Since its inception, the quick-service restaurant category has played an important role in society. It has changed the way we eat and how we spend our time. It has helped mold the family budget by providing affordable, convenient food choices and by providing income for the millions of people who have manned the cash registers, fry stations and grills. Many have carved out life-long careers, with some advancing from the dish-room to the board room, while others have used their time in the industry as a stepping-stone toward other goals. Not to be overlooked is the spirit of entrepreneurship that permeates the industry; a spirit that has created financial opportunity for tens of thousands of people, many of whom started on the ground floor with little more than a nametag and a mop. Taking all of that into account, we have every right to be proud of the value (in every sense of the word) that quick service has added to society during the past 70-plus years. And don’t let anyone convince you otherwise!

Since the start of the pandemic, the segment has added greater value than ever before. When grocery store shelves were stripped bare by consumers hoarding goods during the most uncertain of times, and restaurant on-premises dining was basically shut down, quick-service restaurant drive-thrus became treasured commodities in every community. When the restaurant industry was hit hard in terms of job losses, with positions being cut by operators fighting to keep their businesses alive, it was a different story within quick service. Operators in our segment continued to provide jobs and opportunity at a time when millions were out of work. Quick service led the industry on the road to recovery, adding value to society in unprecedented ways.

We aren’t done yet. Along with the balance of the restaurant industry, the quick-service restaurant segment continues to change; it is an evolutionary tale punctuated and accelerated by the pandemic. The expansion of digital channels such as online ordering and third-party delivery is at the forefront; consumer trial and repeat usage of these services increased overnight when dining rooms were closed from coast to coast. In the absence of the pandemic, it may have taken years to achieve the same level of activity in the off-premises channels.

Quick-service brands have evolved in other ways during the pandemic. COVID-19 gave brands the license to streamline and simplify menus, with the hope of improving speed of service and operating costs. When closing their dining rooms, many operators realized expense reductions without compromising their sales. The demands placed on the drive-thru led to the increased adoption of double drive-thru lanes and windows; it wasn’t unusual to see employees working outdoors to help improve communication and throughput. Discounting, which from time to time has been a staple of the category, became a relatively antiquated practice. Operations were reengineered to accommodate a “touchless” guest experience (and you can be sure that touchless practices that deliver a more profitable experience will be maintained for as long as possible, if not permanently).

The market conditions produced by the pandemic continue to favor quick-service brands. There remains a segment of the population that is hesitant to sit down in a restaurant. The number of people that comprise that population may grow smaller by the day, but it is still large enough to have a meaningful impact on the industry. Consumers harboring an aversion to dining-in will continue to be more likely to visit quick-serves via the drive-thrus or use digital online ordering to limit their time inside the restaurant. The advantage this gives to quick-service brands is reflected in the sales and traffic growth the segment continues to enjoy. The casual dining segment, in contrast, is still fighting to achieve 2019 levels of performance.

What does the future hold for quick service? Much earlier in the pandemic, I was concerned that in the wake of being denied the use of dining rooms, consumers would eagerly flock to casual dining restaurants; guests would be chomping at the bit to enjoy the experiences they had been denied due to government action. Some pundits and industry veterans predicted a modern-day “Roaring Twenties;” a cultural shift that would have presumably worked against the interests of quick-service restaurant brands. That concern was never realized. Guests have returned to dining rooms at a modest tempo, and there is no overt sign that the traffic that is returning to on-premises dining occasions is coming at the expense of quick-service restaurant visits. Threat averted … at least for the time being.

The casual-dining segment has undergone more substantive change due to the pandemic. The increase in off-premises consumption of casual dining offerings appears to be sticky. During Darden’s earnings call in September, it was noted that 27 percent of sales at Olive Garden were to-go, and 15 percent at LongHorn. They specifically mentioned digital transactions as the key contributing factor behind off-premises sales; 60 percent of their off-premises business was executed through digital platforms. At Brinker International (parent company of Chili’s), off-premises accounted for between 32–35 percent during their second quarter (double what it was prior to the pandemic). Brinker’s increase in off-premise was driven in part by its Just Wings ghost kitchen brand, which as of late summer was in more than 1,000 locations. While these are important factors for the restored health of casual dining, their success on this front does not seem to be coming at the expense of quick-service restaurant.

The future for the segment is bright. Quick service will continue to offer convenience and affordability that other segments of the industry are hard-pressed to rival. The brands that can couple those two core category attributes with superior hospitality and food quality will stand the best chance of success. Rising to the top will be brands that forge an emotional connection with their guests—an intangible that many brands aspire to, but all too few achieve.

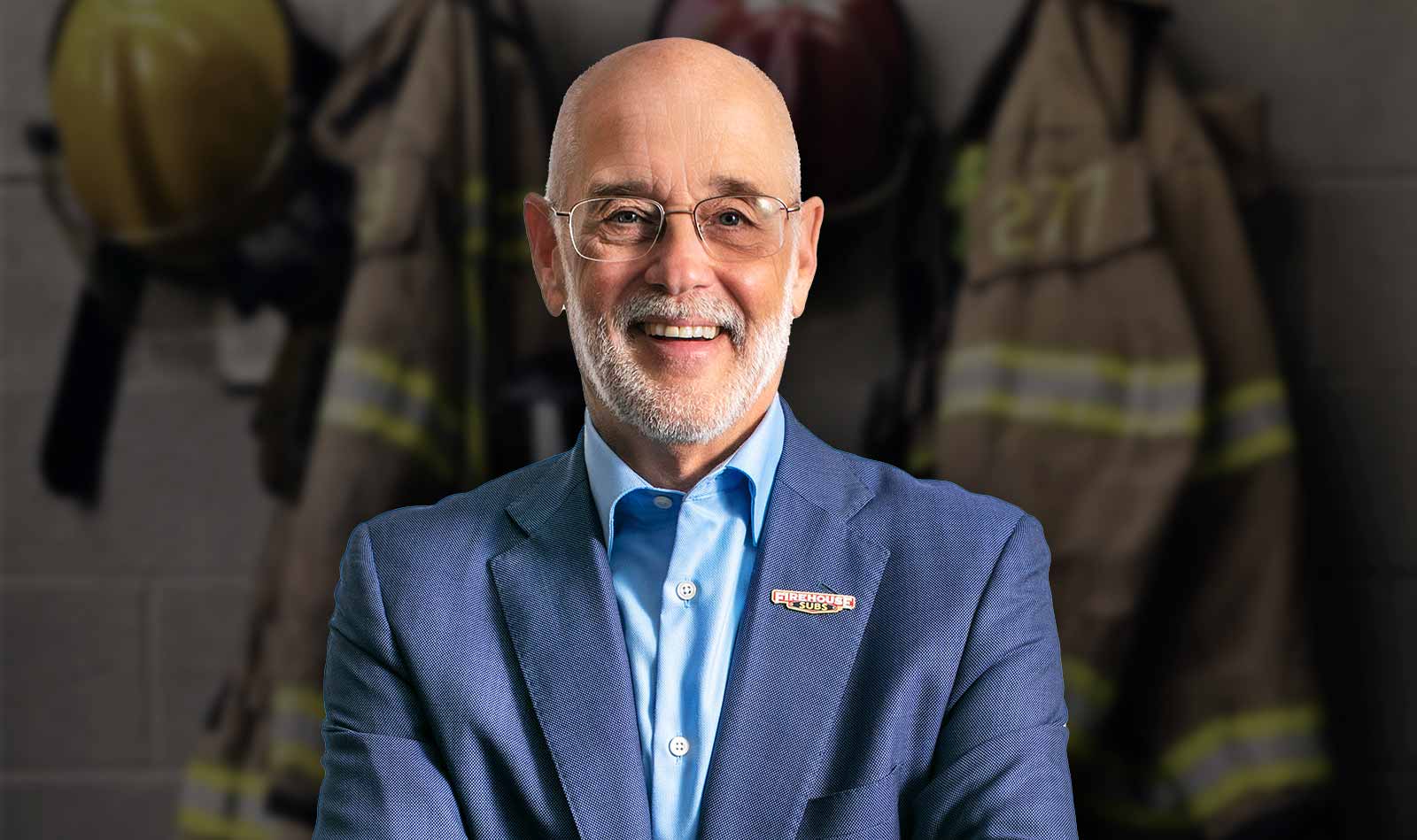

Don Fox is Chief Executive Officer of Firehouse of America, LLC, in which he leads the strategic growth of Firehouse Subs, one of America’s leading fast casual restaurant brands. Under his leadership, the brand has grown to more than 1,190 restaurants in 46 states, Puerto Rico, Canada, and non-traditional locations. Don sits on various boards of influence in the business and non-profit communities, and is a respected speaker, commentator and published author. In 2013, he received the prestigious Silver Plate Award from the International Food Manufacturers Association (IFMA).