It’s no longer a question of whether or not the plant-based movement is here to stay.

With major quick-serve chains like Burger King, Del Taco, and Carl’s Jr. debuting permanent meatless alternatives, and even the likes of McDonald’s testing plant-based options, the heavy hitters of the industry have thrown their weight firmly behind the trend. And, in addition to recent adoption by several quick-serve giants, plant-based foods have garnered a core group of consumers that tends to be on the younger side. These customers aren’t going anywhere anytime soon; in fact, the youngest of these customers are on the edge of adulthood, and, likewise, of their potential buying power.

According to The NPD Group’s “Future of Plant-Based Snapshot,” millennials are the top consumers of the substitute proteins, followed by Gen X. Add in Gen Z—many of whom were raised by Gen X parents on plant-forward foods and beverages—and the customer base widens to include an even younger demographic. Based on the average age of the plant-based consumer, NPD predicts strong staying power for the movement.

“Gen Z is starting to use foodservice establishments, and they’re entering their early 20s, which is the life stage when we go out to restaurants most. I think as they reach adulthood, they will continue to support and expect plant-based alternatives,” says Darren Seifer, NPD food and beverage industry analyst.

And the movement isn’t building its foundation on a niche group of consumers. Seifer says 90 percent of consumers are neither vegetarians nor vegans, but instead identify as flexitarians. These flexible eaters will sometimes dine on a meat-free meal with better health in mind, and are looking to decrease their meat content, as opposed to cutting it out altogether. Seifer says a top health objective with this group is increasing protein without consuming meat.

“We’ve been slowly introduced to ways to eat more protein without more meat,” he says. “Now, we have brands that are allowing us this substitution without sacrifice. In other words, we can have a veggie burger or an egg substitute that tastes like meat or egg, but that still takes care of those health concerns, and we’ve never had that before.”

Getting to know the players

Each concept’s recipe for success is different, and before a company adds some plant-based or plant-forward options to the menu, it’s crucial to understand the movement.

Truly plant-based foods and diets are composed of 100 percent plants, while plant-forward is a catch-all term for dishes or diets that put plants in the center, like a blended burger patty created from a mix of diced mushrooms and ground beef or turkey.

The plant-based process varies from item to item. Famed meatless names like Impossible Foods and Beyond Meat are a popular—and perhaps the most talked-about—approach. These companies create alternatives using all-plant material in lab facilities, then ship them out to various supply centers, restaurants, and grocery stores. Impossible Foods’ beef replacement behaves identically to ground meat and can be served in a number of applications, including taco crumbles, meat sauce, and, most famously, burger patties. The gluten-free, halal, kosher, and cholesterol-free product is made from soy protein, potato protein, coconut fat, sunflower oil, and hem, which is short for hemoglobin, something that is found in all living things, including meat. Impossible produces hem from a plant source.

“As soon as it hits the grill, there’s a chemical reaction that produces a similar smell and that same flavor and experience you’re used to when eating a ground meat protein,” says J Michael Melton, head of culinary for Impossible Foods.

Announcements of new meatless offerings throughout the foodservice industry often center on one of these suppliers, like Burger King’s storewide rollout of its Impossible Whopper in August. But there are other ways operators can incorporate plants into their proteins using in-house recipe generation.

B.Good, a health-forward bowl, salad, and burger chain, unveiled new flexitarian burgers in October, offering three new plant-based veggie patties and one new plant-forward blended option all made in-house. The lineup includes chickpea falafel, quinoa, and beet-pineapple burgers, and the Turkey Medley, a ground turkey and mushroom patty.

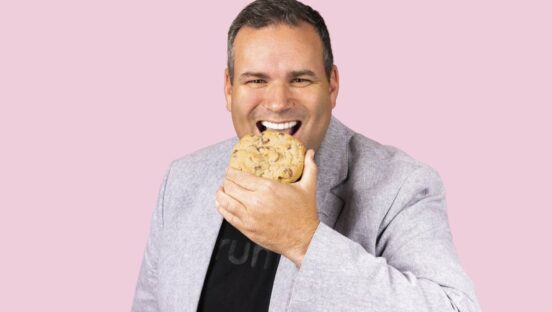

“I think the companies out there that are trying to create these new options are driven by some very good causes in trying to improve the balance in people’s diet and also lessen environmental impact,” CEO Chris Fuqua says. “From the B.Good perspective, we want to adhere to our ‘from the farm and not the lab’ principle, and so we decided not to include something that’s trying to be like meat.”

The Turkey Medley burger is a mixed patty promoted by The Blended Burger Project, a partnership between the James Beard Foundation and the Mushroom Council designed to encourage chefs to create more sustainable burgers using at least 25 percent mushrooms in the meat mix. Mushrooms are the key ingredient in a blended patty due to their taste—the fungi can easily masquerade as meat when cooked correctly—and sustainability. In 2017, SureHarvest’s “Mushroom Sustainability Story” report found that growing 1 pound of mushrooms requires only 1.8 gallons of water. According to the U.S. Geological Survey, the production of a quarter-pound hamburger uses around 460 gallons.

While an Impossible or Beyond patty may share the taste of beef for consumers aiming to eat less meat, a blended patty also cuts down on meat consumption without any taste substitution, offering a method of decreasing meat on a menu that Mushroom Council menu strategist Steve Solomon says is one of the best paths for quick serves.

“A blended burger is endemic to your brand. Each blend is actually proprietary, so it’s not a product that was made by somebody else. This is something that you can do that syncs up with your identity,” he says.

Taste is arguably the most important area of concern for concepts caught in the crosshairs of the plant-based movement. Looking for the best approach or partner that will support a brand’s reputation is crucial—texture and flavor profile must stay consistent with the rest of the menu.

“There is the caveat of the other boxes that we check: lessened land usage, better environmental impact, greenhouse gas savings, less water usage, etc. These are allowing us to scale the business sustainably, and we want to create an accessible product.” — J Michael Melton, head of culinary for Impossible Foods.

When Del Taco was looking for a partner to supply a meat alternative for new tacos and burritos, the quick serve settled on Beyond Meat because the supplier had similar goals, Del Taco research and development director Anne Albertine says.

“In early 2018, we started interviewing all the folks that make plant-based—we learned about the product, about how they work, their companies. It was a process of understanding and trying to figure out which partner would make sense for our brand,” she says. “We ended up working with Beyond because we’re really similar. We both innovate in different areas, we’re both motivated, and we had really good synergy on how we wanted to approach our menu and craft a product.”

Albertine says that, at first, the ingredient presented some challenges as the team searched for a way to seal signature Del Taco flavor into the Beyond Meat crumble. To align the Beyond product with the rest of the tastes on the Del Taco menu, the protein is ordered already in the crumble format, cooked for a second time with proprietary seasonings added at a different supplier, then distributed to units for the Beyond Taco, Beyond Avocado Taco, Epic Beyond Cali Burrito, and Beyond 8 Layer Burrito.

Changing it up

Jumping on board this industry trend can raise costs and amend operations, both in supply chain and back of house. Most plant-based alternatives have higher price tags than the meat they replace, and operators have to consider the changes that will come when these menu items are added to the mix.

Impossible’s beef replacement sells in grocery stores at around $9 for 12 ounces, in contrast to the price of regular ground beef, which is typically $3–$5 per pound. While this price is for grocery customers, quick-serve and fast-casual operators should be prepared to fork out more cash for Impossible and alternatives like it than they would for a meat product.

Melton says that while the cost of Impossible is higher than beef or other meats, the shrinkage of the product does its part to even out the price disparity; while beef has 30–35 percent shrinkage when cooked, Impossible only shrinks by 8–10 percent. Another key factor in the pricing of Impossible is the company’s newness; as Impossible scales up, Melton expects the price of its meat alternative to become more competitive.

“There is the caveat of the other boxes that we check: lessened land usage, better environmental impact, greenhouse gas savings, less water usage, etc.,” Melton says. “These are allowing us to scale the business sustainably, and we want to create an accessible product. We want to be competitive with all ground proteins in the future, and I do think that as we move forward and scale up, we will be able to reduce that cost and be more competitive per pound.”

To offset the increased cost of a plant-based ingredient, most concepts charge extra for the resulting menu item. Carl’s Jr. offers the Beyond Famous Star Burger with cheese and the Beyond BBQ Cheeseburger, while Hardee’s is testing out a Beyond Breakfast Sausage Biscuit and an Original Beyond Thickburger. A classic Famous Star runs customers around $4.39, while the Beyond version sells for around $6.29. Owen Klein, vice president of culinary innovation for both chains, says the customer is OK with coughing up more cash for such a unique product.

“It costs more for us to produce the product because of a scarcity of raw materials at this time. As the movement gains more steam and expands into broader markets, we’ll likely see those prices come down in the future,” he says. “The customer is willing to pay a little more because these are novel products, and unique menu items. You can only get these Beyond products at Carl’s Jr. or Hardee’s, because they deliver our unique flavor profiles thanks to the way we cook them.”

On the operational side, Carl’s Jr. has made minor changes to accommodate the new substitute. The Beyond patties were customized to work with the brand’s signature flame-grilling machines, meaning that the product can be successfully cooked on the proprietary CharBroilers in the same manner as a beef patty. Carl’s Jr. works hand-in-hand with its sourcing team to make sure the product is in the right spot, accessible and easy to cook with for normal kitchen and back of house flow.

Del Taco shared similar operational considerations after partnering with Beyond, adding in color-coded tools to keep things straight. In all Del Taco units, green tools are used for plant-based material and red tools are used for beef, and the new products are kept separate from other animal ingredients, too. This way, if a customer orders a vegan Beyond 8 Layer Burrito, no cheese shreds or sour cream will touch the product. “We make a promise that if you ordered a vegan version of a product, you are going to get a 100 percent vegan product,” Albertine says.

Changes had to be made in Del Taco’s supply-chain facilities as well, since the new crumbles are recooked with brand-specific flavors at these locations. All tanks that store product were swabbed to ensure that no animal-based protein was present. The product is packed into bags and frozen at these supply facilities so that individual units can simply reheat in the bags and then place the crumbles onto make lines, taking away the potential for cross-contamination that could take place during in-unit cooking.

In contrast to the increased costs and operational changes brought about by using a partner, seeking out a meatless or plant-forward strategy similar to B.Good’s—offering a few new recipes cooked in-house—can cut down on the costs of adding these items to the menu. With this approach, the concept eliminated the cost of any plant-based meat alternatives and kept kitchen operations fairly consistent. “Most of our systems were already in place,” Fuqua says. “By only adding a few ingredients, we’re attracting a whole new set of customers.”

Lasting effects

Why are Carl’s Jr., Del Taco, B.Good, and other chains willing to put in extra work on new recipes or spend cash on new products to add these items to the menu? It’s all thanks to the plant-based movement’s growing popularity.

The NPD Group reported that from May 2018 to May 2019, there were 228 million servings of plant-based burgers ordered at quick serves, up 10 percent from the previous year. While this pales in comparison to the 6.4 billion beef burgers ordered at quick-serve restaurants during the same period, it’s still a hefty—and growing—percentage of patties served.

With plant-based earning new followers each day, brands that have made room for these items in the last year are already reporting positive returns on those investments. B.Good’s flexitarian burgers debuted last October, and Fuqua says that only one week after the burgers were unveiled, the new line was already the most successful product introduction that the fast casual had seen in years.

By October, just over 10 months after Carl’s Jr. launched its first plant-based option, the chain had sold more than 4.5 million Beyond Famous Star burgers, making the alternative menu item the most successful burger launch for the brand in the past two years. Klein says the Hardee’s test markets are already exhibiting strong numbers, too, and that the company is continuing to test new products, with its sights set on developing plant-based foods in different menu segments and dayparts.

Del Taco isn’t planning on calling plant-based innovation quits, either. Albertine says the success of the Beyond tacos and burritos have left the team wondering how far they can go with plant-based, as well as wanting to strengthen a reputation of being allergy- and diet-friendly.

“We’re seeing companies that are primarily meat companies investing in building a plant-based option, like Tyson Foods. We know this is definitely something because they are investing in it, and because we see increasing conversations surrounding it, within our customer base and outside. Plus, new brands are adopting it every day,” she says.

With Del Taco, Carl’s Jr., Hardee’s, Burger King, and others opting to diversify protein content on the menu, and even more chains testing out meatless patties (like McDonald’s, which began testing a Beyond-backed, plant-based burger in Canada last September), the movement is already starting to push beyond the burger category into other proteins. Hardee’s Beyond sausage patty is just one example; Dunkin’ introduced a meatless sausage breakfast sandwich in some units last August, KFC tested Beyond Fried Chicken in select markets last summer, and Pizza Hut revealed an Italian sausage topping made with the Kellogg Company’s Morningstar Farms Incogmeato product, a non-GMO soy-based substitute.

“Incogmeato … is a portfolio of meat analogue plant proteins that cook just like meat,” says Dara Schuster, marketing director for Kellogg’s veggie portfolio. “There is also very high consumer interest in a wide range of menu applications with plant-based protein, so we are dedicated to inspiring foodservice operators to look to our versatile portfolio as a source for customizable menu innovations.” The Incogmeato lineup also includes a beef replacement patty, as well as chicken tender and chicken nugget stand-ins.

Facing a movement with a plethora of products already on the market and more on the way, there is the option to DIY your own veggie-based or veggie-forward options and skip suppliers altogether. Rising customer interest makes it all too easy for operators to drown in sea of alternative proteins. Aside from researching partners like Beyond or Impossible, adding up costs, cooking up the proper recipes and flavor profiles, rearranging operations, and adding in new items after initial rollouts, Klein says there’s one simple, final key to hitting plant-based out of the park.

“Be true to yourself,” he says. “Make sure that however you incorporate plant-based into your menu fits in with the rest of your offerings, with your current consumers, and with your identity. We followed that credo very tightly with our Beyond options. Lay a foundation for plant-based that hits close to home for your brand and leverages the equity that you already have.”