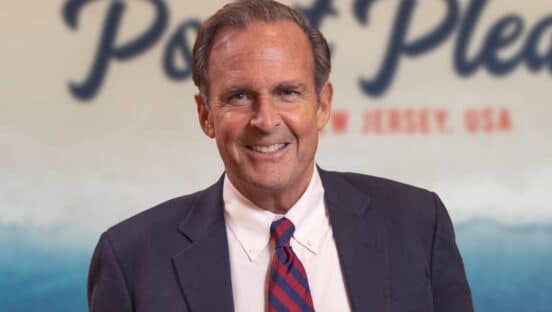

If you just hear Jersey Mike’s growth agenda, it sounds aggressive, CEO Peter Cancro admits. In 2024, the sandwich chain expects to open 350 locations. The same figure, or thereabouts, is on deck for the following year. Then, come 2026, the real breakout—400, 450 openings before settling into a cadence of 13–15 percent annual unit growth after that. We’d be talking 10–15 openings per week for a brand (then called Mike’s Subs) Cancro acquired in 1975 at 17 years old—famously too young to legally slice a sub—with a $125,000 loan backed by his football coach. Or, viewed from above, 5,000-plus domestic locations within five years on the road to 10,000 stores.

These are growth targets Cancro hasn’t shared previously. But one thing that’s become widespread knowledge in recent years is Jersey Mike’s isn’t a company that deals in superlatives. “Whatever we say we’re going to do, we do,” Cancro says.

In the fall of 2021, Jersey Mike’s projected it would open 250 restaurants. It debuted 246. Cancro noted then the ensuing goal would be to reach 300 net openings in 2022. Jersey Mike’s posted 297, which was more like 308, he explains, when you consider relocations and semantics of development. And this isn’t flashing by: Jersey Mike’s expanded by 1,055 restaurants in the last five years.

Yet Cancro has a vision, not entirely tied to unit counts, where Jersey Mike’s would “really be cooking with gas, as Ray Kroc would say.” It’s a perhaps-less publicized element of the brand’s journey through this surge, and one that began in the thick of the pandemic.

Jersey Mike’s average-unit volumes in 2019 were $824,000. It exited 2022 at $1.210 million and sits closer to $1.35 million today, Cancro says. This while taking price of about 9 percent—well under much of the counter-service and sandwich field, where 20-percent plus bumps haven’t been uncommon.

In true sandwich guru fashion, Cancro often refers to throughput as “bread a day.” He used to average 300 per at the original shop in the sea-side town of Point Pleasant, New Jersey. In the summer, it could be as high as 850 giant loaves. And that was in an 8,000-population town where residents couldn’t see the location from the road and awareness circulated through age-old methods. Currently, Jersey Mike’s and its 2,400 or so units are at about 170 bread per day. That’s up from 130. Get to 200 and AUVs would be roughly $1.75 million. Three hundred? “Come on,” Cancro says.

Jersey Mike’s $1.21 million number last year was already rare-air territory. Jimmy John’s achieved $900,000; Firehouse $924,000; and Subway about $510,000.

“We kept our pricing in check pretty much,” Cancro says, “and, all-in now, if you look at it from April 2020, gosh, we’re up 60 percent. That’s one, two, three years, we’re up 60 percent. … Pretty incredible.”

Same-store sales this year tracked about 11 percent higher. Again, it’s a multi-faceted tale that began, Cancro says, when the cards were drawn.

A week into COVID’s March onset, Jersey Mike’s sales tumbled 45 percent. Cancro woke in the middle of the night. It’s not in his makeup to let fate be. He grabbed a pen and wrote two commercials.

Cancro directed and starred in both—something he hadn’t done in five decades. Since the company’s typical sports slots had shut down, Jersey Mike’s bought airtime during news programs. The message Cancro offered viewers wasn’t about Jersey Mike’s product or even the fact its lights were still on. He talked about giving back, what Jersey Mike’s was doing to help out, and asked for the world to join “in the true spirit of Jersey Mike’s.”

This was March 26. All chaos included, by the time 2020 closed, only two of the top-eight grossing sandwich chains in America had managed to grow. One was Arby’s (which sells a lot more than sandwiches), at a net of 10 units. The other was Jersey Mike’s, and it tacked on 189 stores, third only to Starbucks (287) and Domino’s (229) of any restaurant brand nationwide.

Cancro recently pored over awareness data and Jersey Mike’s clocked in over 90 percent. “You look at all the chains, including Panera and Arby’s, and we’re ranked with everybody,” he says. “We’re leading them all in most indicators.”

“The awareness really struck me,” Cancro adds, “how people knew who we are, even though we’ll finish up this year with 2,700 stores.”

One of the things that’s fueled Cancro over these 50-plus years, from the day he started working as a 14-year-old at Mike’s Subs, wrapping subs and waiting until the milestone they’d let him start slicing, to buying the brand instead of attending The University of North Carolina at Chapel Hill to become a lawyer, to 2020’s commercials, is that Jersey Mike’s awareness isn’t only a visibility game. Any chain can light the marketing powder and introduce itself, Cancro says. But are you truly differentiated enough to hold somebody’s attention?

Jersey Mike’s DNA is as split from peers as recent results are. The sandwich shop slices fresh or grills to order and uses whole muscle product and USDA choice top rounds. All of its offerings are more akin to local mom-and-pop delis than four-digit restaurant franchises. “They see us as a chain, but we don’t feel like a chain,” Cancro says. “Keeping that going—that’s one of the big things. No one’s doing it. Everybody is pre-sliced. [Other brands’] steaks come out of a bag and are put in a steam tray. People can see the difference. Can taste the difference.”

“Seeing the difference” is a literal notion that extends beyond the subs themselves, which, adding to the record, are never weighed at Jersey Mike’s.

In early 2020, pre-crisis, Cancro and the brand made a pledge that had industry pundits squinting at the headlines. It would pay for all franchisees’ upcoming retrofits at $75,000 per store, or a roughly $150 million investment in the system. Jersey Mike’s also introduced a Coach Rod Smith (the same youth football coach and local bank executive who loaned Cancro money) Ownership Program that would give managers an opportunity to become store owners with financial and training support. The brand last retrofitted units during a 2009–2011 stretch. While it paid for the majority of that as well, the bill totaled only $15 million.

This $150 million deal started in January 2020 after Cancro conducted a 25-city tour and met an average of 250 people per stop. Owners, managers, assistant managers, and even crew members showed up. Each time, he would save the kicker—that Jersey Mike’s was going to foot the bill—for last.

Cancro says onlookers told him to stop in March and April when the pandemic pumped equals parts uncertainty and financial hardship into the sector.

Cancro saw it differently. No dining rooms? Seemed like a good time to strip seating and gut stores. VP of construction Rodney Taylor and Jersey Mike’s completed the brand-wide project in a year and a half. “First franchise company in the history of franchising, as far as we know, that paid for everybody’s retrofits;” Cancro says, “that invested that much money. Most franchisors are taking off the table.”

It can be difficult to measure same-store sales with retrofits. Generally, the rule of thumb is remodels hike comps 10–15 percent. California was the first Jersey Mike’s market to do so and the line bumped 15 to 20 percent in some cases, right out of the gates. New floors. New counters. New tiles on the backline. “Everything,” Cancro says. “It wasn’t just a façade thing. We gutted the place.” Jersey Mike’s stores would shut down on Sunday night and reopen Saturday.

While there’s little question the fresh look and flow helped jolt and sustain sales, it strengthened something else within Jersey Mike’s trajectory. Of that current growth path mentioned earlier, 83–85 percent is coming from existing owners buying additional stores. In a lot of cases, operators are sponsoring managers to get involved as well.

Put simply, Jersey Mike’s inspired loyalty where it mattered most—the pipeline.

There’s a ground swell at work, too, which can be traced back further. Cancro recalls listening to Starbucks founder Howard Schultz proclaim the java giant was going to become a training company. If Jersey Mike’s wanted to scale as a consumer-centric business, it needed people and systems that would empower it to take care of guests.

In 2021, Jersey Mike’s paid its managers over $100,000 at corporate units, with a good chunk of franchisees following suit and raising compensation during a time when COVID rattled workforce expectations. Previously, it was closer to $75,000–$80,000.

Today, the average is $125,000, Cancro says. Some are nearer to $150,000. Managers work 53–55 hours per week, are off Sundays, and work half-day Saturdays. There’s no alcohol in restaurants. No fryers. “Good quality of life,” he says. “That’s the quarterback, center mid, point guard of the store.”

Returning to the training note, Cancro recalls a conference room meeting in 2022 where Jersey Mike’s just posted a calendar of stellar results. He asked if everybody was done celebrating.

The follow-up, Cancro told the team, would be an unprecedented training curriculum. In July, about 150 top trainers flew to The Breakers Palm Beach Resort in Florida. Clemson football coach Dabo Swinney spoke. “We treated them royally,” Cancro says. “We talked about our future, our growth, and how in 2023 we had to double down.” This past year, Jersey Mike’s did the same with district managers, those in charge of three, five, 10, 15 stores.

“Had big groups and meetings and live discussions about what is our purpose,” Cancro says. “Are we going to be UPS drivers and just deliver things and put out fires? Or are we going to really try and help them grow?”

“What’s their schedule? How are they doing that?” he continues, speaking of operators. “Are they making the product fresh? How is their speed of service? What about third-party delivery? How do we execute that better? And just, what should they do to go in and help stores help that manager.”

A well-worn Cancro mantra is the cultivation of a “nucleus.” Like he noted, it’s the idea of feeling small as you get big. The product and execution should resemble your community shop more than a corporate flood. With training, these localized restaurants learn and grow together and answer to somebody who’s always nearby and available. This way, every location in Jersey Mike’s burgeoning fleet has a base of support in addition to the corporate arm.

At the end of June, Cancro asked trainers what they were doing now. They were back directing groups of people, going store by store, overseeing sprinkling, wrapping, slicing, and talking about all of it.

Given Jersey Mike’s isn’t weighing subs or using pre-packaged product, each order is a technique that has to be taught versus streamlined. “To craft that,” Cancro says, “you’ve got to have major, major, nonstop training.”

The brand in July collected all of its area directors for the first time, plus accompanying teams, and checked in on stores. “We talked to them all as a group,” Cancro says.

Broadly, it’s an ongoing process that anchors Cancro’s long-view goals. Why Jersey Mike’s doesn’t see a ceiling after its most robust growth stretch yet is because it’s not complacent. “We don’t let up,” Cancro says. “We don’t feel like we’re this major success. We’ve kept it humble. We’re pushing harder than ever on the details, on the basics.”

And much of that starts at the top. Cancro recently dropped into an Auburn, Alabama, location on a Sunday morning. He told them he worked in the office but didn’t reveal his title. Cancro put on a uniform and started slicing (he claims to still be the fastest in the company). As the rush began to approach, the owner and Cancro met and spoke about what was working and how the employees bought in.

“That’s kind of the point we’re at,” Cancro says. “Go to any store. We don’t target them. Just go. Tap and walk in and don’t call ahead of time. They were doing a pretty darn good job.”

As Jersey Mike’s has cultivated its core and prepared for the future, it’s evolved in places, too. It spent nearly $185 million on IT and infrastructure. Just Jersey Mike’s app was a $20 million-plus investment. That fortuitously finished in the summer of 2019 and positioned the brand for many of its COVID pivots, like takeout at the door and curbside pickup. Units now have another counter and slicer so off-premises tickets are made on the back line away from dine-in guests. Jersey Mike’s didn’t want people who showed up on-site to have to queue beyond an invisible customer. It was overseen by company exec Hoyt Jones, who once led thousands of Domino’s as EVP of U.S. franchise operations. “Believe it or not, a pizza guy gave us the idea,” Cancro quips.

Naturally, Cancro’s role has morphed across the journey. It’s increasingly rare in foodservice to see leaders with tenure anywhere near the orbit of Cancro’s. He used to land in a city and go see 15 stores or so per day, drop into a market and simply check out the scene. Now, he’ll head to a region and there’s 250 managers, assistant managers, owners, etc. Cancro can’t go one-by-one, so he’s taken to hosting town-hall style gatherings with Jones, CMO Rich Hope, and other leadership to talk about what’s going on. After, they’ll roll the buffet out and Cancro will sit at every table and talk to every person, he says. “I’m downing waters for like three hours, just talking to everybody and shaking hands.”

Jersey Mike’s held its latest national meeting in March in Disney. More than 3,000 people showed. Four charity partners attended to talk about the benefits of working with Jersey Mike’s and the football family of Archie, Eli, and Cooper Manning took the stage as guest speakers. So did brand spokesperson and commercial star Danny DeVito and Keith Urban, whose bandmate once worked at Jersey Mike’s.

These kinds of events, the tying emotion, purpose, and collective pull forward, are part of what’s keeping Cancro activated when it comes to doing it all over again tomorrow, he says. The same is true of stories like area director Daniel Watts, who began when he was 21. “Just to see these young people rising up, that’s really exciting for me,” Cancro says.

Yet no story of Jersey Mike’s can be complete without getting into its beating center. When Cancro was in high school, he watched two Point Pleasant businessmen, Bob Hoffman of Hoffman’s Ice Cream, and Jack Baker of the Lobster Shanty, give back to local causes. He was the recipient of one program and knew one day he’d pay it forward.

Jersey Mike’s is arguably best known on this front for its Annual Day of Giving. It’s really a Month of Giving, but the spotlight is on one full shift—March 29 this year—where stores donate 100 percent of sales, not just profits, to local charities. Jersey Mike’s broke its own record by donating $21 million to over 200 organizations. It was the 13th annual version of the event—a period that’s seen the sandwich chain give back north of $88 million.

What bystanders often don’t realize, though, Cancro says, is charitable donations and participation are not mandatory clauses for operators. “People just do it,” he says.

In 2022, Jersey Mike’s raised $20 million for the Special Olympics USA Games and State Programs. That was well ahead of the previous year’s Month of Giving collection of $15 million. So it’s a significantly elevated bar Cancro doesn’t expect to lower anytime soon, especially as the brand adds hundreds of locations each year.

“Everybody says, boy, Lord please give me a check and I’ll be able to do a lot of good,” Cancro says. “But at this point now that’s really satisfying, huh? To be able to do that. Everybody gets it. All the workers. All the teams. All the crews. At the national meeting, it was just, ‘wow.’ Everybody was talking about it.”

Jersey Mike’s linked up with the USTA Foundation in 2022 to support its “Rally for the Future” campaign, which powers the group’s nationwide network of National Junior Tennis & Learning chapters, and did so again in September, when it expected to raise $5 million in one weekend.

More recently, Jersey Mike’s began to help Best Buddies International, which offers one-to-one friendship and leadership development programs for individuals with and without intellectual disabilities. “When you ask about what keeps me going in the game, it’s that and the young leaders in our organization and the crew and the up-and-coming people,” Cancro says. “It’s the opportunities we’re creating for so many.”

All these tenets are why Cancro feels Jersey Mike’s will climb toward 10,000 units without drifting. There are cautionary tales aplenty in sandwich history of brands that rose in a blur only to crash as quickly. Cancro says, no matter how big it scales, they’ll stay involved. They’ll invest in training. Jersey Mike’s still helps franchisees pick locations and vet the dirt. Each Jersey Mike’s has its own rights that corporate doesn’t infringe upon. Units are at least 2 miles apart, and the runway to fill that in remains vast, Cancro says. They’ve invested money in data to reveal population and traffic counts and potential whitespace, which is where the 10,000 dart came from.

Cancro adds international operators, U.K. and Canada in particular, have expressed interest and could be in the brand’s future. “Here we go,” Cancro says. “And how are we getting there? By the basics, the fundamentals. [But also], I think the reason we’re rising up is people come in and try us and go, ‘really, we’ve never had a submarine sandwich like this.’ And that’s where we say the red and white vinegar, the olive oil, the oregano, we’re the only ones who ever did that.”