Culver’s growth designs weren’t swayed much by the early swings of the pandemic. Its comp sales climbed about 6 percent in 2020 over the previous year as it opened 50 units—the same figure as 2019. Same-store sales jumped 19 percent in 2022, and Culver’s kept growing.

According to data from the brand’s recently filed FDD, few chains in fast food are expanding as consistently as the 1984-founded chain, which remains family owned and operated alongside an investment from Inspire Brands, Subway, and GoTo Foods’ backer Roark Capital, which provided Culver’s its first capital infusion in 2017 as a minority stakeholder.

Culver’s lifted by a net of 52 locations in 2023, per the FDD. It’s positioned to approach 1,000 in 2024 as it exited with 944 (937 of which were franchised). Culver’s, as mentioned, opened 50 stores in 2019 and 2020, respectively, and followed with 55 net openings apiece in 2021 and 2022, meaning the company has added 262 locations since 2019.

Openings:

- 2019: 50

- 2020: 50

- 2021: 55

- 2022: 55

- 2023: 52

- 2024 (estimated): 51

It’s projected to expand by 51 this year, with 60 franchise agreements signed and outlets still waiting to be opened. If that happens, Culver’s would cross into 2025 with 995 restaurants.

Culver’s started franchising in the 1980s. In the first decade of doing so, it brought just fewer than 100 units to market. And it’s closed three franchised restaurants in 36 years (one last year).

Culver’s transferred 49 from franchisees to new owners in 2021—a number that dropped to 37 and 16 in the ensuing two years.

As the company explored with a new marketing push in 2022, there are some similarities to Chick-fil-A in the way it generates exclusive appeal through regional ties, as well as how tight its process to join the system can be. Culver’s requires anybody applying for a franchise to work at least six 10-hour days in one of its restaurants.

That growth expanded outward over the years from high-density centers of awareness. But you can see below how Culver’s has started to seed some new DMAs, carrying that fan-driven cult-fervor and curiosity along with it.

WHY CULVER’S WAS NAMED ONE OF QSR’S BEST BRANDS TO WORK FOR

The first non-Wisconsin Culver’s opened in 1995 in Buffalo, Minnesota, with a Roscoe, Illinois, unit opening later the same year. It spread to Iowa in November 1997 and outside the Midwest in February 1998 with a Texas location.

At the end of 2023, Culver’s home state of Wisconsin had 142 franchised stores, up four from 2021. All seven company units are in The Badger State as well. The brand opened one, year-over-year.

How it broke down on the franchised side.

Current franchised stores open and operating (Wisconsin has 142)

- Alabama: 11

- Arizona: 36

- Arkansas: 2

- Colorado: 23

- Florida: 102 (this number was just 81 in 2021)

- Georgia: 21

- Idaho: 4

- Illinois: 135 (125 in 2021)

- Indiana: 78 (also a big push from 59 in 2021)

- Iowa: 37

- Kansas: 8

- Kentucky: 16

- Michigan: 96 (85 in 2021)

- Minnesota: 61

- Missouri: 42 (35 in 2021)

- Nebraska 13

- North Carolina: 15

- North Dakota: 8

- Ohio: 25

- South Carolina: 10 (doubled since 2021)

- South Dakota: 14

- Texas: 14

- Tennessee: 9

- Utah: 14

- Wyoming: 2

Looking at 2024, Culver’s, as noted, expects to reel off 51 stores. That Florida surge will continue with 13 openings on deck.

Projected openings for 2024 (Florida is 13)

- Alabama: 3

- Georgia: 1

- Illinois: 2

- Indiana: 8

- Kansas: 3

- Michigan: 5

- Minnesota: 2

- Missouri: 1

- North Carolina: 3

- Ohio: 2

- South Carlina: 3

- Tennessee: 1

- Wisconsin: 3

Through this recent growth chart, Culver’s sales followed. The chain’s average-unit volume across 871 counted stores (that didn’t include 2023 openings or 13 franchised restaurants that aren’t typical locations, including three without a drive-thru window, six that share a building with a convenience store, and four that occupy an endcap of a multi-tenant building) was $3.487.5 million.

The nearly $3.5 million result, going by year-end 2022 performance, would put Culver’s sixth among the 50 top-grossing quick-serves in America, trailing Chick-fil-A ($6.7M), Raising Cane’s ($5.44M), Shake Shack ($3.8M), Whataburger ($3.725M), and McDonald’s ($3.625M).

Culver’s number is also a material rise from 2022, when it was $3.28 million and 2021, when it clocked in at $3.099 million. Culver’s AUV in 2020 was $2.624 million and $2.435 million in pre-COVID 2019. In sum, Culver’s emerged from the pandemic making roughly $1 million-plus more per location than it did going in.

According to The Wolf of Franchises, Culver’s touts expected margins of about 12 percent, or $420,000 or so per location.

Culver’s systemwide U.S. sales were $1.73 billion at the end of 2019. That number lifted to $1.986 billion in 2020, $2.489 billion in 2021, and $2.830 billion in 2022 (2023 has not been revealed yet).

One thing to note as well, in markets with nine or fewer Culver’s, the AUV figure was $3.372 million. For markets with 10 or more, it came in at $3.535 million. So while there’s uplift with maturation, new DMAs aren’t lagging significantly, either.

Units within a half mile of an interstate enter or exit ramp reported AUVs of $3.691.6 million. Those not in that distinction: $3.408 million.

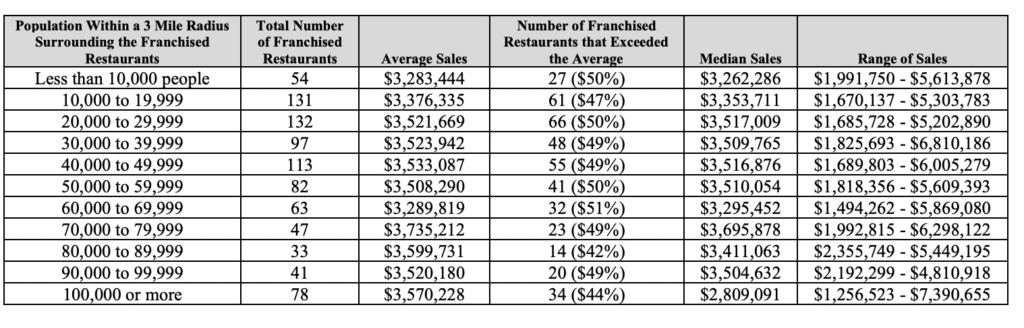

Population metrics were steady, too:

As were household income reflections:

And the ability to compete in or anchor a market:

Franchise revenue for Culver’s in 2023 was $236,209,862, up from $200,139,448. Company sales lifted to $27,599,972 from $22,004,765.

So total operating revenues closed 2023 at $263,809,934 over $222,144,213.

Net income in 2023 rose to $106,298,651—a year-over-year hike from $75,559,111.

It exited the calendar with $52,346,934 in cash and cash equivalents. That was $46,172,572 at the end of 2022.

Culver’s history dates back four decades to when Craig and Lea Culver, along with Craig’s parents George and Ruth, opened the restaurant as a single family-owned spot in Sauk City, Wisconsin. Craig wanted to bring the frozen custard he tried in college to fresh audiences. Culver’s then used an ice cream scoop to place fresh, never frozen beef on a griddle, which it smashed with a spatula and placed atop a buttered toasted bun (what it calls ButterBurgers). That’s the method still used today—everything made fresh to order— alongside a wide-ranging menu that includes cheese curds sourced from a Wisconsin family farm.

More recently, Culver’s introduced a new smoky, thick-cut bacon. Culver’s cooks the product with a propriety method, it said, leaving it chewy on the side with the edges crisped on the grill.

Coming into COVID, Culver’s didn’t offer online ordering. But it was able to sustain and then elevate volume through its drive-thrus, which often morphed into double-lanes as the brand’s off-premises growth surged ahead of in-store gains.

In 2019, drive-thru mixed about 55 percent of sales for Culver’s. It rocketed to 90 percent during the depths of 2020 and settled “around 60 percent,” the brand previously told QSR. Meanwhile, online ordering became “very, very important” and stuck around as a growing channel.