These kinds of statements often come with a hefty price tag. “Although we are investing in the business, I want to make it very clear that this is a part of a unique chapter in our brand’s history, one of significant change in transformation to ensure relevance for generations to come,” newly minted Dunkin’ Brands CEO David Hoffmann said during a July 26 conference call.

Of the leaders in quick service, few have been as ambitious as Dunkin’ Donuts in recent quarters. Not only does the brand plan to open 1,000 net new restaurants by the end of 2020, but 90 percent of those are charted outside its Northeast stronghold.

And alongside this growth, Dunkin’ remains an agile organization vastly reshaping its value, convenience, and digital capabilities from coast to coast. Known as the U.S Blueprint for Growth, CFO Katherine Jaspon said in the call that Dunkin’ expects to spend about $100 million across three areas—equipment to support its on-the-go beverage-led strategy (65 percent of the investment); technology infrastructure to support its digital leadership (30 percent, with the majority expected to capitalize and appreciate over the life of the asset and to Dunkin’s service agreement); and lastly, 5 percent of the total investment for G&A to support the testing, training, and rollout of these initiatives.

The majority of the investment will be deployed in fiscal 2018. So, without question, Hoffmann isn’t overstating when he calls Dunkin’s current calendar a “significant change in transformation.”

Dunkin’ is morphing on the heels of serious momentum, too, with the chain’s U.S. same-store sales growth of 1.4 percent in the second quarter representing its highest quarterly comp growth since Q4 2016. Dunkin’ Brands as a whole reported revenues up 4.9 percent to $350.6 million, year-over-year, which beat Zacks Consensus Estimates of $342 million. Adjusted earnings per share of 77 cents also topped Wall Street’s call for 74 cents. Systemwide sales lifted 4.4 percent globally versus the prior-year quarter.

Hoffmann, who took over the CEO role from a retiring Nigel Travis on July 11, said Dunkin’ is “strengthening the areas of the business that will produce sustainable long-term results.”

Value on the go

This past quarter showcased two key components of Dunkin’s go-forward marketing strategy, which focuses on platforms rather than limited-time offers and value that leverages a high-low pricing strategy.

In April, Dunkin unveiled its first national value platform in company history. Dunkin’ Go2s, live throughout the entire quarter, delivered stellar breakfast sandwich results, among other positives. Go2s launched April 2 and allowed guests to pick from among three of the brand’s most popular breakfast sandwiches, and purchase two of their “go-to” favorites. Average checks for the menu hovered around $8–$9.

“It’s a proprietary way that reinforced the overall brand positioning,” Tony Weisman, CMO, said in the call. “Right now, we’re testing a variety of ideas around that value platform to really make sure we’re addressing consumer needs and choice. We liked the fact that there was a variety of choice on it and the consumers select both the item and the price that match them. So look for us to stay committed to that the platform concept as we look for the optimal ways to package it that meet consumer demand.”

Hoffmann said more than 75 percent of breakfast sandwich transactions included a beverage. Throughout the rest of the year, Dunkin’ said it would continue to test various constructs of Go2s at the local level, while pulsing at different national value offers. Weisman said there are some beverage-driven Go2 tests in pilot currently.

And starting next week, Dunkin’ is introducing its next national value platform—the Dunkin’ Run. This $2 snacking menu is aimed at reinvigorating Dunkin’s afternoon daypart, Hoffmann said. The menu was home to the highly publicized Donut Fries. Munchkins that could be dipped in chocolate sauce, pretzel bites with honey mustard, waffle-breaded chicken tenders, gluten-free brownies, and ham-and-cheese rollups, were also being touted.

Dunkin’ has identified the afternoon daypart as an important priority for the brand long-term. In May, it kicked off summer with a $2 offer on small Coolattas, and also tried a cosmic flavor innovation.

“Our frequency is much different than the frequency of some of the other burger [quick-serves]. So our customers come in and look for a lot of variety, and we want to make sure that we can continue to offer really good compelling value,” Hoffmann said.

Simplify to success

In Q1, Dunkin’ took what it labeled a short-term hit from the rollout of its simplified menu. The 10-percent cutback was tested in five markets in 2017 across 5,000 restaurants. The brand had to expand the platform from 1,000 to 9,000 restaurants last year, and the switch trimmed transactions by about 15 per week in the early going. The move, along with adverse weather and competition, sent same-store sales down 0.5 percent to start the fiscal year. Much has changed since. Hoffmann said the entire U.S. system is on board, and, “I am proud to share that the simplification has been a huge success. Streamlining our menu and removing some of the more complex lower velocity products was a direct investment in creating a better environment for the people who work hard to serve our guests in a fast and friendly manner.”

Franchisees saw a decline of about 100 basis points in same-store sales. However, the kick was offset by a decrease of about 100 basis points in cost of goods sold. Operators also reported modest labor savings. Consumers responded by noticing improvements in speed and accuracy. It resulted in seconds improvement in drive-thru times, as well as the front counter. Notably, though, it unlocked Dunkin’s ability to successfully innovate around new menu platforms, like the Go2s.

“Most importantly, the streamlined sandwich station enabled the successful launch of the new Go2 platform, which as we mentioned earlier delivered strong breakfast sandwich results. We continue to expect the sales impact from simplification to dissipate over the next two quarters. But as I’ve said before, menu simplification is about short-term pain for long-term gain, and we are very pleased with the progress to date,” Hoffmann said.

It’s also key to owning the category Dunkin’ wants to rule.

“Our point of differentiation, this idea of great coffee fast, this is what we are really focused on,” Hoffmann said.

The NextGen restaurant model (more on that later) fits into this speed focus as well. “… You heard me say in a cheeky way, we’re not going to do comfy couches better than some of the other coffeehouse players,” Hoffmann said. “For us, it’s about get in, get out, get on your way.”

Convenience counts

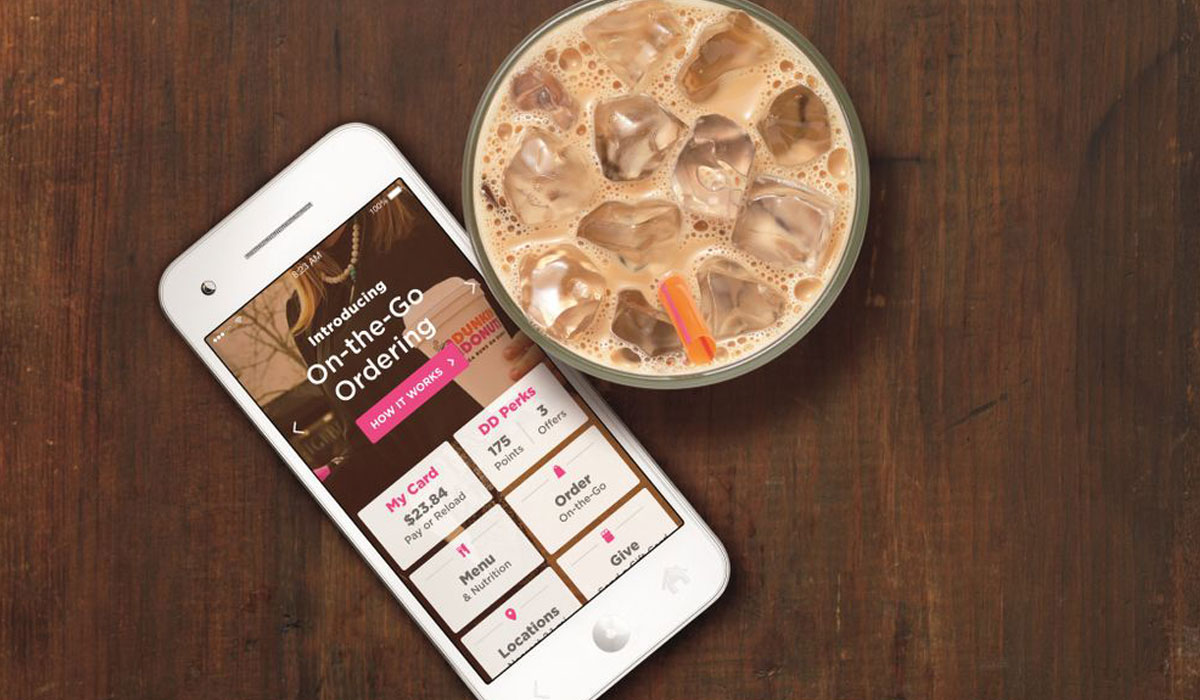

Dunkin’ announced, along with its second-quarter results, a multi-year deal with CardFree, Inc., a leading mobile wallet provider to large merchants. This secured a perpetual license to the software used to build and operate the mobile ordering and payment platform at Dunkin’. The company said the deal would give it greater control over the operation of the technology enabling its mobile payments and on-the-go mobile ordering through its app. It would also support the development of future initiatives, including catering, delivery, and curbside pickup.

Dunkin’ has worked with CardFree since the deployment of its app in 2012. As of Q2, there were more than 18 million app downloads and nearly 9 million DD Perks Rewards members. On-the-go mobile ordering was introduced in 2016. The Rewards Program arrived January 2014.

“Our agreement with CardFree enables us to control our own destiny with the DD Mobile App and to accelerate important digital initiatives, such as a one-to-one marketing, catering, delivery, group ordering and tender agnostic, just to name a few,” Hoffmann said.

Dunkin’s convenience strategy has several facets. Through mid-June, its total portfolio of consumer package goods products across Dunkin and Baskin-Robbins delivered more than $400 million in retail sales, including more than $70 million in ready-to-drink bottled iced coffee. Dunkin’ Donuts K-Cups grew more than 20 percent.

The face of the future

As mentioned earlier, Dunkin’s growth rate makes it one of the fastest expanding retail brands in the country. U.S. franchisees opened 64 net new units in Q2, and also completed 40 remodels, including the first in the NextGen image. Hoffmann said Dunkin’ is on track to deliver 90 percent of net restaurant growth outside of its core markets by the end of 2020. Additionally, Dunkin’ expects to have 50 NextGen units opened, between new builds and remodels, by year’s end.

“The NextGen restaurant is truly the embodiment of the Blueprint and all it stands for, delivering great coffee fast and leveraging technology to stay modern and relevant with our guest,” Hoffmann said.

The design makes mobile order and pickup more visible and easier to understand, Weisman added. The drive-thru lane dedicated to mobile orders is one example. Other core components include a front-facing bakery, a tap system for beverages, and a new beverage line in the back. “I would say the majority of next year’s development will be NextGen,” COO Scott Murphy said. “There’s probably a few in the pipeline that have started before, but we’re pretty excited for next year being a big NextGen year for us.”