McDonald’s CEO Kempczinski tried to temper CosMc’s expectations a bit at the company’s recent investor day, reminding people “we’re talking about 10 stores.” The bigger story was what the concept said about the chain’s innovation cycle and potential. It went from an idea to a test site in Bolingbrook, Illinois, in a little over a year. McDonald’s projects nine more by the end of 2024, with the Dallas-Fort Worth and San Antonio metro areas as Year 1 growth circles.

McDonald’s will then take a calendar or so to crunch results and figure what comes next, whether it’s more CosMc’s or pulling some learnings into traditional units. Or both.

In the larger scheme—McDonald’s has 10,000 openings on deck by 2027 as it races toward 50,000 globally—a 10-store pilot is, as Kempczinski said, a relatively small slice in a wider vision. But you can’t understate the buzz.

Reports had cars lining up as early as 3:30 a.m. for the Bolingbrook debut. At 6 a.m. when the lights flipped on, according to The Chicago Sun Times, 20 cars rolled in. By noon, the number was about 150. Police officers came down to direct traffic and one customer ran low on gas and veered out of line before getting back in. How long wait times were truly vary, but it appears guests sat in their vehicles for anywhere up to four hours to try CosMc’s offbeat, beverage-centric menu, from Sour Cherry Energy Bursts to S’Mores Cold Brews.

@snackolator CosMc's is already a hit and I've never seen anything like this before for a food place – the line wraps the entire shopping center a few times! I want to do more reviews of the @CosMcs food… but once it calms down a bit! Are you going to give it a try? #cosmc #cosmcs #mcdonalds #mcdonaldslife #fastfood #fastfoodlife #fastfoodtok #chaos #longlines #longline #holycrap ♬ original sound – snackolator

On the brand side, Kempczinski said McDonald’s wanted to mix into the $100 billion specialty beverage field, which comes with superior margins, and the store was also dedicated to solving the 3 p.m. slump.

Sharon Zackfia, head of William Blair’s equity research consumer group, visted the location multiple times since its Friday opening to size up where it fits in the competitive arena. Her initial thought was the likeliness of CosMc’s posing a “material threat” to either Starbucks or Dutch Bros was “relatively muted.” She gave three reasons:

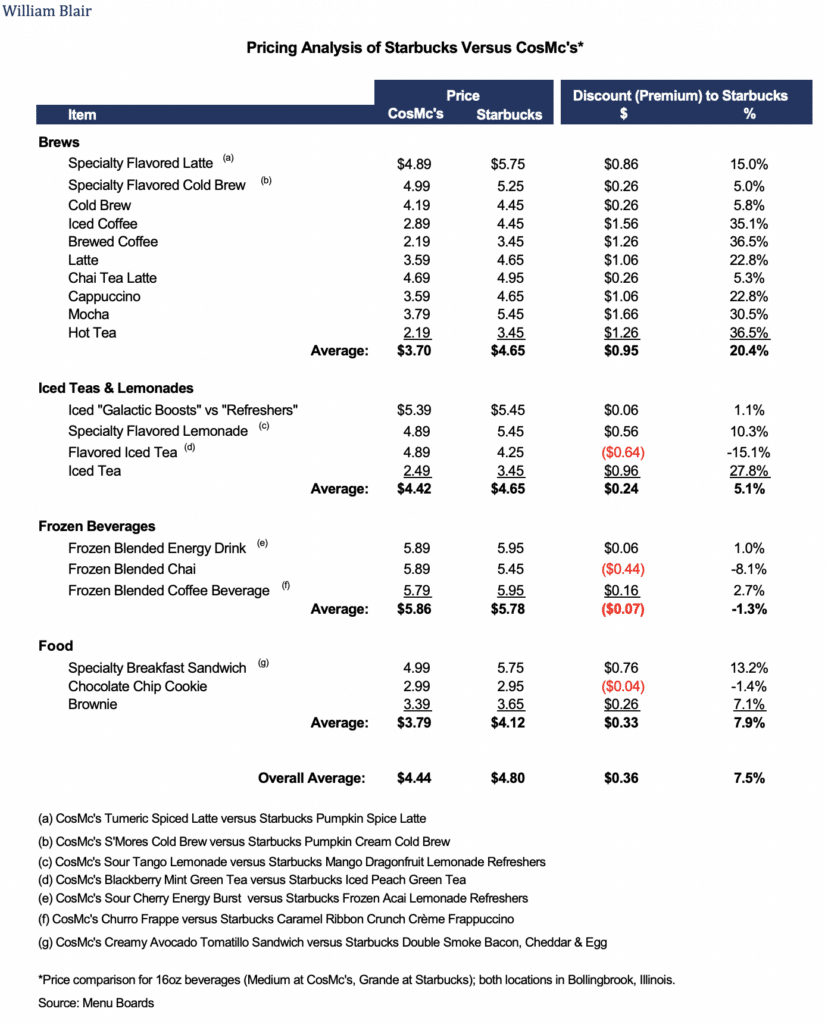

One, there was a fairly modest price discount of 7–8 percent compared to Starbucks (35 cents per item). The prices were largely on par for CosMc’s frozen options versus Starbucks’ Frappuccinos and Galactic Boosts versus Refreshers. The greatest discount (20 percent plus) came for beverages Zackfia labeled as not handcrafted, like McCafe, such as mochas and cappuccinos.

The second point was CosMc’s inherent lack of human interaction as a drive-thru-only, pay-at-the-stall format. Customers, as was widely shared on TikTok and other platforms, checked out at the order point. The four order points equated to a 16-car stack where consumers sat idle until their order was ready at one of three pickup windows.

Zackfia noted the approach marked a “material departure from the service-centric formats cultivated by both Starbucks and Dutch Bros.”

CHECK OUT THE FULL COSMC’S MENU HERE

Her final note was McDonald’s own statement the company was unlikely to replicate the wide variety of handcrafted CosMc’s beverages in the core brand given complexity and concerns about slowing speed of service.

The brand replaced slushies earlier in the year with frozen carbonated drinks.

Take a peek at the kitchen setup below:

Alright folks, a huge $mcd promo starts tomorrow with our McNugget Buddies (don’t forget to activate it $McD peeps)

— McFranchisee (@McFranchisee) December 11, 2023

You buy the “Adult Happy Meal” with a Big Mac or 10 pc and get the Kerwin Frost collectible.

🚨got this @cosmcs kitchen pic setup from a follower. Holy syrups 🚨 pic.twitter.com/wSKktY2oyi

CosMc’s manages the complexity with a different focus. The concept has its own website and mobile app apart from McDonald’s.

There are no grills or fryers in the spot and the exterior-facing wall is nearly entirely windows, per Fast Company. That means there are multiple spots to serve cars, but it also presents an open kitchen of sorts for customers to peer through. The food features options like a Spicy Queso Sandwich and Hash Brown Bites.

Guests, when their orders are ready, round the corner to pull up, where they receive food in gift-style CosMc’s paper bags. Naturally, there’s no dining room.

Ultimately, Zackfia said, CosMc’s appears to overlap more with Dutch Bros (there aren’t any Dutch Bros comps in Chicagoland yet), than it does Starbucks, thanks to the drive-thru-only format and focus on colorful creations that “we suspect will skew younger in consumer appeal,” she wrote in a note.

“A big difference, however,” Zackfia added, “is the proven appeal of Dutch’s customer-centric ordering model in which enthusiastic, friendly runners greet customers, explain the menu, suggest customization options, and take orders on tablets [in lieu of automated menuboards]—all of which stand in stark contrast to our experience at CosMc’s.”

Fast Company, which also toured the venue, said the crew was in training for two weeks and “surprisingly convivial as they prepped orders.” They wore CosMc’s-branded uniforms, including tees, bowking shirts, jean jackets, and customer Air Force 1 sneakers.

Dutch Bros is on the verge of switching leadership, with current president (and former Starbucks and True Food Kitchen exec) Christine Barone set to assume the CEO role in the New Year. Joth Ricci is stepping down.

Zackfia pointed out Barone shepherded a revamped food program during her time at Starbucks where she served as the java giant’s SVP of Food and Licensed stores.

That, coupled with the advent of CosMc’s, could push Dutch Bros to “reconsider untapped opportunities such as food,” Zackfia noted, while the brand continues to explore further ways to lift throughput. CosMc’s outline to drop into Texas will also run alongside Dutch Bros’ ramped-up efforts there— the brand debuted in the Lone Star State in January 2021, and it ended Q3 with 148 shops.

Broadly, Dutch Bros crossed the 800-restaurant mark in October. It had just 317 in September 2018. The company expects to open at least 150 restaurants this year, with 130 of those being company run. Dutch Bros began franchising internally in 2008 but elected to go corporate-only in 2017 with all operators recruited from within. The legacy franchise partners, though, continue to open shops in high-demand areas.

Either way, Dutch Bros wants to reach 4,000 locations in the next 10–15 years and boasts a pipeline of 325 qualified operator candidates, with an average tenure of seven years, it said. Only Starbucks and Dunkin’ are larger beverage chains in the U.S.

Where—and how—will CosMc’s factor in? Zackfia said CosMc’s current iteration is unlikely to follow a drop-and-repeat path. She suspects the chain will evolve the format in future tests. She felt the four-stall drive-thru format as laid out presently, at least thus far, was “fairly clunky, in particular the lack of forward movement associated with cars sitting at digital menuboards after ordering until the menuboard indicates which of the three pickup windows to move to in order to receive orders.”

“As a customer, the format provides no way to ‘eyeball’ how long the line might take to get through, which we believe could serve as a source of customer frustration once the novelty wears off,” Zackfia said.