In time, the COVID-19 pandemic could usher in an era of unit growth. Brands like Chipotle, Wingstop, and Potbelly have all upped development targets in recent quarters as consumer demand supports it, as well as evolving asset dynamics—smaller builds, more drive-thrus—cash reserves stocked during lockdowns (before anyone was certain how long the plunge would last), and continued top-line growth. BTIG analyst Peter Saleh just isn’t sure that reality will come to bear in 2023.

Saleh believes healthy same-store sales will sustain, aided in part by robust crossover menu pricing. Broad-based weakness is unlikely, he added, given the improving health of the labor market.

However, although margins should recover from the several hundred basis points of contraction reported throughout 2022 by a bevy of restaurant chains, the combo-effect of commodity, higher-priced labor (even if there’s more jobs), and construction inflation will continue to weigh on franchisee economics, sentiment, and, in turn, development.

But one thing about 2021, from a cost perspective, is it likely bottomed out for a lot of concepts, paving the way for outsized margin recovery and the ability to leverage pricing power.

A case Saleh is circling for 2023? Domino’s.

The pizza giant could very well enter 2023 with its highest level of pricing in more than a decade. Saleh expects Domino’s to take price on its $7.99 carryout offering, which would bump sales and margins across the coming year. Improvements in fundamentals would then “translate into a resurgence in development in 2024.”

Additionally, Domino’s 2023 is almost sure to benefit from easier year-over-year comparisons versus what it’s endured this calendar, when the brand lapped massive swings from COVID’s early months.

After same-store sales drops of 3.6 percent and 2.9 percent in the first and second quarters of this year, respectively, Domino’s returned to the black with a modest 2 percent rise in Q3. The growth was fueled by 5.4 percent pricing. Domino’s Q1 and Q2 performance represented the two weakest periods of same-store sales since the second half of 2008. Company-owned comps were down 10.5 and 9.2 percent, respectively, marking five straight periods of negative trends (Q3 2022 was the sixth).

These balanced, however, against chaotic comparables.

Domestic same-store sales

- Q4 2021: 1 percent

- Q3 2021: –1.9 percent

- Q2 2021: 3.5 percent

- Q1 2021: 13.4 percent

- Q4 2020: 11.2 percent

- Q3 2020: 17.5 percent

- Q2 2020: 16.1 percent

- Q1 2020: 1.6 percent

So the first half of 2023, in particular, has the potential to race positive for Domino’s. There’s more at work, though. For the whole year, at least three quarters of higher menu pricing on the Mix and Match, and organic improvement in sales performance between top- and bottom-quartile restaurants, driven partially by an increase in driver supply, should set the brand up for an industry-leading run, Saleh said.

Let’s circle the driver quandary. Just in Q3, when comparing the top 20 percent of stores (fully staffed) to the bottom 20 percent (struggling with labor), there was an 8-percentage point gap in delivery performance, versus an 11-percentage point margin in Q2, and an even greater 17 percentage point gap in the first quarter.

Domino’s management said delivery’s sequential increases have owed to an improving labor situation. The number of job applications and new hires climbed throughout the year. By the end of Q3, CEO Russell Weiner said Domino’s was “more or less” back to pre-pandemic levels. Also, about half of units were now connected to call centers, freeing staff up for other tasks.

The industry as a whole added roughly 62,100 jobs in November to bring the total to 11.9 million, or 400,000 or so short of February 2020 figures. The industry shed 5.5 million jobs in April 2020 alone.

Staffing challenged Domino’s from the outset of 2021. In Q2, because of setbacks, store hours were reduced, phones weren’t answered, and online orders were restricted, the company said. To put things in perspective, the number of combined lost operating hours equated to the entire U.S. system being closed for six days.

There’s also the brand’s recent announcement it would launch 800 electric vehicles across the U.S. More than 100 custom-branded 2023 Chevy Bolts hit the road in November, with another 700 slated for the coming months. “While we appreciate the optics of the new 800 electric vehicle launch across the U.S., we believe the benefit will be nominal in 2023,” Saleh said. “We believe this program can assist in attracting qualified drivers that don’t have a car, but note that it only covers about 12 percent of the domestic store base, and an estimated 1–2 percent of the driver base on a busy night. We believe this program has the potential to expand beyond the initial 800 vehicles, but don’t expect it to be material for several more years.”

Despite unsteady conditions, Weiner claimed Domino’s market share, inclusive of dine-in, carryout, and delivery, held steady throughout the year and was rising more than 200 basis points versus pre-virus comparisons headed into Q4. And you can see some of the tide reflected in recent trends. Domino’s originated as a delivery business, but began inserting offers targeted at carryout as far back as 2011. It then began to ramp up a fortressing strategy that stuffed markets with adjacent locations in an effort to shrink delivery radiuses and make carryout more accessible.

At the end of 2021, per The NPD Group, Domino’s was the No. 1 pizza carryout brand in the U.S. The chain’s carryout comps were up nearly 20 percent, year-over-year, in Q3 and are 35 percent higher on a three-year view.

Delivery same-store sales, however, declined 7.5 percent in Q3 versus last year. It was a notable improvement from an 11.8 percent drop in Q2 and 10.7 percent decline to start the fiscal year (delivery comps have tracked negative for five consecutive quarters). But again, there was a notable split from those units fully staffed versus those struggling to find drivers, which speaks to Saleh’s upside projection if the chasm closes.

In March, Domino’s decided to raise the price of its national $5.99 Mix and Match promotion—introduced in December 2009—to $6.99 for delivery orders to offset the higher costs of that transaction. It was the first price increase in over a decade. The same hike came for carryout orders in mid-October.

This carries Domino’s into the New Year with menu pricing over 7 percent. Saleh said Domino’s will likely raise the price of its $7.99 carryout offering in 2023 to reclaim the historic $2 gap versus the Mix and Match (today it’s only $1), and aid franchisee margins. If not, it might need to value engineer the platform to support franchisees.

“We would not be surprised to see this price increase go into effect late in Q1 2023, allowing the brand to sustain high-single-digit pricing for at least the first half of the year,” Saleh said. “Second, we expect progress on delivery driver availability, and in turn transactions, in 2023. In addition to the improved labor availability the industry has seen over the past couple of quarters, we expect Domino’s to benefit from moderating fuel costs, which at their peak in the spring, led many drivers to seek other employment.

The profitability challenge

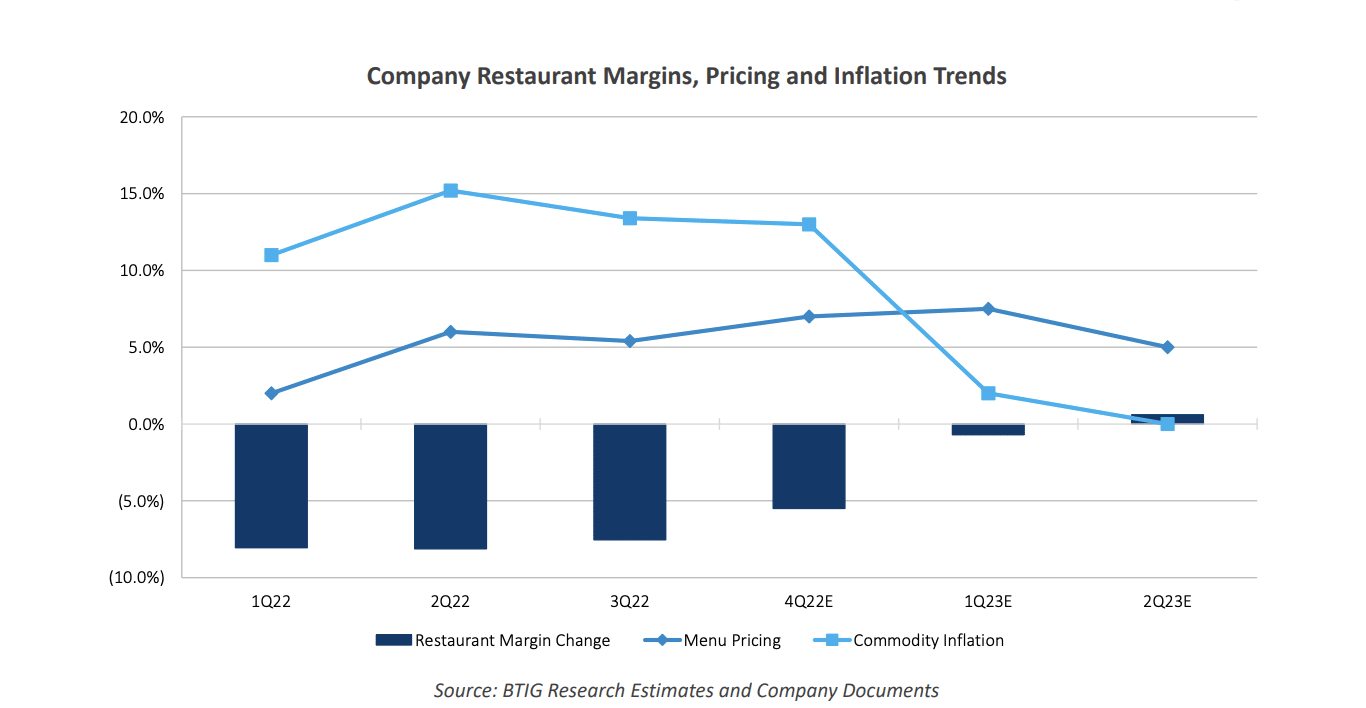

Returning to margins, the Q3 restaurant earnings cycle felt like a roll call on the topic. There was a definitive change in management tone, however, toward commodity inflation among multiple restaurant and food distributors. Although Saleh doesn’t expect commodities to deflate meaningfully in the near future, he is confident the rate of inflation has begun to moderate, which could translate into real deflation later in 2023 or early 2024. US Foods (overall inflation moderated from 15 to 12 percent in Q2) and Performance Food Group reported center-of-the-plate deflation, while Texas Roadhouse (cut Q4 commodity outlook in half to 4.5 from 9 percent, mostly on moderating beef prices), Chipotle, and Wingstop (wing prices down 43 percent) all cited moderating trends, if not full-on deflation, in certain areas.

The package of commodity inflation, labor battles, and other inflationary heat, like utilities and supplies, led to 420 basis points of restaurant-level margin contraction in 2022 for the brands Saleh’s BTIG covers. “While we believe that restaurant margins always recover to historical levels through pricing, commodity deflation, efficiency and the like, this recovery takes time, and development tends to follow the same directional trend as margins, and unit economics.” To reiterate, margin recovery unfurling across 2023/2024 would lead to “significant unit growth” in 2024/25.

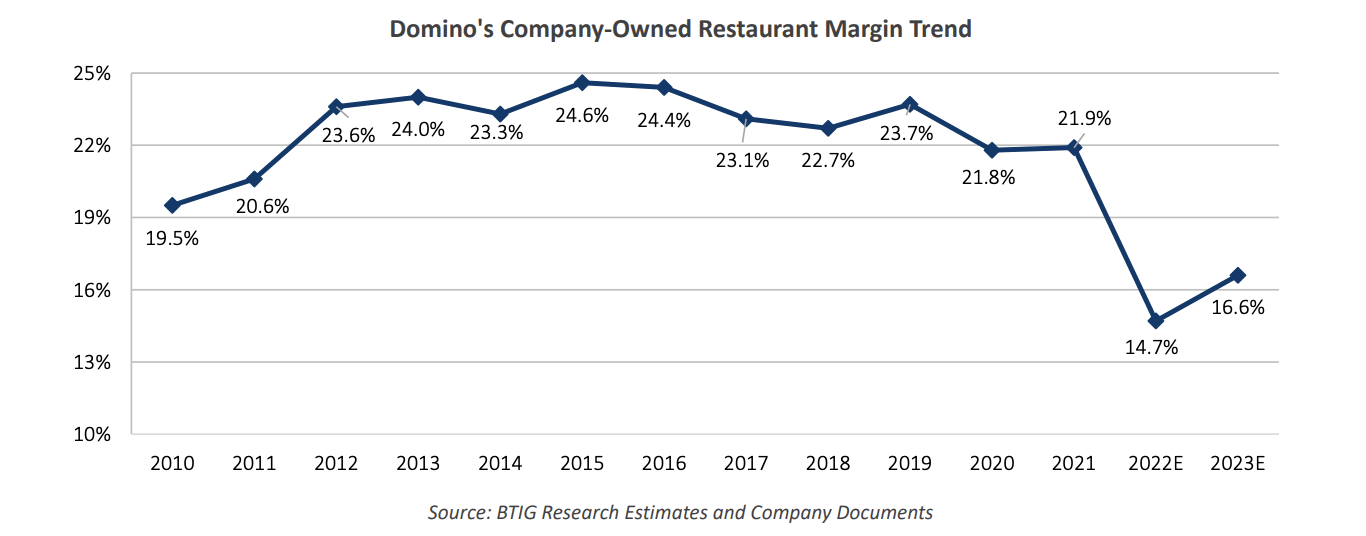

Similar to the field, Saleh feels Domino’s commodity basket inflation peaked in Q2 2022 and has softened since. For the full year, he projects the basket to increase at least 13 percent, including low double-digits in Q1, 15.2 percent in Q2 (the high level), and about 13 percent for the balance of the year.

Yet projecting 2023, Saleh said Domino’s could experience low-single-digit commodity inflation, which would be more than offset by the mid- to high-single-digit pricing already in place. The result? An expansion in margins.

Cheese, proteins and cardboard (boxes) are the most meaningful input costs for the company, Saleh added. Year-to-date, cheese (about 35 percent of commodity basket) is up about 4 percent, declining to $2.07 per pound recently from a peak of $2.40 in the spring. “While cheese is a very volatile commodity that is nearly impossible to predict, it has hovered above $2 per pound nearly all year, and has rarely [last 10 years] been above $2.35 per pound,” Saleh added. “If cheese prices revert to the mean, Domino’s could experience significant moderation in its commodity basket.”

Concerning proteins, or toppings in Domino’s case, there’s been widespread reports of chicken prices easing, as well as beef, and even pork. Saleh expects chicken prices to continue their downward trajectory into 2023, adding Domino’s Specialty Chicken platform as well as its pizza topping costs, and moderation in other options like pepperoni.

For the past five years, Domino’s has averaged 22.6 percent restaurant-level margin, varying about 50 basis points on average. Saleh projects company-owned restaurants margins of 14.7 percent in 2022, more than 800 basis points below their historical average over the past decade. Looking ahead to 2023, he’s forecasting a 200-basis point improvement, but notes the figure “could be much higher,” especially if Domino’s does decide to pull the price trigger on the $7.99 carryout offering.

The wider look

Broadly speaking, as inflation has ebbed somewhat, restaurant pricing in Q3 was at seemingly all-time highs with chains like McDonald’s and Wendy’s sitting around 10 percent, and Chipotle at 13 percent, Saleh pointed out. According to Black Box Intelligence, average checks rose 8 percent sector-wide in recent months. Saleh said “evidence is building that commodity prices are rolling over for the first time in several years, which could bring some welcome margin relief next year, and cause restaurant operators to ease off the incremental price hikes.”

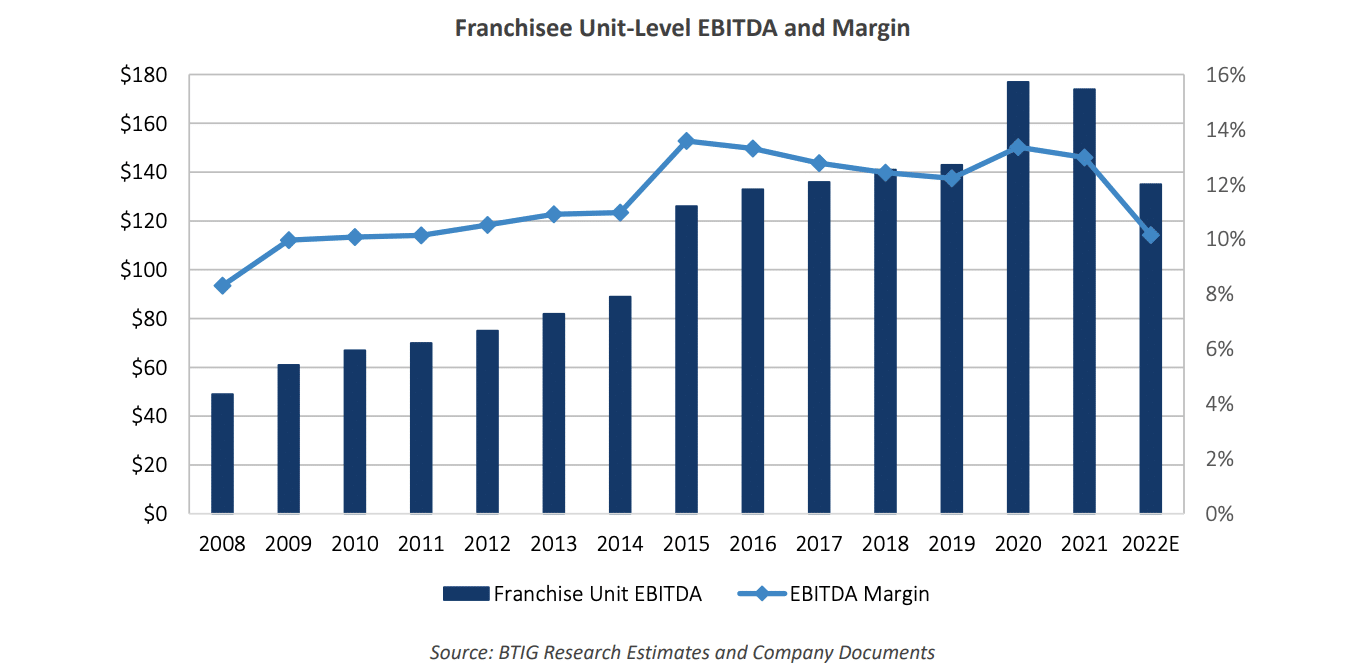

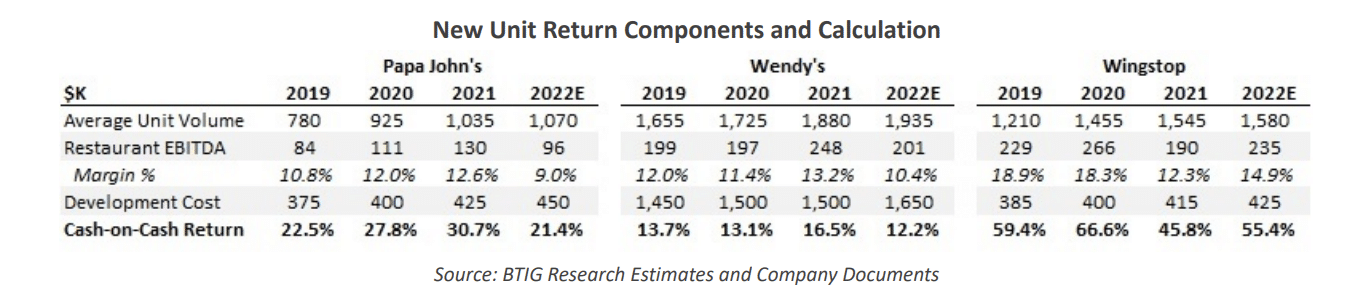

As for development, Saleh said restaurant growth nearly always follows the directional trend of unit economics. Over the past six months, he’s held conversations with franchisees across multiple concepts, and there’s been a clear, pessimistic tone on development, Saleh said, as commodity and labor inflation took their toll on margins. He hypothesizes franchisee EBITDA margins are down 300–350 basis points in the past year, and well off their recent peak of 13.5 percent. Couple that with rising construction costs and cash-on-cash returns have potentially been cut by a third in the past two years. That’s the heart of why Saleh feels development won’t tick up in 2023 for most, but should accelerate as margins ultimately recover.

For Domino’s specifically, Saleh targets $1.3 million franchise average-unit volumes in 2023, down less than 1 percent versus 2021 and up 13.5 percent compared to 2019 as Domino’s has held sales volumes, mostly, in face of the driver shortage.

Across quick service, the decision to slow development and turn focus on recovering margins has been evident. At Wendy’s, unit growth targets were trimmed to 2–2.5 percent from 5–6 percent at the beginning of the year, Saleh shared, while Papa Johns reduced its unit opening guidance for the year to 240–260 units from 280–320 previously.

“A recurring theme of franchise checks we have conducted in the second half of the year has been waning enthusiasm for new unit development compared to 6–12 month ago,” Saleh said. “The combination of restaurant margin degradation, persistent labor challenges. and higher developments costs [typically up 15–30 percent versus 2021] has significantly changed the calculus for new unit returns and led many to reprioritize new units in favor of existing ones.

Domino’s domestic franchisee development slowed to its quietest pace since 2015. The brand hunkered on pricing and worked to attract more drivers. “We believe franchisees are hesitant to build new stores as they struggle to staff their existing restaurants,” Saleh said. “That said, we believe the recent price increases implemented on the Mix and Match menu, and the additional pricing we expect them to take next year should help margins recover, and eventually translate to unit growth.”

Domino’s opened a net of 24 U.S. shops in Q3, pushing its domestic count to 6,643. The growth is a steep slowdown from last year, when the U.S. segment opened a net of 45 units. CFP Sandeep Reddy owed the sluggish movement to delays in permitting and construction. But he added in Q3 those headwinds were temporary, and once Domino’s gets past them, he’s confident the pizza chain will reach its long-term of 8,000-plus stores in the U.S.

Back on the Domino’s projection

Saleh called Domino’s a “secular market share gainer in the pizza category.” Indeed, despite all the aforementioned delivery challenges, Weiner said in Q3 the brand “delivered around one out of every three pizzas in the United States before the pandemic, and we deliver around one out of every three pizzas today.”

The reasons are nothing novel. Domino’s digital ordering, national marketing, and value have been difficult for peers to rival for going on a decade now. Strengths across these buckets have driven considerable increases in retail sales, market share, and unit economics as Domino’s climbed atop the country’s pizza chart. The brand closed 2021 with U.S. systemwide sales of $8.641 billion and 6,560 locations—a gain of 205 net, year-over-year. Pizza Hut reported results of $5.5 billion and 6,548, respectively, which was a net decline of 13 from 2020. Little Caesars followed at $4.185 billion (estimate) and 4,181 units, with Papa Johns next at $3.486 billion and 3,164 units.

“We believe management’s more aggressive pricing posture over the past three quarters and anticipated future pricing should not only drive margin expansion, but should allow them to better compete for driver availability,” Saleh said of Domino’s outlook.