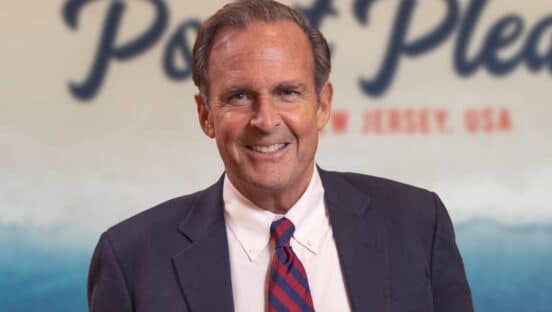

With No. 1 KFC, “we have our work cut out for us,” acknowledged David Novak, CEO of franchisor Yum! Brands. The daunting to-do list includes improving operations, consumer perceptions, and menu appeal. The home office is hoping to improve the appeal and service of units by providing additional field-level support. Already visible is the brand’s effort to be viewed as a bargain option, most clearly with the new value menu.

Meanwhile over at No. 2 Chick-fil-A there are big changes affront. Not long ago, the company could be pigeonholed as a sleepy Southeastern chain with little on its menu but fried-chicken sandwiches. Now it’s finding new roosts as far afield as California and Chicago, with products ranging from yogurt parfaits to a proprietary coffee. Sales topped $3 billion last year, putting it in rarified company. The one constant: Every store still shuts on Sunday.

| Segment Rank |

2010 QSR 50 Rank |

Chain | U.S. Systemwide Sales ’09 (millions) |

U.S. Average Annual Sales Per Unit ’09 (Thousands) |

Franchised/ Licensed Units ’09 |

Company- Owned Units ’09 |

Total Units ’09 |

| Chicken | |||||||

| 1 | 9 | KFC2 | $4,900.0 | $960.0 | 4,307 | 855 | 5,162 |

| 2 | 12 | Chick-fil-A* | $3,217.0 | $2,095.0 | 205 | 1,275 | 1,480 |

| 3 | 20 | Popeyes* | $1,597.0 | $1,057.5 | 1,539 | 37 | 1,576 |

| 4 | 26 | Church’s Chicken* | $835.0 | $680.0 | 975 | 287 | 1,262 |

| 5 | 28 | Zaxby’s | $718.0 | $1,581.0 | 406 | 86 | 492 |

| 6 | 31 | Bojangles’ | $659.5 | $1,556.4 | 296 | 163 | 459 |

| 7 | 35 | El Pollo Loco | $582.0 | $1,600.0 | 243 | 172 | 415 |

| 8 | 39 | Boston Market* | $545.0 | $1,020.0 | 0 | 520 | 520 |

| 9 | 56 | Wingstop | $306.6 | $744.0 | 425 | 23 | 448 |

| 10 | 72 | Wing Zone* | $56.0 | $580.0 | 96 | 4 | 100 |