Taco Bell’s two-story, neon purple-lit “Defy” arrived with a bold objective: Get customers through the drive-thru in two minutes or less. When franchisee Border Foods built the 3,000-square-foot showstopper in June 2022 in Brooklyn Park, Minnesota, it triggered a tidal of social chatter. Was this the most ambitious prototype ever built in fast food? The buzz was so constant, Border Foods cofounder and CEO Lee Engler said at the time, the only thing that kept Defy from hitting its projection was guests slowing to take videos instead of putting in orders.

As eye-catching as the design, with its lift system and four-lane setup, was, the methodology fit. “Our customers are digitally savvy, so we created digitally forward restaurants that simplify ordering and alleviate the increased drive-thru traffic,” says Matt Shaw, Taco Bell’s chief development officer. The chain’s digital sales grew nearly 35 percent, year-over-year, in Q2 2023. So the opportunity Defy aimed to crack was twofold, and orbited by COVID-19’s acceleration of trends: Restaurant customers were suddenly more comfortable with tech in their ordering process; and drive-thru’s elevated usage amid lockdowns created a habit that’s endured.

For the first time, QSR, in tandem with Intouch Insight, added an extra layer to its Drive-Thru Report to take stock of the asset battleground. Or to frame it differently, does a revolutionary build like Defy answer the call?

We drove through the location (pictured above) 25 times to find out. We did the same with McDonald’s Fort Worth, Texas, small-format prototype that debuted in December with an order-ahead lane for customers to receive food via conveyor. Although the unit garnered a bevy of headlines for being an “automated restaurant” early on, it’s not a people-less operation by any means. The order-ahead lane deploys technology McDonald’s said enables employees to begin preparing customers’ orders when they’re near the restaurant. There are also kiosks, which accept cash and credit, for consumers to place orders to go, as well as a pickup shelf. Outside, McDonald’s built parking spaces dedicated to curbside order pickup alongside designated blocks for delivery drivers.

In addition, Intouch Insight rolled through Chick-fil-A’s Alpharetta, Georgia, location on Old Milton Parkway that invested in robotic delivery from Refraction AI.

RELATED:

After sharing results, we’ll get into the overall QSR© Drive-Thru Report, which will paint a portrait of how flashy innovation complements the category’s hallmarks, and where they’re starting to mesh; what challenges remain with these evolutions, and how traditional drive-thrus are learning from revolutionary ones to lift the tide industry-wide.

Shaw says Defy created the opportunity to serve more Taco Bell customers and provide two to three times the throughput of standard restaurants thanks to an increase in ecommerce sales. “And it’s not just fans who love the Taco Bell Defy experience,” he says, “it’s team members, too. Taco Bell Defy continues to maintain a steady application flow.” Defy boasts four production lines versus the two Taco Bell generally features. It’s not, despite what some might assume after pulling through a contactless experience, a less-labor intensive operation. Rather, Defy is a restaurant built to improve speed, not replace people.

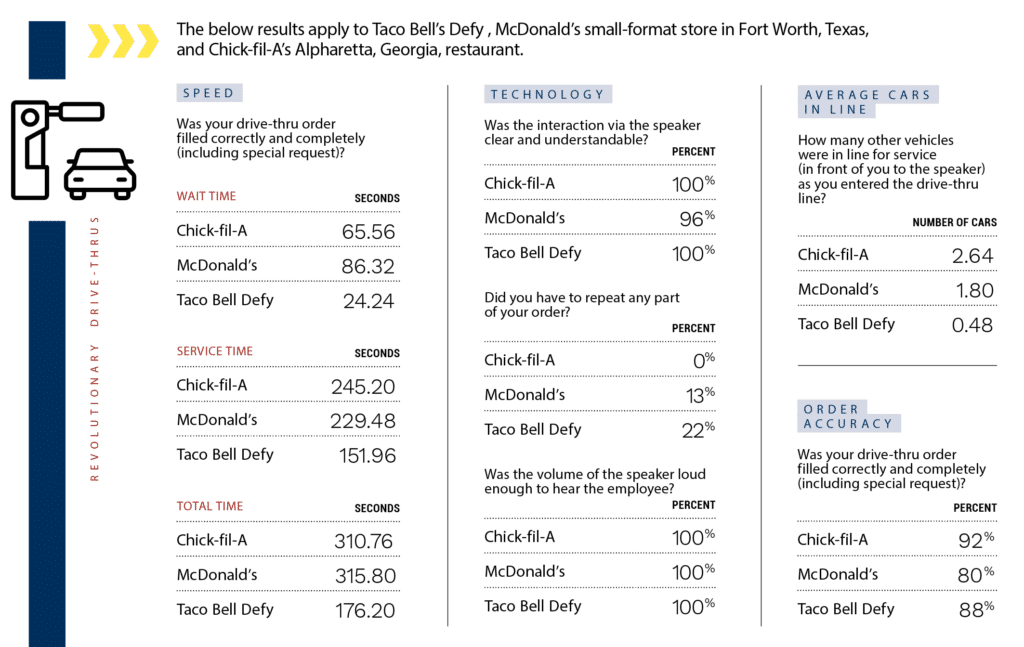

In the 25 trips, the average wait time (from arrival to order) for mystery shoppers was 24.24 seconds. The service time (from order taken to order received) was 151.96 seconds. The total time was 176.20 seconds.

For perspective, non-Defy Taco Bell locations tested in this year’s Drive-Thru Report posted comparable results of 73.49, 205.35, and 278.84 seconds.

Defy might just be the fastest traditional (not just a pickup window) drive-thru in America.

What’s worth spotlighting, however, is the cycle of innovation needs refinement. McDonald’s, for instance, lost 8 percentage points in order accuracy as it gained nearly 100 seconds in total time.

And while these restaurants are blazing trails, they’re as much pilots as signals of future development. “Despite being the most ambitious concept in Taco Bell’s history, the company is taking Taco Bell Defy’s learnings and exploring how we can integrate the successes into future builds,” Shaw says. “The restaurant was an industry-wide lesson to embrace the digital age and, at Taco Bell, we see this technology as a tool to interact with our fans.”

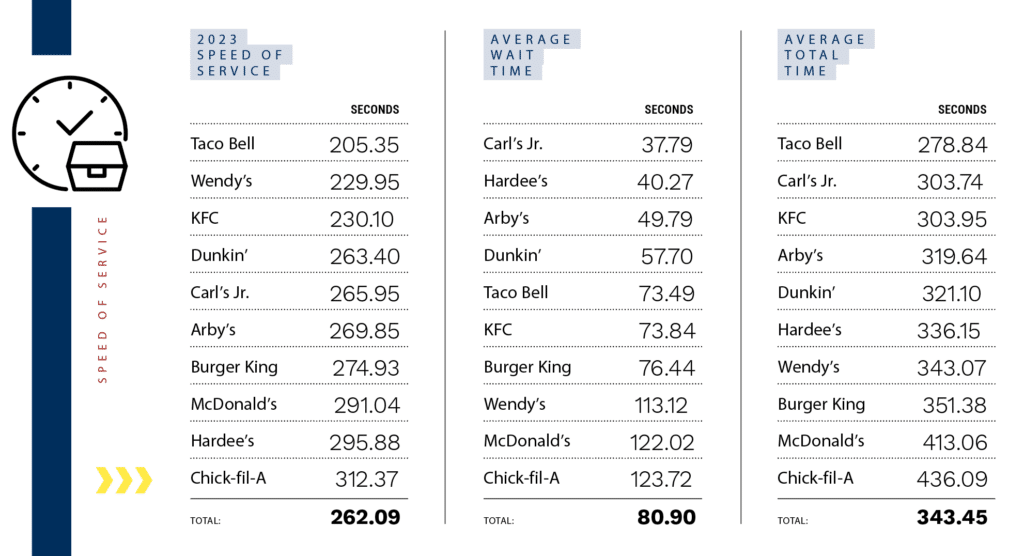

For the third straight year, Taco Bell was the fastest drive-thru in the industry. And it has new “Go Mobile” prototypes coming to market.

An example is Taco Bell’s “Go Mobile” concept. Introduced in August 2020, it’s a framework built around improving drive-thru experience through additional access points. Shaw says Taco Bell has since “learned a lot.” Some tools that worked, in particular, are access points via its loyalty program, Go Mobile’s order-ahead capabilities, curbside pickup, and the expansion of physical drive-thru lanes. “While Go Mobile is not the only contributor to success, the uptick of rewards members visiting Go Mobile locations is certainly something we’re excited by,” Shaw says, suggesting the very bones of Taco Bell restaurants can now influence how customers choose to interact with the brand. Go Mobile gives guests a reason to engage on a deeper level than traditional rewards and discounts—convenience and faster access is part of the draw, too.

More recently, Taco Bell unveiled a Go Mobile design that’s the brand’s first small-box iteration. It touts limited dining space and more digital touchpoints than any other store in the fleet. The first opened in March in El Paso, Texas, and provided solutions for drive-thru bottlenecks created by the increase of mobile delivery orders and drive-thru popularity. There’s no indoor dining area and Taco Bell added dedicated parking for mobile or delivery orders. The unit also includes an outdoor pickup window and grab-and-go shelves. Another opened in Columbus, Georgia, and, likewise to some of Defy’s learnings, will carry elements into future builds.

Clearly, Taco Bell has speed on its mind. For the third consecutive year, the brand topped the QSR© Drive-Thru Report’s total speed chart. This time, at 278.84 seconds, a pretty sizable gap from Carl’s Jr.’s No. 2 result of 303.74. Taco Bell was also the pack leader in average service time at 205.35 seconds, ahead of Wendy’s 229.5. Wendy’s, as we’ll explore further, was one of this year’s big drive-thru winners. The brand ranked in the top five in four out of five categories a year after doing so in just one field.

A common theme across the 2023 drive-thru sector appears to be streamlined operations. Pulsing fixes like AI and voice ordering are as much a tool to improve employee experience as they are to correct the labor line. Traditionally, many of quick-service’s mistakes occur at the order-taking point of a drive-thru. An employee is trying to listen to a guest, input, prepare, and fulfill while watching a line of cars queue around the building.

Taco Bell rolled a Touch Kitchen Display System that gives workers the ability to prioritize orders based on size and complexity, obtain cards that explain how to build the meal, and share orders with other employees. The system was expected to be live in most units by the end of 2023. Taco Bell is simultaneously working on a new open kitchen floor plan to improve efficiency. Touch KDS, like Go Mobile, debuted in 2020.

“Due to the ease of Touch KDS, we increased our efficiency and accuracy, which contributed to Taco Bell being named the fastest drive-thru for the past [three] years by you all at QSR magazine,” Shaw says.

He adds customer and team member perception have become the most important measures of success Taco Bell actively tracks when it comes to the drive-thru. It’s no coincidence they hold hands with accuracy, hospitality, and speed.

The Chick-fil-A paradox continues

Even before COVID, the definition of “speed of service” was a difficult one to pin down. Was it still the end-all of drive-thru? In a customer’s view, where does it begin? When you arrive? When your order is taken? Is there more leeway for one category or the other? The overall total time in the industry this year was 29 seconds faster than 2022 at 5 minutes and 43 seconds, with the biggest drop taking place in wait time (25 seconds lower), which came in at 1 minute and 20 seconds. Wendy’s alone jumped to 113.12 seconds from 170 seconds.

It’s no grand mystery to see quick-serves stress this specific metric. QSR’s survey data last year showed guests would wait six minutes prior to ordering. After that, there was a clear move to pull off the line and head somewhere else.

In some ways, this is where the magic of Chick-fil-A’s drive-thru experience ignites. It’s become a common sight to see the brand at the bottom of QSR’s total time ranking. But it’s hardly a negative truth. Chick-fil-A’s drive-thru is a long-running amalgam of perception, execution, and customer experience delivered at unrivaled volumes.

The brand’s freestanding drive-thrus ended 2022 with average-unit volumes of $8.676 million. Perhaps more impressive, 48 percent of the system reached that mark or higher. One operator was at nearly $17 million.

As usual, there are a few levers at work. Chick-fil-A takes a guest’s order via tablet in-line and then conducts hospitality checks throughout the process. So from a perception standpoint, customers don’t feel unattended to or like they’re stagnating, despite how lengthy the line might get. The other, less nuanced fact is Chick-fil-A simply has a lot more cars stacked than the rest of the industry.

This year, to help illustrate the dynamic, we created an average total time per chain by vehicles in line distinction. It takes the average cars mystery shoppers saw at pull up and, using total time of service, calculates to uncover how quick the brand is funneling vehicles forward relative to the crowd.

In this view, Chick-fil-A’s superpower settles into focus with a time 48.32 seconds faster than Taco Bell’s Defy.

A year ago, Chick-fil-A was beginning to try Mobile Thru drive-thru lanes and looking at ways to alleviate what’s the densest capacity in America. Matt Abercrombie, senior director service and hospitality at Chick-fil-A, says the brand continues to expand the option and tacked on additional stores this fall. “This shift helps customers who prefer to order ahead in our app to receive their meal more quickly in their preferred service channel, the drive-thru. We are also finding that many guests choose to switch between service channels depending on their daily needs,” he says. “We are continuing to meet those needs through various channels, delivering a great customer experience no matter their preference.”

One example is Chick-fil-A’s upcoming elevated drive-thru that plans to open in 2024 in the chain’s homebase of Atlanta. The four-lane, two-story concept includes dedicated Mobile Thru and traditional drive-thru lanes.

When Chick-fil-A lifted the lid on the restaurant in July, Khalilah Cooper, executive director of restaurant design, noted similar themes to Taco Bell’s Shaw. In some markets, digital orders comprise more than half of sales at Chick-fil-A. “So we know,” she said then, “our customers have an appetite for convenience.”

The headliner of Chick-fil-A’s rendering was the detail it could house 75 cars at once. The kitchen is built above the drive-thru lanes. Meals are expedited to employees who then deliver orders directly to guests in a space protected by the upper level. This way, human interaction remains at the heart of Chick-fil-A’s core experience.

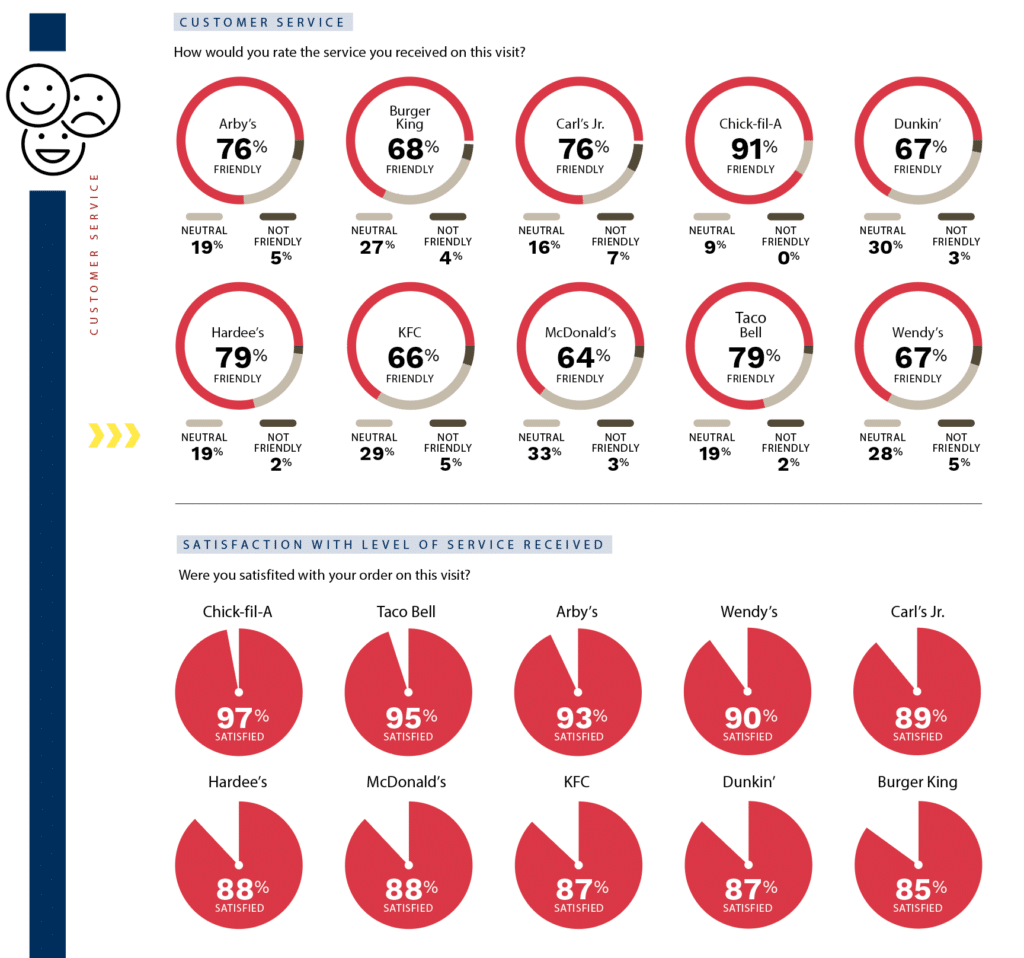

Speaking of that, Chick-fil-A, as it has throughout the history of QSR©’s Drive-Thru Report, topped the customer service chart with a friendly rating of 91 percent. No other brand was above 79 percent.

At 92 percent, Chick-fil-A was also the most accurate brand in the Report. Wendy’s made yet another huge jump here year-over-year—from 79.40 to 87 percent.

Overall, order accuracy for the chains tested was 86 percent, a 1 percent bump from last year. But here’s a very Chick-fil-A-like point to underline: Order accuracy was 18 percent higher when there was friendly service compared to not friendly service. And yes, it made the experience faster, too: total time was 30 seconds better when employees delivered friendly service.

It’s not a convoluted point: overall satisfaction was 84 percent higher when there was friendly service and overall satisfaction lifted 20 percent when the order was accurate. You generally can’t achieve speed or accuracy at the drive-thru without having employees who care about the guest experience.

Abercrombie agrees employee well-being has become table-stakes in delivering across these fronts. It’s especially vivid when face-to-face ordering encourages personal connections, even at the drive-thru. Chick-fil-A invested in employee apparel that includes specialized clothing for heat, cold, and rain. Drive-thru canopies were installed in the majority of locations and the brand introduced specially designed enclosures for workers to have a sheltered space to rest and escape the elements.

“We are also actively collaborating with operators to develop new solutions to further enhance order-taking with the elements in mind,” Abercrombie says. “One approach we’re exploring will aim to remove team members from the outdoor elements during specific weather conditions, while simultaneously meeting customer expectations for quick, friendly, and efficient service.”

News of the two-story restaurant arrived alongside Chick-fil-A’s unveiling of a walk-up concept slated for New York City. This urban-market-tailored design allows guests to order ahead via the app.

Abercrombie says in-restaurant dining “remains the fullest experience of the Chick-fil-A experience” and it’s a real positive to see it race back into the fold. But the quick-service game is an omnichannel target in COVID’s departure.

“We know that every service channel meets a unique need, and we are dedicated to delivering a great experience and signature Chick-fil-A hospitality for every guest, no matter how they choose to dine with us,” he says. “Our off-premises channels—carryout, curbside, and delivery—are constantly evolving to meet the changing needs of our guests who prefer to dine offsite.”

“Dine-in mobile ordering [where a customer orders from their table] is also a unique and convenient way for our guests to dine with us without waiting in line,” he adds. “This unique channel allows our customers to take the time they need to order and customize their meals, and we look forward to continuing to improve upon and personalize this experience as we refresh dine-in mobile ordering in 2024.”

AI and the tech rush

Wendy’s enjoyed a resurgent drive-thru year. Speed of service, and operations in general, is a focus CEO Todd Penegor surfaced often on recent quarterly calls.

And it could crystalize further with Wendy’s Global Next Gen design standard, which was optimized to reflect the needs of today’s digital customer preferences while streamlining tasks for the crew, says Deepak Ajmani, Wendy’s U.S chief operating officer, in what’s visibly a repeating thread in this story. “We see technology and innovation as key ingredients to not only push the quick-service restaurant industry forward, but to deliver greater speed, accuracy and consistency our customers expect. As part of delivering a quality customer experience with every single visit, we constantly ask ourselves ‘how can we streamline the work of the restaurant team?’” Ajmani says.

Wendy’s Global Next Gen includes dedicated mobile and delivery pickup points and an enhanced drive-thru design. The first units opened in Kansas and Oklahoma less than a year Wendy’s announced the standard, and it has more than 200 slated to debut through 2024. Global Next Gen unlocks 400 times the capacity for digital orders through the Wendy’s app and third-party delivery.

In addition to developing cutting-edge blueprints, Ajmani adds, Wendy’s is exploring fresh approaches. Among them is a partnership with Google Cloud to automate drive-thru ordering with generative AI. This empowers crew to focus on key elements of customer experience, he says. “With every Wendy’s order, we remain committed to creating quality experiences and serving the hot, fresh Wendy’s favorites our customers know and love,” he says. “Ultimately, it’s our job to turn customers into Wendy’s fans—and we’re willing to put in the work.”

“By providing choices in how our guests interact with the brand, we can meet them where they need us, whether it’s through the app, drive-thru, kiosks, curbside, third-party delivery, or dining-in,” says Gagan Sinha, the SVP of technology at Inspire Brands.

On the AI topic, Wendy’s labeled the system “FreshAI.” As of August, it was testing in a corporate unit in Columbus, Ohio, with restaurant No. 2 on the way. Penegor said, echoing some of Defy’s aims, the tech isn’t about labor savings. Instead, “[it’s] about how do we reposition the labor within the restaurant to drive more throughput, drive speed and accuracy, and a better customer experience to drive frequency and repeat moving forward.”

Hardee’s and Carl’s Jr. parent CKE Restaurants delved deep into the AI arena. In May, the company expanded partnerships with Presto, OpenCity, and Valyant AI to spread automated voice ordering across the country. Phil Crawford, CKE’s chief technology officer, says the brands continue to make advances in upsell and meal add-on scripts to complement the ordering experience, not deter from it.

“So far,” he says, “we are excited about the results we are seeing, which are measurable changes in service exception, product quality, increased revenue, and a decrease in costs in drive-thru operations.”

Presto, a provider that works with Checkers & Rally’s and Del Taco, among others, piloted the tech with CKE going back to the middle of 2022. It says early pilots showed, on average, drive-thrus achieved an 88 percent upsell offer rate to guests. Additionally, more than 46 percent of the upsells offered were accepted by guests.

Crawford calls the potential of AI in hospitality “vast.” Beyond improving metrics digital-minded guests look for—efficiency, personalization, easy ordering—it can speed up service times by not putting diners on hold. Pull through the loop detector, place an order. It never takes a break. And employees can focus on making and handing out orders versus taking them and constantly trying to juggle life behind the window.

Crawford adds AI can be integrated with inventory management systems to suggest menu items based on real-time supply levels. Leveraging machine learning algorithms, AI also has the ability to up- or suggestive sell products based on promotions and past history. Things like dietary preferences. “This could boost sales while making customers feel individually catered to,” he says.

“Modern AI is getting increasingly good at understanding and interpreting human speech,” Crawford adds, “even with ambient noise or various accents. This makes it viable for use in drive-thru scenarios.”

And like loyalty and data programs traditionally reserved for email or website collection, AI at the drive captures and analyzes data from each transaction, pushing brands to better understand customers and make informed decisions.

But that’s not to say it’s a cover-all topic. In last year’s Report, more than two-fifths (45 percent) of polled customers said they disliked hearing an automated voice when ordering. Only 11 percent noted they wanted AI to help make ordering preferences, although 27 percent were interested in an ordering system that remembered their past history. The results were a bit disjointed, which isn’t all that surprising. In plain, it’s unlikely most of the respondents had even tried it yet. And to Crawford’s point, you have to consider where they saw it in addition to how it worked. What was their expectation of the chain and where did technology fit in? “Some quick-service brands may have a brand image centered on personal, human interaction, which might be diminished with the implementation of AI technology,” he says. “For these brands, it will be crucial to find a balance between tech-driven efficiency and maintaining their personal touch.”

Pal’s Sudden Service, as one illustration, is a chain that not only doesn’t use AI, it doesn’t even have speaker boxes, and it likely never will. One of the regional icon’s core equities is that customers pull up to a window and place orders face-to-face with an employee. Pal’s, by the way, claims to average 18 seconds at the handout window to place an order and 12 seconds at the drive-up window to receive an order. Pal’s also doesn’t suggestive sell and offers everything a la carte.

Crawford says brands need to consider demographics. There are certain markets and cohorts of guests that expect human interaction over an AI interface. Conversely, younger, tech-savvier groups might appreciate the convenience and novelty of AI.

There’s also the nuts and bolts. “The cost of implementing advanced AI systems can be high, and not every quick-service restaurant might have the necessary resources or see a satisfactory return on investment, especially in the short term,” Crawford says. “Smaller or less profitable quick-serves might find it more challenging to implement such technologies than large, well-established chains.”

“The success of AI implementation would require seamless integration with existing systems like POS, inventory management, and others,” he continues. “Some brands might have more adaptable systems than others.”

The dressed-down way to phrase all this, regardless of what broad-stroke trend pieces might predict, is the use of AI tech in the quick-service drive-thru is not necessarily an inevitability for all restaurants, Crawford says. Yet that doesn’t mean it’s not a promising avenue.

“Brands that can successfully navigate the potential challenges will likely find themselves at a competitive advantage,” he says. “The key will be in thoughtful implementation that enhances customer experience and operational efficiency without sacrificing the brand’s unique qualities.”

Stepping into the drive-thru of the future

It’s become evident in recent years that speed is not so easily defined. The definition needs layers. In some ways, you can blame the pandemic and the global shifts it prompted, from safety to digital adoption. There are also smart phones to keep diners busy in cars and how Amazon order procurement reset expectations for good. Consider mobile devices and the ability to order ahead. An order confirmation screen is now in the hands of nearly every consumer in America.

Case in point: Order accuracy in the QSR© Drive-Thru Report was 7 percent higher when the customer was asked to confirm their order on the OCB. It lifted 18 percent when the interaction via speaker was clear and understandable and 15 percent when the customer did not have to repeat their order. Order accuracy improved 11 percent when the volume of the speaker was loud enough to hear the employee as well.

You can’t even order a movie these days without getting an email prompt. That’s one reason why accuracy has become as vital an indicator of success as speed at the drive-thru, and essentially tied at the hip.

“While speed remains important, it may not be the ultimate king anymore,” Crawford says. “With the introduction of new ordering technologies and menu items, speed might be compromised in favor of other aspects such as order accuracy or menu complexity. Still, reducing wait times continues to be a major focus for quick-service restaurants.”

It’s a point Gagan Sinha, the SVP of technology at Inspire Brands, echoes. “Until recently, speed was the primary measure of success at the drive-thru. Today, we comprehensively analyze speed, convenience, accuracy, and a great guest experience to measure success,” he says. “Drive-thru traffic skyrocketed during the pandemic, and those rates have continued, so we are driven to provide a personalized, high-quality guest experience without sacrificing the perception of speed. This has led us to innovate around different lane configurations and restaurant formats, which unlocks the capability to handle the increased volume and deliver a winning experience.”

Thanks to mobile and online ordering, customers have grown accustomed to a high level of accuracy—and seeing receipts before the transaction is fulfilled. Accuracy is now an expectation of the drive-thru, Crawford says. There’s too much parity for restaurants to trade it off with convenience and expect customers to accept the deal.

Speed and technology, unsurprisingly, also form a symbiotic relationship.

In the Report, service time was a sizable 61 seconds faster and total time 58 seconds better when the volume of the speaker was loud enough to hear the employee.

Wait time was 8 seconds faster, service time 64 seconds, and total time 72 seconds better when the customer didn’t have to repeat their order.

Service time improved 59 seconds and total time 45 seconds when the interaction via speaker was clear and understandable.

In general, service time was 23 seconds faster when there was an OCB. The more stations in use, the slower the service and total time were.

“The ability to integrate with digital ordering platforms, apps, and contactless payment methods is now a significant factor. Customers appreciate the convenience and safety of these systems,” Crawford says. “Brands that seamlessly connect their drive-thrus with digital technology generally have an edge.”

Customer experience has become a holistic drive-thru approach. “This can include the friendliness of service, the ease of ordering, and even the physical design of the drive-thru,” Crawford adds.

And it’s also a matter of customization rising to new ideals, from the systems to the layout itself. “As we prioritize providing exceptional guest experiences, innovations like order ahead, loyalty programs, digital menu boards, and drive-thru-only restaurants offer us a chance to personalize their visit,” Sinha says. “By providing choices in how our guests interact with the brand, we can meet them where they need us, whether it’s through the app, drive-thru, kiosks, curbside, third-party delivery, or dining-in.”

At Inspire, much of the AI focus is tilting toward labor. Through identifying efficiencies and opportunities afforded by automation, chatbots, or other solutions, Sinha says the company can redeploy employees to other areas of the restaurant that are higher touchpoints with guests.

“For example, AI can use data on a restaurant’s historical sales, transaction volume, traffic information, order complexity, make times, and guests’ time expectations to help team members prioritize orders,” he says. “This frees them from the time-consuming responsibility of sorting through the noise and empowers them to make the best decisions. The more cumbersome tasks we can take off managers and team members, the better they can support their team and interact with guests.”

Inspire of late placed resources into expanding its delivery and mobile pickup areas, especially in locations with higher-channel demand, like college campuses and urban areas. “That is where our digital-only stores have been performing very well,” Sinha says. “By aligning across our key goals—guest satisfaction, team member satisfaction, and restaurant profitability—we continue to evolve our omnichannel strategy across formats.”

Amid all the innovation, Crawford says, some other consumer movements will take hold, like sustainability and contactless service. Physical drive-thrus are evolving as expectations climb, from high-quality graphics to locations designed to improve traffic flow and reduce congestion. Just as fast-food interiors refreshed to satisfy changing demand, the same is true of drive-thru aesthetics. You might even see virtual or augmented reality providing interactive experiences someday, such as virtual menu browsing or promotional games.

It’s a wide-open universe.

“The drive-thru of the future will likely be more technologically advanced, highly personalized, and eco-friendly, catering to a consumer base that values speed, convenience, safety, and sustainability,” he continues. “However, despite these advances, the essential goal will remain the same: to provide customers with a fast, convenient, and satisfying dining experience.”

The 2023 QSR® magazine Drive-Thru Study Methodology:

The 2023 Drive Thru Study ran from the beginning of June to the end of July. There were 1,491 shops conducted, with 8 percent (125) of shops completed during breakfast (5:00 a.m.-10:29 a.m.), 40 percent (592) of shops conducted during lunch (10:30 a.m. –1:30 p.m.), 12 percent (174) of shops conducted during the afternoon (1:31 p.m.–4 p.m.), and 40 percent (600) of shops completed during dinner (4:01 p.m. –7 p.m.). Shops were geographically distributed throughout the U.S. Below is a breakdown of shops per brand: Arby’s – 165, Burger King – 165, Carl’s Jr. – 85, Chick-fil-A – 166, Dunkin’ – 165, Hardee’s – 85, KFC – 165, McDonald’s – 165, Taco Bell – 165, Wendy’s – 165

The 2023 Drive Thru Study ran from the beginning of June to the end of July. There were 1,491 shops conducted, with 8 percent (125) of shops completed during breakfast (5:00 a.m.-10:29 a.m.), 40 percent (592) of shops conducted during lunch (10:30 a.m. –1:30 p.m.), 12 percent (174) of shops conducted during the afternoon (1:31 p.m.–4 p.m.), and 40 percent (600) of shops completed during dinner (4:01 p.m. –7 p.m.). Shops were geographically distributed throughout the U.S. Below is a breakdown of shops per brand: Arby’s – 165, Burger King – 165, Carl’s Jr. – 85, Chick-fil-A – 166, Dunkin’ – 165, Hardee’s – 85, KFC – 165, McDonald’s – 165, Taco Bell – 165, Wendy’s – 165

SPONSORED BY: