While the point of there being “more tech” in the restaurant industry post pandemic can’t be disputed, there’s no blanket over the topic. How it’s viewed, deployed, defined, and accepted changes by sector, consumer group, and need-state. In the National Restaurant Association’s Restaurant Technology Landscape Report for 2024, the concept was split into three categories: nice-to-have, want-to-have, and must-have.

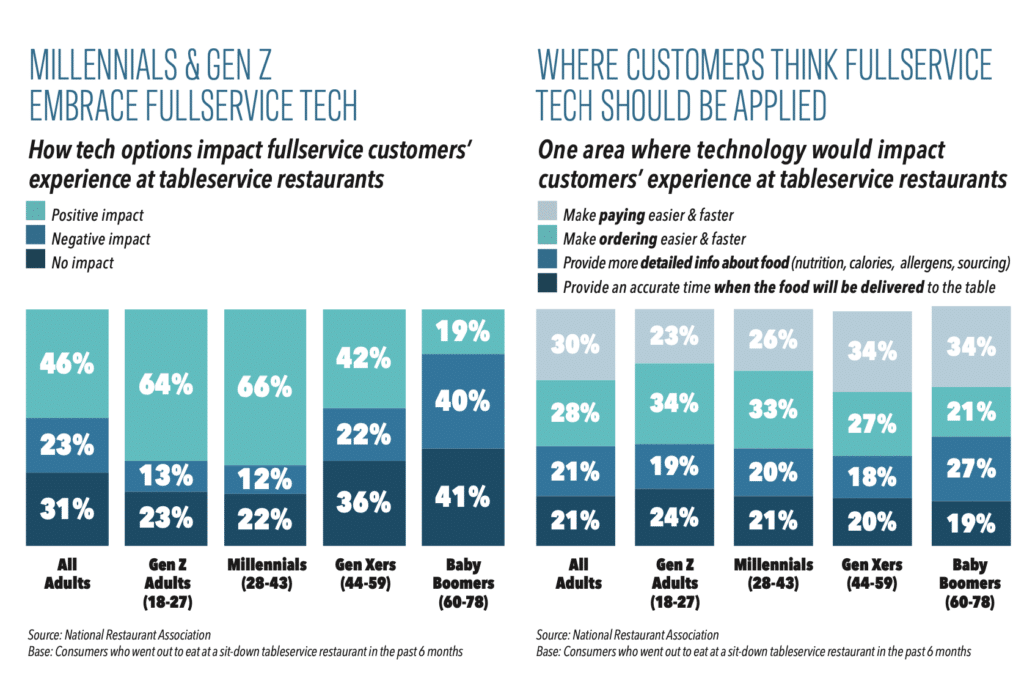

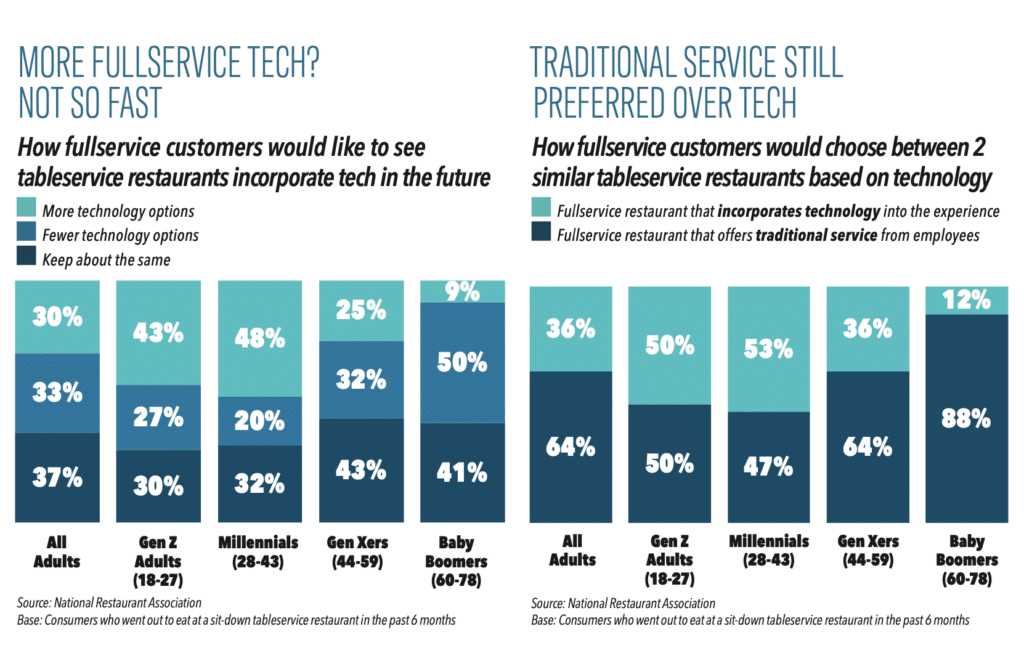

The first applied to full-service tech. “For most customers, engagement with employees is an integral part of the experience of going out to eat at a full-service restaurants, and the data suggests this isn’t changing anytime soon,” the Association said.

Customers don’t appear ready to trade a high-touch experience for a transactional one. Yet still, there is proof some would embrace convenience-enhancing systems intended to improve their overall visit. They simply don’t want tech to substitute human connection. The most popular example was the ability to pay checks easier and faster. Again, per the report, guests suggested these were nice-to-have concepts, but not essential to why they decide to dine.

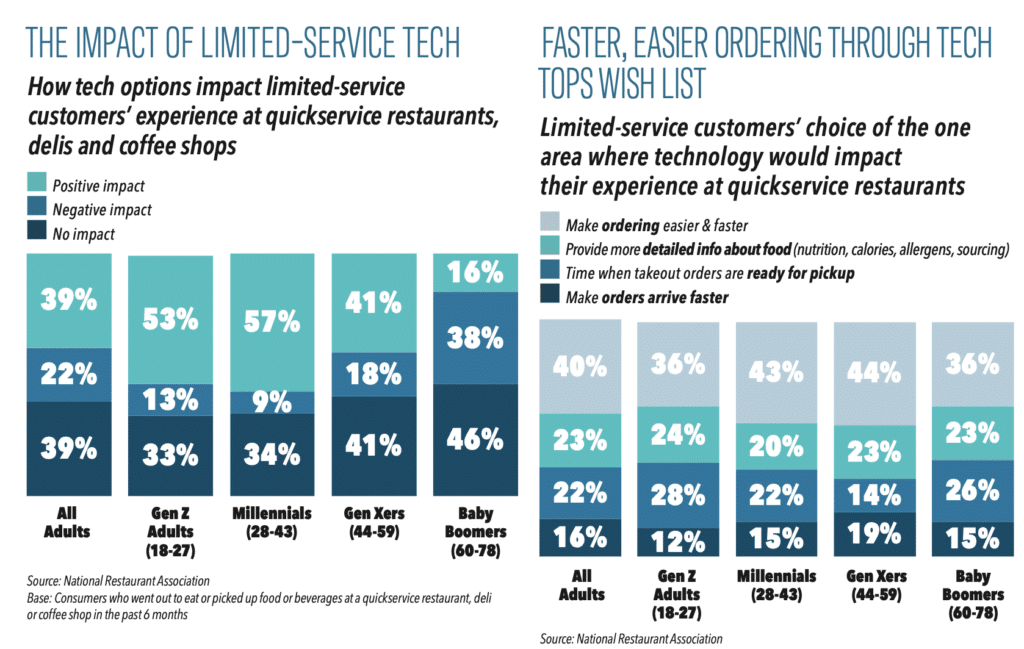

The quick-service arena fell into the “want-to-have” bucket. By nature, it’s a field designed to operate with more limited guest-employee interaction. But the Association’s data showed many younger guests actually desire fewer human-provided services in these restaurant experiences than what’s out there today. They welcome tech that fills the gaps to make an experience faster and more efficient, and it was true across all ages. It’s not necessarily a deal breaker for quick-serves who don’t have these tech options. However, a solid majority of customers want them.

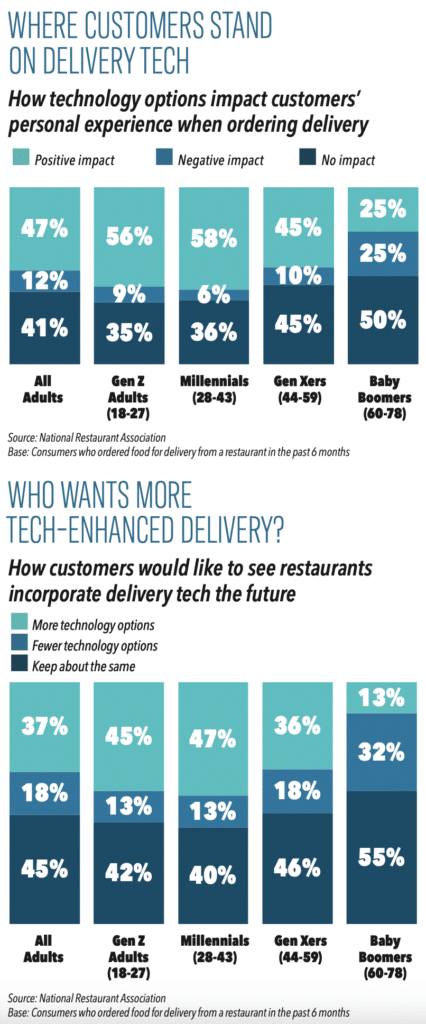

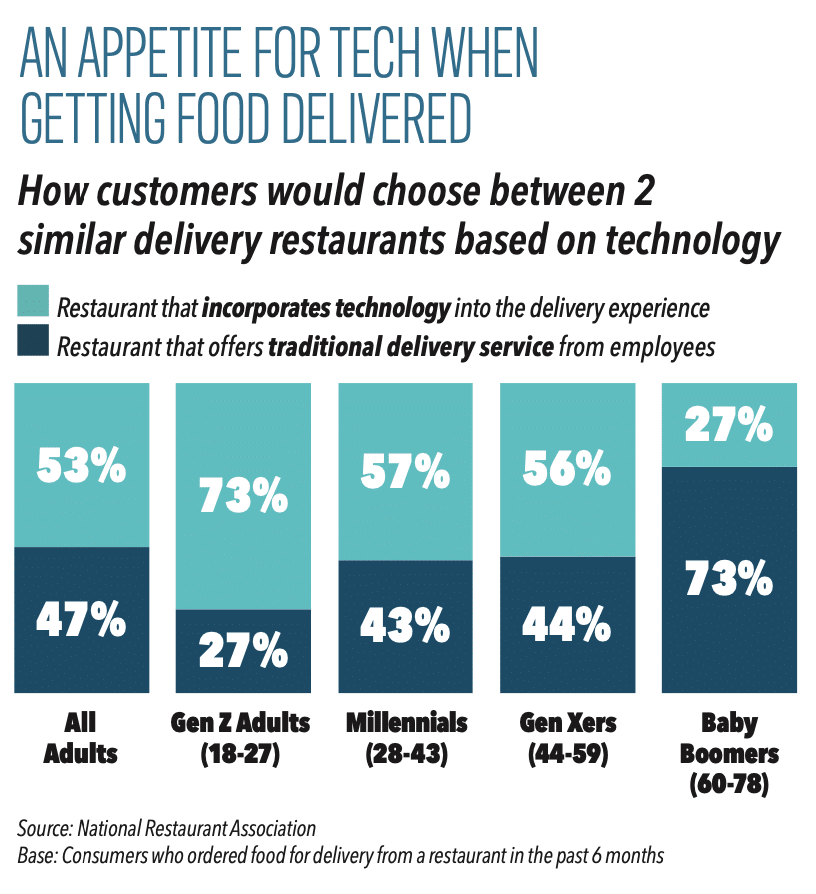

The last—“must-have”—applied to delivery tech. Compared to on-premises occasions, tech is already baked into the journey. So options like web- or app-based ordering are must-haves, rather than a nice add-on, and deal breakers to the point where users will head to another restaurant if they can’t use tech to order. “It’s much more important for operators to incorporate the baseline tech options that delivery customers expect, while keeping an eye on new developments that will set them apart from the competition,” the Association said.

“Restaurant operators have tremendous entrepreneurial spirit, and they are constantly innovating—sometimes through new dishes or flavors, and sometimes through new business practices,” said Michelle Korsmo, president and CEO of the Association, in a statement. “More than 3 in 4 operators say technology gives them a competitive edge, and this research will also help operators find the right technology fit for their restaurant and their customers. In addition to valuable research on restaurant operator outlook, our research on the technology landscape in restaurants provides insights on consumer expectations that operators need to confidently evaluate their tech investments.”

Let’s unpack some of the findings.

To the point Korsmo made, tech isn’t sneaking up on operators at this point. Seventy-six percent said using tech gives them a competitive edge, but many believe their restaurants could do more to keep pace. Just 13 percent felt their restaurant was on the leading edge in terms of how they’re using innovation compared to peers. Twenty-three percent said their operation was lagging.

Sixty-four percent added they consider their use of tech to be mainstream, “which means the restaurant industry is still far from becoming a tech-centric sector,” the Association said.

What it adds up to—restaurants aren’t close to tapping out their investments.

More on full service

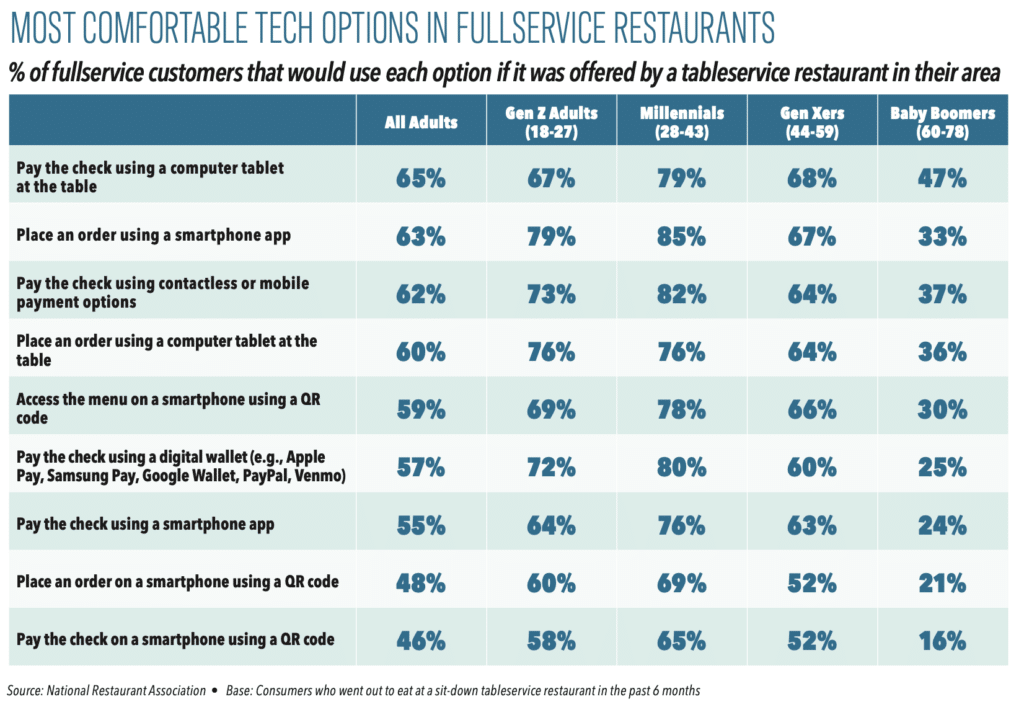

Table-service consumers were given 11 tech-related options and asked how likely they’d be to use each one.

Access to computer tablets at the table topped the list. Sixty-five percent of sit-down guests said they’d likely use it to pay the check; 60 percent would to place an order.

A majority of Gen Z adults, millennials, and Gen Xers noted they’d deploy these options if available, while fewer than half of Baby Boomers felt the same. A majority of diners also said they were comfortable using a smartphone app to either place an order (63 percent) or pay (55 percent).

Other tech-driven payment options proved popular, too. Sixty-two percent of full-service consumers would pay the check using contactless or mobile payment options and 57 percent would activate a digital wallet (like Apple Pay or PayPay). Affinity for these options pulsed among younger people.

QR codes in the dining experience showed up further down. Although 59 percent of full-service diners said they’d pull up a menu on their smartphone using one, fewer than half were comfortable using QR codes to place an order (48 percent) or pay (46 percent). Boomers were the least likely to say they’d tap one at a full-service venue.

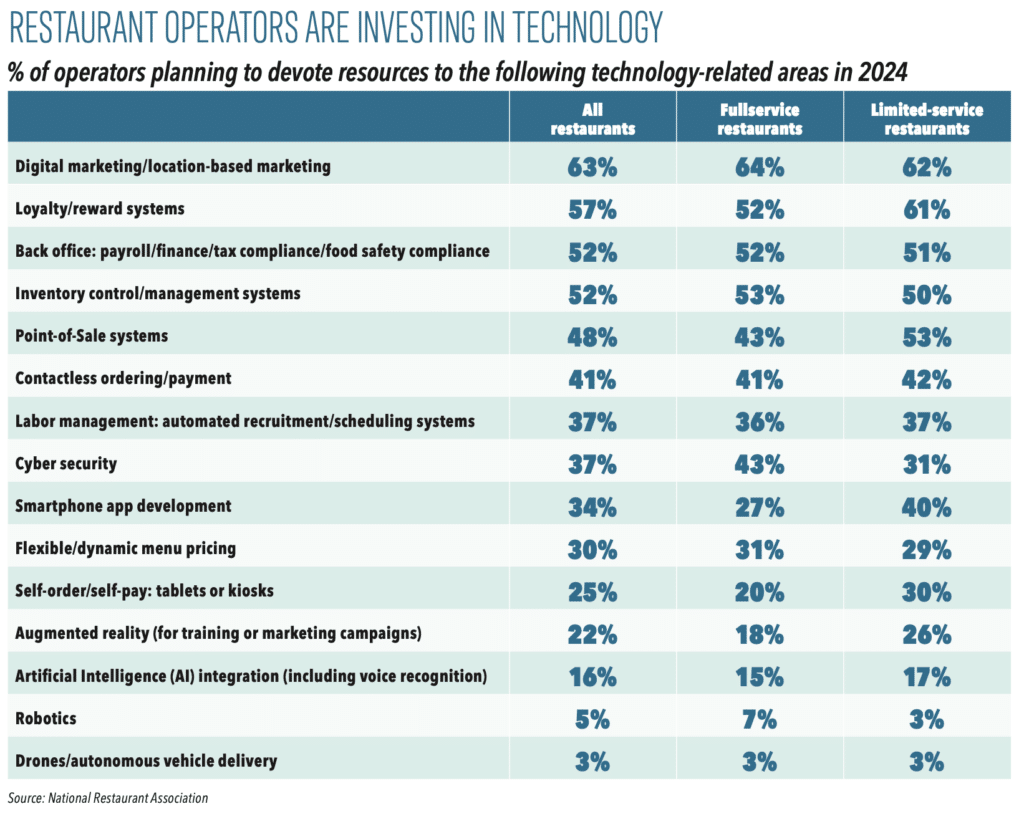

Twenty-seven percent of full-service operators said they plan to devote resources to smartphone app development in 2024 versus 40 percent of quick-service operators.

And when it came down to where category guests were least comfortable with tech, 37 percent shared they’d order food that gets delivered by automated systems or robots, and 29 percent said they’d like their food to be prepared by automated systems or robots.

So, robots aren’t quite here yet in the full-service arena.

Percentage of customers who would use each option if it was offered by a sit-down restaurant in their area

All adults

- Order food that gets prepared by automated systems or robots: 29 percent

- Order food that gets delivered to customers by automated systems or robots: 37 percent

Gen Z adults

- Order food that gets prepared by automated systems or robots: 41 percent

- Order food that gets delivered to customers by automated systems or robots: 43 percent

Millennials

- Order food that gets prepared by automated systems or robots: 45 percent

- Order food that gets delivered to customers by automated systems or robots: 58 percent

Gen Xers

- Order food that gets prepared by automated systems or robots: 29 percent

- Order food that gets delivered to customers by automated systems or robots: 37 percent

Boomers

- Order food that gets prepared by automated systems or robots: 7 percent

- Order food that gets delivered to customers by automated systems or robots: 14 percent

Into the quick-service space

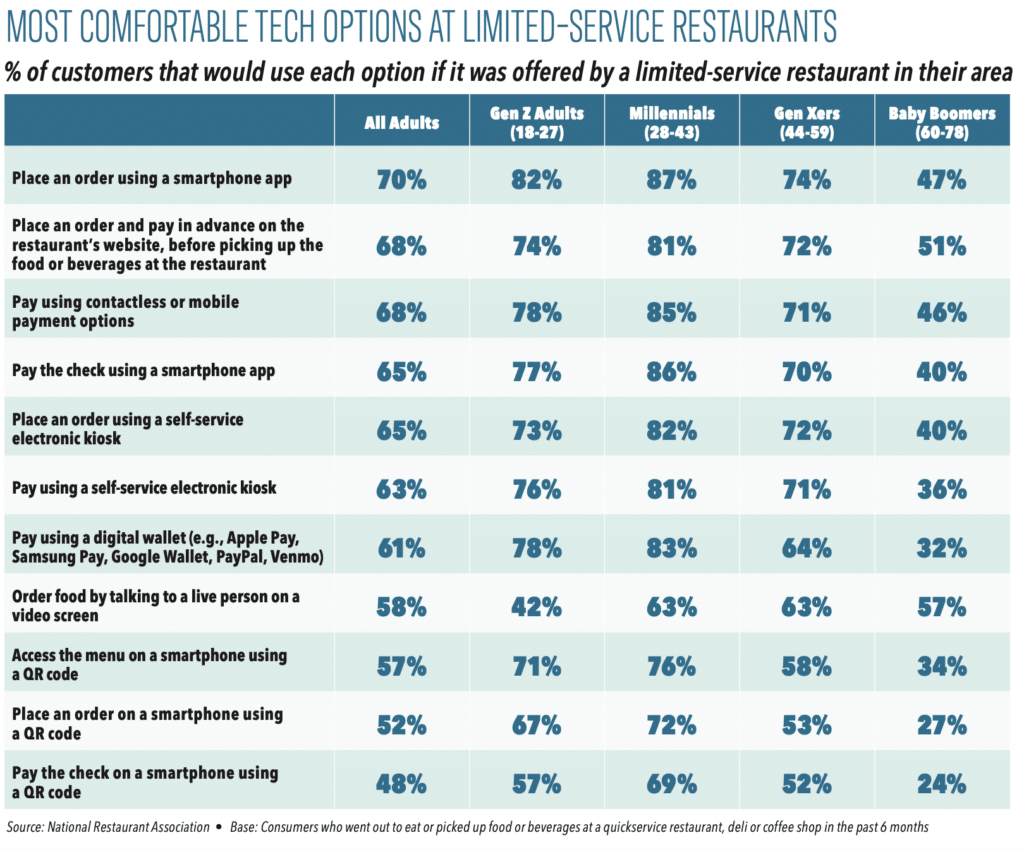

In this realm, consumers were handed a list of 14 tech-related options at quick-service spots, delis, and coffee shops, and asked how likely they’d be to use each one.

No. 1 on the list: Smartphone apps. Seventy percent of respondents said they’d use an app to order and 65 percent to pay. Most Gen Z adults, millennials, and Gen Zers would tap a smartphone app in their limited-service restaurant experience.

While fewer than half of Boomers reported the same, they were far more likely to accept use of smartphone apps here than in full service. The ability to pay when the order was placed on the restaurant’s website was another popular opinion.

Forty-two percent of limited-service operators noted they plan to invest in contactless or mobile pay tech in 2024.

The ability to order (65 percent) or pay (63 percent) with a kiosk was widespread among most category customers. In particular, younger ones. A way to increase ordering efficiency, the Association said, is to give guests the option of ordering by talking to a live person on a video screen—nearly six in 10 limited-service customers (58 percent) said they’d use this option.

QR codes were, understandably, more preferred in this setting than sit-down venues. Fifty-seven percent of quick-service diners said they’d access the menu on a smartphone using one, while roughly half would use it to place an order (52 percent) or pay the check (48 percent).

Like full service, there remains trepidation with automated systems and robots. Thirty-six percent of respondents would order food that gets delivered by automated systems or robots and 30 percent would like their food to be prepared by them. Limited-service customers, though, have no problem ordering through a live person via video screen, but they were less enamored by AI-generated interactions. About a third of these customers said they’d like this ordering option.

Percentage of customers that would use each option if it was offered by a limited-service restaurant in their area

All adults

- Order food that gets delivered to customers by automated systems or robots: 36 percent

- Order food by talking to an Artificial Intelligence (AI) generated person on a video screen: 33 percent

- Order food that gets prepared by automated systems or robots: 30 percent

Gen Z adults

- Order food that gets delivered to customers by automated systems or robots: 48 percent

- Order food by talking to an Artificial Intelligence (AI) generated person on a video screen: 33 percent

- Order food that gets prepared by automated systems or robots: 43 percent

Millennials

- Order food that gets delivered to customers by automated systems or robots: 53 percent

- Order food by talking to an Artificial Intelligence (AI) generated person on a video screen: 49 percent

- Order food that gets prepared by automated systems or robots: 46 percent

Gen Xers

- Order food that gets delivered to customers by automated systems or robots: 39 percent

- Order food by talking to an Artificial Intelligence (AI) generated person on a video screen: 37 percent

- Order food that gets prepared by automated systems or robots: 31 percent

Boomers

- Order food that gets delivered to customers by automated systems or robots: 12 percent

- Order food by talking to an Artificial Intelligence (AI) generated person on a video screen: 16 percent

- Order food that gets prepared by automated systems or robots: 9 percent

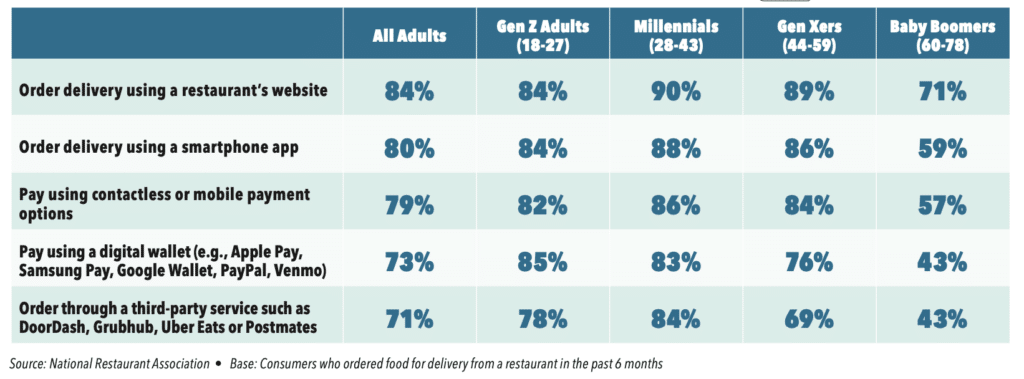

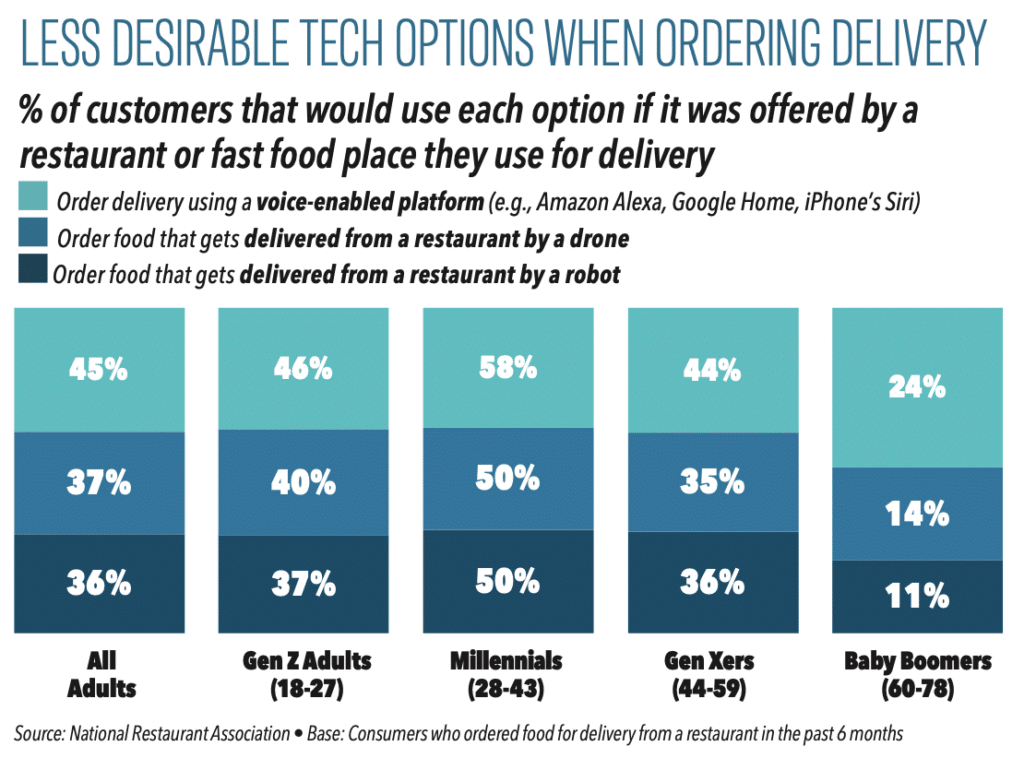

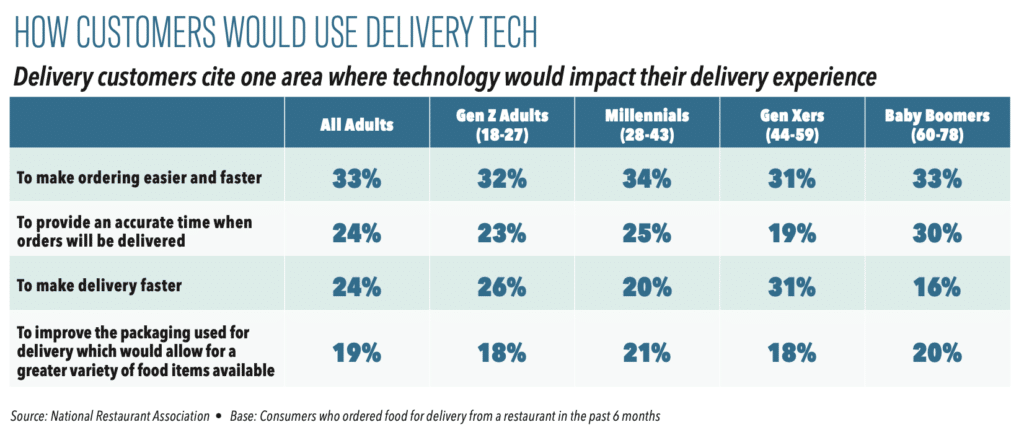

The delivery must-haves

As noted, delivery is one world where tech is table-stakes. If consumers expect digital and instant fulfillment in their retail lives (Amazon), the same is widely true of how they procure food through the channel. Delivery customers in the report saw eight tech-related options at restaurants that deliver F&B orders and were asked how likely they’d be to use each one.

Eighty-four percent reported they’d order delivery using a restaurant’s website. Eight in 10 delivery customers, including 50 percent of Boomers, added they’d tap delivery through a smartphone app.

These customers were much more likely to embrace electronic payment options (as you’d expect), with 70 percent of delivery customers saying they’d go for contactless or mobile payment outlets; 73 percent green-lighted digital wallet options as well.

Seventy-one percent of people said they’d be likely to order delivery through a third-party service, like DoorDash, etc.

Here’s a look at the percentage of guests who would use each option if it was offered by a restaurant they use for delivery, category agnostic.

On the “less comfortable with tech” side, fewer than half (45 percent) said they were eager to order via voice-enabled platforms like Alexa. Fewer than four in 10 said they’d order food that gets delivered by a drone or robot.

As for operators, 16 percent said they plan to invest in AI integration (including voice recognition) in 2024.

The integration game

There were four categories consumers showed particular interest in: ordering in advance at full-service restaurants; variable pricing; reserving specific tables online; and loyalty programs.

Sifting through, 70 percent of respondents—88 percent of Gen Z adults and 84 percent of millennials—said they’d take advantage of the ability to order in advance online, schedule a time to arrive, and get their food shortly after they’re seated in a full-service environment.

Thirty percent added they’d pay a fee to reserve a specific table from a seating chart on a website.

Percentage of consumers who would pay more to reserve their preferred table

- All adults: 30 percent

- Gen Z adults: 54 percent

- Millennials: 44 percent

- Gen Zers: 26 percent

- Boomers: 10 percent

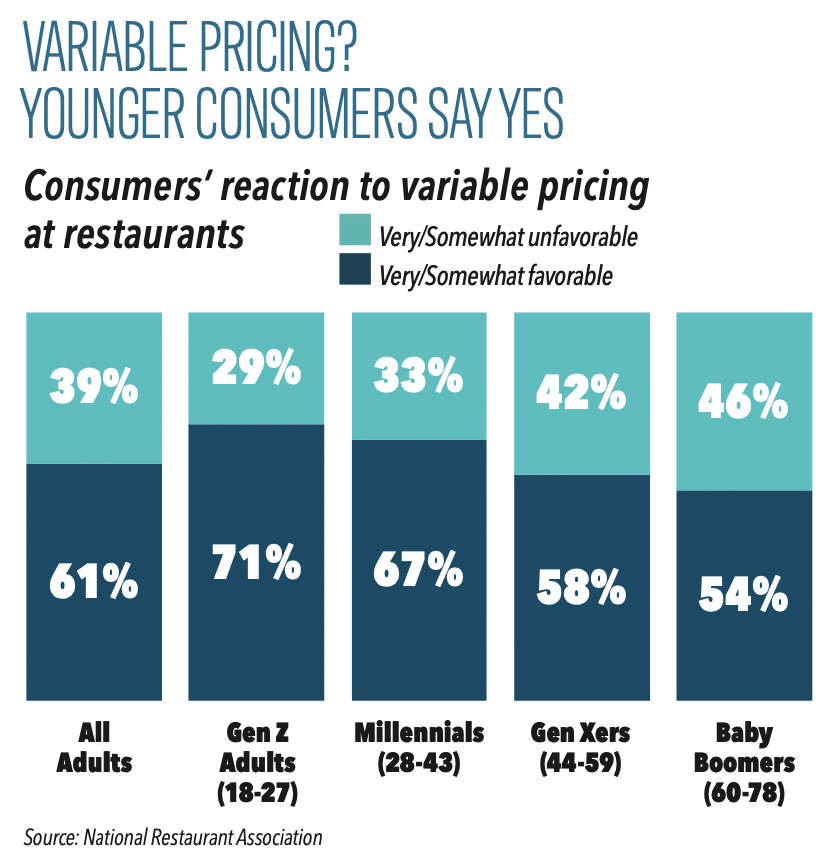

Sixty-one percent of adults noted they were game for variable pricing in general. Operators, the Association said, could communicate price changes to guests using a smartphone app and social media. Say fluctuations depending on how busy the restaurant is. Naturally, this concept created a firestorm with Wendy’s recently, but it’s broadly a more flexible idea than what that controversy made it out to be.

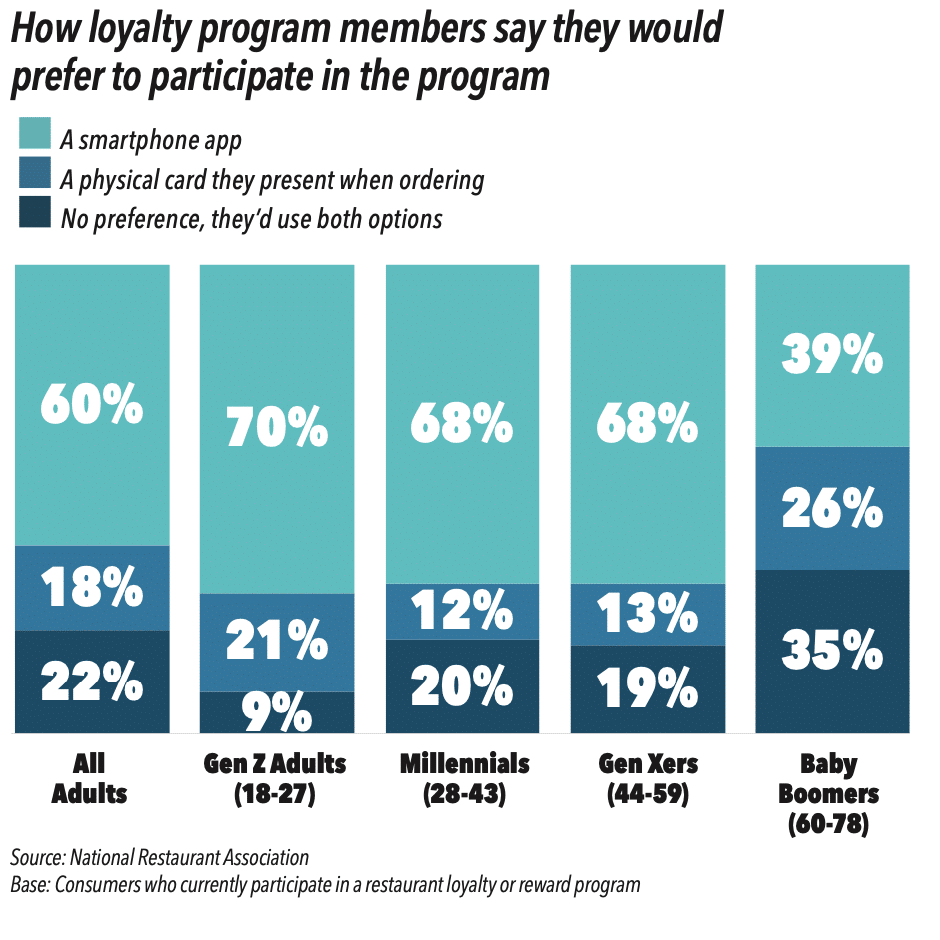

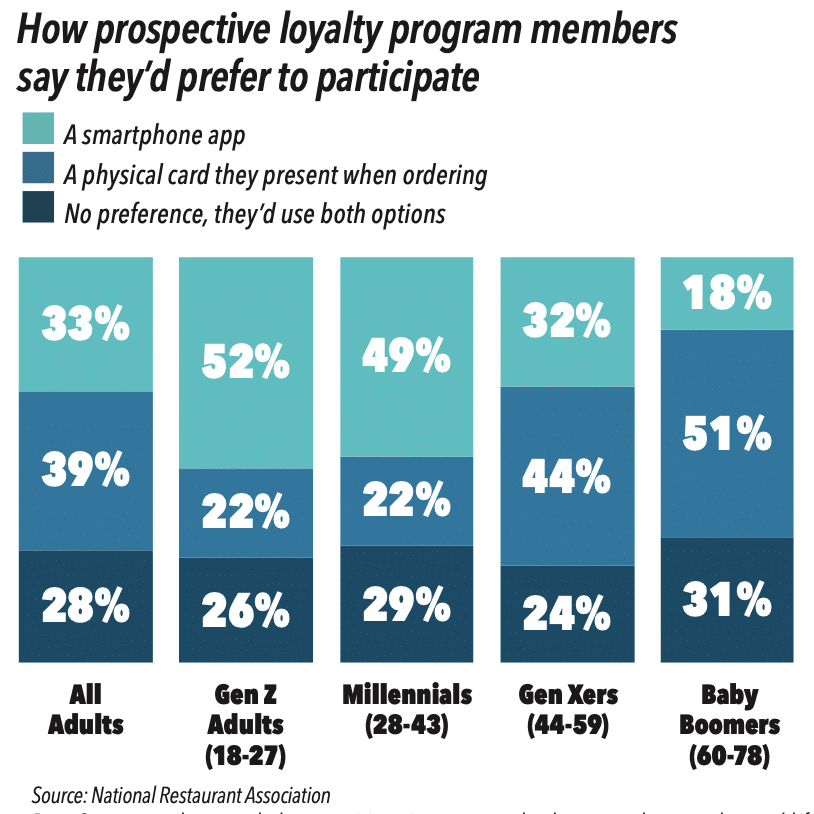

Shifting to loyalty, 52 percent of adults said they currently participate in a loyalty or rewards program at a restaurant, coffee shop, snack spot, or deli. Ninety-six percent of these participants reported being a member was a good way to get more value. Sixty percent of current users prefer to access programs through smartphone apps versus physical cards; 18 percent would rather use a card; 22 percent don’t have a preference. Boomers were the most likely to suggest they’d use both.

Sixty-one percent of quick-service operators expect to invest in loyalty/rewards technology in 2024.

The Association added, for prospective loyalty customers, technology might be an issue, at least compared with current members. If given the choice, 39 percent said they’d prefer to have a physical card to present when ordering. Only a third preferred to participate using a smartphone app (this is the prospective pool of loyalty guests, not those who have already enrolled somewhere). Among Boomers, 51 percent said they’d rather use a card.

The operator response

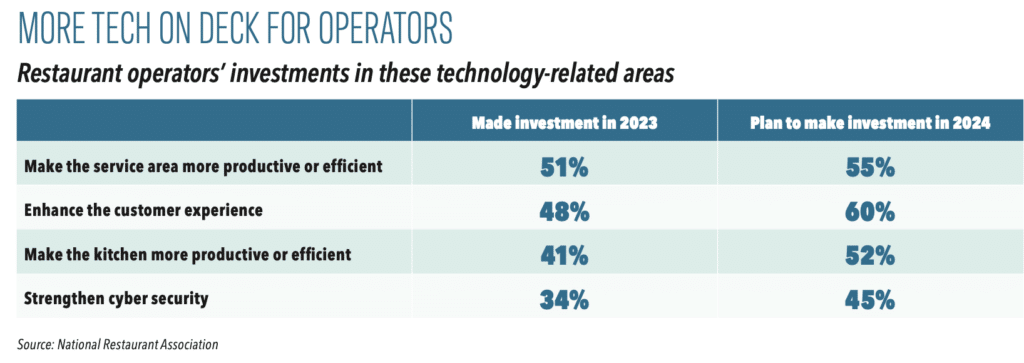

Half of operators in the Association’s survey said they devoted more resources to make their service more productive last year; 48 percent invested in the customer experience.

Four in 10 deployed tech to enhance productivity in the kitchen. Even more expect to spend on tech-related fixes in these areas in 2024. Seventy-three percent reported their restaurant is more efficient and productive today than pre-COVID.

The Association also asked operators to unpack where they plan to invest in 2024.

As always, labor challenges spiked. Forty-seven percent of operators said, in 2024, the use of tech and automation to help with labor will become more common (44 percent in full and 49 percent in quick service). Sixty-nine percent added tech integration in restaurants would augment rather than replace human labor (68 percent in full and 69 percent in quick). Twenty-five percent noted using temporary workers to increase staffing levels would become more prevalent and 37 percent expect to spend on automated labor management recruitment/scheduling systems.

“The data clearly show that restaurant operators and owners are rapidly embracing technology and integrating it into their daily operations,” said Hudson Riehle, SVP of research and knowledge for the Association, in a statement. “Understanding which technologies customers in each segment would like to have, really want, and consider essential, provides operators with substantial opportunities to enhance the customer experience, amplify marketing and operate more efficiently.”