1. Roark Capital Buys Arby’s

With concerns about the economy running high, restaurant industry mergers and acquisitions dipped noticeably.

None of 2011’s mergers came close in value to the previous year, when Burger King and CKE, parent of Carl’s Jr. and Hardee’s, were each sold for more than $1 billion. Instead, there were smaller deals and one big buyer, Roark Capital Group.

Roark already acquired Il Fornaio America Corp., owner of Corner Bakery Café, for an estimated $300 million when the investment firm agreed to buy an 85 percent stake in Arby’s for $430 million.

Roark’s portfolio also includes FOCUS Brands, led by Moe’s Southwest Grill and Schlotzsky’s, along with McAlister’s Deli and Wingstop.

“We like restaurants, because we have a lot of experience in the industry,” says Geoff Hill, a vice president at Roark and a former FOCUS executive. “We like to invest in things we know and understand.”

Roark looks for companies that have “solid core economics and a good long-term outlook” and “ones that we can provide value to.”

Despite the spate of acquisitions over the past two years, Roark isn’t done. “We are still active, we are still out there, always looking at what great brands are out there for us,” Hill says.

2. The King is Dead

In August, Burger King shocked the world when it announced that it would retire its King mascot. It was a move many lauded as way past due (some have called the King “creepy”). The company, which also switched marketing agencies, is opting for more food-centered advertising, like the spots that hyped its new California Whopper.

3. McDonald’s New Kids’ Meals

McDonald’s Corp. began filling its Happy Meal boxes with apple slices and smaller portions of french fries in September.

“We are a company that cares about our customers, and we’re determined to run our company in a way that honors our founder, Ray Kroc, who believed that anything worth doing is always worth doing right,” Jan Fields said during the launch of the new program over the summer. The move came shortly after the National Restaurant Association announced its voluntary nutrition program “Kids LiveWell.”

4. Wendy’s Tests New Prototype

After hearing feedback from customers that its brand was tired and dated, Wendy’s unveiled a new store prototype in Columbus, Ohio, that allows diners to see the fresh preparation of food and offers more comfortable dining areas for customers to lounge in.

The new store is one of four the company is launching. The new prototype in Columbus includes a WiFi lounge area, a new premium coffee program, updated interiors, and an exterior design inspired by Frank Lloyd Wright.

5. Swipe Fees Capped

After nearly a year of work, the Federal Reserve announced June 29 that it would cap debit card “swipe fees” for merchants at 21 cents per transaction.

Merchants pay these fees, also known as interchange fees, each time guests use a debit card as payment. The cap took effect October 1.

6. YUM! COO Joins Wendy’s as CEO

In September, Emil J. Brolick joined Wendy’s as president and CEO, leaving his position as COO of YUM! Brands.

Brolick is no stranger to Wendy’s, having been one of the primary architects of Wendy’s strategy in the late 1980s—a business model that led to 16 consecutive years of same-store sales growth for the brand.

7. Sbarro Declares Bankruptcy

7. Sbarro Declares Bankruptcy

Private-equity-held Sbarro declared bankruptcy, looking to cut its debt by $195 million. The company also received a $30 million capital infusion. In a court filing, the company said, “Sbarro intends to emerege expeditiously from Chapter 11 as a stronger, well-capitalized, and more competitive company.”

8. “We’re looking for leadership from quick-serve restaurants. There’s no question that we’re really going to need folks in the industry to step up and help us get this initiative where it needs to be.”—Sam Kass, senior policy advisor for healthy food initiatives at the White House, speaking to QSR about the First Lady’s anti-obesity campaign “Let’s Move!”

9. Restaurant Stocks Survive Market Turmoil

Restaurant companies’ stock prices held up fairly well during the 2011 market correction. Although major market benchmarks declined more than 6 percent through the first three quarters of the year, the S&P restaurant index rose 12 percent.

The restaurant index was led by a 50 percent gain by Chipotle Mexican Grill, as well as double-digit percent increases by Starbucks, McDonald’s, and Panera. Jack in the Box and Wendy’s were more in line with the market in general, while Sonic shares dropped 30 percent.

[pagebreak]

10. Top Acquisitions

The top U.S. limited-service restaurant transaction was Golden Gate Capital’s $454.9 million purchase of California Pizza Kitchen. After that was the Arby’s transaction, and then the sale of Bojangles’ Famous Chicken ‘n Biscuits by Falfurrias Capital Partners to global private-equity firm Advent International for an estimated $400 million.

Other deals include the acquisition of Salsarita’s Fresh Cantina by a company led by former McAlister’s Deli exec Phil Friedman, and Groupe Le Duff’s $91 million purchase of Bruegger’s Enterprises Inc.

11. Papa John’s Bets On the Super Bowl

No Super Bowl has ever gone into overtime.

And no pizza company has ever called such a bold play as when Papa John’s, the Official Pizza of the NFL and Super Bowl XLV, announced it would give a free large pizza to everyone in America if Super Bowl XLV broke the no-overtime streak.

“There’s no better event or day to serve as a platform for our largest offer ever,” said Andrew Varga, Papa John’s CMO, at the time of the announcement. Varga and other Papa John’s execs breathed a sigh of relief when Green Bay Packers’ Aaron Rodgers took a knee with 49 seconds remaining in the fourth quarter to win without a second of overtime. Perhaps double or nothing next year?

12. Little Brand Hosts Big Party

On May 1, East Coast salad concept SweetGreen invited friends, diners, and VIPs to its SweetLife Festival at Merriweather Post Pavilion in Maryland. As the marquee sponsor for the festival, SweetGreen was credited with bringing acts such as Girl Talk, Lupe Fiasco, Ra Ra Riot, and Cold War Kids to the event, enforcing its “welcome to the sweet life” corporate philosophy.

On May 1, East Coast salad concept SweetGreen invited friends, diners, and VIPs to its SweetLife Festival at Merriweather Post Pavilion in Maryland. As the marquee sponsor for the festival, SweetGreen was credited with bringing acts such as Girl Talk, Lupe Fiasco, Ra Ra Riot, and Cold War Kids to the event, enforcing its “welcome to the sweet life” corporate philosophy.

13. Dunkin’ Goes Public (Again)

Dunkin’ Brands became the first limited-service-restaurant company in about four years to go public. The Canton, Massachusetts–based business raised $422.75 million in July after pricing its initial public stock offering at $19 per share, slightly above expectations.

Dunkin’ is the parent of Dunkin’ Donuts and Baskin-Robbins.

The price put Dunkin’s value at upward of $2.3 billion, when all of the company’s outstanding stock is considered. That’s a bit less than the $2.45 billion that Bain Capital, Carlyle Group, and Thomas H. Lee Partners paid for the enterprise six years ago. The trio of investors still control 78 percent of Dunkin’s stock.

“It’s an exciting time for Dunkin’ Brands as a new public company,” company CEO Nigel Travis said after the offering was completed.

14. Chipotle Debuts ShopHouse

From the owners of Chipotle this September came ShopHouse in Washington, D.C., serving an Asian version of fast food.

As you’d expect from the Chipotle folks, the food is fresh, sourced sustainably, and raised without hormones or antibiotics. The dishes are also simple: bowls or banh mi sandwiches.

“We have long believed that Chipotle’s success wasn’t necessarily tied to serving tacos and burritos, but rather is rooted in our making great tasting food … and serving our customers in a format that is personal and that lets them choose exactly what they eat,” says spokesman Chris Arnold.

15. MyPlate Stacks Up

MyPlate couldn’t have come at a better time for quick-service operators who are increasing healthy choices on their menus, especially for children. The new food icon introduced this year by the USDA is designed to encourage Americans to eat healthier. The colorful plate is a layout of appropriate amounts of vegetables, fruits, lean meats, whole grains, and dairy in a meal.

Applauded by the National Restaurant Association and the Center for Science in the Public Interest, MyPlate is easily displayed and referenced, making it useful in the industry’s continuing advances toward more healthful menus.

16. Burger King Gets Downgraded

Among the bigger financial deals was Burger King’s $1.85 billion term loan to finance its buyout, although ratings agency Fitch later downgraded the burger company’s long-term debt to B-minus from B with a negative outlook.

Fitch also assigned a BBB rating to YUM! Brands’ proposed 10-year $350 million senior unsecured notes.

17. Quiznos Grows Globally

Quiznos is struggling domestically (the chain is down to about 3,500 stores, compared with almost 5,000 before the recession hit), but it is moving into new territory.

This August, the Denver-based chain opened a flagship store in Kuwait and its largest international location in southern India. Further plans include 200 locations in northern Brazil, including seven stores before the end of the year.

[pagebreak]

18. McDonald’s Execs Open New Concept

In October, two former McDonald’s executives launched LYFE Kitchen in Palo Alto, California.

It’s not what you’d expect from a couple of McDonald’s guys. It’s healthy comfort food, or what Mike Donahue, COO of the brand, describes as “a lifestyle restaurant.” The menu includes frittatas, burritos, salads, and pasta.

“We cater to energy, balance, and lifestyle,” he says. “Nothing will be over 600 calories or 1,000 mg of sodium. There are no preservatives, no butters, no creams, no GMOs.”

While large-scale expansion is expected (there are hopes for 250 locations within the first five years), the company has four potential sites earmarked in Northern California. The first stores will be company-owned—“so we have control,” Donahue says—but he hasn’t ruled out franchising down the line.

19. “I don’t really see any excuse for some of the huge errors we saw. I think it is lax quality control that can be improved now that we have identified [it] as an issue.” —Susan Roberts, lead author of a Tufts University study that found that about 20 percent of tested restaurant menu items had significantly more calories than advertised on menuboards and websites

20. Buffalo Ranks No. 1 for Restaurant Growth

In the January “Growth 40” report, Pitney Bowes Business Insight ranked Buffalo, New York, as the top large market for quick-service expansion. Combining data, such as the area’s restaurant landscape, changes and projections in unemployment, retail sales, home prices, and disposable income, the report identified the nation’s top 40 markets poised for quick-service growth.

In the January “Growth 40” report, Pitney Bowes Business Insight ranked Buffalo, New York, as the top large market for quick-service expansion. Combining data, such as the area’s restaurant landscape, changes and projections in unemployment, retail sales, home prices, and disposable income, the report identified the nation’s top 40 markets poised for quick-service growth.

Other top 10 large markets were:

21. Seattle, Washington

22. Rochester, New York

23. Portland, Oregon

24. Pittsburgh, Pennsylvania

25. Philadelphia, Pennsylvania

26. Austin, Texas

27. Houston, Texas

28. Tucson, Arizona

29. Boston, Massachusetts

30. “Where’s the Beef?” Returns

Wendy’s spent the last year reinventing itself, from selling sister brand Arby’s to Roark Capital to debuting a more modern store prototype. In September, the company took it up another notch by reintroducing its “Where’s the Beef?” catchphrase, which first earned popularity in 1984.

Securing the new campaign’s appeal was the use of “Modern Family” actor Reid Ewing in the new spot.

31. Popeyes’ New Dip’n Chick’n

For a limited time this fall, Popeyes Louisiana Kitchen offered Dip’n Chick’n to diners.

Never heard of it? You’re not alone. Dip’n Chick’n is an invention of the company’s “culinary dream team.” They’re tender chicken breast “scoop” medallions, which have been marinated in authentic Louisiana herbs and spices, then hand battered and breaded and paired with the company’s new signature dipping sauce.

32. #BarBQforBaldricks

Twitter doesn’t always have to be about fun and games. In fact, sometimes Twitter can be used to do much more meaningful things. That’s what North Carolina–based Smithfield’s Chicken ’N Bar-B-Q used it for in March when it supported the St. Baldrick’s organization, which funds research for childhood cancer. The company donated 25 cents to St. Baldrick’s for every tweet that included the #BarBQforBaldricks hashtag on March 5.

33. Georgia-Pacific Helps Joplin Relief

Continuing on-going relief efforts for Joplin, Missouri, tornado victims, Georgia-Pacific Professional joined the “airlift of support.” The flight delivered thousands of pounds of Brawny Industrial wipers and towels donated by Georgia-Pacific Professional to help with the clean-up efforts.

Continuing on-going relief efforts for Joplin, Missouri, tornado victims, Georgia-Pacific Professional joined the “airlift of support.” The flight delivered thousands of pounds of Brawny Industrial wipers and towels donated by Georgia-Pacific Professional to help with the clean-up efforts.

34. The Melt

Who ever said food and technology don’t go together? Certainly not Jonathan Kaplan, founder of the Flip camera and now The Melt fast-casual concept, a grilled-cheese restaurant with an innovative twist. Customers can order and pay for their sandwiches from their computer or phone. Then, using a QR code that is sent to them and scanned at the counter, they pick up their orders hassle-free and in a matter of minutes.

“We’re using innovative technology to reinvent the fast-casual restaurant experience for the better,” Kaplan says.

[pagebreak]

35. Arby’s New Kids’ Meals

In an exclusive announcement to QSR, Arby’s debuted its new kids’ meal options this fall. The changes included two new kids’ meal entrees and the replacement of fries with apple slices and strawberry yogurt dipping sauce as a side to each kids’ option.

“The moms told us that they wanted some healthier choices available, and the apples and the yogurt sauce were definitely popular items, so that was a no-brainer to get that in there,” says Hala Moddelmog, president of Arby’s Restaurant Group.

36. Greg Creighton Moves to President, Smashburger

Greg Creighton was named the president of “better burger” chain Smashburger, having previously served as COO for the company.

“Our overall goal is to be the No. 1 brand in better burgers around the globe in the next 10 years, so we are also looking at international opportunities,” Creighton tells QSR. “We have recently announced our expansion into the Middle East with franchise partners.”

37. World’s Biggest DQ Opens

Dairy Queen opened the world’s largest DQ Grill & Chill this year in Riyadh, Saudi Arabia, a two-story restaurant with a seating capacity of 240. It will have a breakfast menu and cakes along with the chain’s signature ice cream and lunch and dinner options. Franchisee Al Safwa Food Group plans to expand to 32 locations in the country by the end of 2015. The chain also has locations in Bahrain, Oman, and Qatar, in addition to 14 other countries.

38. NRA Pushes for Menu Label Fairness

The industry’s lobbying organization sent a letter to the commissioner of the FDA calling for fairness and flexibility in applying the new federally mandated menu labeling rule. In addition, the National Restaurant Association encouraged the FDA to push the deadline back an additional six months.

39. Subway Boosts Bread Nutrients

On the heels of this year’s sodium reduction, Subway’s commitment to healthy eating continued when it rolled out nutrient-boosted bread. Subway’s sandwiches are now made with bread fortified with calcium and Vitamin D.

40. Pei Wei Offers Trip of a Lifetime

Restaurant market research firm Technomic Inc. found more than a dozen quick-serve Facebook contests that offered thousands of dollars in cash or prizes.

In one of the more unusual contests, Pei Wei Asian Diner invited a fan to travel with chef Eric Justice and other company officials on an 18-day trip to the five Asian countries where Pei Wei draws its influences. The winner experienced the cultures and sampled all types of food while blogging and video recording the experience.

41. Franchisee Acquisitions

Several franchise units changed hands during the year, including Arkansas’ K-Mac Holdings Corp., the operator of 167 Taco Bells and a handful of KFCs, which was acquired by Los Angeles–based private equity firm Brentwood Associates.

Some franchise sales were made under duress. Bankrupt Duke & King auctioned off 74 Burger King units, mostly in the Midwest, for $12 million plus assumption of certain debt, while 25 bankrupt Fatburger restaurants were sold for $7.35 million.

42. Mark Wahlberg Fights High School Dropout Rate

The Taco Bell Foundation for Teens and Mark Wahlberg, actor, producer, and former rap star, launched “Graduate to Go Studios” at the Boys & Girls Club of Los Angeles Harbor. Doing its part to keep kids in school, the mentor-based studio program provides a curriculum of video and music production projects, hoping to inspire teens with real-world experiences and show them that if they stay in school, they can indeed graduate and go places.

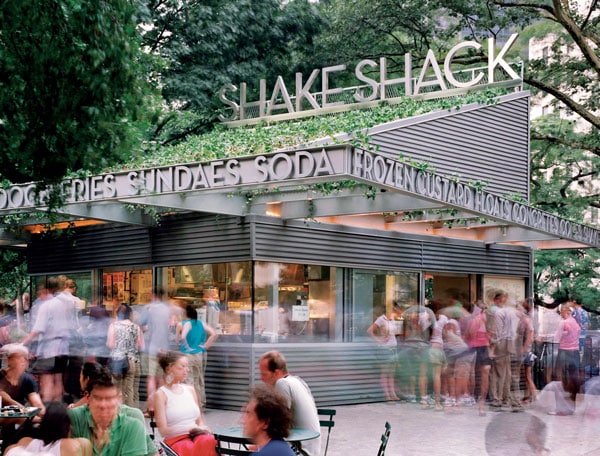

43. Shake Shack Grows by 100 Percent

Danny Meyer’s burger joint Shake Shack grew 100 percent in 2011, with five new openings in the U.S. and two in the Middle East, for a total of 14 restaurants that serve more than 12,000 people per day.

Danny Meyer’s burger joint Shake Shack grew 100 percent in 2011, with five new openings in the U.S. and two in the Middle East, for a total of 14 restaurants that serve more than 12,000 people per day.

And the chain’s not stopping with its 2011 growth. There are already three confirmed locations for 2012—in Philadelphia; Grand Central Terminal, New York City; and Coral Gables, Florida.

Mintel’s Six Hottest Tastes for 2011

Kathy Hayden, foodservice analyst at Mintel, names the top 2011 flavors and ingredients:

44. Fancy coffee drinks, featuring layered flavors such as caramel and English toffee crunch.

45. Skinny drinks are a much more aspirational way of saying “low calorie.” These first showed up in cocktails, then coffee and smoothies.

46. Carl’s Jr. may have started the Angus trend, but now you can see it anywhere from Arby’s to Quiznos.

47. Southern culinary traditions like shrimp and grits, po’ boys, barbecue, and pulled meats. Plus, Southern-style chicken sandwiches are everywhere, from Popeyes to Bojangles’ and Chick-fil-A.

48. Pumpkin is no longer just for fall and appears year-round in ravioli, frozen yogurt, shakes, and desserts. Even Panera Bread has a pumpkin muffin.

49. Mango isn’t just for summer. It’s also appeared in savory and sweet foods, from McDonald’s smoothies to cocktails, salads, and salsas.

[pagebreak]

50. The Colonel Takes Lunch to New Heights

KFC launched an extreme menu makeover by dispatching the Colonel to personally deliver its new $5 Everyday Meals to window washers working nearly 40 stories up at Chicago’s River Bend building in May.

Facebook fans were asked to name people in need of a “So Good” extreme lunch delivery, and after the votes were tallied, KFC decided to bring lunch to one of America’s most extreme occupations, high-rise window washers.

51. Venus Williams Teams Up with Jamba Juice

Venus Williams added Jamba Juice franchisee to her long list of accomplishments, opening her first of five planned stores in the Washington, D.C, metro area over the next two years.

Venus Williams added Jamba Juice franchisee to her long list of accomplishments, opening her first of five planned stores in the Washington, D.C, metro area over the next two years.

Furthering her commitment to Jamba Juice’s healthy fare, Williams joined the company’s “Team Up” program to help slam childhood obesity. As a spokeswoman, Williams is sure to deliver a powerful serve of healthy motivation to help kids choose an active lifestyle and make better dietary decisions.

52. Arby’s Fans Get $10K, Air Time

Arby’s offered $10,000 and an appearance in a commercial as part of a video contest to promote its “Good Mood Food” tagline.

53. We’re in the Golden Age of Drive Thru…

“We are all of us, right now, living in the golden age of drive-thru,” a Bloomberg Businessweek feature declared earlier this year. And indeed, innovation is reaching a peak. With kitchens at places like Taco Bell designed to minimize footsteps and wrapping time, new and easier-to-use menuboards, and ever-more targeted scripts, both efficiency and accuracy are at unprecedented levels.

… But It Might Be Ending Soon

With the advent of Internet ordering, the traditional drive-thru may become less popular. Cold Stone Creamery and Five Guys Burgers & Fries are implementing online orders, and a Sonic Drive-In franchise group is testing a pilot mobile and online ordering program in 71 locations.

54. Foreign Exchange

As U.S. companies expand overseas, international flavors are coming stateside. At this year’s NRA Show, dozens of companies were enticing restaurateurs with ethnic products. Space-efficient noodle machines from Japan’s Yamato Manufacturing Co. Ltd offered a way for restaurants to efficiently customize their own noodles, and Toronto-based Stonefire Authentic Flatbreads was selling naan, roti, and Mediterranean pitas. In the Italian pavilion, Academia Barilla offered a full line of products including extra virgin olive oils, canned peeled tomatoes, and pesto with Italian pine nuts.

55. Rick Ross Raps on Wings

Wingstop is widening its fan base thanks to some crafty name-dropping by rap star Rick Ross.

“The Boss,” as Ross is also known, name-checked his favorite Wingstop lemon-pepper-flavored wings in his hit song, “M.C. Hammer.” It’s no small coincidence that Ross is on board to open several Wingstop franchises in Memphis this fall. As Wingstop’s newest celebrity franchisee, Ross joins football Hall of Famer Troy Aikman, a longtime spokesman for the company who joined the board of directors earlier in the year.

56. The Gap Launches a Food Truck

You may have expected a food truck from Carl’s Jr. or Taco Bell, but The Gap? You know, the clothes and apparel retailer? Alas, the truck was made a reality in August when the Pico de Gap truck rolled onto Los Angeles streets to support a new line of Gap clothes.

You may have expected a food truck from Carl’s Jr. or Taco Bell, but The Gap? You know, the clothes and apparel retailer? Alas, the truck was made a reality in August when the Pico de Gap truck rolled onto Los Angeles streets to support a new line of Gap clothes.

“Top Chef” star Marcel Vigneron provided a menu of tacos, including a braised lamb neck taco with chile negro and guajillo and a carnitas taco with chipotle.

57. Lady Gaga Treats “Little Monsters” to McDonald’s

Known for her poker face, Lady Gaga revealed a rare glimpse of her sweeter side to her adoring fan base affectionately known as “Little Monsters” over the summer.

Touched by their serenade of her own songs outside the Chateau Marmont before her “Jimmy Kimmel Show” appearance, Gaga treated them to a McDonald’s feast, complete with a heartfelt tweet: “Sending some yummies to Chateau Monster tummies!”

58. E-Verify Launches Self Check

Employees in 21 states and Washington, D.C., can now check their eligibility to work in the U.S. via “E-Verify Self Check,” a service of the Department of Homeland Security.

The self-check system (which is also available in Spanish) is aimed at helping employees clean up discrepancies in their employment-eligibility information before they are hired by an employer who participates in the DHS’s E-Verify program.

[pagebreak]

59. Mad Greens’ Life-Saving App

Did you know that about 15 million Americans suffer from food allergies, and that many of them are forced to tip-toe around your menu items? Denver-based salad concept Mad Greens did, and as a result, reached out to the special diners.

The company launched a mobile app in the summer that lets customers explore the menu based on their food allergies and sensitivities. The app is available on all smartphone platforms.

60. Aaron Person Named Chief Chicken Officer, KFC

Aaron Person, a 25-year-veteran KFC cook from Orlando, holds the chain’s new position of chief chicken officer.

He has created training videos to reinforce how to best prepare chicken the Colonel’s way, which he says will allow him to share his knowledge at 5,000 KFC restaurants nationwide. He’s also launching a new Cook Certification program to ensure quality and consistency throughout the system.

61. YUM! Brands Extends Derby Sponsorship

On the fifth anniversary of its sponsorship, YUM! Brands renewed with Churchill Downs Racetrack for a $2 million–guaranteed Kentucky Derby sponsorship through 2015. The derby is the historic Louisville track’s signature race and has been one of the country’s biggest sports and entertainment events for more than 100 years.

“Our partnership with YUM! Brands has been positive for both companies and good for the Kentucky Derby,” says Kevin Flanery, president of Churchill Downs Racetrack.

62. “Some of our employees may, without our knowledge, be unauthorized workers.” —Chipotle regulatory filing after an immigration probe found 450 out of 1,200 of its workers in Minnesota were not eligible to work in the U.S.

Subways are Everywhere

When Subway opened shop at the Chrysler manufacturing facility in Toledo, Ohio, it marked the chain’s 8,000th nontraditional location. Other bizarre places where Subway has found a home:

63. True Bethel Baptist Church in Buffalo, New York

63. True Bethel Baptist Church in Buffalo, New York

64. A high school in Detroit

65. A cinema in Switzerland

66. The construction site of the new World Trade Center

67. An auto park in Germany

68. Pie Five Pizza Co.

68. Pie Five Pizza Co.

Not only does this Pizza Inn spinoff earn high fives for its creative name, but also for its clever business strategy. It sets up shop in high-traffic, urban areas and offers customizable pizzas in five minutes or less. The first unit opened in June in Fort Worth, Texas, and the company aims for 15 more company-owned stores in the next two years, as well as franchised units.

69. FroYo CUPS Overflows with Generosity

Beach-themed CUPS Frozen Yogurt Your Way revealed its very own limited-edition itsy bitsy teeny weeny polka dot CUPS bikini to benefit breast cancer awareness. The summer event unveiled the inaugural bikini, modeled by Style Network’s “Jerseylicious” stars Briella Calafiore and Jacquelina Bianchi, at the CUPS’ Clifton, New Jersey, location. All proceeds from the sales of the designer triangle top swimwear were donated to Susan G. Komen for the Cure North Jersey.

70. Restaurant News, Right to Your Phone

Food News Media, parent to QSR and sister publication RmgtMagazine.com, is making it easier for you to gain access to exclusive food news. This year, the company rolled out mobile sites for both publications, as well as an app for Rmgt that is available for iPhone and Android. Enjoy it on the go.

71. Popeyes Partners with ProStart

Hoping to inspire future restaurateurs and revitalize interest in the growing foodservice industry, Popeyes Louisiana Kitchen partnered with the National Restaurant Association Educational Foundation’s (NRAEF) ProStart program, which brings educational opportunities to more than 90,000 high school students across the country. Popeyes’ $100,000 donation will strengthen the two-year program that introduces students to the culinary and business aspects of the restaurant industry.

72. New Drive Thru Benchmark Group

The QSR Drive Thru Performance Study analyzed seven brands that were historically best-in-class in drive-thru operations. The group, which included Del Taco and gold-standard Chick-fil-A, proved they still were the best when stats like 96.5 percent accuracy in orders and 99.7 percent favorable exterior appearances, respectively, were reported in QSR.

73. Kids LiveWell Launches

In July, the National Restaurant Association launched a voluntary set of nutritional guidelines for kids’ meals. Nineteen inaugural chains initiated the program, including Burger King, ZPizza, and Au Bon Pain. Healthy Dining, which runs the website HealthyDiningFinder.com, serves as the third-party validator of the nutrition profile of menu items, and restaurants serving those dishes are listed on the site, making it easier for parents to identify restaurants with better menu choices for children.

In July, the National Restaurant Association launched a voluntary set of nutritional guidelines for kids’ meals. Nineteen inaugural chains initiated the program, including Burger King, ZPizza, and Au Bon Pain. Healthy Dining, which runs the website HealthyDiningFinder.com, serves as the third-party validator of the nutrition profile of menu items, and restaurants serving those dishes are listed on the site, making it easier for parents to identify restaurants with better menu choices for children.

[pagebreak]

74. Denny’s Offers Fit Fare

Healthy eating is hardly one size fits all. Denny’s new launch of Fit Fare meals and menu items is designed to customize. Whether a guest is looking to lower fat and calories or to increase protein and fiber, the newest additions, which are integrated right into the regular menu, satisfy. Even die-hard Grand Slam breakfast fans can opt for the new Fit Slam of scrambled egg whites with spinach and tomatoes, turkey bacon, an English muffin, and a side of fresh fruit. Fit Fare options can also replace regular menu items at no extra cost.

75. Tip Rules Change for Restaurants

The National Restaurant Association, Council of State Restaurant Associations, and National Federation of Independent Business filed suit against the U.S. Department of Labor in July over an amended Fair Labor Standards Act regulation.

According to court documents, the amended rule affects hundreds of thousands of businesses that employ tipped workers and forces restaurants to face increased and unnecessary regulatory expenses in complying with the new tip-credit notice requirements.

“We believe the new rules, put into effect with just one month’s notice and without properly considering their impact on the nation’s nearly 1 million restaurants, are confusing and will expose our members to regulatory violations and enforcement actions,” says NRA CEO Dawn Sweeney.

76. Ben & Jerry’s Offers Free Ride to Bonnaroo

In line with its Grateful Dead theme, Ben & Jerry’s sponsored Bonnaroo, one of the country’s biggest music festivals, this spring. In addition to adding its name to a long list of participating companies, the ice cream brand also activated its sponsorship with the “Fair Trade Your Way to Bonnaroo” contest.

For a chance to win a trip to the arts and music festival, valued at $4,000, fans of the brand were asked to explain what fair trade meant to them and how they’d promote it at Bonnaroo.

77. The Lawyers Are Getting Involved

Drive-thru bans were last year’s hot topic, but the battles continued this year. A 10-year-old drive-thru ban in University Place, California, was overturned this August, and a proposed ban in Loma Linda, California, never got off the ground. But new development restrictions are also keeping drive thrus off some international roads, including one of Sydney, Australia’s busiest streets and those in Halifax, Canada.

78. “We are doing what we can. We have to evolve with the times, and the times require us, and our customers are asking us, to offer more options.” —Danya Proud McDonald’s spokeswoman explaining a decision to reduce the amount of fries in Happy Meals and include apples

79. #FastFoodAddiction

Want to find out which fast food menu items consumers crave the most? Try using the hashtag #FastFoodAddiction on Twitter. The social media service that might also pass as one of the world’s biggest focus groups started trending the #FastFoodAddiction hashtag in September.

80. How the West Was Won (by Dunkin’ Donuts)

Step 1: Establish dominance east of the Mississippi; tantalize Westerners with cult-like reputation.

Step 1: Establish dominance east of the Mississippi; tantalize Westerners with cult-like reputation.

Step 2: Dip toe in Western markets with a few stores in Las Vegas, Phoenix, Dallas.

Step 3: Announce intentions to double unit counts in next 20 years.

Step 4: Open another handful of Western markets to franchising, including Omaha, Nebraska; Denver; and Albuquerque, New Mexico.

Step 5: Once again shun growth into California, thereby solidifying cult-like status.

81. Taco Bell, MTV Team Up with QR Code

When Taco Bell launched its Big Box Remixed LTO in July, it sported a QR code on the box—a first for Taco Bell. Customers who scanned it with their smartphone were given exclusive access to music and videos from MTV, which was promoting its “Video Music Awards.”

82. The Butcher’s Son

With the staggering number of food trucks hitting city streets across the U.S., it was only a matter of time before someone launched a nationally branded mobile unit. Two Trucks LLC is the first serious player to the table, as the company rolled out two units of The Butcher’s Son truck in Dallas in October and announced plans for a total of 200 food trucks across the U.S. by 2014.

The company is led by Jonathan Wagner, son of Johnsonville Sausage founder Ralph Stayer, and Dain Pool, director of strategic growth and business development at Pool’s Restaurant Group.

“We realized we had a three-year window to jump on this market, because if we put that out any longer, maybe five years, we may miss the chance to be on top,” Pool says.

100 Montaditos

The new Spanish concept 100 Montaditos opened its first U.S. store in Miami and has plans for about 4,000 more in the U.S. Here are 10 montaditos, or mini sandwiches, featured on the menu.

The new Spanish concept 100 Montaditos opened its first U.S. store in Miami and has plans for about 4,000 more in the U.S. Here are 10 montaditos, or mini sandwiches, featured on the menu.

83. Ham Lacón with Cream Cheese

84. Chistorra and Iberic Cheese

85. Serrano Ham with Salmorejo

86. Turkey with Lettuce and Pico de Gallo

87. Duck Mousse with Crispy Onion

88. Pulled BBQ Pork with Blue Cheese, Bacon, Tomato, and Alioli

89. Shrimp with Pink Sauce and Lettuce

90. Grilled Chicken with Guava and Bacon

91. Goat Cheese with Sundried Tomato and Pesto Sauce

92. Grilled Beef with Hummus, Fresh Tomato and Arugula

[pagebreak]

93. NetWaiter Jumps On Google Train

How NetWaiter and Google+ can boost a quick serve’s Google Search content:

- Company uses NetWaiter for online ordering function.

- Company installs Google+ icon on NetWaiter page.

- Customer clicks on icon, establishing that restaurant as one of their interests on Google+ and boosting the restaurant’s Google Search content.

94. The Fancy Fast Food Blog

Fast food, especially the deep-fried fare, is notorious for appearing tragically unhealthy and, sometimes, for even coming across as unappetizing. Along comes Fancy Fast Food, a blog dedicated to ordering meals from quick serves then steaming, scrambling, and slashing their individual ingredients into more appetizing alternatives.

McDonald’s famous fries are chopped into rice-like pieces and steamed while KFC’s grilled chicken is deboned, thrown into a food processor, and converted into a paté.

As if that wasn’t enough, there was even a book of the same name published this fall.

95. Moe’s Southwest Grill’s Approach to … the Southwest

You may be surprised to find out that Moe’s Southwest Grill does not have much of a presence in the Southwest. But that will change in the coming years.

You may be surprised to find out that Moe’s Southwest Grill does not have much of a presence in the Southwest. But that will change in the coming years.

The Atlanta-based brand is planning for an unusual approach to entering new markets: licensing. Moe’s inked a deal this year with BJ’s Wholesale Club that will carry 17 Moe’s-branded products into 190 BJ’s stores.

“As we start to grow with other license channels, in the supermarket chains and other club chains, we’re going to start to see our products move west,” says brand president Paul Damico.

96. Corner Bakery’s Twitter Promo

When Corner Bakery rolled out its new Smoked Turkey Cobb sandwich in February, it played up the release with a Twitter promotion that handed out freebies. Followers just needed to keep an eye on the @CornerBakery handle, where three questions a day were posted for several days. The first five to reply with the correct answer scored a coupon for a free Smoked Turkey Cobb sandwich.

97. Northern European Cuisine is the “It” Food

Foods from Northern European countries, particularly Denmark, Norway, Sweden, Germany, Austria, and Belgium, are resonating with consumers, according to the Center for Culinary Development (CCD) and market research publisher Packaged Facts.

Americans are discovering pairings such as beer with bratwurst, smoked fish with dark hearty breads, and schnitzel with spaetzle.

98. Freestyle Appears Outside Test Kitchens

Whispers of a soda fountain that offers more than 100 options to restaurant diners have been growing since Coke created its Freestyle machine in 2009. But not until this year have the fountains been in regular rotation across the country. Companies including Firehouse Subs, Five Guys, and Chick-fil-A all have the space-age fountains in their units. Could your stores be next?

99. Epic Meal Time Gets Gross

In his YouTube cooking show, Harley Morenstein cruises to fast food joints in pursuit of combinations that cause maximum bodily harm.

In April, “Epic Meal Time” debuted one of its most popular episodes, Fast Food Lasagna. Nearly 10 million viewers have watched as Morenstein layers 15 Wendy’s Baconators, 15 McDonald’s Big Macs, and 15 A&W Teen Burgers with bacon strips, Jack Daniel’s meat sauce, cheese, and onion rings, bakes it, and consumes.

100. Food Trucks Head to … the Ballpark?

Food trucks may be a thing of the streets, but ARAMARK decided it wanted to carry the trend into Major League Baseball stadiums, too. Starting in July with Wok in the Park in Denver’s Coors Field, and then in August with Just Loaf’N Po’Boys and The Mobile Marlay in Atlanta’s Turner Field, ARAMARK parked trucks on ballpark concourses to much fanfare. No word on what kind of parking violations ballparks might enforce.

Food trucks may be a thing of the streets, but ARAMARK decided it wanted to carry the trend into Major League Baseball stadiums, too. Starting in July with Wok in the Park in Denver’s Coors Field, and then in August with Just Loaf’N Po’Boys and The Mobile Marlay in Atlanta’s Turner Field, ARAMARK parked trucks on ballpark concourses to much fanfare. No word on what kind of parking violations ballparks might enforce.