Shake Shack was a materially different company in 2019. It drove yearly revenue up 29.4 percent to $594.5 million that calendar thanks to 73 systemwide openings—39 domestic corporate stores and 34 licensed.

At its center, Shake Shack was a growth story. Headed into 2020, 60 percent of U.S. locations were less than three years old. Twenty-four percent had been on the market for 12 months or less. The average age of restaurants across Shake Shack’s then-163-unit domestic company footprint was 2.9 years (there were also 111 licensed venues). Even more striking, 23 of the burger fast casual’s 31 markets boasted five or fewer locations.

Four years earlier, Shake Shack touted just 44 stateside company-run restaurants and 31 licensed.

Yet beyond expansion, there was another evolution at work. On the doorstep of COVID-19, digital and kiosk sales totaled $147 million for the brand. Kiosks were in about a third of restaurants (roughly 40 or so) at the end of Q3 2019. But while a topic for Shake Shack, more of the conversation those days concerned its efforts with delivery—the digital pressure point on the table for most.

Shake Shack migrated to Grubhub as the sole third-party provider in 40 percent of stores, a move expected to spread over time. Naturally, COVID-19 fractured the path. Shake Shack first needed to widen the third-party gates (to get food to at-home guests) and then work toward a white-label approach. This past November, it renewed its contract with Uber Direct as the company’s exclusive nationwide delivery partner on the Shake Shack App. Direct delivery launched in March 2021 and surged order volume through the brand’s app 70 percent in one year. Shake Shack continues to incentivize guests to use its own channels, whether in-store or via the app/website.

That $147 combined digital and kiosk figure, however, has progressed in a hurry.

- 2020: $329 million (65 percent sales mix)

- 2021: $442 million (62 percent sales mix)

- 2022: $500 million (57 percent sales mix)

Shake Shack’s revenue to close fiscal 2022 was $900.5 million, or 21.7 percent higher than 2021. Systemwide sales were up to $1.378.6 billion, 22.7 percent over 2021 and well ahead of 2019’s $895.3 million.

Amid the industry’s race to accessibility, Shake Shack responded with store format innovation called “Shack Track,” which includes everything from pickup stores to drive-thrus. And it’s also leaned into kiosks. The chain announced last year it would implement them—its most-profitable channel—in nearly all restaurants by the end of 2023. At that juncture, about half of Shake Shacks touted them. The brand, in its most recent update, said kiosks were installed in 90 stores since the start of 2022.

The benefits aren’t cloudy. One ties back to growth—kiosks visually display Shake Shack’s differentiators. CFO Katie Fogertey told QSR kiosks were vital to new-market development and Shake Shack’s aim to separate from the burger pack. Why are prices higher than the outlet down the road? Just flip the screen and find out.

Less holistically, though, the numbers add up. In restaurants where Shake Shack has kiosks, about 75 percent of sales flow through the hardware as well as digital channels.

They’re a solid return on capital, Fogertey added. You can put four to five-plus in each location and take out cash registers (there will always be at least one of those for guests who use cash or for the sake of alcohol purchases, the company said). Shake Shack can redirect labor within boxes and appreciate a lift on ticket sales given how superior the merchandising is. “We’re selling more LTOs,” Fogertey said. “We have more of a higher premium attach rate on those [kiosk] channels.”

Shake Shack, this past quarter, said kiosks helped in-store same-store sales jump more than 20 percent year-over-year (kiosks are counted as in-store transactions, not digital ones). Restaurants with kiosks run more efficiently during an time when staffing and retention remain a constant pain point. “While we made significant improvements in the first quarter in our staffing and retention, if I just look back to the third and fourth quarter where the industry was deeply impacted, we were able to leverage kiosks,” Fogerty told investors. “Our operators were able to leverage kiosks as a key tool to let them operate when they were a little bit thin on staffing.”

“When you think about the guest experience and what our guests like to see, we still have a portion of guests that come in and they want to have that face-to-face human transaction communication connection with the cashier,” she added. “But we have a ton of guests who come in and they want to just go right to the kiosk. They want to sit there and learn about the menu and see, build up their tray, kind of go from protein to fries to shake, cold beverage, and so forth. And so, it’s a really amazing experience. If you haven’t used one, I highly encourage you to go.”

The investor take, and a case study to note

BTIG analyst Peter Saleh is among those investors bullish at Shake Shack’s kiosk prospects. He projects the rollout could generate mid-single-digit same-store sales growth and result in “several hundred” basis points of labor savings as adoption increases. And to the brand’s note on helping deal with peak traffic, he expects the tech to lift throughput and lead to better order accuracy and guest satisfaction. The idea there is kiosks would empower Shake Shack to optimize labor to other parts of its guest journey depending on need. They can provide operators flexibility during setbacks. “While we expect these benefits to build throughout the balance of 2023, we believe there could be upside to restaurant margin from labor leverage if adoption ramps faster than we expect,” Saleh said.

Going off Shake Shack’s numbers, kiosks are likely in about 200 company-owned units currently. Saleh believes kiosks are pushing average checks at least 15–20 percent higher than traditional orders, which aligns with the brand’s own commentary and relative comparisons.

Calculate Shake Shack’s current kiosk sales mix (35 percent or so) and you get the mid-single-digit comps bump Saleh outlined. It’s a sales increase primarily due to up-selling, customization, and larger order size—all ticks that push average check higher.

The labor line benefit could be slower moving, but it’s no less material. If (or when) Shake Shack’s kiosk sales mix reaches 70 percent-plus of in-store sales, Saleh said, a major labor shift will unfurl. He’s held conversations with industry brands using kiosks and the general consensus is a 30–40 percent sales mix allows redeployment of labor within the restaurant but reducing labor—mainly from order taking—requires a higher threshold of 70 percent and above.

Regarding throughput, high-volume urban stores are likely to report the biggest tailwind. They can take multiple orders from several kiosks simultaneously, driving transaction growth.

But this isn’t all just math and conjecture. About a decade ago, Panera trailblazed this kiosk path in corporate cafes and reported a mid-single-digit lift in same-store sales above the control group and franchised restaurants that had yet to make the investment. Past management meetings, recapping several units from one of the first fully deployed markets, indicated those locations experienced 200–300 basis points of leverage on labor expense given the benefit of higher sales and reduced need for order taking.

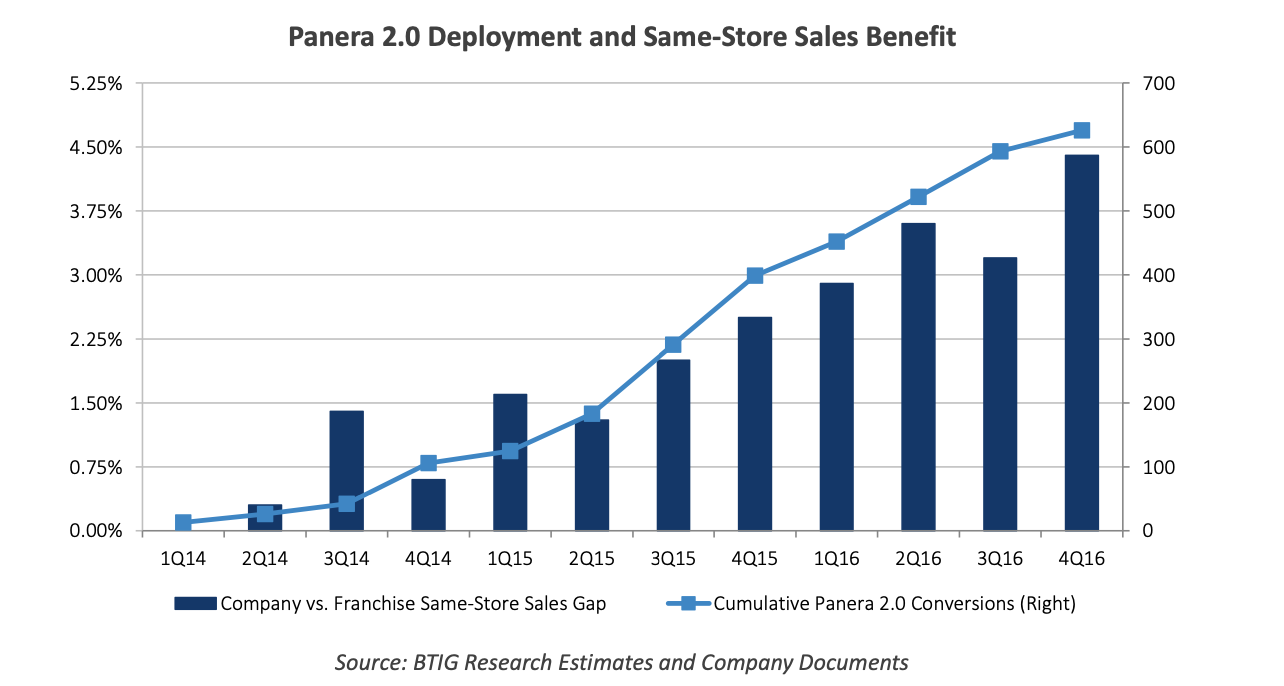

It’s a movement the company eventually dubbed “Panera 2.0.” Saleh recalls it initially met “significant pushback” from the investment community. By the end of 2015, Panera had completed the transformation of about 45 percent, or 400, of its corporate locations, with 70 percent (625) onboard a year later. Panera 2.0 cafes generated a mid-single-digit lift in comps, as noted, throughout this transition. Come Q4 2016, Panera hit that 70 percent mark and reported 450 basis points higher comps versus franchised stores without kiosks. That suggests converted Panera venues produced 6 percent higher same-store sales.

Based on Panera’s digital utilization in mid-2016 of about 18 percent, alongside the same-store sales gains, Saleh estimates average checks rose 15–20 percent at Panera kiosks (this is where the Shake Shack prediction stems from).

In late 2015, Saleh and BTIG held operator meetings in the Dallas market that indicated Panera’s converted restaurants there produced 200–300 basis points of leverage on labor experience. Panera’s 2.0 comp tailwind would go on to last roughly three years, with the labor improvement solidifying after about five quarters. Later, it would come out Panera’s order accuracy improved about 700 basis points several months following the implementation of the kiosks. In turn, customer satisfaction scores hiked. Panera was taken private in early 2017 in a $7.5 billion deal with JAB Holding, thus ending the chain’s public sharing of top-line details. But kiosks hardly appear less relevant in the brand’s footprint today, as any trip to Panera would reveal. Its NextGen design includes them inside, just as the legacy venues do.

A more recent side-by-side is BurgerFi, which recently implemented kiosks in 50 units systemwide, including 20 or so corporate locations. The public brand told investors it was experiencing a 12–15 percent increase in average check for kiosk orders versus traditional counter ones, “given the ability of the technology to upsell and allow customization,” Saleh pointed out.

Management added restaurants need to achieve at least a 70 percent sales mix from kiosks before any true labor savings were realized. Again, 30–40 percent allows for labor redeployment more than reduction. BurgerFi said results showed higher average check, significant usage from walk-in customers, and the ability for stores to reallocate workers to more hospitality-related tasks.

BurgerFi first released the innovation during spring 2022 at three corporate spots. Kiosks then spread to nearly all company-owned stores throughout the fall. Some franchisees began adopting the technology in Q4 2022, and more started signing up after demonstrations during the franchise convention, executives said. Kiosk orders consistently saw higher average check because of AI suggestive offerings. When combining those sales with web, app, and third-party delivery, restaurants were at 60–70 percent digital revenue generation, BurgerFi shared.

“We believe this is further evidence that digital kiosks can have a meaningful impact on average check and in-time, labor utilization,” Saleh said.

In truth, Saleh is surprised it’s taken Shake Shack this long to roll kiosks across its system. But the chain is making up for lost time. If Shake Shack meets its trajectory, the number of corporate stores featuring kiosk ordering would more than double year-over-year. And Saleh expects consumer adoption to be faster at Shake Shack than it was at Panera. Simply, guests today are more digital-minded and aren’t strangers to self-checkout, whether at a restaurant, grocery store, or retail shop. “In addition to the sales and margin benefits that should accrue, we believe Shake Shack will also be able to capture much more data on its customer purchasing habits,” he added.

At a recent investor conference, Shake Shack CEO Randy Garutti indicated total digital sales mix in stores with kiosks was about 75–80 percent, more than double the Q1 systemwide digital mix of 36 percent. So that implies kiosk utilization is at least 35 percent of sales in stores that have them, if not higher, Saleh said.

In all, assuming the timeline holds, Shake Shack’s same-store sales surge could begin showing in the back half of 2023. Saleh said it comes down to the pace of adoption.

If history is any harbinger, Shake Shack won’t have to wait long.