This year marks the 30th anniversary of Wayback Burgers, and the company is as strong as it’s ever been.

In 2020, systemwide sales lifted 4.9 percent, four locations opened, and 17 new franchises were awarded after August. The same story is true for 2021—Wayback saw sales skyrocket 30 percent in January, and those significant numbers have continued through February and March.

Stimulus checks, tax refunds, warmer weather, decreasing COVID cases, and accelerating vaccinations are all working in the chain’s favor. The confluence of events is bolstering consumer confidence, says president Pat Conlin.

Early into the pandemic, about 35 percent of sales came through third-party delivery, and another 30 to 35 percent came through Wayback’s digital platforms. Since then, those numbers have slipped to 25 percent each, but in exchange, Wayback is experiencing a notable uptick in dine-in sales as nearly all of the brand’s 166 stores have indoor dining availability.

“While the delivery is a great piece of our business, we’re happy to see that percentage go down some because it comes with a cost as opposed to people dining in or or coming in to pick up or using the app,” Conlin says. “So we’re happy with which way the ordering platforms are going, and with nice weather, a fair amount of our restaurants around the country have outdoor patios, so that’s going to help out also.”

One of Wayback’s main strategies was switching from national to hyper local marketing. Even though business was questionable at the start of the pandemic, Conlin says operators realized the value of advertising amid the uncertainty, and contributed additional dollars to the fund. The chain also implemented curbside pickup by April, rolled out a few LTOs, and placed a greater emphasis on sanitization and safety.

The performance of individual stores in diverse circumstances proved that Wayback can be successful in any market. Four stores topped $1 million in sales in 2020: Hinesville, Georgia; Hilton Head, South Carolina, Eugene, Oregon; and Olive Branch, Mississippi.

The stores are around 1,600 to 1,800 square feet, and have the same menu and systems, but each one comes with distinctive characteristics. The Mississippi restaurant opened in December 2019, so it entered the pandemic during its first full year of business. The space is also in-line and doesn’t have a patio. The location in Hilton Head serves a resort community, and Conlin says it was always one of the top-performing restaurants prior to COVID. Wayback was concerned because of the lack of traveling, but the CEO notes that the franchisees “blew it out of the water.” He believes the traffic may have come from customers retreating from cities and working out of their homes at Hilton Head.

The Georgia store, open for roughly three years, is in a rural community close to a military base. It’s housed in an endcap space and offers patio seating. The oldest of the group is in Oregon, a unit that’s been around for eight or nine years. The franchisee achieved $1 million in sales despite his dining room being closed for a majority of the year because of both COVID restrictions and forest fires.

“We’re not in downtown areas. We’re not in big cities,” Conlin says. “That contributed to our success and weathering the pandemic. Because if you were in a big city atmosphere, all those office buildings and offices closed down, and people were working from home. So if you were dependent upon that for your business, you didn’t have that trade. Where it really helped us, the people that did work in the cities, now they were back at home, and that just bolstered business for our franchisees, because we really look for small-town venues across the country, and that definitely helped us.”

A 7-year-old unit in Woodbury, Minnesota, had a nearly 70 percent increase in systemwide sales. The current franchisee bought the store a couple of years ago, cleaned it up, and pumped money into marketing and labor—all in an effort to increase the level of service and quality of product.

Conlin has pretty good insight on the store’s performance because the sales rep of the ice cream company that Wayback uses for its milkshakes lives near the store. The sales rep sent pictures of the Wayback bags, burgers, and milkshakes on his kitchen table, and then eventually showed photos of his family sitting in the dining room.

“It’s always a nice story, and he always says great things when he goes there about the food, the friendliness, and the service that he gets,” Conlin says. “It’s a 7-year-old restaurant that hasn’t been remodeled yet. That’s the next step—to get that restaurant remodeled and keep that increase going.”

Wayback’s remodeling initiative began prior to COVID, when the chain wanted to update its 10-year-old design that consists of red barn boards, beige colored walls, old lighting, and not the best seating. To begin the ideation process, a design company immersed itself into Wayback’s culture and gathered feedback on the chain’s identity. The goal was to create a space that kept nostalgia, but ushered in a modern era.

The biggest change is the positioning of the grill and POS system. In the old design, the grill and work stations are directly behind the POS counter, which presents issues for both employees and customers. The configuration creates a bottleneck effect, and employees who work behind the counter track smells whenever they bring food to customers dining inside.

“So if I’m sitting in there for half an hour eating my lunch or eating my dinner and I walked back out to my car, I’m going to smell like a burger and fries,” Conlin says. “And so we wanted to do something to lessen that effect.”

In the new design, the kitchen is behind a glass wall with a big pass-through window, which has prevented smells from getting trapped in clothing. In addition to the operational fix, the upgraded design comprises banquettes and a couch, a flag made up of Delaware license plates, a special Wayback clock, and a curved milkshake station with low, red leather stools.

Twelve remodels have been completed so far. In the backend of 2020, those particular stores saw sales grow 39 percent or better year-over-year. One remodeled unit in East Windsor, Connecticut, lifted 68.7 percent. Another 14 are in the process of gathering pictures and measurements in preparation of the remodel. Conlin says Wayback should have another 20 to 30 franchises signed this year to do the new design.

Wayback initially built a couple overseas with its international partners. The first domestic remodeled store came in Texas, with a franchisee who now has one store with the new design and another with the old design. When Conlin visited the store, he confirmed with the operator that the new design was doing everything Wayback had hoped.

“She said, ‘I love the new design. I hope they could build everything this way going forward,’” Conlin says. “And she didn’t think that she would do the kind of business that she’s doing in her new design store with the old design—not operationally, just more aesthetics, she said, because she thought it was more upscale than the old design.”

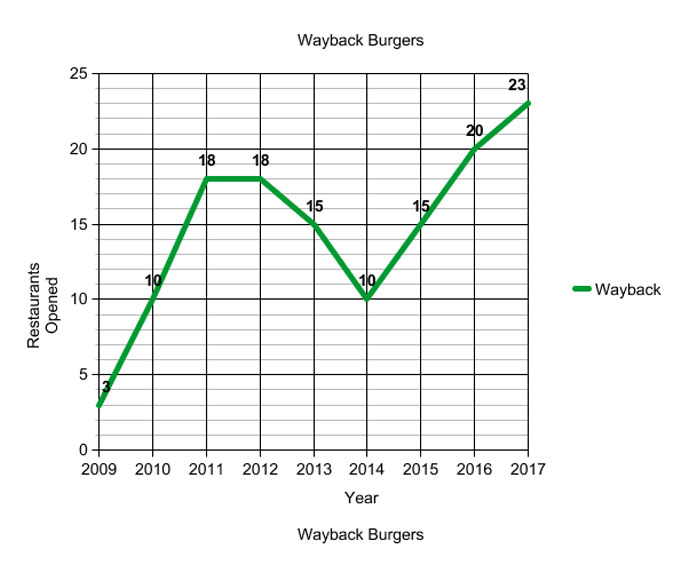

[image source_ID=”129410″]

[image source_ID=”129410″]

The development is a far cry from what Wayback experienced in the early weeks of the pandemic. When COVID arrived, the chain stopped franchise advertising because it didn’t think many would be interested in opening a business at that time. It re-opened external advertising around May 15, but the responses were slow. However, some existing franchisees were doing quite well, and indicated to Wayback that they may want to open additional locations.

The majority of those high-performing stores were older restaurants, and Wayback wanted to remodel them. So the brand created the “Let’s Get Growing” program, which rolled out to franchisees on July 1. As part of the deal, if an operator wants to open another location, Wayback will cut the $20,000 franchisee fee in half. The company then takes that $10,000 and contributes 100 percent back into remodeling the franchisee’s existing restaurant. Any franchisee who’s been in operation from July 1, 2020 to June 30 is eligible.

Conlin’s confident that by June 30, there’ll be close to 15 franchisees participating in the program.

“Not only do we look to grow with new franchisees, but we wanted to reward and incentivize our existing franchisees because we already know that they’re doing a great job in the restaurant,” he says. “And the learning curve is quicker with them. They’re already in the business, and twofold, it could get an older restaurant on the path to remodel.”

In addition to the new design, Wayback considered a slimmer footprint option, especially because of the rise in takeout and delivery. Since the company was doing so well during the pandemic, the chain decided not to move forward. Conlin says the kitchen wouldn’t change sizes, so a slimmer footprint would knock out aspects of the dining room. That knowledge wasn’t good enough for Wayback, which is confident that indoor dining will have a huge comeback.

“In the grand scheme of things, we’re probably sticking still with that 1,600 to 1800 square feet,” Conlin says. “We have some existing franchisees that are looking at their second and third locations, and they want bigger sizes.”

In 2021, Wayback will open 15 stores across 10 states. The company also expects to award 24 new franchises and for 17 restaurants to reach $1 million in sales. In terms of technologic upgrades, the company is contemplating the use of self-ordering kiosks and food lockers that require QR codes. LTOs won’t take a backseat either. Wayback has already rolled out an Impossible Melt and a Chocolate Cake Shake and plans to add four or five more special items before the year is over.

The CEO believes Wayback is poised to take advantage of the new trial it gained over the pandemic, whether that’s high-end customers trading down or fast-food guests that gave Wayback’s better burger concept a try.

“I know more and more things are opening up, so we’re gonna have more competition, but I think we’re still pretty confident and bullish on our future this year and next year and beyond,” Conlin says.