Founders Table Restaurant Group comprises concepts created by operators who never let go of their curiosity.

Chopt cofounders Tony Shure and Colin McCabe wondered why salad couldn’t be a side dish. Brothers Liam and Oliver Kremer wanted to know why they couldn’t find a decent mission-style burrito in New York, which led to Dos Toros. FIELDTRIP founder and James Beard Award-winning chef JJ Johnson had a vision to bring healthy rice bowls to Harlem when no one else did. And then John Seymour, creator of Sweet Chick, discovered just how much chicken sandwiches and hip hop together create a special vibe.

Founders Table CEO Nick Marsh says these four concepts have two things in common—everything they do starts with food and all have a unique personality that “would not have survived focus groups if it were done at a larger company.”

“The customer that they are trying to connect with is something special and something unique,” Marsh says. “And it is to be valued. And so our goal in creating a platform here is that we bring to the table the experience and the scale to create a rational growth plan for these businesses and for these concepts that will maintain the integrity of that original connection between the founder and the customer. And that’s what we’re trying to do.”

“ … Founders Table is a collection of brands that both the consumer has voted ‘yes’ for and the investors have voted ‘yes’ as well,” he adds.

Founders Table began its journey in 2020 “to create, acquire, and cultivate innovative and profitable founder-led restaurant companies,” according to its website.

The flagship brand is Chopt, which was founded in NYC 23 years ago and has expanded to 87 locations across the Eastern Seaboard. The chain earned $165 million in sales last year and earned a $2.1 million AUV. Same-store sales grew 10 percent year-over-year, driven by increases in transactions. Store-level EBITDA was 19 percent and suburban store-level EBITDA was 21 percent. Before COVID, Chopt had positive EBITDA every single year in its history. Currently, each store is profitable.

Here’s how AUV breaks down by region:

NYC: $2.5 million

New England: $2.4 million

Carolinas: $2 million

Southeast: $2 million

Mid-Atlantic: $1.9 million

DMV: $1.8 million

After private equity firm L Catterton invested in 2015, the fast casual grew beyond urban locales and into suburban and secondary markets in Connecticut, New Jersey, Virginia, Maryland, North Carolina, Tennessee, Georgia, Alabama, and Pennsylvania. Marsh says Chopt has moved from tier-one markets to tier-two and tier-three cities as opposed to “hopscotching around the country.” Some examples include New York, Washington, D.C., Atlanta, Nashville, and North Carolina-based mid-sized and smaller markets Charlotte, Winston-Salem, Greensboro, and Wilmington.

Fifty-eight Chopt units are based in suburban markets.

“Our belief is that if fast casual and premium fast casual is going to take its place as a segment in the restaurant industry that really develops any level of market share, that the target has to be a broader set of markets than a lot of our competitors have focused on,” Marsh says. “Obviously Chipotle, Panera, whole different ends of the spectrum. We see CAVA a lot. CAVA is a player that’s done a very good job of not just going to tier-one, coastal-type cities. And we coexist with them in a number of places very successfully.”

Chopt matches those markets with a variety of store prototypes that fit into urban central business districts, suburban strip centers, regional power centers, tourist locations, and university towns.

In the past seven years, Chopt has focused more on its suburban prototype.

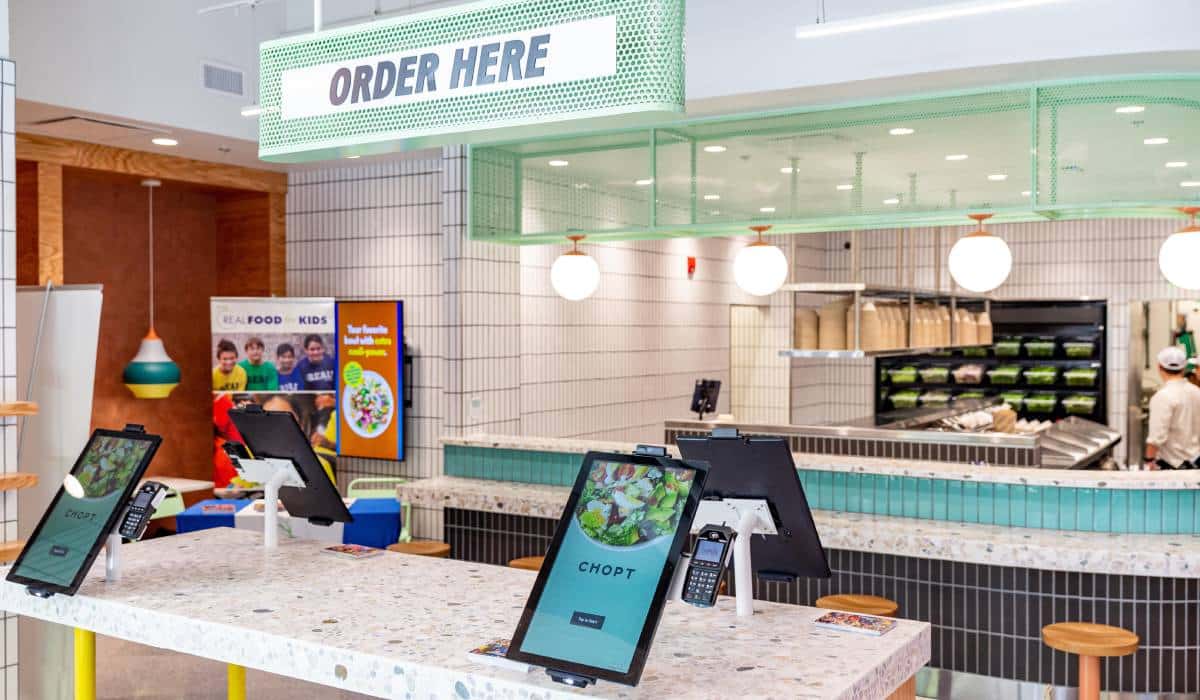

Since before the pandemic—when digital sales mixed 60-70 percent, with more than half coming from first party channels—Chopt has evolved from Chipotle-style assembly ordering to digital-only restaurants served by kiosks. These formats are smaller, cheaper to build, simpler to operate, more accurate, and faster. Eighty percent of the time, salads come out in three minutes or less. Suburban freestanding locations with drive-thru pickup lanes are crucial as well. At those venues, 80 percent of takeout orders are grabbed via the drive-thru lane.

Chopt has also had success with nontraditional stores. The brand operates train station units that earn more than $4 million per year. The company is now moving into airports with some licensing deals. It has six signed for 2024; Marsh expects 12-15 airport-based restaurants by the end of 2025, and some of them will have Chopt and Dos Toros side by side. FIELDTRIP will be in the mix in some cases.

Behind the scenes, Founders Table formed a platform of proprietary, end-to-end digital products used by Chopt and Dos Toros. FIELDTRIP and Sweet Chick will be added soon. The company has 1.4 million loyalty members in its CRM database, and they come with a 20 percent higher average check and 3x higher frequency.

“We are constantly innovating our business in order to improve the customer experience and increase profitability,” says CFO Rick Goldberg. “And we are just getting started.”