Intouch Insight reports that a staggering 87 percent of consumers surveyed report having placed an online order for pickup in the past year. While this was a trend that was ticking upward prior to the pandemic, such widespread adoption would have been impossible to picture a few years ago. What a difference a pandemic makes.

As inflation continues to impact spending habits, consumers are looking for places to cut back. Not spending money on third-party delivery fees and having to tip the driver may be the force behind an increasing number of online pickup orders.

This is a topic that market research firm Intouch Insight recently dug into, with a study of 800 mystery shops across 10 leading fast casual brands, including Chipotle, Panera, Shake Shack, Jersey Mike’s, Five Guys, QDOBA, Panda Express, Noodles & Co., McAlister’s Deli, and Chicken Salad Chick, in early 2023. The goal was to establish how different elements of ordering and pickup impacted overall satisfaction with the dining experience.

“What really interested us about this topic is how much change the growth in digital has driven within restaurants,” says Sarah Beckett, director of marketing at Intouch Insight. “It’s a growing channel that’s continuing to emerge and evolve, and there’s no one way that brands execute it.”

Here’s a closer look at the study, the results, and what operators can take away from it all.

Ordering Experience

The study measured the online ordering experience from a few different angles. Mystery shoppers were asked how easy it was to find items, place items in their cart, and to modify their order. The ten brands in question scored well in nearly all of these categories: scores for all brands ranged from 89 to 100 percent in each. It is worth noting, however, that no brand scored 100 percent in all three categories, and only 71 percent of the shoppers gave a five out of five rating with the ordering experience.

“Overall, the brands performed quite well when it came to the ordering experience,” Beckett says. “If we look at the past three years, there’s been a lot of investment in that technology to support this part of the experience. These results support that the investment was a good one—it’s working.”

Both Beckett and her colleague Laura Livers, head of strategic growth at Intouch Insight, mentioned that this may not be the win some operators would see it as. “I think we all agree that it’s great to see the technology is really effective,” Livers says. “However, in all honesty, that’s technology. That’s the evolution the industry has taken and it’s going well. But once you get into involving personnel, the procedures of making the pickup process as easy as possible—that’s the part of the equation where you see brands being challenged.”

The Pickup Experience

As Livers alluded to, the pickup process scored considerably lower marks, with just 59 percent of mystery shoppers saying they were fully satisfied with that stage of the experience. The results uncovered three factors in the pickup experience that were most pivotal: Was interacting with staff built into the pickup process? Was there signage indicating where customers could pick up orders? Was there a designated pickup area?

One interesting note is that just 17 percent of the over 2,000 North American consumers surveyed earlier this year said they would rather not interact with an employee. That was half as many (34 percent) who said they would prefer to interact with a team member, while 49 percent said they had no preference.

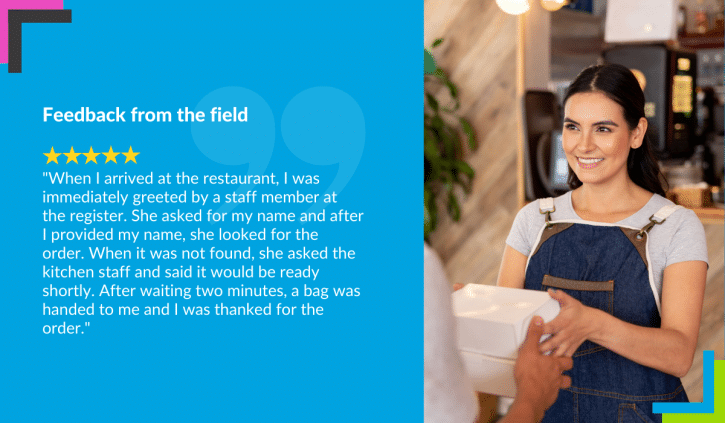

Interacting with a team member even appeared to have the ability to save the experience—satisfaction with the overall experience was 15 percent higher when the consumer interacted with staff during the pickup process.

“The positive interaction with an employee—on top of a seamless transaction—very clearly went a long way with the shoppers,” Livers says. “In reading over the shopper comments, this became even more obvious: you see descriptive words such as pleasurable, sincere, genuine—one employee told a shopper to drive safely on the way home. It’s little things like that which could make or break the experience.”

Signage

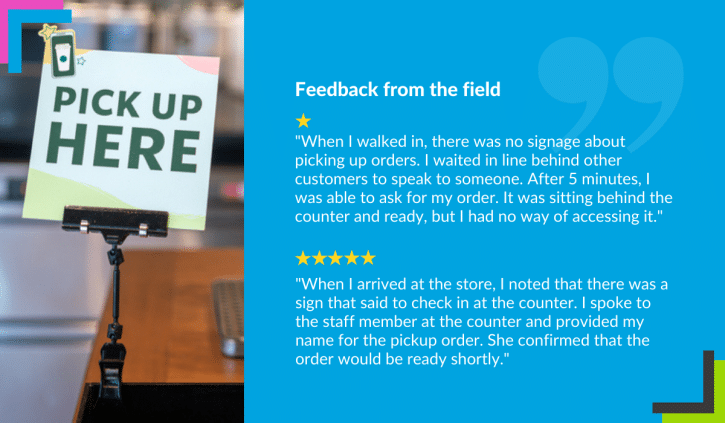

Many of the gripes associated with the pickup process in general came down to one thing: consumers wanted a consistent, easy-to-understand protocol. While adoption of online ordering is on the rise, many guests are still new to this merging of digital and physical experiences, and removing any of the unknown surrounding what to do or where to go appears to be what customers are asking for, observed Beckett and Livers.

“While the human interaction element had the most upside to improve the experience, the most common complaint we saw in the shoppers’ comments was that there wasn’t any signage,” Livers says. “One shopper talked about walking into the store and waiting in line even though they could see their order on the other side of the counter—they just didn’t know how to get to it. Things like that could cause the most frustration.”

Another shopper observed: “I was given very little attention for the first 10 minutes of walking in and standing near the pickup area. After the quoted ready time had passed, they checked my name and told me the order hadn’t even been started yet, but that it would be made next.” Unsurprisingly, this shopper rated the pickup experience with just one star out of five.

Implement Systems, Measure Them Often

Quick-service and fast-casual operators alike had to pivot in a hurry when the pandemic pushed more orders into the off-premises space. In many ways, the online ordering segment has had to grow up in a hurry. There’s no shame in the fact that restaurant brands are still perfecting the process—but now, three years later, it’s pivotal that operators begin to think more critically about what is working for the consumer and what is not.

“From start to finish, this whole process is about how to remove friction,” Beckett observes. “You have to make it seamless and easy. None of us like ambiguity—do I wait in line, do I not wait in line?—so smoothing out that process has to be your first priority.”

And, Livers adds, finding out what works best requires being able to measure customer satisfaction with the process. Intouch Insight has been helping brands do just that for over 40 years.

“Customer experience measurement is the best way to quantify the impact of your efforts and to identify other areas for improvement,” Livers says. “Intouch Insight provides brands with the tools and services that enable them to ensure they are delivering consistent customer experiences across all locations.”

To download the full report, Emerging Experiences: Where Tech Meets Taste, visit the website here.