Over the past two years, dine-in closures forced customers to switch to takeout, delivery, and drive-thru ordering. Despite widespread reopening, this trend away from dine-in is expected to grow further with only 25 percent of those surveyed more likely to use dine-in compared to last year. On the other hand, nearly half of the survey respondents (46 percent) are more likely to order takeout and only 22 percent are less likely to place drive-thru orders compared to a year ago.

These are among the findings of the Presto Pulse of the Industry study (“Presto Pulse”), a survey designed to understand customer trends and perceptions related to restaurant usage, quality of service, and receptiveness to automation technology.

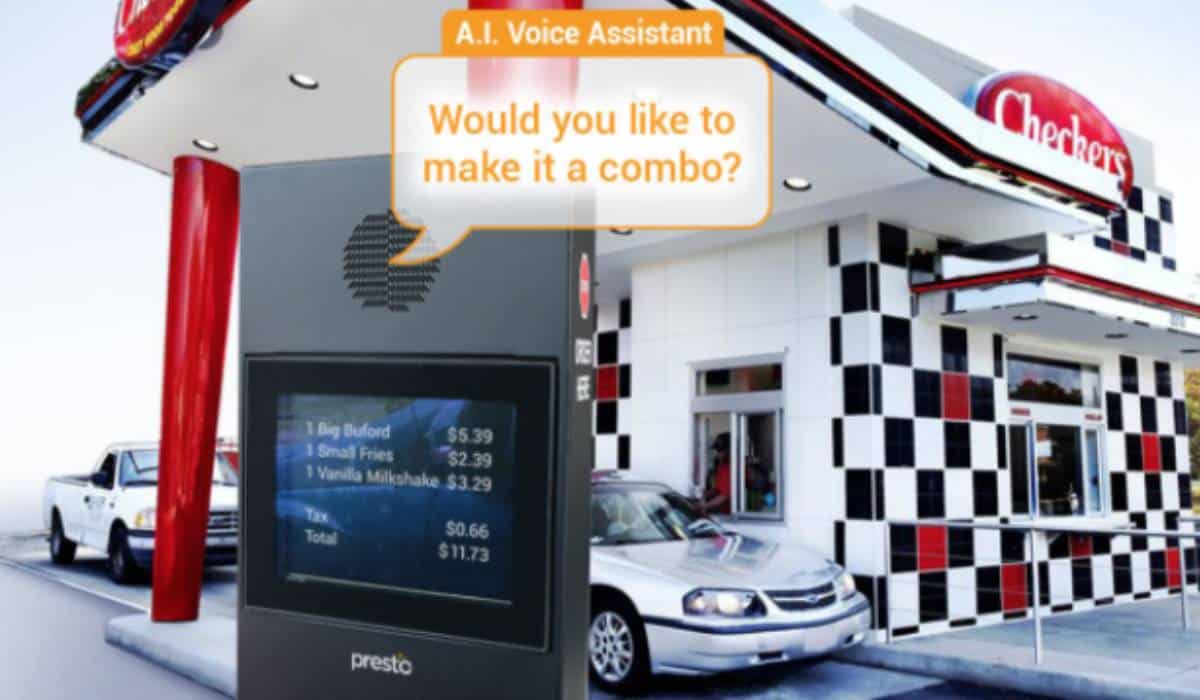

Presto, a leader in the restaurant hospitality technology industry, noted that results of the survey indicate a continuing shift away from dine-in, overall consumer frustration with drive-thru quality of service, and a strong positive attitude towards technology. As drive-thru wait times increase and service seems to worsen, 70 percent of the respondents want technologies such as A.I. voice assistants, personalized menus, and smartphone apps to help alleviate the pain.

When asked about the quality of their drive-thru experience, the vast majority of respondents (77 percent) felt the situation is the same or worse than last year. Long wait time was identified as the biggest issue with 27 percent of respondents saying it has gotten significantly worse over the past year. Friendliness of service came in second worst with 18 percent saying it has become worse. So while demand is shifting towards the drive-thru, service levels are becoming worse, leading to greater customer dissatisfaction.

“In many drive-thrus it’s difficult to hear the person taking your order,” said one respondent. “This leads to frustration and inaccurate orders.”

“Use technology to make the order process faster,” said another respondent.

So how can this situation be mitigated? 78 percent of those surveyed thought that automation technology is critical for smooth operations of a fast food restaurant. Most respondents felt that use of technology at a restaurant makes the experience more efficient. They also felt that a technology-augmented experience is more enjoyable, could lead to lower menu prices, and is inevitable. However, a third of the respondents felt that technology could take away from some of the personalized service and may make the overall experience less personal.

“We need a drive-thru with shorter wait times,” according to one respondent. “Automated order taking”, “designated lane for advanced online orders”, and “faster payment methods” were some other suggestions.

Regarding specific drive-thru technologies, customers were the most comfortable with use of an artificial intelligence (A.I.) voice assistant for faster ordering, personalized menus, customized suggestions, and order / payment using a smartphone. Over 70 percent of respondents indicated that they would be receptive to using one or more of these technologies in the drive-thru if they result in shorter wait times and more efficient service.

Going forward, the company plans to conduct Presto Pulse every 6 months to gauge customer sentiment and identify trends across the industry. The current survey had 243 respondents representing a wide cross section of U.S. restaurant customers accounting for different socio-demographic, economic, and lifecycle variables.

On November 10, 2021, Presto announced the execution of a definitive merger agreement with Ventoux CCM Acquisition Corp. (NASDAQ: VTAQ), a publicly-traded special purpose acquisition company (“Ventoux”), that will result in Presto becoming a publicly listed company. Upon closing, the combined company (the “Company”) will be renamed Presto Technologies, Inc. and expects to trade on Nasdaq under the PRST symbol.