When COVID-19 hit, fast-casual restaurants transformed their parking lots into dining rooms in the form of curbside service, and concepts that once prided themselves on not offering big chain-associated drive-thrus promptly began adopting the format to serve customers. Then, the industry saw restaurant groups start partnering with third-party delivery providers, despite many claiming they would never do so because of the steep fees.

“I thought that honestly once COVID was dwindling down, that part of the business would subside a little bit and people would go back to their normal routines. Well what we’ve seen is, delivery is now a part of the normal routine, and that part of the business has not dropped off,” says Sam Rothschild, chief operating officer of 200-unit Slim Chickens.

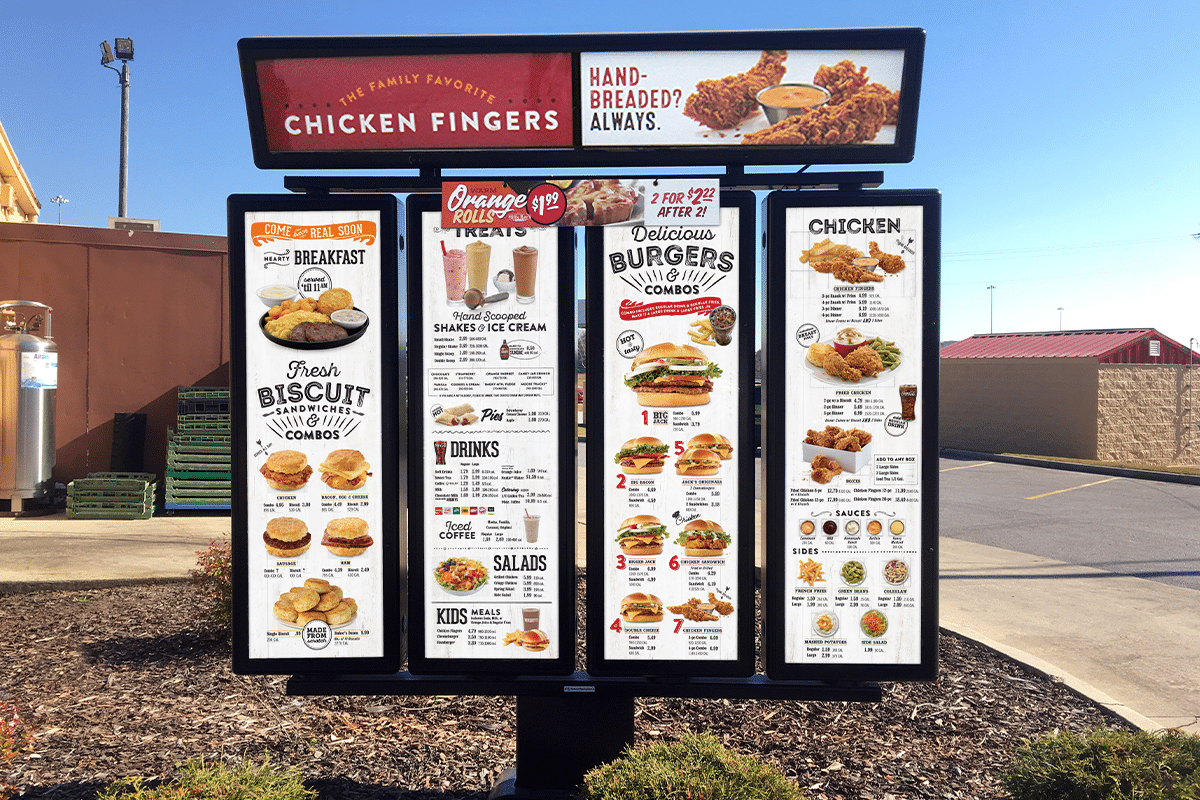

Indeed, consumers are now conditioned to expect food delivered to their front doors at the tap of a touchscreen, and study after study keeps proving the steep fees are no match for the value of convenience. Delivery orders now account for about 10 percent of Slim Chickens’ business, while curbside, takeout, and catering make up about 20 percent. Drive-thru business is 50 percent, and the other 20 percent is dine-in—whereas pre-pandemic, dine-in accounted for about 35 percent of sales.

“We had to come up with new standard operating procedures, because you grew entirely overnight a whole new day part or segment of your business that really wasn’t there before, because delivery in our segment was very small, and takeout was OK,” Rothschild says.

That meant reevaluating packaging, staffing, design layouts, and more. If “pivot,” “unprecedented,” and “new normal” were the buzzwords of 2021, “optimization,” “efficiency,” and “new prototype” are gaining cause to be called the popular clichés of 2022—for good reason.

Now that dining rooms are filling up again, yet off-premises channels remain far elevated to prior levels, restaurateurs are grappling with how to balance their various business formats in a way that satisfies consumers and their labor force—groups with higher expectations and standards than ever, which isn’t necessarily a bad thing. Pandemic-related pressures continue to force the restaurant industry to make progress with new, creative solutions to improve customer and employee experiences, which in turn make for better systems overall.

Slim Chickens, for example, reconfigured its restaurants’ kitchens and designated parking spaces for delivery drivers to help optimize the flow for employees and guests. After recently bringing on a new vice president of technology, the brand is also looking at implementing new technologies in the drive-thru and adding staff members armed with order entry pads in parking lots to increase throughput.

“We spent a lot of time over the last year retooling our prototype, then going back and starting to do some work in the kitchens we already have, looking at new equipment and new processes,” Rothschild says, which also included reengineering cook lines, and moving around existing equipment to increase food quality, accuracy, and speed. “We’re just trying to get more efficient and keep costs under control with lots of out of the box thinking.”

Rothschild isn’t alone in thinking beyond conventions. Kevin King, president of Donatos Pizza, says automation will be critically important for the restaurant sector as the labor market remains tight post-pandemic. With digital orders now accounting for about 60 percent of Donatos’ business versus 40 percent before COVID, anything the company can do to make restaurant employees’ jobs easier is welcomed. As such, Donatos’ latest investment was implementing a piece of equipment in restaurants that applies sauce to pizzas—apparently one of the hardest skills to teach.

“It sauces pizza as fast as a human could do it, does it way more consistently, and the portion control is spot on; there are no peaks and valleys in the sauce,” King says. The Smart Saucer, made by Agápe Automation, rolled out to more than 15 stores as of press time, and was on track to be in about 100 more Donatos and Red Robin restaurants by early 2023 and eventually throughout the entire system, he says.

Columbus, Ohio-based Donatos partnered with Red Robin in 2020 to bring its pizzas to new markets. With 172 traditional stores and 250 Red Robin “nests,” Donatos’ footprint has now exceeded the 400-store range in about 27 states. “I think it’s a fabulous partnership for both, and it’s clearly been incremental in sales for them which is great,” King notes. “Donatos has an operating system that’s easy for [Red Robin] to execute at an extremely high level in their stores.”

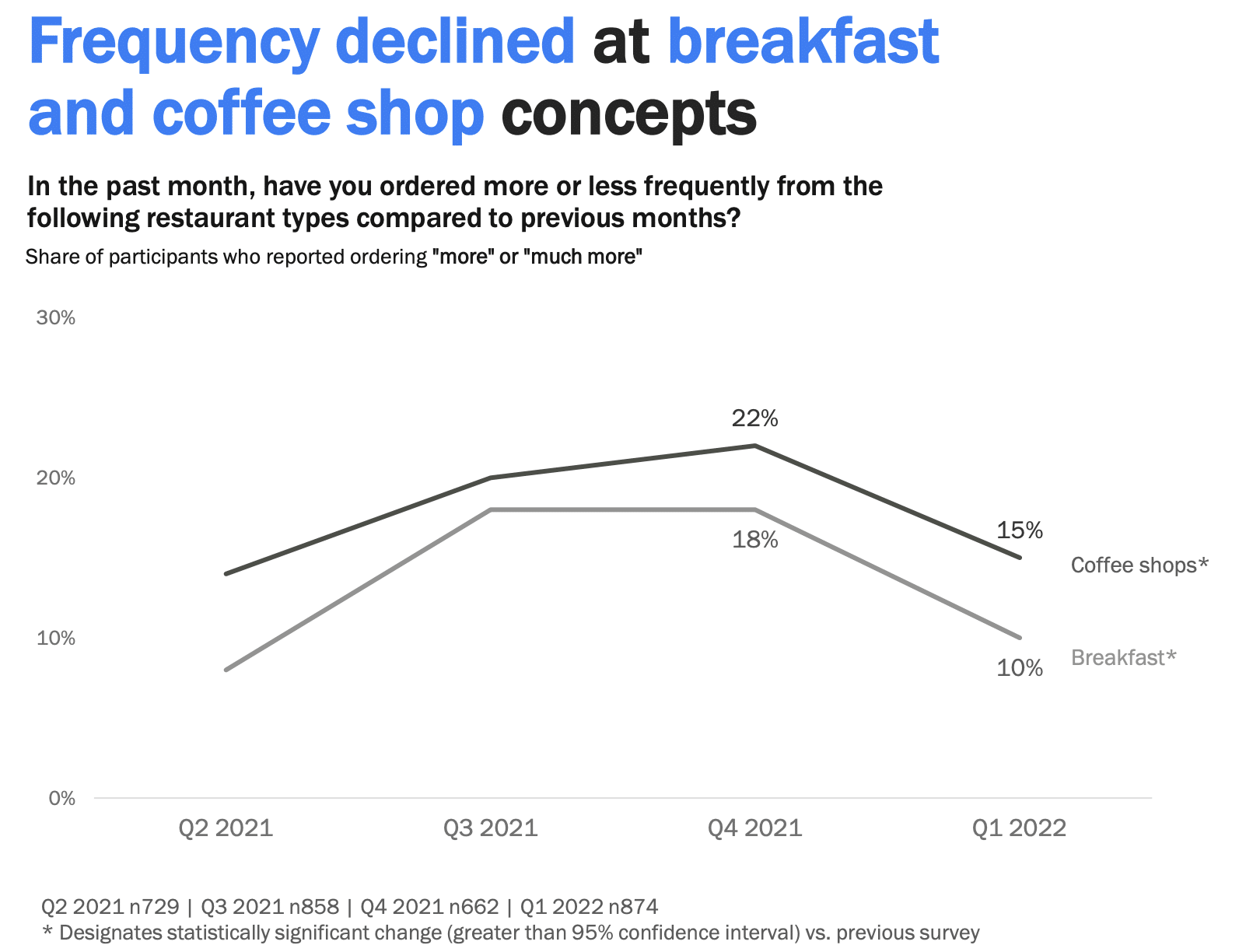

Minneapolis-based Caribou Coffee also found a way to improve on its operating system and drive-thru experience. By introducing a “Cabin” prototype with drive-thru lanes and walk-up windows at a smaller footprint and lower investment, the 460-unit coffeehouse brand was able to “offer speed and convenience without sacrificing quality or service,” says John Butcher, Caribou’s president and CEO.

Caribou also completely refreshed its Perks loyalty program while simultaneously launching a new app, which allowed customers to save customizable beverages and frequently visited stores, as well as a revitalized points and rewards system.

“To remain relevant in today’s climate, a brand must be able to adapt to consumer preferences and continue to improve its business model,” Butcher adds.

At Modern Restaurant Concepts, which owns 28-unit Modern Market Eatery and 20-unit Lemonade, the leadership team decided to lessen the pressure on restaurant team members by fielding all calls to their in-house corporate guest relations team. Callers can place takeout or catering orders through guest relations, who also can give them directions or information on hours. Modern Restaurant Concepts tested out a call center years ago, but they found it too difficult to continually train people at a third-party company about their menu and operations, says Robin Robison, chief operating officer at Modern Restaurant Concepts.

Dine-in represents about 30 percent of MRC’s sales, while all other channels account for the remaining 70 percent of business, which includes sales from MRC’s app, website, third-party channels, guest relations, and catering.

“[Restaurant operators] wouldn’t know what to do if the phones started ringing in the restaurants again,” says Robison. “They have a huge appreciation for us being as innovative as this so they can focus on their operations, and guests are very appreciative of it.”

Flexibility in design has become a staple of fast casual coming out of COVID-19.

Finding solutions to supply chain challenges

Despite progress being made in so many areas, the restaurant industry still faces strong headwinds, from supply chain and labor to inflationary pressures. The National Restaurant Association published a survey in November 2021 that found 95 percent of restaurants experienced significant supply delays or shortages of key food items, and 75 percent of restaurants have made menu changes because of those issues.

At Slim Chickens, having a menu centered around one protein helped, Rothschild says, plus boasting an experienced supply chain team who developed great relationships with vendors.

“We were chasing some supply stuff around, but we never had a real issue where we couldn’t serve our menu,” Rothschild says. “Where we ran into issues like my peers was the cups, the lids, the straws, and plastic ancillary items in supply chain, which was one of the most challenging we saw.”

Issues with plastic ancillary items had more to do with manufacturers being understaffed and not being able to keep up with orders, he notes. While restaurants experienced issues with stocking enough of their inventory earlier on in the pandemic, it’s now transitioned to feeling the effects from staffing challenges hitting broadliner and supplier partners.

“There’s a greater incident potential for new people at a broadliner pulling product or mispicking, so we could get romaine instead of spring mix,” Robison says. “We’re going to have to continue to work on this industry side by side with our broadliners to understand what they’re facing, yet also hold them accountable for what we need from them to take care of our guests.”

King echoed Robison’s comments about food distributors’ labor challenge in competing for truck drivers.

“There’s not a lot of excess capacity in supply chain distribution, so it’s time to really work with those partners, because there really are no options to go anywhere else. It’s been a real challenge for us to have to think about it differently than we’ve ever thought about it,” King adds.

Aside from trying to find out about food shortages and changes in advance, King is also pushing stores to make sure inventory levels are higher than ever, and be “more flexible on when those deliveries are going to come, because we have to be,” he says.

Bolstering employee benefits is no longer a trend, but a thoughtful necessity

According to the National Restaurant Association, no other industry has faced a longer road to reaching a full employment recovery. As of April 2022, eating and drinking places were still down 794,000 jobs, or 6.4 percent below pre-pandemic employment levels.

For King, one post-COVID trend he sees is the need for companies to market their mission statements and values—and demonstrate those with actions—in order to attract the younger generation of employees and customers. In August, Donatos tapped Christina Jackson to enhance company culture and develop an inclusive personnel plan as chief people officer.

“If you want to be successful in today’s world, guests want to know what you stand for and what’s important to us as much as our team members do,” King says. “The younger you are, the more important it is for you to say, the brands I do business with need to align with my values, and I think it’s a fantastic thing.”

With that being said, restaurants that showcase how they value their staff members—by increasing pay or bolstering benefits packages, for example—are gaining a leg up on competitors in their space. Donatos, for example, has raised wages and created opportunities for employees to learn more skills in the workplace, especially since Donatos is a big employer of 14- and 15-year-old staff members where it’s allowed.

“We’re constantly looking at quality of life and what we’re asking our team of people to do in the stores,” King says. That means outsourcing certain tasks when necessary, such as embracing third-party delivery companies to supplement locations where they don’t have enough drivers on staff, or at peak times on Friday nights and on Superbowl Sunday. “Five years ago, third-party delivery was just a tiny thing that was super expensive for the restaurant operator, but together, we figured out a way to make it work,” he adds.

Though King believes the labor crisis will still last for years to come, a combination of competitive pay, flexibility, and opportunities for career advancement will help restaurants become employers of choice. The last point is crucial, because career development allows employees to grow within an organization and hopefully stay longer.

Rothschild thinks the restaurant industry has a retention issue, not necessarily a hiring issue. For him, the key to increasing retention rates in restaurants is hiring exceptional general managers as leaders, who inspire employees in a fun environment.

“They want to work in a really nice place where they’re appreciated for the work they do and have great team members to work with. When I see great GMs who know how to take care of their team and run a restaurant, they don’t have problems hiring or retaining people, because good people want to work for good people,” Rothschild says.

“Make sure you have great leaders and people running your restaurants, and staffing should help itself,” Rothschild adds, though he admits there are areas of the country within smaller population pockets where companies need to be creative about recruiting and sometimes offer unusual incentives. “One prong is attracting people to get them to apply, and the other is taking really good care of them when they do decide to work for you.”

At Lemonade, Robison notes general manager turnover rates dropped to 17 percent last year—”which is unheard of in this industry,” she says, where hourly crew rates can be upward of 200 percent. Increased retention was driven by gathering feedback from general managers at retreats and at regular town hall meetings, where any employee at the company can ask questions and make suggestions.

“If you don’t stay connected with those people, you don’t find out what makes them tick and excited and what their pain points might be, so you’re never going to find the right things that help them be better in their roles and make the restaurant better,” Robison says.

The increased benefits MRC has rolled out have directly come from employee suggestions, from paid time off for volunteering to time and half pay on certain holidays.

“I think every business has the opportunity to look at what their current standards and benefits are and be able to say, what else can we afford to do to take care of our people?” she adds.