As much as we talk about diversified media mix and the rise of digital, the old ways are far from dead. TV remains one of the key advertising channels for restaurants, and it’s one of the most tangible ways large brands aid local units. BIA Advisory Services recently estimated that local advertising spent on quick-service restaurants would represent $3.9 billion in 2019 and grow by $47 million annually through 2023.

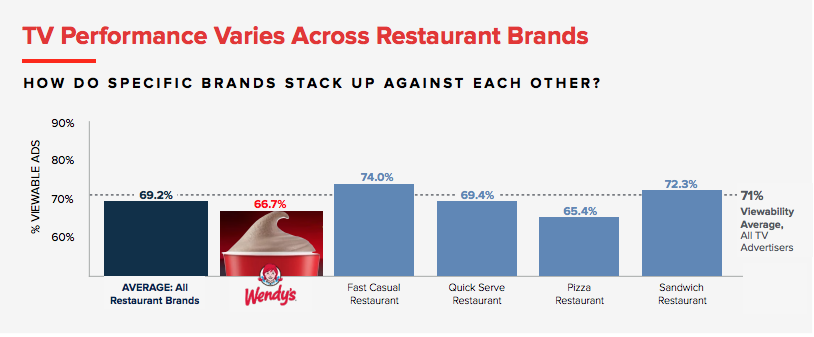

Like all things in this margin-tight industry, it’s often not effective enough to just generalize. Not all TV ads are equally viewable. And not every brand should advertise during the same time slots, in front of the same audiences, with similar creatives.

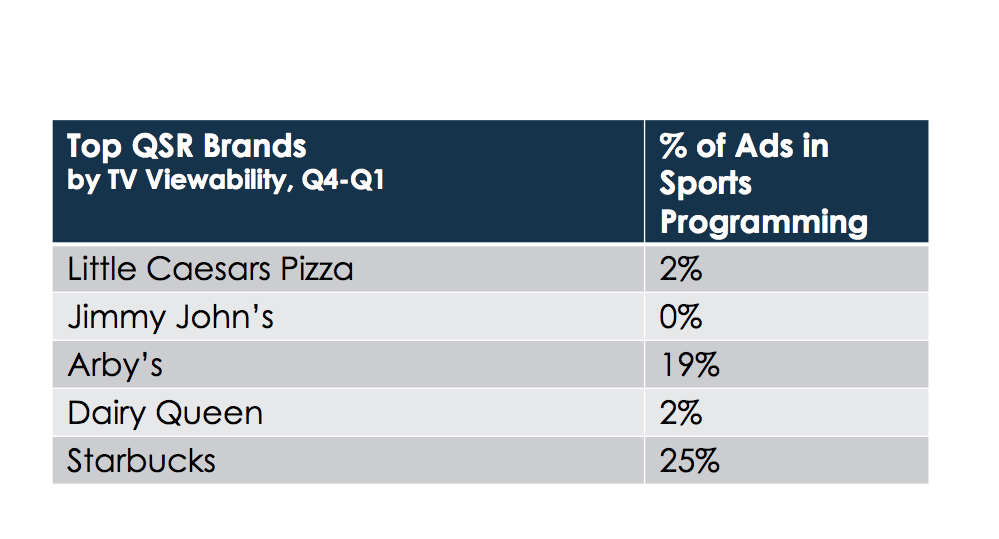

TVision shared a report with QSR that looked at the TV viewablity (defined as the opportunity to view, or when someone was in the room to view the ad) and audience size for hundreds of programs where restaurant brands advertise, uncovering key hits, misses, and opportunities.

READ MORE: Wendy’s named America’s No. 2 burger chain.

TVision found that, for restaurant brands, evening dramas, like Manifest, The Passage, Chicago PD, and Grey’s Anatomy offer room for increased investment. Additionally, syndicated comedies, such as Two and a Half Men, The Big Bang Theory, Family Guy, and The Office drove large audiences and high viewability for restaurant advertisers.

Many top food programs were noticeably absent. And the few food competition shows where restaurant advertisers invest, like Chopped and Guy’s Grocery Games, performed poorly. Also, while news is largely watched around breakfast and dinner times, restaurant advertising bought during morning and evening news programs showed low viewability.

Here’s a ranking from TVision on TV viewability. The metric is calculated as the percentage of TV ad impressions where a viewer is in the room for 2 or more seconds.

- 1. Chili’s

- 2. Red Lobster

- 3. Little Caesars Pizza

- 4. Jimmy John’s

- 5. Ruby Tuesday

- 6. Olive Garden

- 7. Outback Steakhouse

- 8. Arby’s

- 9. Dairy Queen

- 10. Starbucks

- 11. Golden Corral

- 12. Applebee’s

- 13. Chipotle Mexican Grill

- 14. Dunkin’

- 15. KFC

- 16. McDonald’s

- 17. Red Robin

- 18. Domino’s

- 19. IHOP

- 20. Denny’s

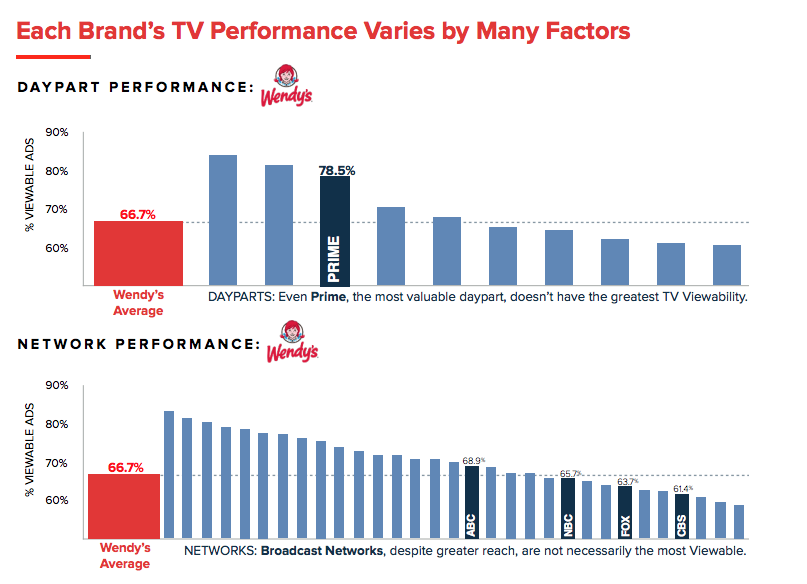

Let’s dive deeper into Wendy’s as a case study.

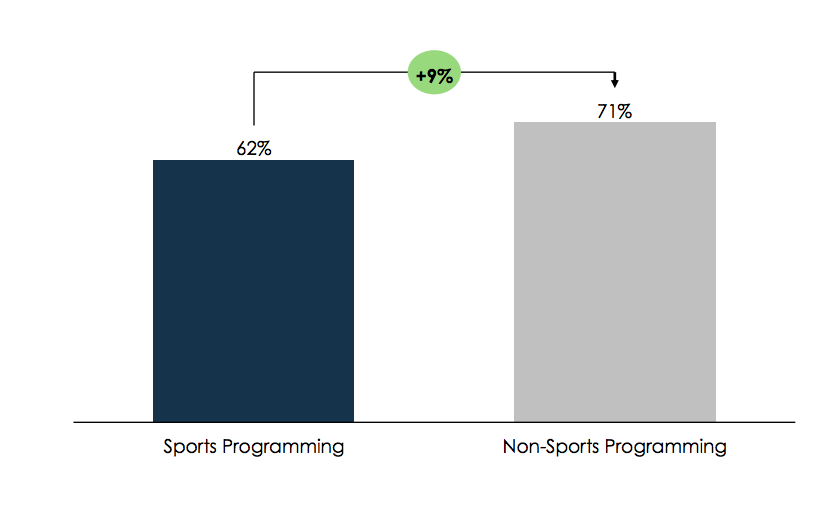

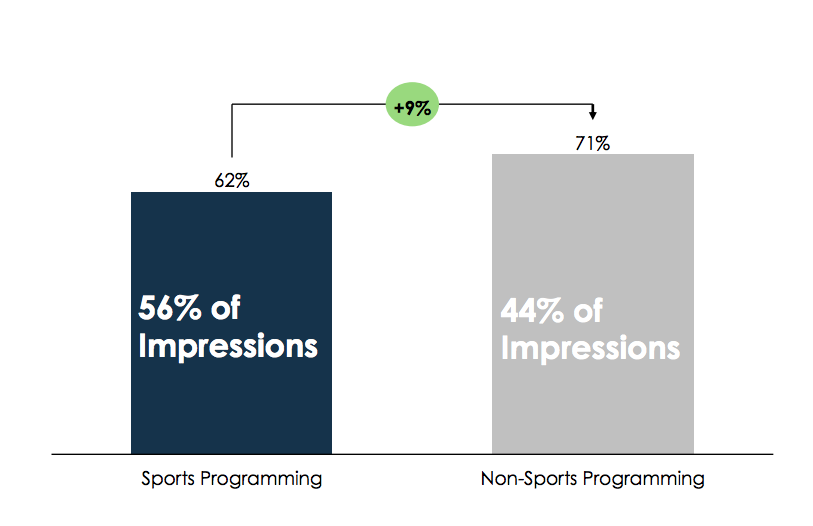

As the above data suggests, the burger chain performed a bit under the average. Why? TVision discovered that sports programming was 9 percent less viewable than non-sports programming.

That’s where Wendy’s aired more than half of its ads.

That was not the case for the top five quick-service brands studied.

The takeaways from this: for quick service, evening broadcast dramas and syndicated hit sitcoms resulted in high overall performance. Sports programming actually lowered Wendy’s TV viewability percentage. The chain is doing well during prime TV, however. So while sports is still a valuable media environment, this should be incorporated when planning and pricing high-cost inventory, TVision said.

The company also provided a second-by-second analysis of a recent Wendy’s ad about the “Biggie Bag,” deal. It shows how viewers paid attention. After viewability, the question turns to whether or not guests engaged with the ad by giving it their attention. This breakdown shows where Wendy’s spot resonated—clearly a hit with the 55-plus crowd.

Wendy’s “Biggy Bag” Commercial – Second-by-Second Attention from TVision on Vimeo.

TVision did the same for KFC and its “Fender Bender” commercial. Check out the results. It does a good job of showing how creative works for target demos, which is a solid place for any marketer to start.

KFC “Fender Bender” Commercial – Second-by-Second Attention – May2019 from TVision on Vimeo.

Wendy’s makes a marketing shift

Wendy’s reported North America same-store sales growth of 1.3 percent in the first quarter of fiscal 2019, building off last year’s 1.6 percent figure. Total revenue rose 7.4 percent to $408.6 million.

The marketing behind Wendy’s promotions is a critical element of its evolving menu strategy. The $5 Biggie Bag combo was part of Wendy’s shift to focus on platform launches over products, and deals that offer future innovation opportunity. Wendy’s menu architecture, unlike some chains in fast food, doesn’t target traffic through discounts on premium-end products. It has its core business and everyday prices—coupons, mobile offers, promotions, etc. But where Wendy’s differs is that it designs options for guests to climb the value ladder not tied to occasions.

However, Wendy’s lost share in recent quarters on the dollar front, the company admitted during its Q1 review, which meant it didn’t do as good of a job trading customers on once they decided to visit. Basically, customers came in for the deals and left after individual purchases.

So the $5 Biggie Bag and Made to Crave menu, which skews higher with options like the S’Awesome Bacon Cheeseburger, were important adds to Wendy’s construct, and, naturally, how it approaches marketing.

The Biggie Bag drove incremental traffic last quarter and also moved check higher thanks to a $5 price point over a bottom-rung one. Moreover, Wendy’s can now change products and price points within the deal and innovate around the brand more than the food choices themselves.

It all results in a balanced high-low strategy that doesn’t rely solely on deep value for visits. Brings customers in. Trade them up. That’s a healthy margin recipe and also one that pushes guests to the best Wendy’s has to offer, as its marketing sees fit.

“With organic same-restaurant sales at the forefront to drive a healthy restaurant economic model, which is job one, we evolved our marketing tactics to drive better mix results,” CEO Todd Penegor said in Q1.

Wendy’s marketing calendar was grounded in its strategy of “one more visit, one more dollar.”

Penegor said that notion creates a platform to capitalize on Wendy’s mix opportunity and drive comps, as well as margin. The chain began Q1 with its $5 Giant Junior Bacon Cheeseburger in January, introduced the Made to Crave hamburger lineup in February, and then finished the quarter with the Biggie Bag.

“I think you’ll see over time that there is a remix and a re-blending, so it doesn’t have to be all incremental. It will be what’s more effective and efficient, especially as we get more data and we start to move to the one-to-one communication, because it becomes more effective and your dollars work harder.” — Wendy’s CEO Todd Penegor.

Just like the Biggie Bag, Made to Crave is designed to fuel marketing opportunity. It lifted check and attracted traffic, and has much longer legs than a typical LTO. For instance, Wendy’s later infused Made to Crave chicken options into the construct. The company didn’t need to divert marketing spend to introduce and educate customers on an entirely new platform as it would with an LTO—it simply marketed another menu item in a familiar setup and price point.

Of both platforms, Penegor said, customers associate them with the Wendy’s brand (more sticky than a fleeting deal), and “we have already seen that awareness build,” he said. “These platforms will allow us to continue to bring new news in the future.”

Wendy’s marketing shift to a calendar more confused on mix did drop customer counts a bit. CFO Gunther Plosch said the hit was expected given Wendy’s rolled over a $1 Double Stack promotion that ignited significant amount of traffic last year.

Yet playing the mix game is an approach Wendy’s is willing to balance and trade short-term barrage traffic for. This has been a common approach for many brands lately in an environment where consumer spending is up but traffic is down. Trade transactions for healthy traffic and higher check, and a frequent customer.

“What I really like about the evolution of our marketing calendar is we’ve got three great platforms—we’re known for 4 for $4. We can continue to bring news, keeps it fresh and ownable. We’ve now got a Biggie Bag platform, whether it’s at a $5 price point or something else is called Biggie Bag, we can innovate into that platform to continue to trade folks up,” Penegor said. “And then to move folks up on to what our core strength is innovation and premium, we got Made to Crave lineup on both hamburger and chicken that creates a variety that can allow us to really cater to the needs of our customer to make sure that they’ve got the variety they need to drive frequency to come in a little more often into our restaurants. So, we feel good about the laddering our menu price architecture at the moment.”

Penegor said Wendy’s would continue to look at marketing mix, too, as it considers avenues of growth. Is that mainstream media? Digital media? Digital coupons? Delivery offers?

“I think you’ll see over time that there is a remix and a re-blending, so it doesn’t have to be all incremental,” Penegor said. “It will be what’s more effective and efficient, especially as we get more data and we start to move to the one-to-one communication, because it becomes more effective and your dollars work harder.”

What this suggests is that big data will adjust the entire marketing conversation in time. Restaurants in general will race to not just collect information but to also find actionable ways to flip customer activity into predictive results. And finding a way to reach guests in a personal way will separate a powerful message from just another voice in the crowd.

But no matter how much things change, some things won’t. TV, for one, won’t ever turn off its impact. It just comes down to paying attention.