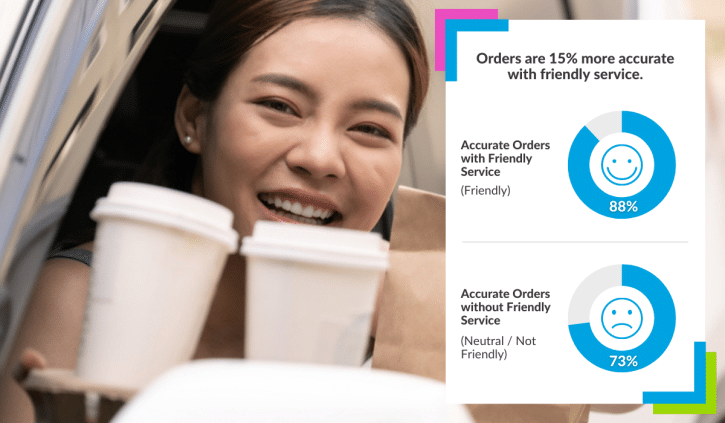

The data regarding consumer preferences can be informative to quick-service operators looking for a playbook on how to dominate the mobile-ordering space. First, Livers recommends that restaurants across segments focus on what has always made the quick-service experience superior in the eyes of consumers: good food, order accuracy, as well as fast and friendly service.

In fact, all of these things all go hand-in-hand: the recent annual QSR Drive-Thru Study conducted by Intouch Insight found that order accuracy was 15 percent higher when service was rated as “friendly.” According to Livers, the connection between order accuracy and friendly service has been historically true, but even rose year-over-year.

Back to Basics

The news of c-stores encroaching upon the prepared foods mobile ordering share should not be taken lightly, Livers says. At a time when the U.S. is facing increasingly uncertain economic times, consumers are going to gravitate toward where they find value and convenience. Mobile ordering can be a huge difference maker in the quest to win sales—and now’s the time to invest in efficient, crowd-pleasing off-premises channels.

“My message now is the same as it was 30 years ago: brands have to evolve with the consumer,” Livers says. “They have to stay true to their core values in regard to the customer experience and make sure they are putting their best foot forward. People talk about how much has changed with technology—it sure has. But what hasn’t changed is the customer: who still wants great food, in a convenient manner. And I think that’s what this study showed most of all.”

To download the Intouch Insight Mobile Ordering Study, click here.