Now that December has arrived, we’ll begin to unravel what might await restaurants in 2024. First, it’s worth taking stock of the present. According to Revenue Management Solutions, from a recent survey of 550 people, nearly half said they had begun to cut back on restaurant visits in Q3—a jump of nearly 20 percent. Although the majority noted they were still using restaurants at least once per week (particularly the drive-thru, at 75 percent), the share of diners reporting a weekly delivery, takeout, or drive-thru occasion fell in the double-digits. Dine-in usage increased slightly.

More than two in three surveyed said they were paying more at restaurants. In turn, they were coming less frequently, ordering fewer items, or choosing less expensive restaurants. Intentions to dine dropped as well, year-over-year. Less than 16 percent of respondents planned to use restaurants more in the future, compared to nearly 30 percent in 2022. It varied across generations: For millennials, it fell by nearly 30 percent; Gen Z, just 4 percent. Is that a sign student loan repayments forced some millennials to reset priorities? Or are millennial and young families balancing costs in their overall food take and acting accordingly?

These kind of data points have surfaced often of late. Sixty percent of consumers said they’re dining out less as menu prices at quick-service chains lifted 13 percent from 2021 to 2022, per The Food Industry Association. Menu prices in October were 5.4 percent higher than last year, according to federal data.

A global survey released by Stellar Elements, which polled 500 business leaders and 2,000 consumers, highlighted there’s a challenge with guest experience to go along with the price lift. Essentially, diners aren’t finding the plate to be worth the cost, regardless of the notion everything is more expensive. The gap between expectation and execution is being caused by underprepared and unknowledgeable employees, service consistency, and a lack of a seamless experience, the survey showed, which 74 percent believe is important yet just 27 percent feel they are getting.

Some other points:

80 percent of customers consider alternatives after just one bad brand experience.

73 percent show strong willingness to switch to brands with superior CX, even if they’re more expensive.

72 percent spend more on companies that get CX right.

80 percent recommend brands based on consistently positive customer experiences.

50 percent disengage after four or fewer bad experiences.

The study also discovered a growing gulf between some quick-service brands and consumers: 87 percent only recognize product/service quality (the highest of all industries) as key components of CX—over 40 percent of leaders who do not factor the entire overall customer journey and interactions with their brand.

More:

While 64 percent saw investing in CX as extremely important (the highest of all industries), 96 percent agreed that CX plays a critical role in revenue generation.

80 percent acknowledged that cost reductions are the main reason they are increasingly unable to deliver the high-quality service that customers expect.

67 percent blamed inadequate employee staffing/training and lack of personalization as leading to a disjointed and frustrating customer journey.

All this is to say, restaurants are likely close, if not bumping against, the price ceiling as the calendar turns. But value proposition and perception are a layered battleground. McDonald’s, for instance, although it’s garnered headlines for some stores charging higher prices, continues to lead with local value and offers through its app. Unsurprisingly, as executives shared recently, it’s topping affordability and value for money metrics, benefitting from trade down with middle- and higher-income groups. Deals through digital means and technology to improve efficiencies and make it easier for restaurants to deliver experience, will be a lead theme in 2024. Can operators deploy the tools available to streamline operations and find revenue drivers through fresh channels? It’s going to be another crazy year.

We asked this year’s Digital Disruptors, “What do you think is the next big tech trend nobody is talking about today?” Here were their answers.

Olivia Ross

Head of CRM, Loyalty and E-Commerce, Digital Marketing, El Pollo Loco

I believe that Consumer Data Platforms (CDPs) will become table stakes for major brands in the next five years. We will be able to break down the data about our customers so that we can be more intentional in how we communicate with them. For example, we may have a guest who we’ve identified as a family meal purchaser and know they order the same thing every other Thursday on their way home from work to feed their family. We can pre-emptively send them a one-click purchase push-notification that reminds them to order and schedule a pickup based on the time it takes for this individual to go from work to our restaurant. We can then take it a step further, delivering an email with ideas for leftovers for school lunches and we can continue to support that consumer as their tastes and preferences evolve, delivering strategic offers, messaging and content across our ecosystem. These CDPs will also support front of house employee interactions, R&D, Supply Chain, marketing decisions as well as so much more.

Then there is the integration of technology into the direct customer experience. We’re seeing a lot of brands embracing kiosks in strategic ways, especially in college campuses and airports, but customers still may want the option to order directly from a person. The introduction of these kiosks have allowed businesses to focus more on food prep and other areas, but the lessons learned point to a varying preference for direct customer service amongst consumers. Another exciting development is AI in restaurants, from dynamic menu boards to ensure consumers have an experience that caters to them or real-time translation between languages; AI is complimenting the consumer experience and redefining what it means to visit a restaurant. While testing these automations is very exciting, I do think there’s an innate desire from consumers to preserve some of the restaurant experience and that needs to be a strong consideration by brands before fully committing to a 100 percent digital restaurant.

Lena Katz

Content and Creator Strategy Lead, Ampersand, Inc.

I think the phygital evolution is very exciting, because what it could look like is taking the “best of” content from the social and digital customer interaction channels and integrating them into the ordering experience. How many people look to social media to inform their ordering? Lots. And if we’re just walking up to a counter or a kiosk, we’re probably not jumping on devices to see what the latest crowd-sourced innovation item from Chipotle or Starbucks is. But a lot of us WOULD.

If there was an option while ordering to see and order meal deals, suggested customizations or upgrades from my favorite social media barista or burger expert—I’d be all over it, and I’m pretty sure millions would agree with me here. Also, I think you could make it much more dynamic and niche-targeted than the celeb-endorsed partnerships that we’re currently seeing. Best case scenario there, the celeb-endorsed special sells out nationwide. But if local personalities or niche experts are each promoting something different, it diversifies according to different tastes and allows for several menu items/categories to share the spotlight.

Steph So

Head of digital experience, Shake Shack

While everyone is talking about AI, I think the next big tech trend is how we use tech to enable more human interaction. One of our biggest examples of this at Shake Shack has been the kiosk. When we use technology to enable ordering, it frees one of our team members to provide great guest interaction—like bringing food to tables, setting up a high chair for a young guest, keeping tables clean and tidy and providing table touches.

Elad Inbar

Founder and CEO, RobotLAB

Everyone is focused on the things they can see in their day to day. I think many are overlooking the advances happening with vertical farming, which is the practice of growing crops in vertically stacked layers in a controlled environment (think warehouses, shipping containers and even office buildings left unused post-pandemic).

Robotics is playing an increasingly important role in vertical farming, such as planting, watering, harvesting and packaging crops. They can also be used to monitor the environment and control the climate. The combination of vertical farming and robotics has the potential to revolutionize the way we grow food. It can help to address the global food crisis by allowing us to produce more food on less land, reduce our reliance on pesticides and herbicides, use more recycled and reused water and grow fresh food year-round inside a controlled environment.

The use of robots in vertical farming is still in its early stages, but it has the potential to be a major game-changer. Robots are already helping to make farming more efficient, productive, and sustainable. As the technology continues to develop, vertical farming robots are likely to become more affordable and widespread. This could lead to a major transformation of the food system, offering a more sustainable and equitable way of producing food.

Deborah Matteliano

Global head of restaurants, Amazon Web Services (AWS)

I think tech trends start with noticing shifts in human behavior and getting ahead of them. While I cannot predict the future, I am curious about the psychology behind it all. With steady growth in drive-thru, pickup, and digital orders and a delivery market that’s still very dominant, it’s time to admit that the way people interact with food has fundamentally changed. We’ve discovered new formats that change the way restaurants fit into our lives.

I don’t know what the solution is for this yet, but I know whoever figures out the next version of the ‘copper pot’ in food tech will have an understanding of the dramatic ways our relationship to food has shifted over a short time span. Restaurants have been around since the French Revolution as a steady location for people to gather in person, discuss ideas, and strengthen bonds. People have less of a desire to eat in a social setting now—and when they do, they’re seeking an elusive sense of ‘experiential’ dining where something unexpected, memorable, Instagrammable, will happen. Yet restaurants still exist as a ‘third space’ for in-person meetings—how will they evolve to meet this need?

Imagine what our relationship to social eating will be in the next 10 years. Working back from what matters to that diner will be the next big frontier.

Shelly Rupel

Co-founder and CEO, Devour

The use of digital assets and NFTs for loyalty, marketing campaigns, customer data, and rewards. While NFTs have been talked about for awhile as a digital art for purchase, we don’t talk a lot about the actual technology value behind digital assets. There are a lot of companies, including Devour, working hard to make these easy to use for merchants, brands and consumers. We have built the infrastructure and are working with our technology partners to make this possible with brands that have millions of customers.

Colin Webb

Co-founder and CEO, Sauce

“Virtual Time Travel. In a world where everything is recorded and search is AI-enabled, we’ll be able to put together any moment or data point from the past, and aggregate it linearly over time, or laterally across a select time period, which is extremely powerful. By no longer needing to go and search for something that happened at a particular time, you’ll be able to summarize all things that happened over all times. Imagine having deep insights into Strengths, Weaknesses, Opportunities, Threats, and Alternatives for every single company, individual, or process without having to spend time compiling this data. From a strategic standpoint, we (humans) can play 5D Chess much more often with our decisions.

Tammy K. Billings

Strategic Technology Advisor

Not sure I can identify a trend that nobody is talking about—with all the podcasts, articles, conferences, and LinkedIn posts—there’s no shortage of trends—or talking heads. However, what I see are small and quiet layoffs among brand marketing teams, slow industry traffic yielding slow technology sales, supplier consolidation, companies shifting from growth to profitability strategies as the cost of money has increased, restaurant groups merging and more.

As technology has become more abundant—it’s more fragmented—making it challenging for restaurants to choose which solutions to adopt. While the recession may not have materialized—industry traffic is still down—further taxing the opportunity for technology adoption. Many investors have shifted their focus away from restaurants technology requiring suppliers to become profitable or merge. As part of this cycle, restaurant companies themselves are merging to gain better economies of scale and streamline technology or other shared services.

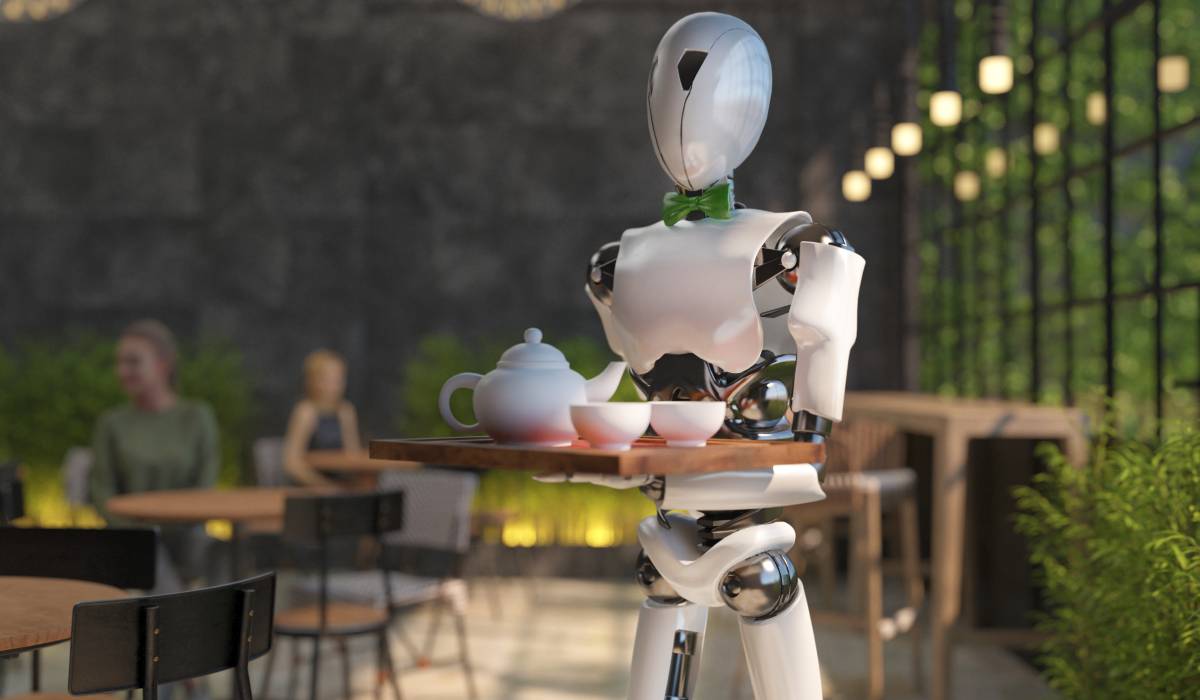

These big industry technology trends collide in labor utilization. The highest demand in the industry is for solutions that reduce or eliminate labor costs. That may be in the form of artificial intelligence paired with cameras or voice to prompt an action or eliminate the need for an employee. It may be in the form of robots flipping burgers, delivering food, or making pizzas. Or it may simply be in talent sourcing and retention. Human capital is at a premium as line level jobs remain hard to staff in a post-COVID world.

Clay Johnson

Chief digital and technology officer, Yum! Brands

AI and robotics continue to generate a ton of buzz and rightly so—they have huge transformative potential in our business. In fact, many of our proprietary technologies already use AI today and we continue to invest in deepening these AI capabilities. For example, we acquired Dragontail Technologies in 2021, allowing us to tap into the power of AI to optimize the entire food preparation process from order through delivery—including automating the kitchen flow, driver dispatch and customer order tracking. Simply put, Dragontail takes much of the guesswork out of running a delivery business.

I see opportunity for more conversation around how we find and scale enduring AI use cases for the restaurant industry. At Yum! we have a significant advantage in that we have four different brands and restaurants located around the world. This is the most fertile quick-service restaurant testing ground in the industry, and we are exploring innovative use cases across our portfolio every day. As we identify the use cases that have the most transformative potential for our customers, team members and franchisees, we must be able to scale them quickly. This requires our brands to have a shared digital and technology ecosystem, which is at the heart of our strategy.

Dan Mosher

President, Presto Automation

Everybody is talking about it, but I don’t think people have fully grasped how big of a trend AI is going to be for the restaurant tech space. At this point, its mostly theoretical but we really believe that very few of the current 130,000 drive-thrus in the U.S. will be using human staff in five years to take orders. These trends around AI will impact every facet of the quick-service restaurant business.

Carl Orsbourn

COO & Co-Founder, JUICER

Data unification and utilization. It’s not that we’re not talking about it, but I’m not sure much is really happening about it. We’re drowning in an ocean of data, and restaurants don’t know what to do with the data they’re collecting. Their organizational models haven’t afforded them sufficient resources to resolve it either. I think this is where artificial intelligence, CDPs, and companies like mine at JUICER will help. The technology solutions that utilize data most effectively will be explicitly results-oriented and efficient to implement because frankensteined tech stacks are holding restaurants back. Old, rigid, and inflexible systems are a ball and chain around the proverbial neck of the restaurant industry and its ability to move faster and use data more effectively to improve the guest experience and bottom line. It is also why we will see more vertically integrated tech stack solutions that remove the complexity altogether to have one harmonious system that symbiotically optimizes restaurant operations.

Bryan Solar

Chief product officer, SpotOn

For the past three years or so, we’ve seen a growing trend of “marketplaces” and tech providers pushing their own brands above their clients’ brands. Consumers are encouraged to download a provider’s app to order takeout or delivery instead of ordering through an app or website of the restaurant they’re actually interested in. We believe that a wave of change is coming where restaurants and brands, more broadly, are going to reclaim their guest relationships and focus on building direct relationships with their customers. How? For quite some time, customers of airlines, hotels, and ecommerce retail have benefited from tailored experiences bespoke to their preferences, spending, and loyalty. That level of customization still hasn’t crossed over into the hospitality space. We believe that the restaurant concepts that figure out how to deliver deeply personalized experiences (including status, special access, special rewards, etc.) will be able to pull their customers back directly. SpotOn’s bet: it’s all about your restaurant brand.

Erle Dardick

CSO, Lunchbox

The evolution of order management technology is on the cusp of another seismic shift, a reckoning, if you will. If we trace the history of this field, we find key moments that shaped the industry. About 50 years ago, in 1973, the point-of-sale system, or POS, was born, when IBM developed the first computer driven cash register, which is the predecessor of today’s POS systems. It rapidly infiltrated the restaurant industry, setting off a technological revolution that redefined how restaurants operated.

Fast-forward to the mid-’90s, the era I refer to as the beginning of the industry’s “digital revolution.” I started my company back then, when everything was centered around static web pages. Digital technology began to take root, and we saw the humble beginnings of integration of new tech with legacy systems. This gave birth to ecommerce, with software solutions increasingly moving to cloud-based environments. During this period, we also saw the emergence of backend solutions that moved foodservice operations into a cloud based environment. This paradigm shift allowed operators to “share their transaction experience” with their customers, in real time, for the first time in our history.

About a decade later, marketplaces started making their appearance on the scene. Companies like SoftBank invested heavily in third-party marketplaces and entities began to edge their way by getting customers to spend money directly with them, instead of directly with the brand. This set the stage for an ongoing battle for the customer.

Now, in 2023, we’re witnessing a movement toward rapid technology consolidation which points us toward a more mature market. A good example is LBX acquiring Novadine, and I foresee more mergers and acquisitions on the horizon. Advancements in AI and robotics are now entering our kitchens, and these shifts are being primarily driven by sophisticated order management systems. Operations are increasingly moving to cloud-based environments and companies like LBX, are facilitating rapid movement towards restaurant automation.

However, the challenge we face today is ongoing fragmentation of our technology providers. Systems aren’t as seamlessly integrated as they could be. But I believe the next generation of order management technology is on the way. The vision is to bring all channels into one unified space. Companies like Lunchbox are at the forefront of this revolution, and I also predict that Enterprise Resource Planning Systems (ERP) will enter the race and disrupt the status quo in the months forward.

So, the future is incredibly promising, but it’s essential for us to navigate these transformations carefully to ensure that technology serves us, rather than the other way around.

Perse Faily

CEO, Tillster

Through tech, there is an opportunity to increase how personalized and relevant experiences can ultimately become. For restaurant owners, there’s still much more that can be done to increase average check size, drive the bottom line, operate more efficiently and utilize labor even better. In some of the digital transformation scramble of the pandemic we saw an influx of disparate solutions. So now, the next step is consolidation to have visibility into a full 360, real time understanding of the customer.

Another one of the biggest areas of opportunity is in operations—and tying together the front and back of house. We’re all aware of the labor shortage and retention issues restaurant owners have faced in the last several years. So, there is technology aimed at enhancing efficiency to counter that reality. However, there’s still a lot of opportunity when it comes to supply chain management too.

Andrea Huels

Head of Global Growth & Strategy, Radius AI

The biggest tech trend in quick service that nobody is talking about is the transformational impact the combination of human voice and AI will have on future operational strategies.

Not everyone can afford a PC or internet service to place an online order, not everyone has the dexterity to put thumbs on glass to place a phone order, and not everyone speaks the language required to place a drive-thru order, but we all have a voice.

Quick-service restaurants have historically grappled with issues like order inaccuracies at the drive-thru, nonoptimal throughput, and an impersonalized experience. The introduction of voice automation will revolutionize this landscape. When guests pull up to the drive-thru, they’ll be welcomed by an AI-powered voice system that ensures they’re never asked to wait. Tapping into the power of conversational AI will improve order inaccuracies caused by human error, dialects, and background noise. Quick-service brands can also leverage this technology to assess the customer’s voice, analyze their age and mood, and identify smarter upselling opportunities.

Voice AI enables greater accessibility by providing multilingual support, allowing quick-serves to cater to a diverse customer base. A conversational voice kiosk enhances inclusivity for individuals with disabilities by providing audio menus, assisting with ordering, and allowing customers to complete payments with the recognition of their voice.

The future of quick-service restaurants is set to become multi-modal, characterized by the seamless integration of various advanced technologies, including voice AI, computer vision, and sensors. Multimodality is a new paradigm in AI that allows machines to understand and process data from multiple modalities, such as text, speech, images, and video. Gen AI, in of itself, is a powerful tool however as part of a stack that includes multi-modal AI, that is truly where the next iteration of transformative technology will come from. This integration will usher in a new era of efficiency, customer engagement, and operational excellence in the quick-service industry.

Ryan Stackable

CEO, Adplorer

AI has been a prominent topic in the restaurant world for a while now, but what’s hardly talked about now is its impact on advertising. I think we’re going to start to hear more about hyper-localized and AI-driven ad campaigns, including dynamically optimized ad content, placement, and timing to target specific audiences in real-time. AI will continuously learn and adjust strategies, ensuring efficient budget allocation and maximizing ROI.

Chris Demery

Chief Technology Officer, Blaze Pizza

The next big tech trend is leveraging artificial intelligence and machine learning to provide enhanced capabilities around making the food manufacturing process more predictable in the face of guests’ changing needs. Today our guests want their favorite locations to provide ‘what they want,’ ‘when they want it,’ and ‘where they want it;’ this is a daunting challenge in today’s environment. I do think people are talking about it, but not seeking to enable it fast enough.

Steve Fredette

Co-President and Cofounder, Toast

We can innovate for the sake of innovation all day long—but if there isn’t a practical application to the tech that solves a real pain point, it will collect dust, especially in the restaurant industry where everyone is doing their best to make every second count. There’s always a shiny new object in tech, but it’s so critical to be thinking about the next step with any innovation and whether it has pragmatic use for the restaurant community.

While there’s a lot of talk about AI, including generative AI, robotics, voice ordering, etc., I think one of the things that’s less talked about but still one of the biggest opportunities to make a better guest experience is just using technology to make everyone feel like a VIP or an insider or a regular. If every restaurant could have a version of the Starbucks App or the Disney Magic Band, and a guest can easily order, have their preferences and food allergies already taken into consideration, and have payment be taken care of without having to worry about taking out a credit card and paying, that would be magical. Granted this is a pretty hard problem because people have been talking about the Starbucks App experience for years and if it was easy for other restaurants to replicate I think they’d have done it already, and maybe this is why this is a trend that is less talked about right now.

Katie O’Dell

Vice President of Client Services for Restaurant Accounts, Bounteous

The potential impact of EV charging on the restaurant business.

The U.S. is estimated to have more than 48 million electric vehicles on the road by 2030, and the public charging infrastructure will have to hit around 1.2 million charging units to meet this surge in electric vehicles. The average amount of time spent charging is 24 minutes, but can be up to 98 minutes. The peak time for EV charging is 8 p.m., which makes dinner a key opportunity for restaurants. One respondent in a recent EV survey said, “We’ve spent way more money eating at restaurants with charging stations than we ever would have spent on gas.”

There is a real and growing opportunity for restaurant brands to leverage the growing EV trend with order ahead, targeted marketing, location-based marketing and other digital technologies to increase traffic from EV customers.